Low-cost online brokerages have finally descended onto Singapore and the latest entrant is Moomoo, powered by Futu Holdings Limited. After using the Moomoo app for about a week, I believe the traditional brokerages have a real fight on their hands to maintain market share.

Why? Because it’s been a great experience for me so far and I believe almost any investor should give the Moomoo platform a real shot.

If you are still sitting on the fence, here’s 9 reasons why you should sign up for a Moomoo trading platform today.

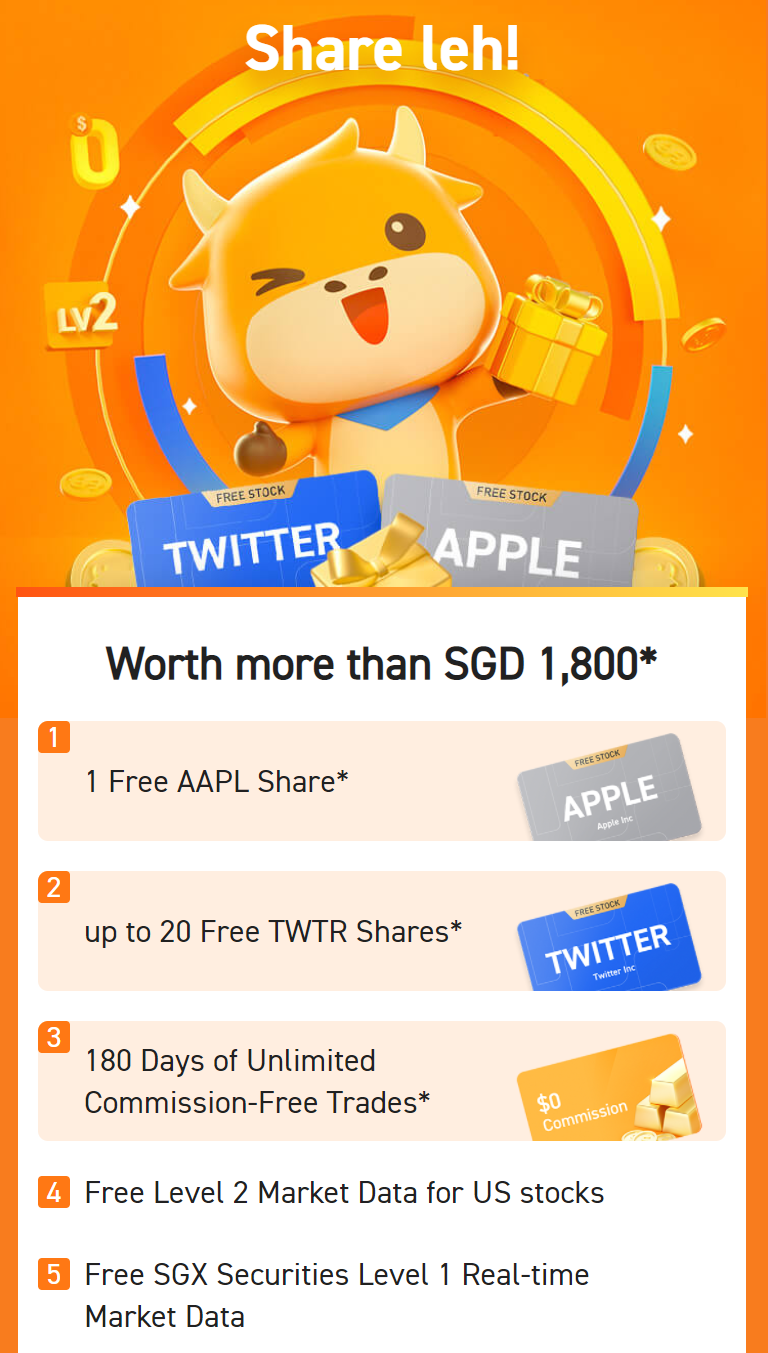

1. Attractive Welcome Bundle Worth SGD 180

As the latest low-cost online brokerage to enter Singapore’s market, there is a chance you might already be using a similar low-cost online brokerage, and so there’s some inertia to switch.

