As I wrote almost 8 years ago in this post, we spent about $40,000 for the renovation of our 5-room BTO flat and an additional $25,000 for furniture and appliances.

View of our living room and the brick wall which we spent a bomb on.

View of our living room and the brick wall which we spent a bomb on.

But there’s no regrets even after 8 years.

At that point in time, I did not think too much about protecting the value of this investment. In fact, I had erroneously thought that HDB’s mandatory Fire Insurance Scheme would cover for any potential mishaps.

Yes, I am talking about the Fire Insurance that the HDB officer will ask you to purchase when you collect your keys.

However, the HDB fire insurance only covers the cost of reinstating damaged internal structures, fixtures, as well as areas built and provided by HDB. It does not include home contents such as furniture, renovations and personal belongings, even if the fire did not originate from your home.

Other than fires, there’s also the risk of flooding should the pipes burst or even burglary! Should I risk my life to protect the gold bars or give it up without putting up a fight because I have a home content insurance to cover my losses?

The House Has Become More Valuable With Time

One might argue that since the renovation is close to a decade old, if a fire really happens (touch wood), it would just be bringing forward a timely renovation.

So you wonder, what’s the point of insuring the renovation at this stage?

The truth is, if our house is severely damaged by a fire, the cost of reinstating it to its current condition is likely to be so much more costly, since it would include reparation and restoration works.

Moreover, we have accumulated valuables in the house which is likely to more than offset any depreciation of the renovation. They include alternative investments like gold bars and silver coins and not to mention, the Mrs’ handbags and jewellery.

Yea, Mrs 15HWW bought a Celine bag instead of a Chanel bag.

Yea, Mrs 15HWW bought a Celine bag instead of a Chanel bag.

Save On Travel Insurance, Allocate To Home Insurance!

I hate to admit it. But the lack of a home contents insurance has been a big blind spot for us over the past 8 years.

We always have no qualms getting travel insurance when we are on vacations. But if you think about it, we easily spend 300 days in a year residing in our home. And with Covid-19, it is probably at least 360 days for 2021. So it’s a no-brainer to shift our travel insurance budget to home insurance.

