Honestly, I did not expect myself to be a car owner in Singapore. After all, the easiest way to achieve FIRE or set yourself up for a comfortable retirement is to cut down on the big expenses.

Like choosing to stay in a HDB flat instead of a condominium OR relying on public transport instead of competing in the market for a COE. The latter is so obvious that it is often a maxim espoused by many financial bloggers, including myself not too long ago.

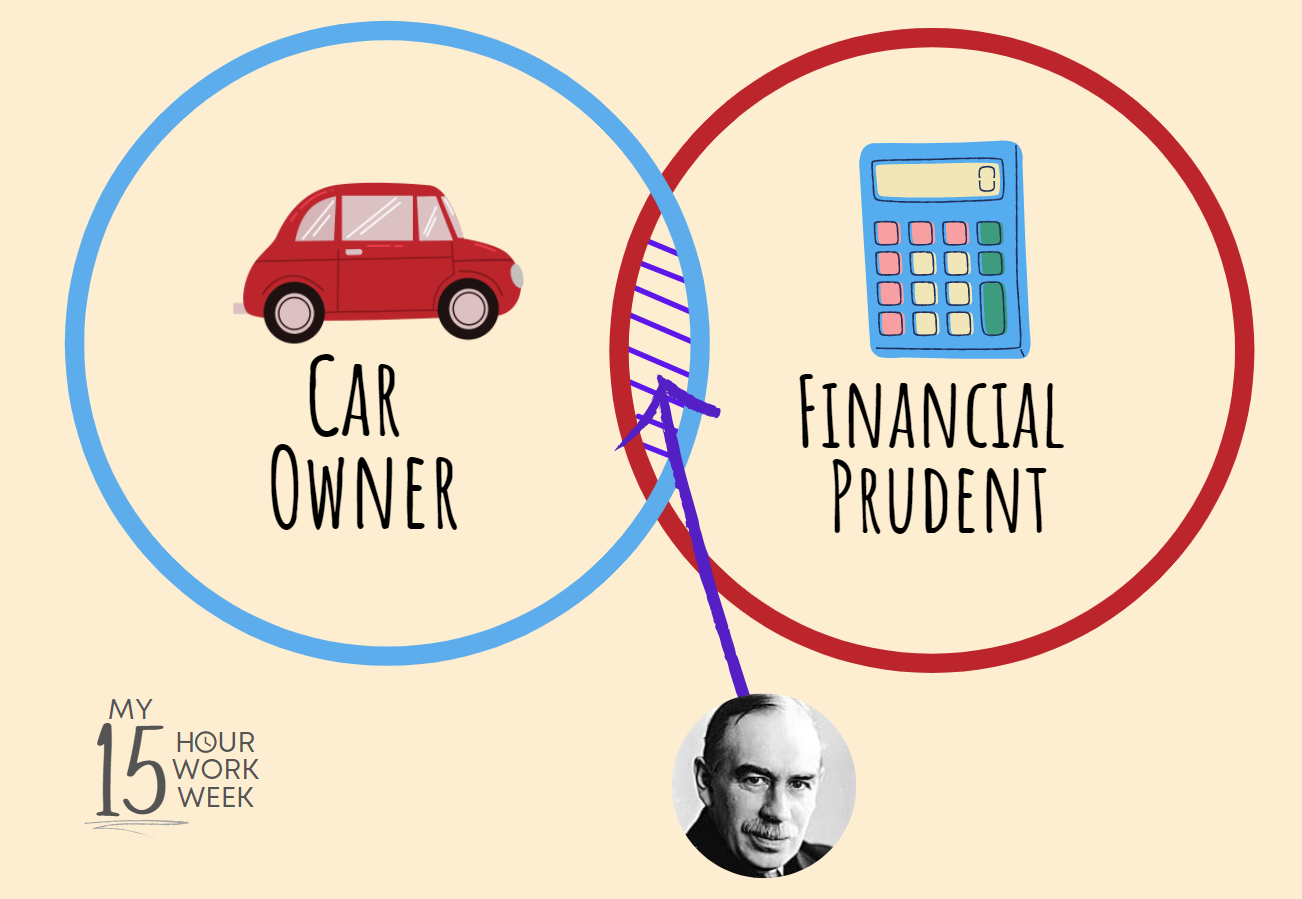

So on hindsight, I still find it quite surprising that I bought a car. And even as a car owner, I still definitely identify myself as financially prudent.

