I shall admit it.

I take a lot of pride in the quality of our Ministers in the Singapore Cabinet. As a junior policy officer working in a Statutory Board some years ago, I got to observe DPM Tharman and Minister Tan Chuan Jin first-hand and I was rather impressed by their astute decision-making skills and all-round brilliance.

Therefore, when NTUC invited me (among other much more prominent online influencers) for a sharing session with their Secretary-General Chan Chun Sing, I jumped at the chance.

Oh, I forgot to ask him if Yeo’s soya milk really tasted THAT fresh…

====================

Who Is Chan Chun Sing Exactly?

Unless you’re totally apathetic towards Singapore politics and social issues, you will probably have some idea who he is.

This is the guy who became the youngest Minister in the Cabinet after the 2011 General Elections and even now, is slated for bigger things in future. How big? My guess is that he has a good and realistic chance of taking over the most popular politician (>800,000 likes) in Singapore.

However, it doesn’t help that SG Chan’s public image has taken quite a few beatings in recent years, especially on social media. A quick search on google would likely yield some memes and gifs that are at least half-mocking him for his perceived goofiness.

And after meeting him in person yesterday, my take is that his down-to-earth persona and his humility might have been (maybe maliciously) misconstrued.

Top-notch credentials

This is a guy who graduated from our rigourous education system with flying colours, and was awarded the prestigious President’s Scholarship in 1988. He also rose through the ranks in the Singapore military to become the Chief of Army.

Ok, you might argue that he was identified early and groomed for success and thus, scoff at those national achievements.

But did you know that he was the first foreign student to be conferred the “Distinguished Master Strategist Award” in the US Army Command and General Staff College (CGSC) in 1998? That’s one of the highest accolades a military man can possibly strive for.

A smart photo of SG Chan (rare on the internet)

My take is that compared to the available home-grown competition, he must have been significantly better by some distance to have won the award. And that’s a sign of world-class talent for me.

With such credentials, you might think the common man might find it hard to relate to him. However, the reverse can’t be truer.

Heart is in the right place

SG Chan didn’t put on any airs and spoke to us in plain English yesterday. Occasionally, some Singlish were also sprinkled in. The whole atmosphere was light-hearted and actually akin to a class gathering.

I really like the fact that he is a simple man and of course, to a personal finance blogger, it helps a lot that he’s really frugal. As I mentioned in this tribute to LKY, when you’re a frugal person and less beholden to money and materialism, you are in a better position to fulfil the vision and mission you set for yourself.

Proof?

I spotted his no-frills Casio digital watch which is most probably a more basic model than mine. Furthermore, he drives a second-hand Japanese car.

Since his lifestyle doesn’t really require a high salary and he believes that entering politic is “the whole family’s contribution to national service“, my hypothesis is that like most other ministers, despite the public scrutiny, SG Chan is in this job because he wants to be in a more influential position that allows him to better serve Singaporeans’ interests.

Since his lifestyle doesn’t really require a high salary and he believes that entering politic is “the whole family’s contribution to national service“, my hypothesis is that like most other ministers, despite the public scrutiny, SG Chan is in this job because he wants to be in a more influential position that allows him to better serve Singaporeans’ interests.

What I Learnt From Chan Chun Sing?

I was disappointed that I didn’t had a chance to ask him questions like:

1. What’s your savings rate and what do you invest in?

2. Which is your favourite hawker dish and colour?

3. The age of second-hand cars that provide the best value?

Nonetheless, the session was enriching as I was given an Economics and Psychology lesson by SG Chan.

Singapore: Socialist Heart In Capitalist Clothing

Let me illustrate with fuel as the good.

Singaporeans always compare the high fuel prices in this country with those of neighbouring countries, where fuel is subsidized. And most Singaporeans hanker for lower prices and believe that lower prices are in their welfare. But is it really so?

Let’s take a look at a simple example below:

1st Scenario: Price of fuel was kept low at $1 per litre

| Rich Man | Average Man | |

| Price of Fuel | $1 per litre | |

| Quantity Consumed per Month | 200 Litres | 100 Litres |

| Government Revenue | $300 | |

Outcome: The rich man pays $200 for fuel every month since he travels more on his oil-guzzling luxury European car while the average man pays $100 to run his no-frills and more fuel-efficient car.