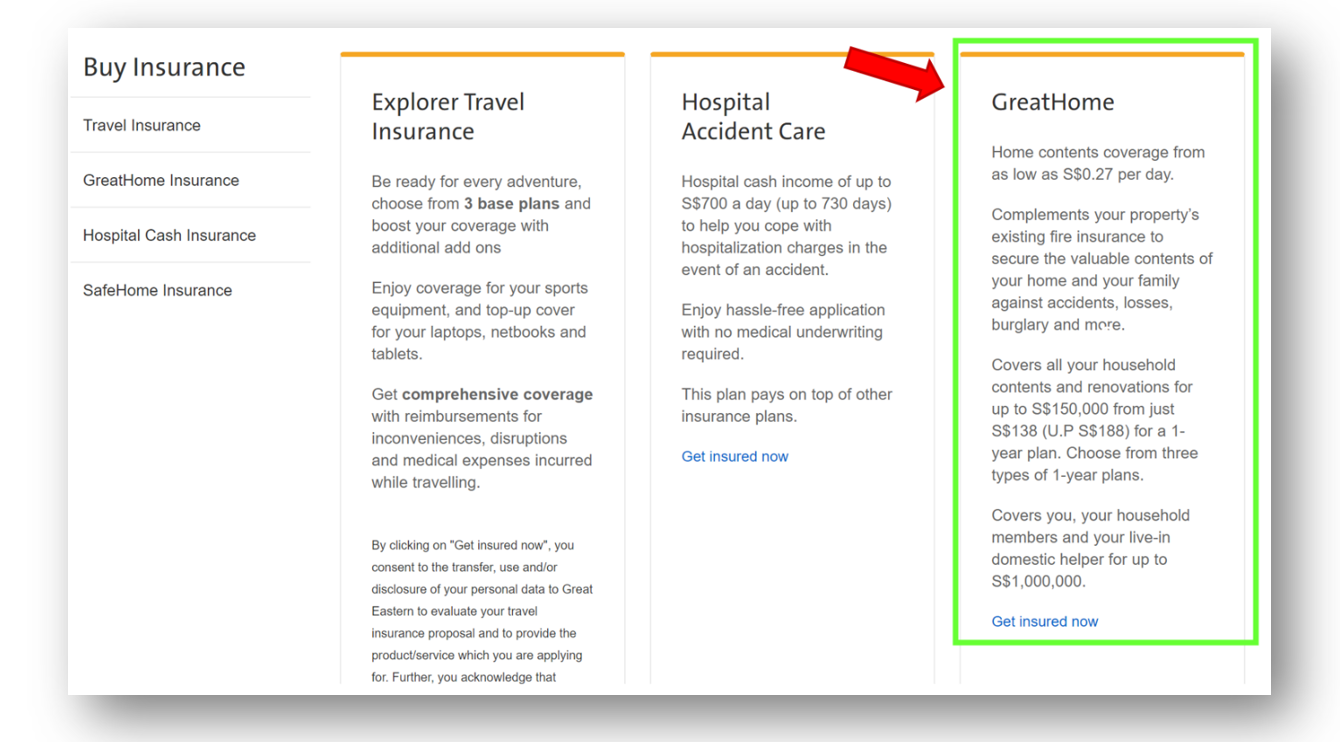

Furthermore, home insurance is affordable and accessible. In fact, the Starter Plan from OCBC GreatHome costs less than 35 cents a day.

