It’s been slightly more than 2 years since I have updated my portfolio on this blog. You can check out the Sep 2018 update if you want a comparison.

What’s really interesting is that in Sep 2018, I announced my first foray into tech stocks, with a small purchase on Tencent. Even then, many many many, including myself thought that I was maybe a bit too late in the game. Hindsight has proven otherwise.

The composition of the portfolio has since tilted towards that direction, as I started adding the US tech giants into the mix.

This evolution is partly responsible for pulling up my returns and I am happy to admit that it’s close to my long term target of 10% annual returns. The other factor?

The. Year. 2020.

Of course, not everything I touched (traded would be more apt) turned into gold. Like selling 12,000 shares of FLCT at 87 cents in late March 2020.

“Well, show me someone without investment mistakes in 2020 and there you have it, a market commentator” – Mr 15HWW

The saving grace is that I was a net buyer of decent stocks (CICT, DBS, Alphabet, Disney, Alibaba) in the first half of 2020.

Buying then was simple, but NOT EASY. I actually broke out of my self-imposed hiatus and wrote a blog post on 19 March 2020 (do read it, I think it’s one of my best ever off-the-cuff posts) to clear my thoughts and observe my emotions from a third person point of view.

I bought more even when I felt that there were strong odds the prices could drop further.

Honestly, glad to be proven wrong. With the recent run-up, I am also more inclined to harvest than sow seeds in the financial markets.

Locking in some gains is crucial, even if right now, I am quite happy with the composition of the portfolio. I believe the geographical exposure is quite balanced and in line with my geopolitical views. A 70/30 stock-cash split is a satisfactory default and I am prepared to navigate between 60/40 and 80/20.

This also means I likely won’t be too active with trades, so barring sensational market movements, I believe quarterly portfolio updates should suffice on this blog.

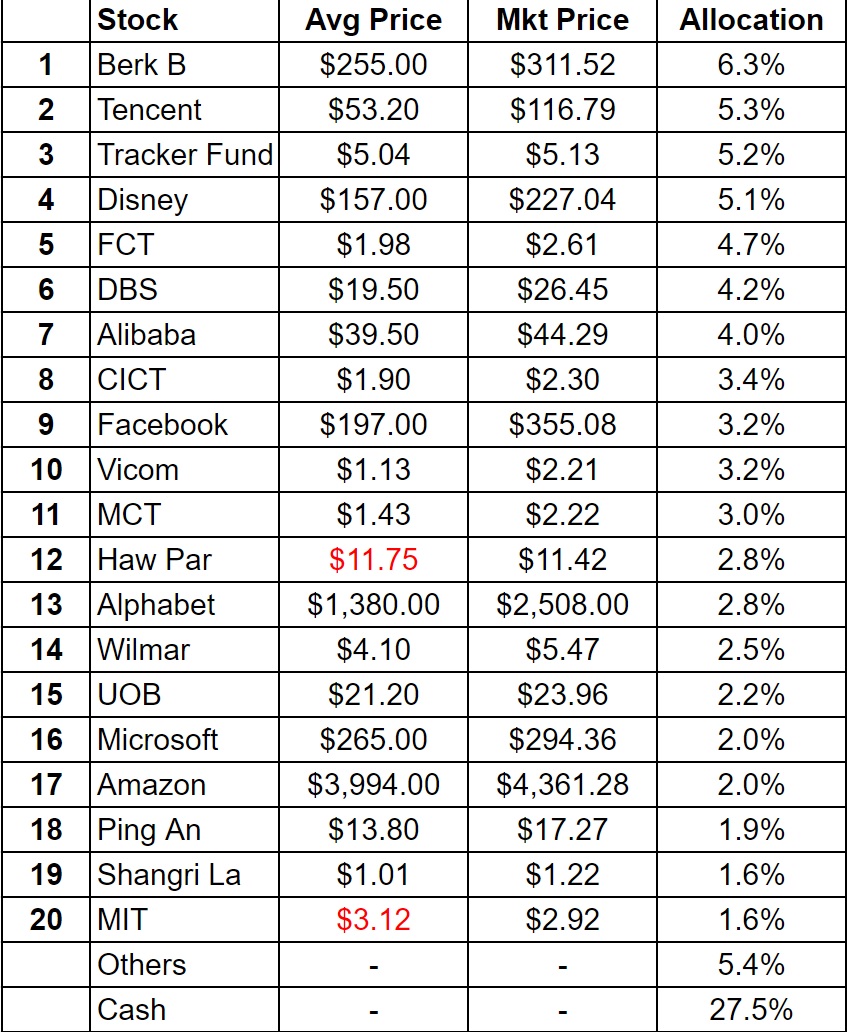

So here’s the 15HWW Investment Portfolio:

Annualised Return: 9.7% p.a. (Nov 2010 to Jan 2021)

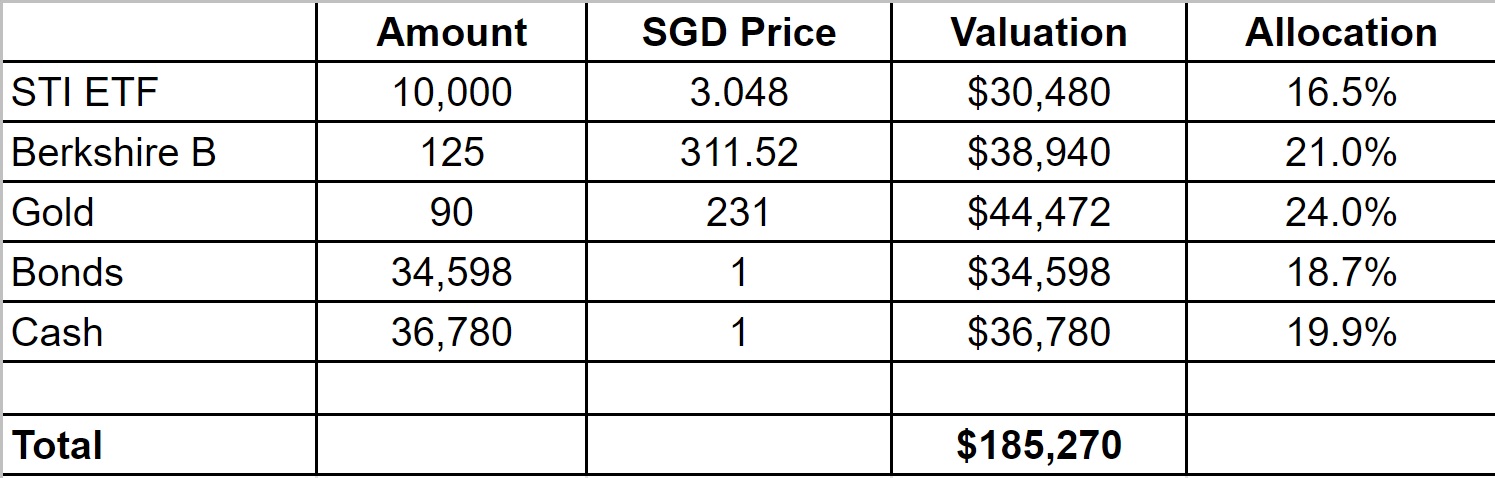

I have also maintained the 15HWW Permanent Portfolio judiciously. Even though the portfolio was ripe for a rebalancing during the sharp market crash in 2020, I opted not to. Instead, I used it as a signal to buy more equities for the 15HWW Investment Portfolio.

As self-employed, the Mrs and my CPF savings are quite threadbare. However, we are not comfortable topping up our CPF accounts. Even when we have reached our mid-thirties. Whether it’s the RSTU or even the more flexible Voluntary Contributions.

For this portion of funds, I believe a viable alternative is some version of the Permanent Portfolio:

- Liquidity and optionality is preserved

- Volatility is low and

- Based on my experience so far, the returns have matched (in fact, exceeded) CPF returns.

So here’s the 15HWW Permanent Portfolio:

Annualised Return: 5.3% p.a. (Jan 2017 to Jan 2021)

Gold has been the best performer in the 15HWW Permanent Portfolio over the past 4 years. And these days, when you mention gold, it’s hard not to have Bitcoin (or cryptocurrency) creep into the conversation.

It’s also the elephant in the room.

For a millennial (yes, I am young enough to still qualify) who believes in the value of having gold in his portfolio, not having any exposure to Bitcoin prior to 2020 is a little bone-headed. Especially after one of my favourite financial bloggers wrote a fantastic piece and got himself some skin in the Bitcoin game in August 2018.

Something to explore in 2021 would be to pare down some cash/bond and allocate a 5% or even 10% exposure to Bitcoin in the 15HWW Permanent Portfolio.

Am I too late in the game? Like my foray into tech stocks, only time will tell.

Thanks for reading.

Hi

Just curious about the decision to sell FLCT and buy CICT. Were you concerned about the Covid impact to office landlords but change your view later?

A Happy New Year to you and your family!