So, it is not surprising that Futu is offering an attractive welcome bundle to entice investors and traders to come onboard and test out their Moomoo platform. And if you have not tried out a low-cost brokerage before, like my Mrs, signing up for a Moomoo account is a no-brainer.

Just the free Apple share is already worth ~SGD 180

One Apple share is worth about USD133 (as of 2 May 2021).

Not to mention the commission-free trading on US, HK and Sg markets for 180 days and the free Level 2 Market Data for US stocks.

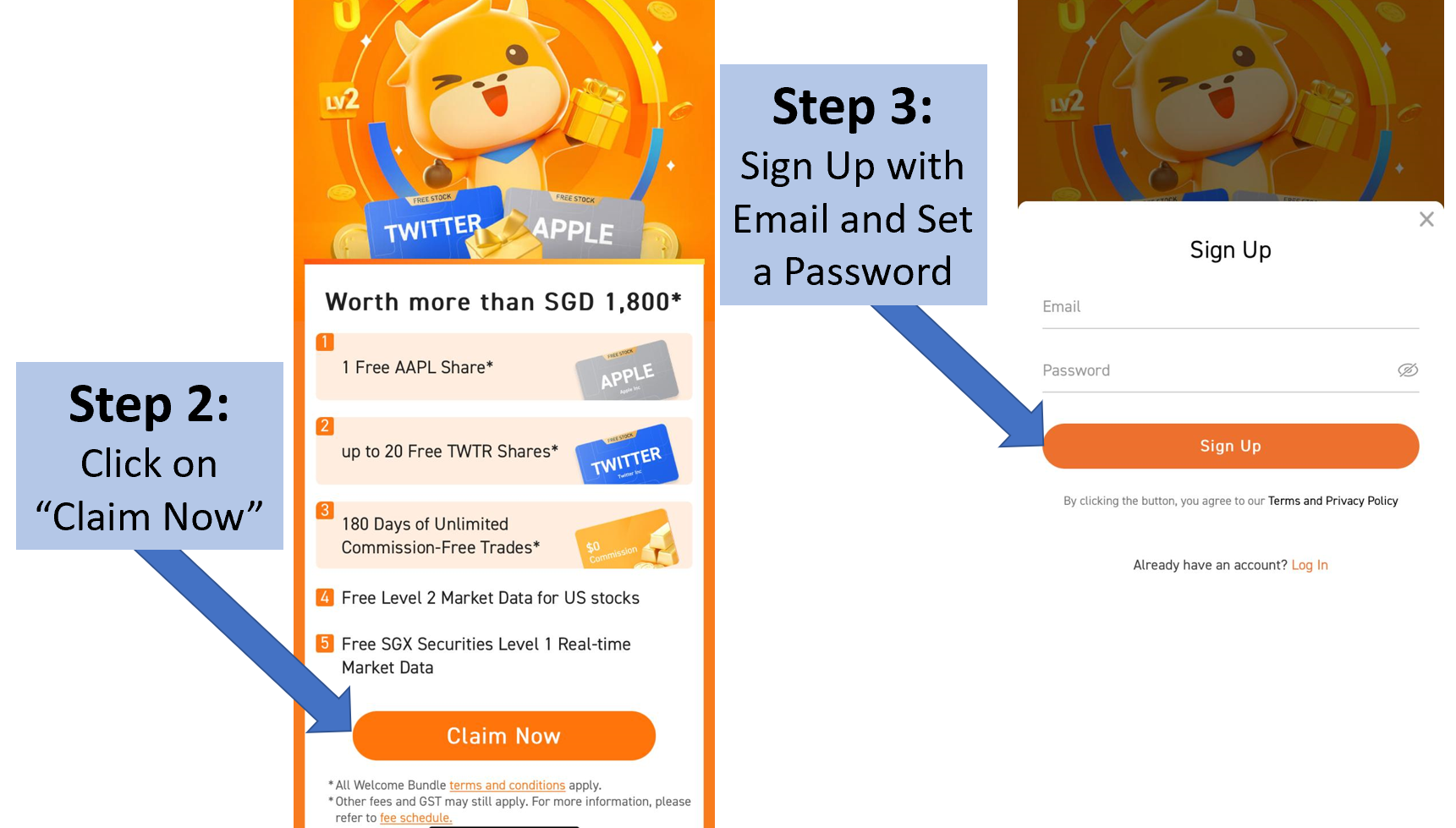

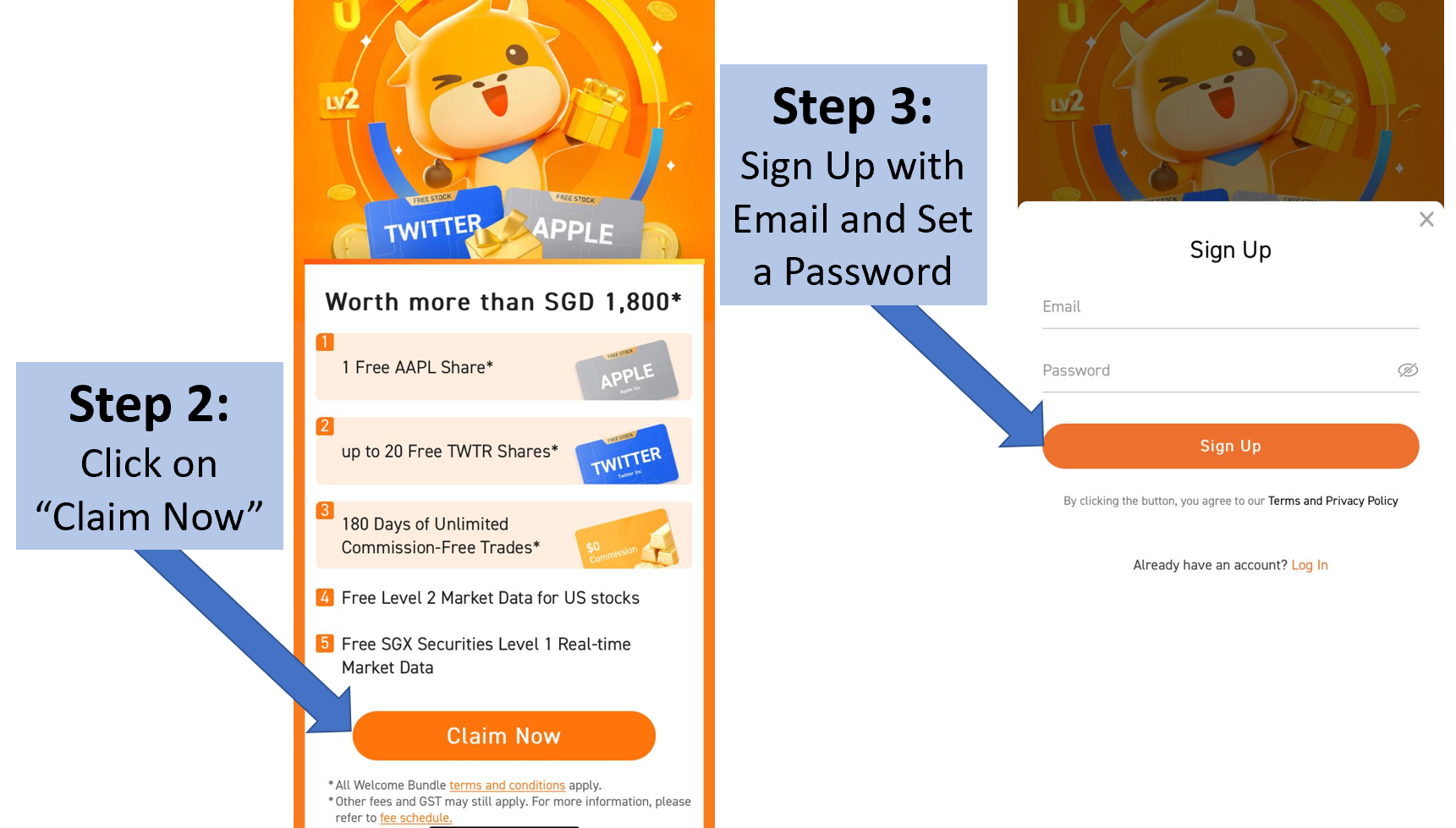

Here’s what you need to do to receive this attractive welcome bundle:

- Step 1: Sign up using this link

- Step 4: Download the Moomoo app on your phone and then log in

- Step 5: Set up and open the trading account

- Step 6: Wait for the account to be approved (email will be sent)

- Step 7: Complete an initial deposit of SGD 2,700/HKD 16,000/USD 2,000 within 30 days

Do it as early as possible to avoid getting disappointed!

