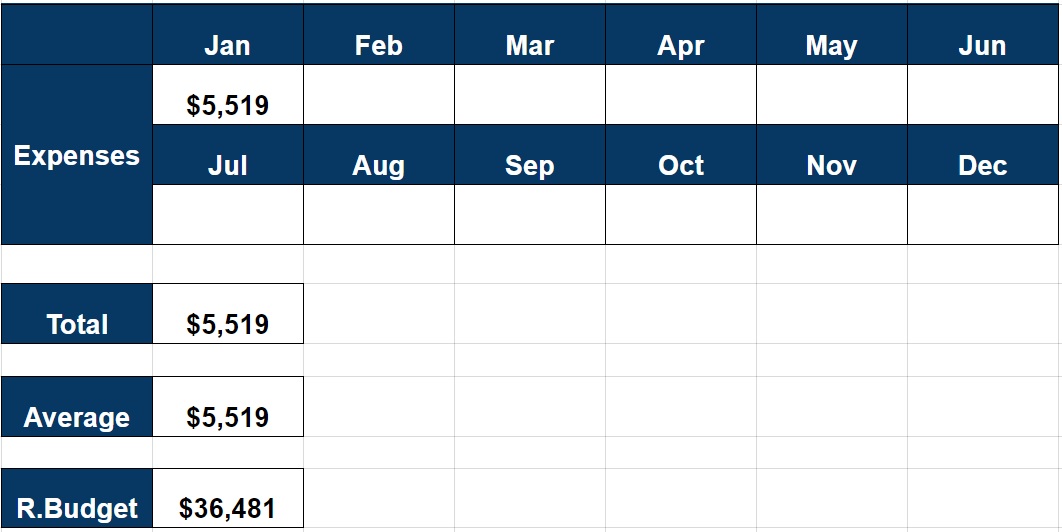

Just a month ago, we actually established a budget of $42,000 for our expenditure in 2017. This translates to a $3,500 monthly budget and to give ourselves some leeway in the first few months, I gave an additional $5,000 buffer.

Unfortunately, in this month alone, we have used up $2,000 of the $5,000 buffer as there were plenty of birthday/wedding celebrations and Chinese New Year was also in January this year.Furthermore, we paid another $1,100 for two air tickets to Melbourne.

So honestly, the higher expenditure is not unexpected. I had actually anticipated our expenditure to be above $6,000 this month (1/7 of the budget) so I am actually quite happy for it to come in at only $5,500.

Let’s see if we can keep to an average of $3,300 for the rest of the year to meet the target.

The breakdown for January 2017 is shown below.

Eating Out: $1,060.10

Hawker ($292.80) – $10 a day for two people doesn’t seem like a lot. $5 per pax that covers most lunches and dinners. The occasional more expensive salads are mixed in with the typical cai pengs I eat for lunch.

Fast Food ($39.50) – A Mac breakfast together, two meals at MOS while I was out meeting some fellow bloggers and a Subway lunch for the Mrs. Pretty controlled on this front.

Restaurants ($727.80) – There was only about 10 entries but 4 were pretty mega. We had a semi-buffet at Equinox to celebrate the Mrs’ birthday. $69 since we had a 50% discount. A dinner at Uncle Leong with the Mrs’ cousin and family that was close to $150, a birthday treat for my father-in-law ($125) and another birthday celebration for the Mrs’ god-father ($200).

Groceries: $153

Supermarket ($30.50) – Surprisingly, 4 trips to the supermarket only sets us back by $30. Most of the reunion dinner stuff were either bought at the market or by my mother-in-law.

Wet Market ($122.50) – 4 trips to the wet market and I ran there twice on two occasions alone. It will be part of my Tues morning routine as I go there to grab chicken breasts, thighs, corn, sweet potatoes and vegetables.

Beverages & Snacks: $165

Snacks ($147) – The CNY goodies bought from Johor Bahru cost us close to $150. Most of them were intended as gifts for our students and friends.

Drinks ($18) – Sugar cane, Koi and Yakult bought from Johor Bahru.

Utilities: $139

Electricity, Gas & Water ($42.45) – Electricity usage was much lower at 292kWh for this month as there were some days when we went without aircon. 28KWh of gas and 7.2 Cu M of water meant the bill added up to $92.45. The U-Save vouchers reduced the bill by $50.

Cellphones ($96.55) – $51.55 for me and $45 for the Mrs for our mobile services. Mine comes with upsized data.

Transport: $122

1 EZ Reload transaction for me and 1 for the Mrs. A wedding lunch at Sentosa and a cab ride in was inevitable.

Miscellaneous: $2,195

Clothes ($120) – We spent another $120 at Padini following two more trips to Johor Bahru.

Books ($60) – Some assessment books for my students.

Gifts ($880) – Two ang baos for the wedding lunch and CNY ang baos for our relatives. My in-laws gave us huge red packets which helped to offset half of our ang bao budget.

Travel ($1,110) – Two Emirates air tickets to Melbourne in May. Still deciding between a self-drive trip or to book guided tours.

Others ($25) – A haircut at JB for the Mrs.

Total: $3,834.10

Overall Total: $5,519.10 (included fixed expenses of $1,685)

Nice figures. Agree that the outlay for January tends to be higher because of the festive period. Saw the miscellaneous expenses for the air tickets. Just wondering if the travel plans are factored in the $42,000 budget for the year or are they kept separate?

Hi Kate,

My intention is to include all expenses (including travel) in the $42,000 budget. It’s going to be difficult and in all likelihood, I am just going to show how bad we are at “sticking to budgets” at the end of the year. But I guess with a budget, I will get to exercise some frugality muscles.

Anyway, I just popped by your blog and all the best with the $60,000 budget. Yours will be challenging too! And thanks for the mention in that blog post!

I have always been intrigued by minimalism and I have alot to learn from you on that front. I am definitely going to show the photos of your house to the Mrs!

Thanks for your kind comments 🙂 I am glad you like it.

Yes, we are trying to work around the $60,000 budget and with at least 1 trip planned, it’s definitely going to take a lot of discipline from our end to make it work (hopefully)!

You seem to spend quite a lot.

I am single, staying with parents and

My monthly expenditure doesnt even come close to yours (including a car).

Heres my profile:

-300 on food including eating out

-50 on groceries

-30 on phone bill

Hi John,

With a car, your expenses should also hit at least $1,000 a month?

We do know that our expenditure are not the lowest, therefore we are trying to see if it’s possible/optimal to lower it to $42,000 for this year.