The OCBC GreatHome Plan We Chose

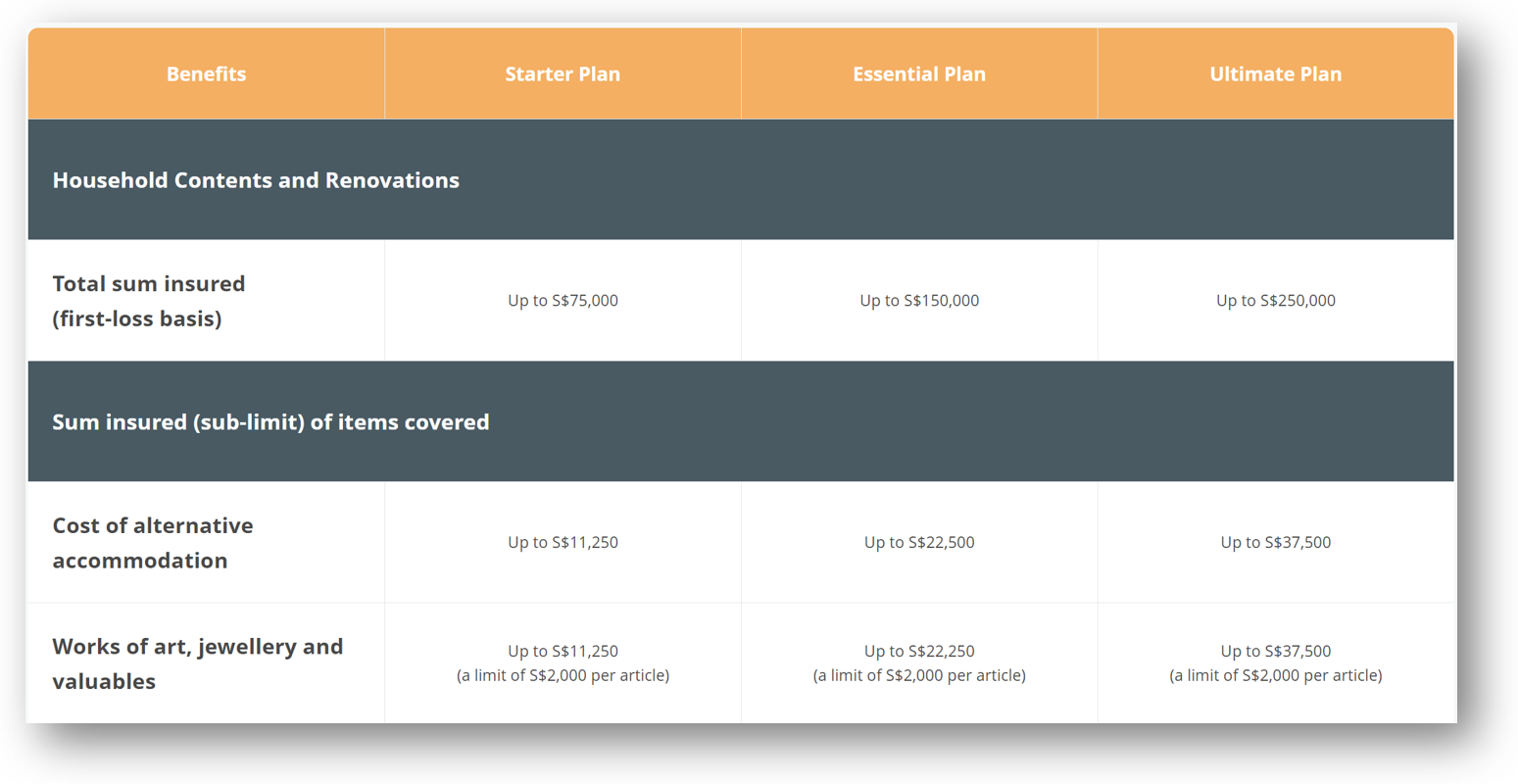

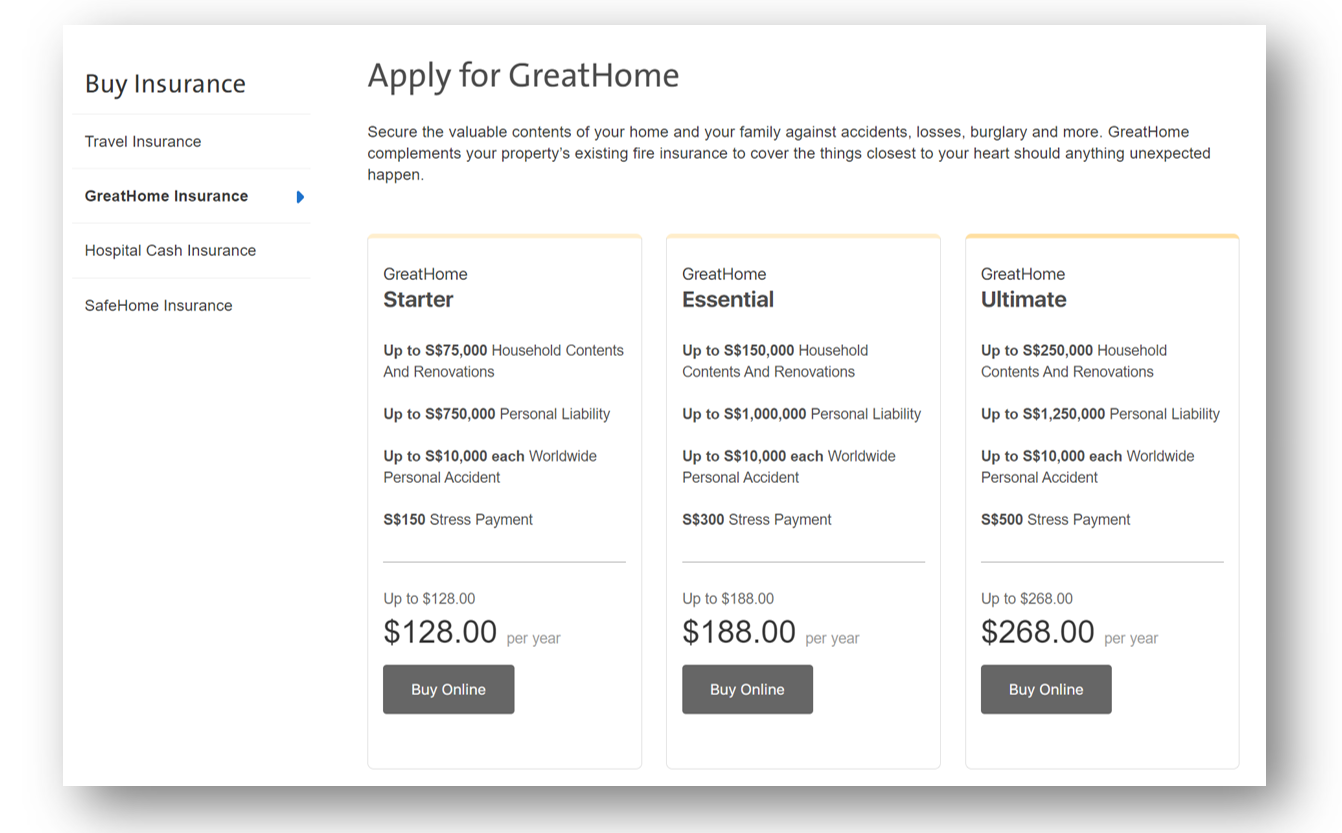

There are 3 different plans for you to choose from – Starter, Essential and Ultimate Plan. They are applicable for all HDB, Condominiums and Landed Properties. The deciding factor is how much coverage you need and want.