2. Smooth and Fast Set-Up Process

The Mrs and I have opened an account each. Here’s the time it took for the steps mentioned above.

| Steps 1 to 4 | Less than 5 minutes. |

| Step 5 | Less than 10 minutes using MyInfo. Opting for the manual process would of course take longer. |

| Step 6 | Might take 1 to 3 business days but both our accounts were approved within 15 minutes! |

| Step 7 | Less than 5 minutes to add the Futu Singapore PL account into our bank accounts and then transfer the initial deposit of SGD 2,700. |

| Beyond | The funds are expected to be deposited in 1-3 working days and our experience was it took about 1 working day. I have spoken to Futu SG and they are working on reducing the deposits and withdrawal times to provide an even better customer experience. |

So yes, for less than an hour of effort, you are rewarded with up to SGD 180 worth of benefits. For perspective, my hourly wage is no way close to that. #damnworthit

3. Three Important Markets on One Convenient Platform

My father-in-law has procrastinated on activating the HK and US markets on his traditional brokerage for the longest time. There is a lot of inertia on his part to fill up the necessary forms.

So once in a while, he will “commission” me to buy overseas stocks for him using my account.

All these will be unnecessary once the Mrs and I get him onboard. I am quite sure he will enjoy the Moomoo app and the convenience it provides to invest in the Singapore, Hong Kong and US markets all on one platform.

I really believe access to the overseas markets is crucial for Singapore investors to reduce home country bias. In fact, my decision to venture overseas a few years ago has helped to propel the performance of my investment portfolio.