2nd Scenario: The price of fuel is taxed heavily and the price goes up to $2 per litre

| Rich Man | Average Man | |

| Price of Fuel | $2 per litre | |

| Quantity Consumed per Month | 200 Litres | 100 Litres |

| Government Revenue | $600 | |

Outcome: Both the rich man and the average man pays double the amount and the Government Revenue increases to $600.

And this is when Singaporeans cry foul, castigating the government for profiteering from the hard-earned money of Singaporeans. But is that really the case? What if the extra $300 was redistributed back to the average man and the poor man in the form of social transfers?

| Rich | Average | Poor | Govt | |

| Fuel Payment | -$400 | -$200 | $0 | $600 |

| Transfers | $0 | $120 | $180 | -$300 |

| Final Outcome | -$400 | -$80 | $180 | $300 |

In the end, compared to the 1st scenario, only the rich man is paying more. The average man saves $20 and the poor man, who can’t afford a car and doesn’t spend any money on fuel, actually gains $180 from others’ consumption of fuel.

I think most of us would agree on such a social contract, where the poor receives more help from the government. So isn’t Scenario B a better option?

This applies for GST on even basic items like rice and sugar since the richer are more likely to consume more. You could also replace fuel with other goods like COEs and alcohol and the argument and conclusion will stay the same.

Why Scenario B, Like The Government, Is Under-Appreciated

In Singapore, there’s actually a lot of social transfers back to the middle class and the lower income in the form of housing, education and healthcare subsidies. However, these transfers are not well-appreciated by the general population as they are largely undetected by most social indicators.

Moreover, in the hypothetical example, the average man sees the high price of fuel on a daily basis whereas the rebates are likely given only once a month. Therefore, psychologically, he’s likely to be full of angst whenever he has to top up his petrol and might easily “complain” about the government. And when rebates like GST vouchers get credited to his account, he tends to “forget” about them.

But sadly, in the name of effectiveness, the government has to stick with this arrangement and bear the brunt of psychological biases. Talk about getting the shorter end of the stick, even when the heart is socialist.

And so, the above is what I found out after an afternoon with SG Chan.

====================

I actually used to think that consumption taxes are regressive by nature since that’s what was being taught to us in Economics but Singapore’s unique model shows us that this might not be the case.

In fact, right now, I believe that consumption taxes are better at taxing wealth than income taxes. If there’s no consumption taxes, a retired man living in a landed house and driving a Mercedes Benz would literally pay no taxes. In my humble opinion, that’s not an ideal outcome for society.

I shall end here before I spout even more Economics and turn you off. Yeah, I am in the Keynes mood, all thanks to the lesson by SG Chan.

