I opened a Singlife Account some time in May 2020.

That was a stressful period in my life. Circuit Breaker, investment portfolio tanking, temporary loss of income, and yeah, no bubble tea. It was really bad.

Furthermore, I took a mortgage deferment, so my cash funds sitting at DBS Multiplier took a huge interest hit.

So when the people behind Singlife dangled a 2.5% risk-free p.a. return, I bit. Even if the rate only applied to a rather paltry $10,000 balance.

No strings attached, but still a bad taste in the mouth…

Sure, I knew this was a time-tested recipe to attract sign-ups and the good returns were temporary . But when under stress, a $250 guaranteed return seemed like a godsend.

Until it was not.

The (UnPleasant) User Experience

The Mrs and I opened an account each, so straightaway, that’s two new accounts and two sets of passwords to remember.

This was also not a typical account with a bank, so we dipped our toes and just transferred $500. We then tested the withdrawal system with a $100 withdrawal. Mine went through without much of a hiccup, although I still had to wait for half an hour for the transfer to be reflected.

But the Mrs’ experience was not as smooth sailing.

We waited for one, two and then three hours. The $100 was not transferred back to her bank account even at the end of the day. The Mrs had to text Singlife but was greeted with a bot reply to wait till the following day as it was past their operating hours. Throughout the communication, the customer support personnel did not state the reason for this issue, but we guessed that there was some back-end problem syncing to her bank account.

After 3 working days, the $100 finally came in. We were not worried throughout the whole episode but it was a hassle to have to keep track.

2 Nerfs Within 3 Months

On 1 November 2020, Singlife reduced the interest rate on the first S$10,000 from 2.5% to 2.0% p.a.

“Argh, we barely enjoyed the 2.5% for 5 months but well, 2% is still decent, better than their competitors.”