A Starter Plan ($128 annual premium) might suffice for most who stay in HDB flats. For those that are staying in bigger houses or have more valuable possession to insure for, the Ultimate Plan ($268 annual premium) might be the most suitable.

As for us, we decided on the Essential Plan ($188 annual premium) as we value a higher sub-limit for both the cost of alternative accommodation and the sum covered for works of art, jewellery and valuables. Beyond the furnishing and our appliances, there are easily 10 other items worth at least $2k in the house.

Onboarding Process

I presented the case to Mrs 15HWW to purchase the insurance ASAP to close the gap. However, I was dismissed with “Lawrence Wong reminded us to stay home, we shouldn’t be going to the bank now.”

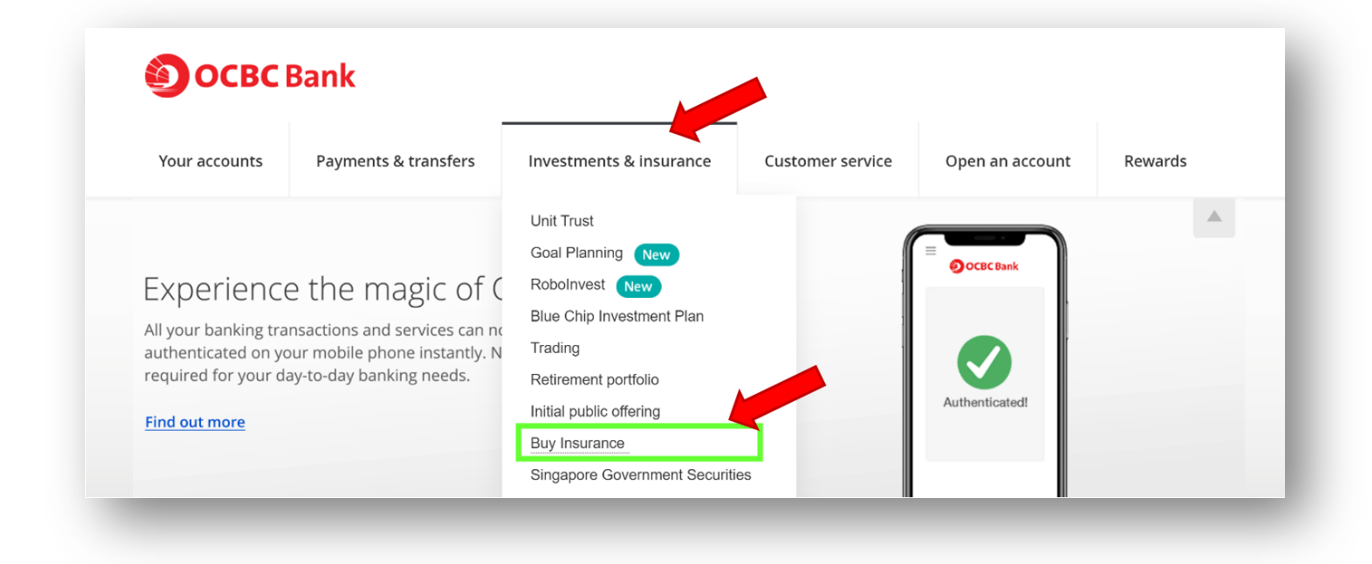

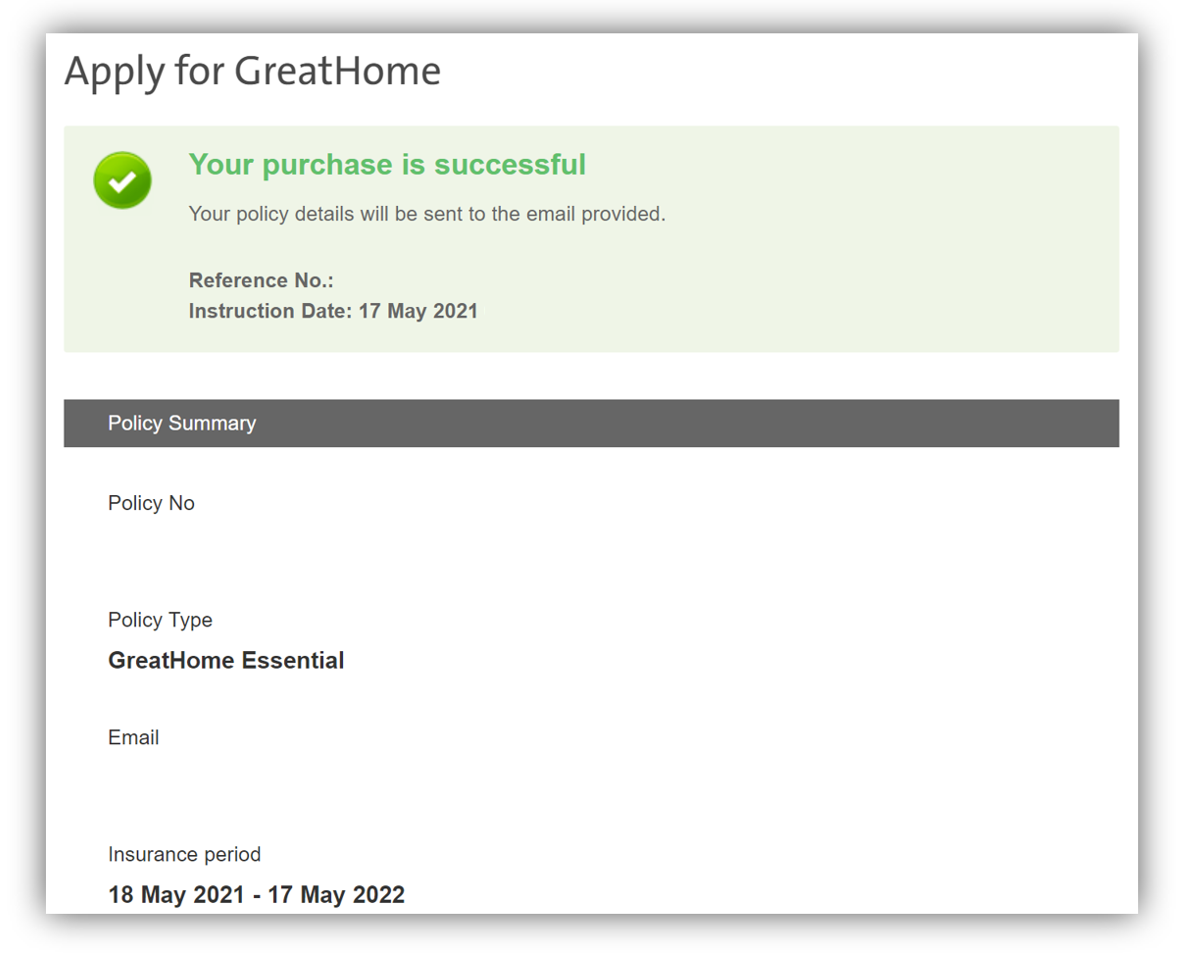

Little did she know that signing up for OCBC’s GreatHome insurance was a breeze. We did not have to go to the bank outlet or approach a financial advisor. Since we are OCBC customers, we just had to log on to our OCBC Internet Banking (on desktop). If you are not a customer of OCBC, you can still purchase via Great Eastern’s website.

The whole buying process took less than 5 minutes. So there is no excuse for procrastination.