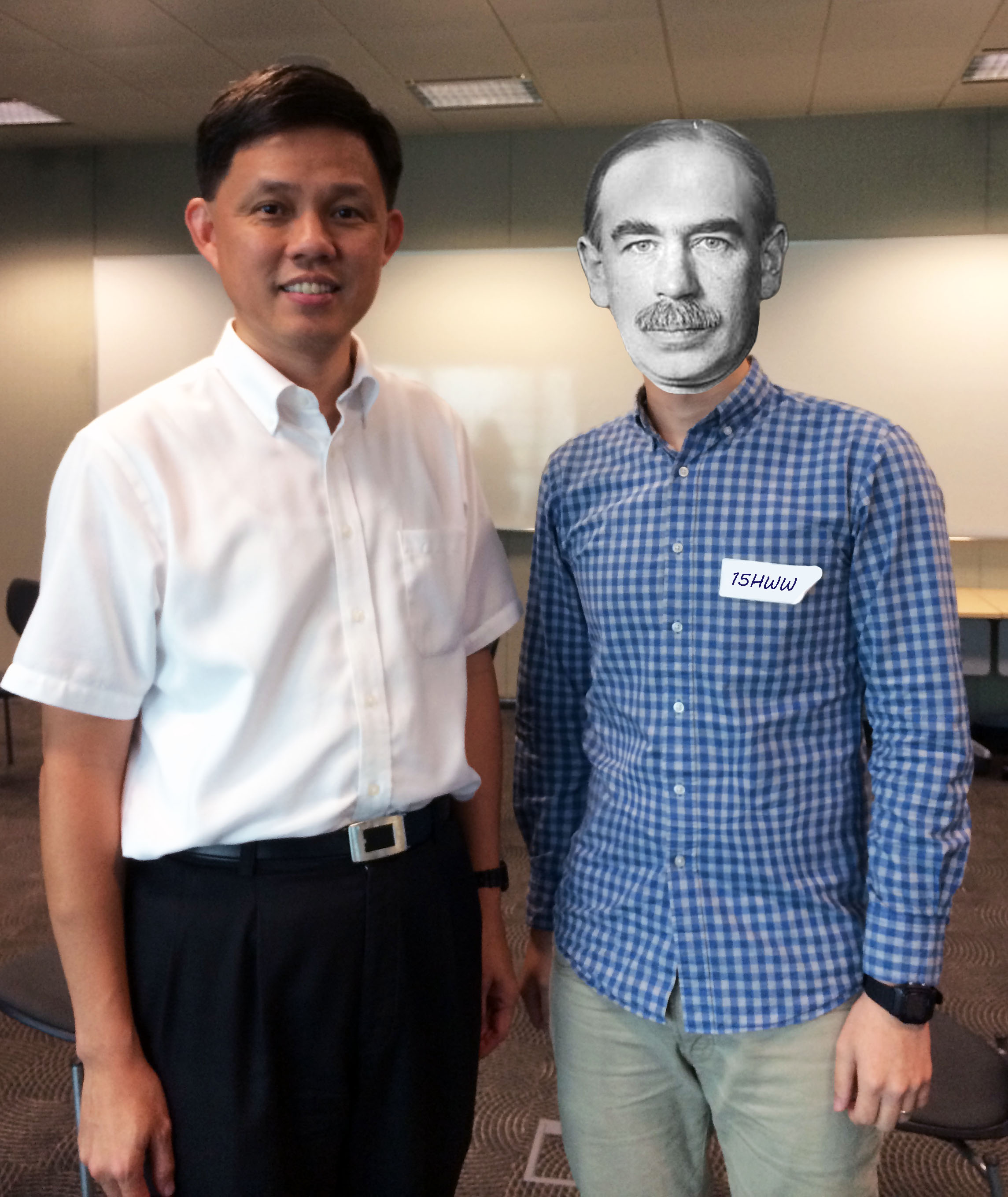

And lastly, here’s my picture with SG Chan yesterday:

I think SG Chan (an Economics major) would likely have enjoyed a conversation with the legendary Keynes

(P.S. Can you spot our Casio watches in the pic?)

Hi Mr 15HWW,

Great post! All I know about SG Chan was kee chiu, so it’s nice to learn more about him. Good presentation on how consumption tax is targeted at those who consume more – the rich. I’ve always been a fan of GST because of what you’ve demonstrated up there.

There are still many people in Singapore that think that GST should be abolished and “tax reforms” should be done to extract revenue from other sources. Malaysians are putting up a very strong resistance against their recent GST introduction.

I wish more people would realise that GST isn’t some evil conspiracy to increase cost of living by 7% and instead understand how they stand to benefit from consumption taxes.

Malaysians are resenting GST because the implementation is haphazard and full of discrepancies esp in the month before it. Furthermore, unlike Singapore, they don’t know what the money collected will be used for and whether subsidies flow down to the needy.

Hi yt,

I have to agree with you.

One assumption I made in Scenario 2 was that the additional revenue would be returned back to the masses. That’s one big assumption made. But from the government’s track record, it’s a safe assumption in Singapore.

Hi GMGH,

Haven’t seen you around here for some time!

Glad I have shed a little more light about SG Chan.

As for Malaysia’s GST, I think I can understand Malaysians’ resistance. After the 1MDB saga, many might feel that the money are just going into government coffers straight.

Thanks for the very fascinating article! (Regarding 3. The age of second-hand cars that provide the best value, the answer is 9 years, just before expiry of COE, short explanation is that nobody wants to sink down 10-30k for a car they have to go through the hassle of changing after 1 year, so the cost of operation, after scrapping the car at the end of the year, is very, very low. Of course I’m not including opportunity costs here.)

I think you’ve hit many issues on the head in this one post, especially about petrol and taxes. Now that I have no car, I have exactly 0 petrol cost and pay $0 in tax! The government is not perfect, and there a lot of areas for improvement especially non-economically, but they have gotten some things right.

I’m glad that Mr Chan is frugal and down to earth, although his English probably could be polished up? If I were to be very cynical though, politicians can make a lot of money but probably can’t spend it lavishly without drawing attention to themselves.

One slightly unrelated note though, is the government indirectly promoting detrimental stuff, eg the casinos (which made me a lot of money investment wise, so I’m not supposed to complain, but you get what I mean.) I’m sure that has caused the detriment of quite a few families, although of course, such societal problems are difficult to solve.