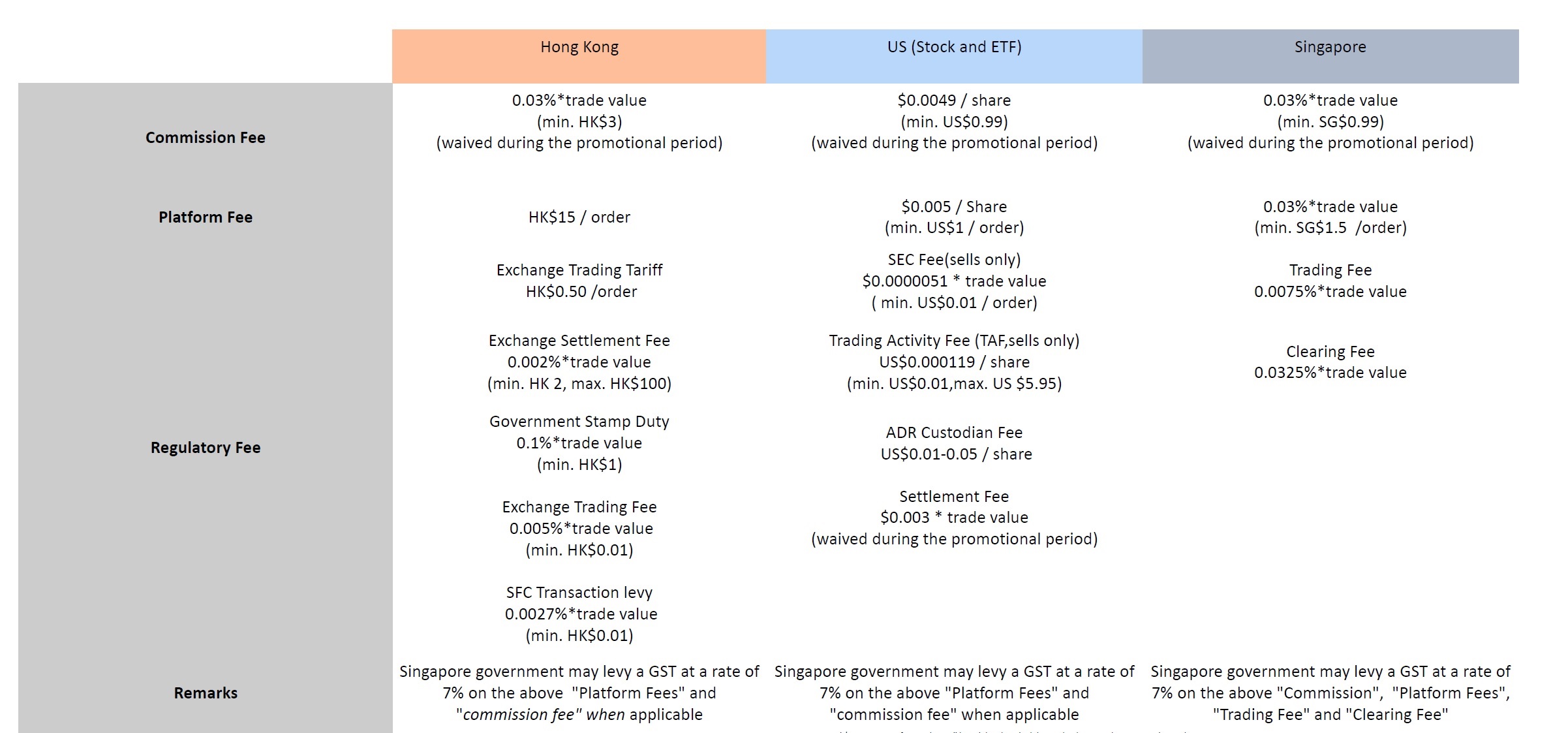

4. Low Transaction Fees

I have attached this table below, but unless you trade multiple times within a day, it is probably not necessary to go down to the nuts and bolts.

Feel free to do a comparison with your current brokerage. But you do not have to spend hours comparing and miss the forest for the trees. Because what’s obvious is:

- Futu SG is competitive with other low-cost online brokerages and

- For a typical retail transaction, the total transaction fees on Futu SG should be much lower as compared to those at traditional brokerages

5. Competitive Exchange Rates

The Mrs and I tested out the differences in exchange rate. She used DBS Multiplier Account to convert to USD before transferring to her Moomoo account while I transferred using SGD and then converted on the Moomoo platform.

The exchange rates were similar. In fact, based on our transactions on 9 March 2020 at around 2pm, Moomoo’s exchange rate was slightly better. Nothing against the DBS Multiplier Account, but I guess the message is in no way are you disadvantaged if you just transfer SGD to Moomoo and convert from there to trade in the US or HK markets.

6. Opportunity To Dollar-Cost Average (DCA) Slowly

Many brokers charge a minimum commission of SGD25 and that is a big constraint.

Previously, most of my trades are >SGD 10k as I prefer to keep my commission to <0.5% of the investment amount.

This also means that I often agonise over the timing of my trade, since I would have limited attempts to average down. There is always the lingering fear that “I am buying just before the CRASH!”