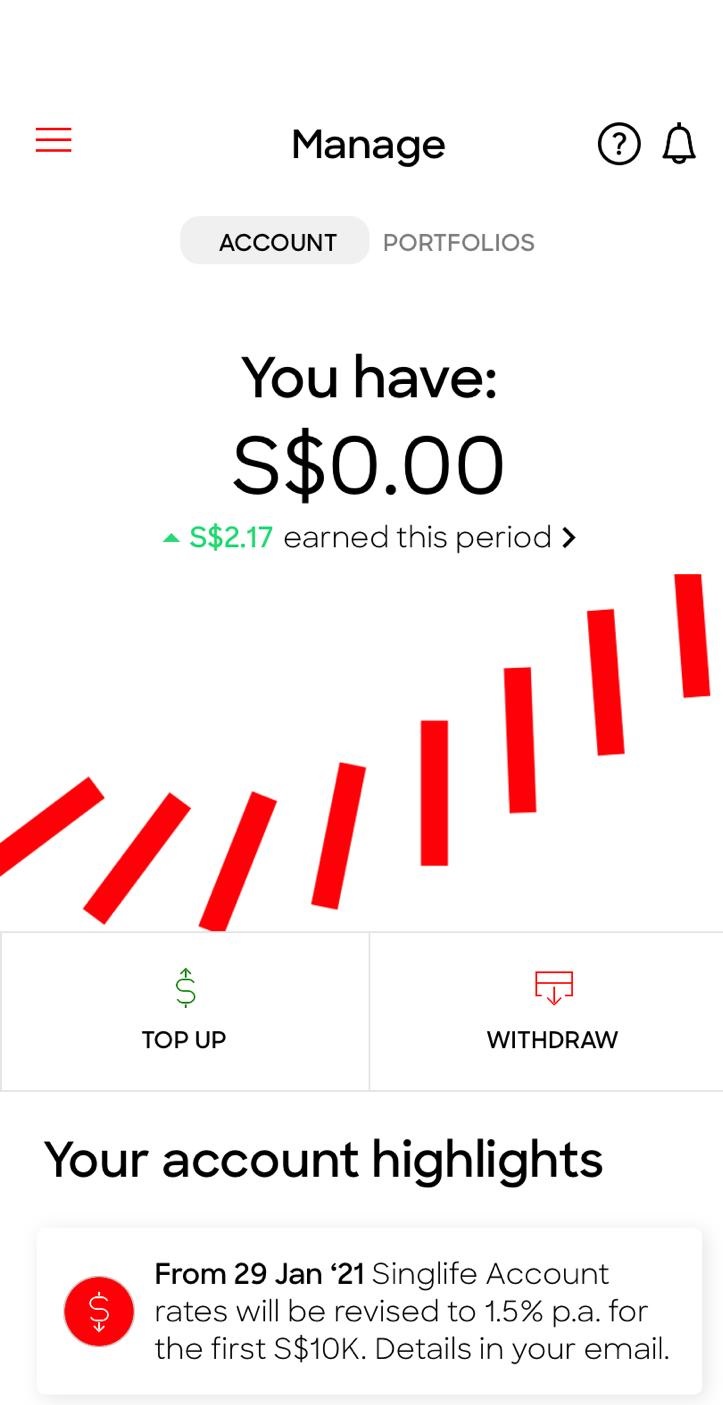

A few days ago, I received an email informing me that Singlife will be adjusting the crediting rate on the Singlife Account from 2.0% to 1.5% p.a. for the first S$10,000 from 29 January 2021.

“This is ridiculous. Competitors’ rates are better. They are really banking on people’s inertia to switch. We are going to prove them wrong.”

Dash EasyEarn Dash EasyEarn |

Singlife Singlife |

||

| Returns | 1.8% p.a | 1.8% p.a | 1.5% p.a* (+0.5% for Save Spend Earn) |

| Breakdown | First S$10K: 1.8% Above: 1% |

First S$20K: 1.8% | First S$10K: 1.5% Next S$90K: 1% |

| Initial Deposit | S$50 | S$2K – S$20K | S$500 |

| Min Balance | S$50 | S$2,000 | S$100 |

| Max balance | S$200K | S$20K | None |

| Lock-in | None | None | None |

| Withdrawal penalties | None | None | None |

| Withdrawal blocks | None | S$100 | None |

| Withdrawal fees | 70 cents/ 50 cents (for DBS/POSB) |

70 cents (free to Dash Wallet) |

None |

| Life insurance coverage (% of account value) | 105% | 105% | 105% + terminal illness |

| Capital Guarantee | Yes | Yes | Yes |

| *Effective 29 January 2021 | |||

Source: Milelion

In Quickly, Out Quickly

Both the Mrs and I transferred all the funds out of Singlife yesterday on 27 January 2021.

Assuming an alternative that gave us 1% returns, each of us had gained about an extra $75 each by choosing to park our cash with Singlife. I personally think it’s a wash considering the amount of hassle it involved and of course, the questionable rapid cuts that leave a bad taste in the mouth.

We are generally long-term people and at 8 months, this is the shortest period we have parked money with an organisation.

I understand even at 1.5% (without any conditions), this might still be a pretty good place to park cash for some people.

Just not us. We have an alternative with DBS (>2%) since we easily fulfil some conditions and get to park $100k. Somehow, I believe that’s still something worthwhile to maintain in the age of GME, TSLA and BTC. #sighsighsigh

If that gets nerfed, there’s always the option of paying down our mortgage.

Would I turn to some of the competitors in the table above? I highly doubt so.

Especially since I am determined to adopt the advice of a wiser and wealthier blogger to stop majoring in minor stuff.

Thanks for reading!

Hi! Can I ask which is the DBS alternative that’s more than 2%?

Hi Fiona,

It’s DBS Multiplier Account but you would have to fulfil certain conditions to get the higher interest rate. We have credit spend, salary credit, mortgage and investments with them.

Don’t be a circus animal, is all I can say LOL.

Hi Sinkie,

It’s like a scab that you know you should not scratch, but you end up doing it anyway.

Good advice