Hey Singaporemm,

I think I know why 9 year old cars are the cheapest. The hassle of maintaining a 9 year old car until it’s de-registered can cause a headache. Most vehicle owners towards the tail-end of their vehicles lifespan opt for patchwork repairs instead of replacement parts. Many parts have their integrity compromised since it does not make sense / cents to get a replacement part that lasts longer than the lifespan of the car. I think a very clear example is tyres. Many owners opt to fit on used tyres to just tahan until de-registration and safety is actually highly compromised.

I agree that casinos can cause social problems to residents, but the effect of the casino is much larger than just drawing in gambling revenues. Our global image and tourism has been greatly boosted by the IRs. Case in point is how within 5 years, the most iconic landmark of Singapore is now MBS. Jobs have been created out of nothing and many businesses now provide services to the casino and the expanded tourism industry. I think it has been overall net positive.

I’m going to jump in here because we were just discussing Singapore’s policies during my GP tuition session last night.

There are many negative externalities (in econs speak) that can impact society with the casinos. But one thing many of us forget is how the govt listened to public feedback and concerns regarding these, and thus implemented controls and helplines as a preventive measure. They ran campaigns on gambling, charge locals a fee for entering the casino as a deterrence (while tourists get in free) and have empowered many social agencies on helping those who need it.

That really won my respect.

Re: the car, safety is a factor of how you drive and how often you drive. Of course there are suay people who are in the wrong place at the wrong time, but generally speaking if you’re not beating lights and speeding the risk of accidents, even with ‘compromised safety’ is very low. Most Singaporean cars don’t drive up mountain roads or dirt tracks.

I have to agree with you about the tourism and other benefits of MBS. I’m probably anti-casino because I am frugal :p

Worked with him in my previous career. Additional nuggets of facts:

#1 – He’s been wearing the same Casio watch since before 2007.

#2 – He writes extremely well but always remind us to communicate simply so that even an Ah Soh on the street can understand.

#3 – errr… you mean his Toyota Corolla not scrapped yet??

Hi Johnny Lee,

Wow. Same Casio since 2007. But well, not too surprised since the watch is hardy and the batteries hardly ever need to be replaced.

I think everyone underestimates his English because he speaks simply. As for the car, I shall ask him more about it if I get the chance.

Hi Singaporemm,

Glad you enjoyed it.

I have a feeling most people would either feel that a 1 year old car is the most “worth it” or like what you mentioned, a 9 year old car.

Of course the government is not perfect. As I always say, if Mao was 70% right, our government has to be at around 99%?

Regarding SG Chan’s frugality, I don’t think I am as cynical as you. It’s hard to put on an act of being frugal for 4 decades. And I always feel that if one is a spendthrift, the highest utility one can get from spending is when one is still young (20s to 40s).

Thanks for the article and the insight into CCS. I had quite the poor impression of him esp with the kee-chiu episode, but i now see the other side of him, which is a good thing. Now i can at least remove the tinted lenses…….

Hi Jason,

Thanks for dropping by. I am glad I have made a positive contribution towards your view on his image.

Sometimes, we just have to think through objectively a person’s motivation for entering politics to get a more accurate picture.

I have heard him speak too, outstanding person, frugal and down to earth. I will always remember that phrase, we are a socialist country in capitalist outfit!

Hi Lawrence,

I was impressed by him, especially his frugality. For someone who has such outstanding achievements, having that extra trait really earns my respect.

Capitalism is what keeps our economy going. But socialism is what keeps us united as a country.

I work with him and you are spot on ! Chun Sing is smart but will never try to show you how smart he is. He is like a good teacher, lecturer and mentor.

Hi TSL,

“smart but will never try to show you how smart he is”. That’s something that’s counter-intuitive. Most people like to flaunt the limited knowledge that they know and it’s hard to suppress this feeling of being “one-up” on others. Guess that’s why he is a Minister and I am not. :p

Mr Chan also comes from a very very humble background. His mother worked as a machine operator and his parents were divorced when he was young.

Truly amazing journey from his austere beginnings to the position he is in today.

I can only imagine the sheer amount of hard work and determination to overcome the odds to produce this result,.

Hi Alvin,

Yes, you are right. He’s definitely one of the 14% who was in the bottom twenty percentile who has now made it to the top top twenty percentile!