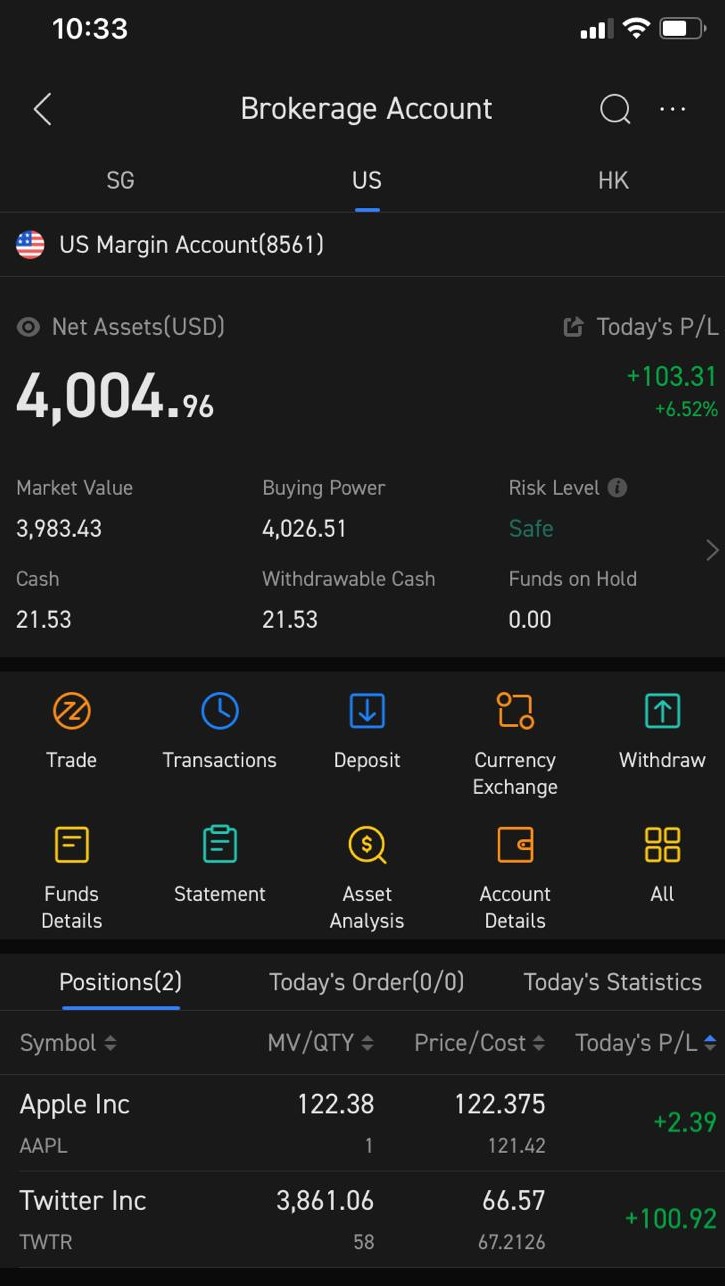

Using Moomoo has helped me to break away from these invisible chains and stress. Recently, I am slowly building up a position in Twitter. I am glad I could accumulate 58 shares in Twitter over several different trading days, using only about USD1,000 for each trade.

Screenshot of my holdings on Moomoo

Markets are increasingly volatile these days and the opportunity to DCA enables me to sleep more soundly as I build up this new position.

Disclaimer: All investments carry risks and the above screenshot is definitely not investment advice! Please do your own research before you make a trade.