The Mrs wanted to use a unicorn to represent us…… but I vetoed it!

Since I probably belong to a small sample size, I thought it would be worthwhile to reflect after 2 years of car ownership. (Yes, I just burned a hole in my pocket and paid for another round of road tax)

1. Efficiency vs Variety

If FIRE or an Early Semi-Retirement is the be-all and end-all, one could probably

- Live in a small HDB flat/room,

- Repeat the same nutritious and value-for-money meals

- Reduce socialisation as much as possible

That would be a really efficient way to live a life, but before long, one is likely to start asking, “What’s the point?”

A useful analogy would be this whole Covid saga. As a nation, we have traded off freedom for safety (quite rightly so far), but at some point, diminishing returns would likely set in and alot more people will sacrifice some safety for more freedom.

I am at the point in life where I am prepared to trade off some efficiency for more variety/slack/comfort/beauty in my life. Yes, I can go to Waterway Point for my mall needs and Waterway for a walk.

But really, it’s nice to be able to venture to IMM or Tampines One for something slightly different and my favourite Changi Village for a run by the sand and sea. All these could be impromptu with a car and that greatly helped me to retain my sanity during the lockdown periods.

2. Timing A Car Purchase Matters

Even though I have used the car for two years, with the rising COE prices, it is almost certain that I can sell my car at a price close to my original purchase price.

That is not to say that I have “driven for free”. That’s a common fallacy as I had to incur petrol, parking, insurance costs and road tax. But it does feel good not to have incurred any depreciation cost for the past two years.

Of course, there is the issue of opportunity cost. It is possible I could have used the $50k downpayment and doubled it with some astute investments a year ago, but I could just as easily realise a 50% loss in some other punts. So I guess it’s a wash on that front.

3. Lack of Graciousness Creeps In

Doxing myself a little here, but let me caveat that I still have lots of patience towards delivery riders and pedestrians and often go out of my way to give way to them.

But this does not extend to other cars on the road and I find myself increasingly impatient towards road hoggers, especially those on the first lane on expressways. I am experiencing more bouts of road rage these days.

A decade or two ago, as a passenger on the bus, I often remarked at how selfish some car drivers are, overtaking the buses and slowing the buses down, especially if such an action means the bus is caught in a traffic light. Surely a minute saved for two people in a car cannot outweigh a minute saved for the 20 to 30 passengers on a bus?

I remember telling myself then that if I were to drive in the future, I would never do such a thing.

Alas……

“You either die a hero, or you live long enough to see yourself become the villain” – Harvey Dent

I am now much more skeptical of those who claim to empathise better because they grew up from a humble background.

4. The Need For Control

I actually had little confidence to test drive cars two years ago as I had not driven for a few years. After the purchase, the Mrs and I also shared driving duties for the bulk of the first year.

However, once I became comfortable on the roads, I began to enjoy the act of driving. It is often a healthy respite from screentime and I never ever have car sickness as a driver.

Personally, I think it boils down to control and being able to anticipate bumps, turns, accelerations and decelerations. I am not a fan of cabs and Grabs since I often feel nauseous after a trip and I sometimes feel that way even as a passenger on my own car.

5. Good To Have, But Not Crucial

It is highly likely that we will use up the full COE tenure (10 years) attached to this car. However, I am likely on the fence with regards to buying another car after that. It is really touch and go, especially if we decide to scale down our work and active income in the future.

On a monthly basis, car-related expenses is almost twice of mortgage plus utility bills and if push comes to shove there is no doubt which is the priority. The car will also be the first to go if a huge compromise has to be made on our savings and retirement goals.

Loss aversion is a real problem for many but I really do think that the Mrs and I can give up the car without much pain, especially if the financial situation calls for it.

Otherwise, why not? I find it really hard to argue that a car adds little to no utility for my life.

Thanks for reading!

Related Articles:

4 Insights For Potential Car Buyers In Singapore

The “How Much Does A Car Cost Guide” For…… Ourselves

You mentioned it, “what’s the point”. The reason we work so hard to be “FIRE” is so that we could enjoy the rest of our life earlier than normal, but if what it takes is to sacrifies all our desire and lush…then achiving the “FIRE” status is meaningless…I would rather delay the “FIRE” in another year or two or work double hard to earn it (based on your case…a car which is not something that’s far fetch…unlike a condo or a big house :))

Obsessing over FIRE is not a life well lived.

Having experiences and stories to tell are miles better 🙂

Can I ask why you bought a new car instead of used ?