Here’s how to get insured with GreatHome:

Choose the plan that suits your home best

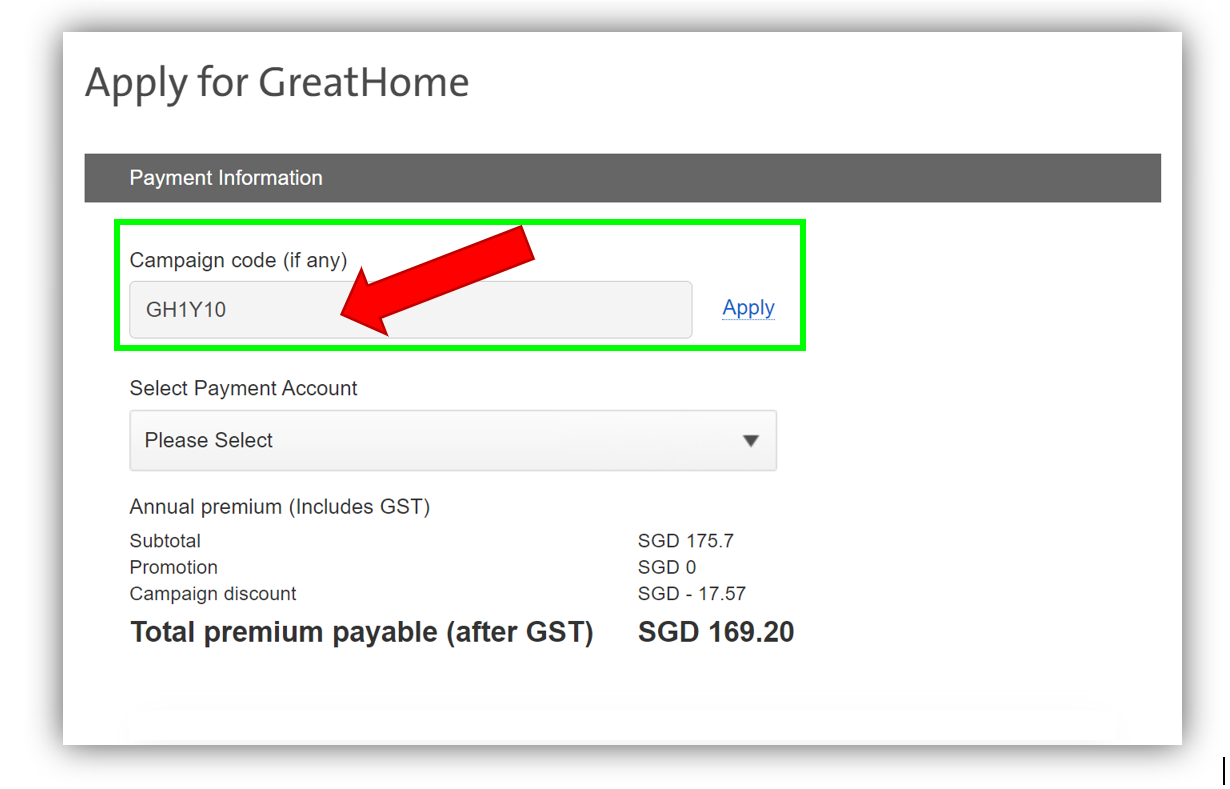

Remember to enter <GH1Y10> and click <Apply> to get 10% discount

Remember to enter <GH1Y10> and click <Apply> to get 10% discount

Make your payment and done! Your home is now insured.

Make your payment and done! Your home is now insured.

Promotion – 10% Off 1-Year Home Protection

A home content insurance is not just for a newly renovated house. Even when you have stayed in your current place for some years, like the 15HWW house, it is still not too late for you to protect yourself against mishaps that will cause a big dent in your finances. Remember to sign up for GreatHome with campaign code ‘GH1Y10’ when you apply for a Starter, Essential or Ultimate Plan to enjoy this discount. It is applicable till 30 September 2021 and for purchase via Internet banking (on desktop) or from Great Eastern.

Click here to find out more about the protection for your home.

Thanks for reading!

This is a sponsored article by OCBC but the views belong to the author.

Disclaimers:

The above is for general information only. It is not a contract of insurance. It does not constitute an offer to buy an insurance product or service. It is also not intended to provide any insurance or financial advice. The precise terms and conditions of the plans are specified in the insurance policy contract. GreatHome is underwritten by Great Eastern General Insurance Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and member of the OCBC Group. GreatHome is not a bank deposit or obligation of, or guaranteed by OCBC Bank. Protected up to specified limits by SDIC