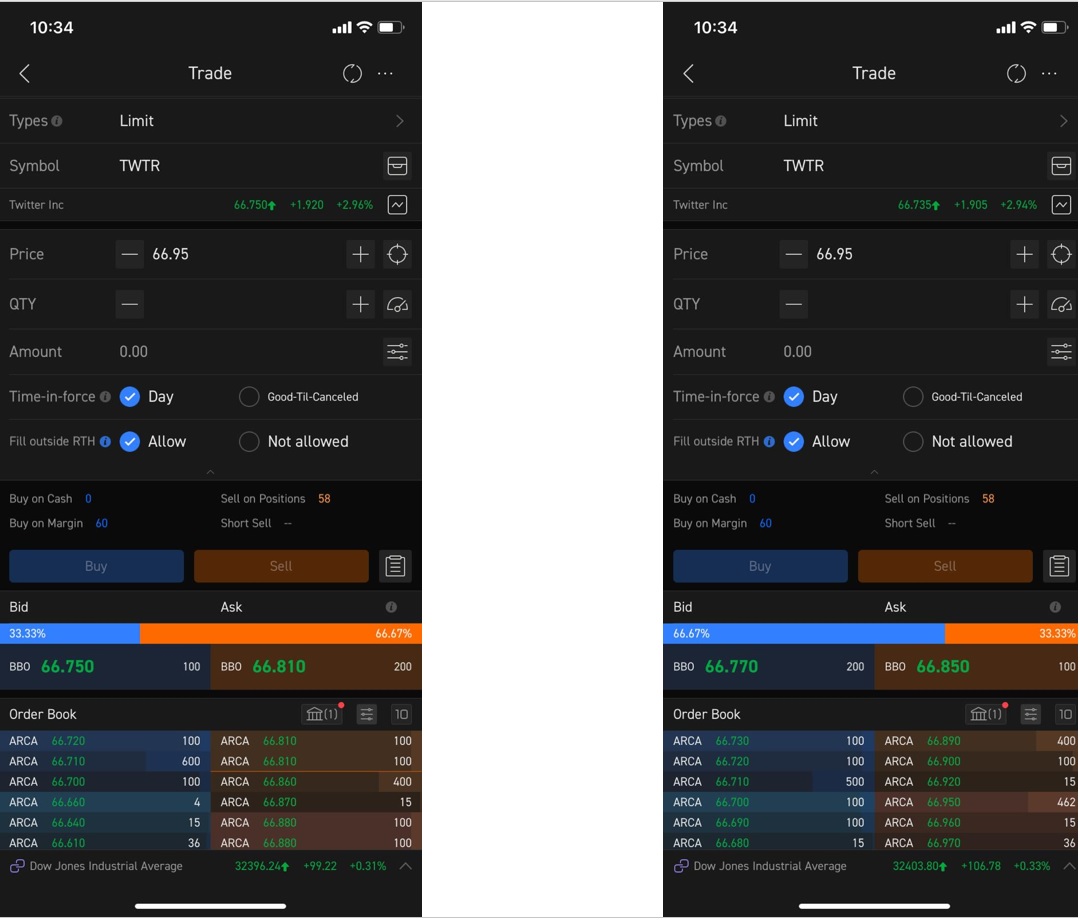

7. Swift Trades, Mind-Blowing Trading Experience

I personally do not like to queue and wait when I want to make an investment. For SG stocks, that’s not an issue since live prices are likely free and I can always execute my order at the latest ask price.

However, for overseas markets, especially the US market, there’s typically a 15-min lag for stock tickers using a traditional brokerage unless a user pays for premium services.

So there’s a vagueness and plenty of guesswork in the prices set when I attempt to buy US stocks. I often have to revise my bids too, adding to the frustration.

It’s akin to throwing a dart at a board in misty conditions.

The above did not apply to my Twitter trades on the Moomoo platform. They were all executed within 5 seconds of placing the order. It was mind-blowingly efficient. Below is a screenshot of the comprehensive data that I receive.

Two separate screenshots 5 seconds apart, showing the value of market depth

8. Futu & Moomoo Are Reputable Establishments

This might be the first time you have heard of Futu and Moomoo so you might be thinking if you can trust them with your SGD 2,700.

In Singapore, investment products and services on Moomoo are offered by Futu Singapore, a wholly-owned subsidiary of Futu Holdings Ltd. Futu Singapore is also licenced and regulated by the Monetary Authority of Singapore (MAS).

Futu Holdings Limited (富途: loosely translated as “The Path To Wealth”) was established in Hong Kong back in 2011 and is listed on the NASDAQ.

It is also backed by Chinese internet giant Tencent Holdings, so I do believe there is credibility in their credentials and intentions to become an influential global financial services platform.

9. Skin In The Game From Mr 15HWW

To be absolutely transparent, I have always set myself a very strict criteria in terms of what I promote/advocate on this blog to my readers, which includes you.

- I must use all of these products and services myself

If you are a sharp reader, you would have noticed from my earlier screenshot that I have USD4,000 of assets in my Futu SG securities account. This is way higher than the minimum requirements needed to qualify for the welcome bundle.

So in this instance, not only am I using the same product and service, I might be taking even more risks than someone who puts in the minimal requirement of SGD2,700.

- Product and services must benefit readers

The welcome bundle is easily worth more than SGD 180 and many readers have signed up and benefited from this promotion.

- There is no additional cost to readers in any way

There is no additional cost to you when you click on my referral link to register a Moomoo account before you download the app. This post is essentially also a review from a satisfied and grateful customer.

So grateful that if you were to drop me an email and inform me of your support, I will be very inclined to buy you coffee.

Conclusion

Therefore, if you are convinced to sign up for a Moomoo account, let me reiterate the steps that you need to do.

- Step 1: Sign up using this link

- Step 4: Download the Moomoo app on your phone and then log in

- Step 5: Set up and open the trading account

- Step 6: Wait for the account to be approved (email will be sent)

- Step 7: Complete an initial deposit of SGD 2,700/HKD 16,000/USD 2,000 within 30 days

If you have done the above and fulfil all the conditions, you should receive the free Apple share within 5 business days, if not earlier.