A relative of mine interacted with CCS before and found him very humble and willing to listen. This was when he was in the previous ministry. He was also one of LKY’s favourite new minister. =) Glad to hear that you had a good time interacting with him as well.

Hi gagmewithaspoon,

Your experience is consistent with what many have heard. I am not surprised. Anyone who knew him personally always had something positive to say about him.

Woah 15HWW,

You are so lucky to be able to meet the potential future PM in person. I think he is capable and handles things really well, which is why he got promoted the fastest but he really does need to work on his image. Most of us know his ‘kee chiu’ and singlish speaking antics and felt that he is working too hard to please the crowds and that is turning people off. Definitely he can be someone great and really hope the masses get to understand him better!

Honestly if I can ask him any 3 questions, I won’t be asking those superficial one. I’ll just ask one:

1) Taking away more than 30% of our pay every month throughout our working life, when will the CPF system finally be sufficient for our retirement? Does he have a plan to make it work? How long does the govt intend to procrastinate the problem?

For your info, there are many Singaporeans who win world competitions. He is just one of the suspected many who is bestowed a good position wherever he went.

Anyway since you are working under him, then please don’t ask him any really useful questions. You may be fired.

Hi To The Point,

I am sorry for appearing superficial. The 3 questions were meant as some form of humour. Sorry to have disappointed you.

But I won’t be sorry for tearing apart your concerns over CPF.

1. 20% of an employee’s pay is contributed to his CPF accounts & 17% is contributed by employers

2. 23% (and close to 20% up till age 50) is allocated to the OA account which is effectively liquid since most Singaporeans use it to purchase their homes.

3. Therefore, the retirement and medical portions are effectively paid for by the employer. If one consumes less housing, one will have more for his retirement needs.

4. The comparatively lower income taxes enable individuals to have more disposable income and many can choose to save up for their retirement on their own

5. The CPF is meant to provide for the basic needs of a retiree and for those that satisfied the Minimum Sum requirements in the past and now, they have always been allowed to withdraw the excesses.

And lastly, for your information, I am not working under him and the contents of the post was just an independent view from me.

I grew up hearing my father complain about the government, CPF and other policies for 20+ years… Didn’t even believe in Medishield. We were lower middle class but we benefitted and prospered with the nation. I graduated and now have a stable career & family life. Unlike my father who didn’t do anything except to be suspicious of the government 1/2 his life, I make the most of my environment and adapted.

If you need to rely on CPF for retirement, I personally feel that it is correct that the government (and me) would be worried if you have the knowledge and ability to take care of your finances!

We only live once, and either “To The Point” or I shall realize our folly when we are old. So far, the track record says: Trust the government who has made the lives of most Singaporeans better in the last 50 years!

Hi G,

Thanks so much for your comment!

I probably isn’t as successful as you (or at least not yet :p) but I definitely can identify with your upbringing and feelings.

And yes, if one is financially savvy, the reliance on CPF would be minimal.

The track record has been impeccable thus far and I choose to rely on that for my judgement rather than some conspiracy theories.

The example is flawed because

1. You took on Chan’s assumption that there are housing, education and healthcare subsidies, HDB is no longer sold at cost price but market price. Healthcare subsidies are definitely very hard to get unless you are extremely poor or a Pioneer Generation. Education is the only one that the actual transfer is noticeable

2.The example of using fuel is only true if there is transfer. However, if you use a basic necessities, you will find that the consumption tax burden is heavier on the poor. The rich does not consume more rice, much contrary to your assertion.

3. Consumption tax is a regressive tax. There is nothing unique about Singapore methodology that makes it otherwise. Transfer is inefficient btw.

4. On your last example, a retired man living in a landed house and driving a Mercedes Benz would literally pay no taxes, Well, I think he should have paid his dues previously in income tax. As a man inspiring for early retirement, I though you will prefer this.

On a related note, I will rather tax the retired person on estate when he passed on than to tax his petrol. However, the Singapore government has abolished estate duty.

Hi oremun,

Thanks for your comment and you have raised interesting points. Here’s my answers to your doubts:

1. I know that land cost is a bugbear here. It’s not entirely transparent. But still, I would argue that BTOs are definitely sold below market prices. If a couple buys a BTO and decides to forego owning a place and then rents forever, making a profit from the sale of the BTO is very likely. Furthermore, on similar plots of land, a HDB unit is priced much cheaper than a condominium. This applies for public hospitals vs private hospitals too. If the “real price” is closer to the “private price”, there is already an implicit subsidy during government provision of these services and goods.