Hope you enjoy the Moomoo app and platform as much as I do. Feel free to share with me your experience.

Thank you for reading.

Disclaimer: This article contains affiliate/referral links and contributes to the sustainability of this blog and our next IVF cycle.

Supported. Thanks for sharing the good deal

Hi Jon,

Thanks! Hope the set up was a breeze for you.

Sorry, I’m a newbie. Would like to check how you can FUTU SG account in my bank account? Similar as add payee?

How to transfer fund from our bank account to MOO MOO and convert to USD in MOO MOO platform as mentioned in your post. Thanks

Hi Larry,

Yes, adding Futu SG to your bank account is like adding a new payee.

Click on “Me” tab in the app, click on “Brokerage Account”, and then click “Deposit”.

Just follow the instructions and add the payee on your bank account. And then “Inform FUTU”

As for the currency exchange, once your SGD deposits are in your account, click on “Me” tab again and there is a button “Currency Exchange”. Click that and change to the currency of your choice. If u change to USD, then your US brokerage will have the funds for you to trade.

Hope the above helps and let me know if you have any further questions.

Hi , thanks for the steps.

Its a breeze and the transfer took just 1 hour.

Hi, once I get the Apple share and sell it, am I able to withdraw the money back to my bank account? Are there any withdrawal fees should I do so? In short, was planning to simply sign up for this account simply to get $150 (i.e. cash coupon and Apple share). Thanks in advance!

Hi BS,

There are no withdrawal fees. So you can definitely do what you had just suggested.

But as always, I would urge to give the platform a try and you can then see how it stacks up against traditional brokerages.

Hi Thomas,

I chance upon your blog and took up subscription to moomoo following your link. I had managed to open an account and collected 0ne apple share & $30/. Thanks.

But as a new subscriber , I will like to find out do you require full share price that you intend to purchase to be in your MM account before you purchase?

Hi Koh,

Yes, you need to have the funds in your account before you make the purchase. So if you are buying US or HK stocks, please make sure the funds are converted to the respective currencies before you make the trade.

Otherwise, you will be buying on margin.

Hello there, great post! Just wondering, did you get charged when exchanging your funds from SGD to USD within Moomoo?

I have exchanged all my SGD funds to USD and the following month I got an interest fee in my SGD account. The only reply the customer service provided was because there was an exchange and the account had zero balance -.- but I still don’t know what charge it was for in the first place.

Thank you.

Hi Joanna,

I did not have such an experience when I exchanged all my funds from SGD to USD. It is quite puzzling.

Just curious, so since there is no SGD in the account, so the balance is now negative?

Hi 15HWW,

Opened my moomoo and received the free apple share. Just want to highlight that if you want to do a limit price order, the range is only 24 bid from the last price of the counter according to the support staff of moomoo. I don’t really understand what it means.

An example, if you want to key in a buy order for Meituan (3690.hk) which is trading around HK$290 currently, the range you can key in for your order is only HK$0.20.

For tiger brokers, I tried for JD (9618.hk) which is trading around HK$296 currently, I am able to key in an order limit price of HK$290 and they accepted my order.

Hi Chong,

Thanks for your feedback.

I have not used the app to trade the HK market. It’s been the US market for me so far as I find the Level 2 data much friendlier.

A 24-bid spread should be much greater than HK$0.20. This seems to be a technical issue and did it persist when you tried with another share?

Hi 15HWW,

The HK$0.20 range bid spread was what their technical support told me yesterday and I find it not really true. I tried again this morning and the order was accepted when I key in a HK$0.60 range bid spread.

Also I found that when using moomoo to buy 150 shares, the order will be executed as 100 shares using cash and 50 shares using margins even when you have enough cash in the account to cover the total cost for 150 shares. Their technical support told me for HKSE, shares are traded in lots of 100 shares and anything below multiples of 100 shares are considered as odd lot. I am unsure if this is the standard as I am still very new to HK market. But it doesn’t seem to be so when I tried to use Tiger Brokers.

Hi,

Do you know how much for the charges for Lvl 1 market data in SG stock market? So far all good just worry any hidden fees after the promotion period.

*charges for level 1 market data in the SG stock market will be applicable from 1 Aug 2021.