2. I think it’s debatable whether the rich or the poor consumes more rice per capita. But perhaps the rich would purchase more of such basic necessities and likely to waste more of them? I would argue it is inefficient to provide exemptions as “basic necessities” can prove to be very subjective.

3. Consumption tax is regressive, if there are no transfers. And yes, transfers are inefficient but we mitigate that by having one of the most efficient government and public sector in the world.

4. What if that retired man’s wealth was initially inherited? I think a consumption tax (when it behaves like a wealth tax) could sometimes be fairer than income taxes. It’s true that a stronger reliance on income tax could suit my personal aspirations more. However, I do believe in social justice and I am more than willing to play/pay my part to have stronger social cohesiveness.

5. Regarding estate duties, I previously shared the same sentiment as you. However, I now realise that the truly rich will almost always be able to evade estate duties through various investment/insurance/estate planning instruments. In the end, estate duties might only impact the middle classes.

butting in a bit on point 2, on the consumption of, say, rice,

yes, the rich may not necessarily consume more rice, but i think it’s a reasonable assumption to say they are likely to consume a more expensive brand or type of rice. in contrary, the poor(er) are likely to buy more of generic house-brands or lower-priced rice.

1. You have missed the point altogether. I am talking about cost price. Unless HDB sells flats at below cost price, there is no subsidies. If there is no subsidies, there is no transfer of tax money.

Implicit subsidy does not exist because tax dollars are absolute.

You pay $100 for cost of HDB and if you sell it at $110 to citizen, you are are not subsidising . Yes, you can sell at $120 in open market but its $10 less profit and absolutely not a subsidy. Therefore, no subsidy = no transfer of tax

2. Even assuming rich and poor consume same amount of rice and the rich consumes higher cost rice, it is trite law that the poor spends more percentage of their earnings on basic necessities. That in turn leads to high percentage of income that the poor is taxed. That is regressive taxation.

Why basic necessities are used is because there is no way one can avoid spending on them. The rich however, may choose to spend on luxury goods such as cars.

3. There is no relation between imposing regressive/progressive tax and how efficient the government is.

One can argue that govt may be efficient at doing a wrong thing. Which is essentially making a bad thing worse. Specifically, collecting tax efficiently from the poorer population

4. Agreed that if retired person is inherited, the person basically pays no tax. As for the other point, lets just say our definition of social justice differs.

5. That brings us back to point 3.

In your example, it shows perfectly how the govt is inefficient in collecting tax from rich and extremely efficient otherwise.

To be fair, this is a topic on Chan.

Thus, I apologize for the the topic hijack and will post no further on this

You reserve the rights to post the last response on this off-tangent discussion.

Cheers !

Hi oremun,

Firstly, this is an interesting conversation and I enjoyed it. Many of your points are valid although I do hold a different stand in some grey areas.

1. I think you are right that as long as the cost price is higher than the selling price, there is no transfer. However, perhaps the transfers exist in other forms (i.e. Building and maintaining world-class libraries etc)

2. I think it is hard to define “basic necessities” and I do agree that it is likely that a rich person will spend a lower proportion of his income as compared to a poorer person. An assumption is made that the government transfers back these taxes progressively or use it to enhance infrastructure that could potentially benefit the masses more than the rich

3. What I meant was that if I collect $100 but give $200 back to you (efficiently), society and you would not be worse off.

5. Most countries are finding it difficult to tax the rich effectively, including Singapore. High consumption taxes on luxury goods (property & car) is probably one of the best ways.

The key to whether our SG50 system continues to improve or at least be maintained lies in having the right people with character competence and commitment to lead and also to implement.

Thankful for people like CCS.. and others like him.

Good leaders also need good followers. It’s scary that bad followers can elect bad leaders too.

Hi Joshua,

I agree with you.

At the same time, wanted to add that good leaders would like a good mandate from the people they lead. :p

I have a good feeling you will agree with me on that additional point.

Singapore Government is very pragmatic, with a laser focus on what works and not ideology. You get either a extreme left or right dogmatic person to tour Singapore and they will hate the place for HDB (extreme right) or the lack of minimum wage (extreme left)

And speaking about price of gas, the poor don’t need gas. The poor need jobs and food, which Singapore have abundance. Do take note we are a small island, we cannot afford to have too many people driving around.

Hi,

I agree largely with you! Better to be more moderate than extreme.

Food is really abundant now. One just needs to check out the Mac app for free food sometimes.