It has been a tough few months for most investors.

Macro conditions are souring with the Fed set to raise interest rates multiple times this year. Major indices have dipped, with tech/growth stocks bearing the brunt so far.

Not to mention the double digit inflation which decimates savers. Would price pressure subside once we solve supply chain issues (from the pandemic) or are we about to embrace the scary prospect of stagflation? I doubt anyone really knows.

And then there are increasing geopolitical tensions. Ukraine, and obviously the elephant in the room, Taiwan.

Maybe it’s the recency effect, but this climate somehow “feels” worse than even March 2020.

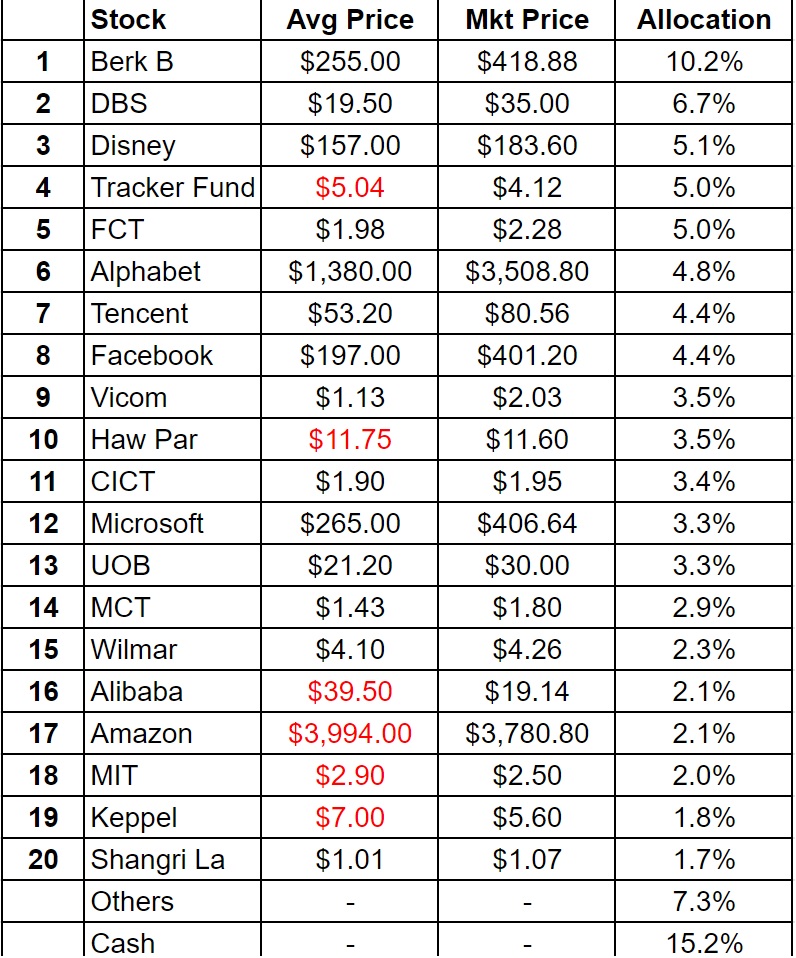

Here’s the 15HWW Investment Portfolio:

Annualised Return: 7.8% p.a. (Nov 2010 to Jan 2022)

Getting further and further away from the magical 10% target.

This investment portfolio is positioned pretty defensively but it still retreated significantly in the past quarter. US Big Tech is down, China is down and even Disney and the REITs have been a drag. I am pretty sure the Mapletree merge is not what most MCT shareholders desire. If it’s one shareholder one vote, the proposal will simply not pass.

There were a few bright spots in Berkshire B and the local banks that helped to stabilise the portfolio.

Cash proportion remains low because a big portion of them are in crypto, oh well.

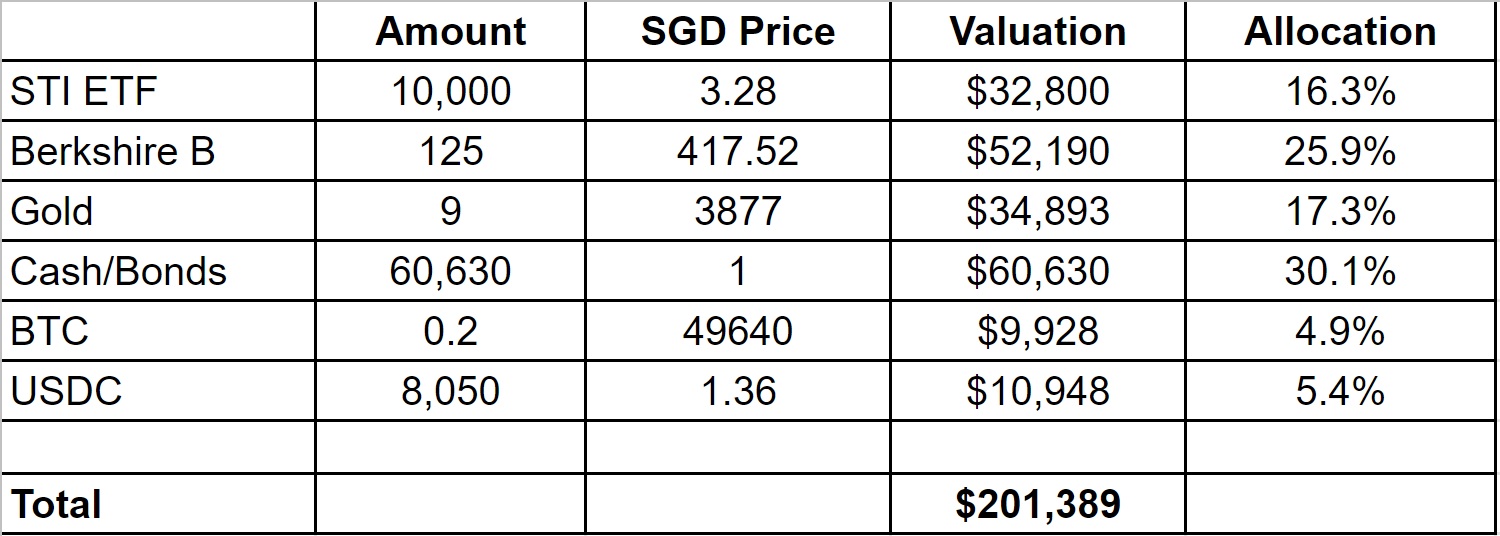

Here’s the 15HWW Permanent Portfolio:

Annualised Return: 6.0% p.a. (Jan 2017 to Jan 2022)

STI and gold is flat, Berk B is up but BTC is down pretty horrendous (~-35%) from tradfi perspective. Even with such a small allocation, BTC has contributed most of the volatility in the past few quarterly updates of the permanent portfolio.

2021 was generally a great year for crypto but just one month into 2022, we are into a full-blown bear market, especially in DeFi. Most of my paper profits have evaporated and my conviction has been shaken by some of the revelations in the space in the past few days. Will probably share more in the next post.

The silver lining is that the 15HWW Permanent Portfolio is still ahead by 2% if we compare to CPF SA returns.

CNY is around the corner and wishing all readers a Happy Lunar New Year!

My heart really goes out to those who somehow cannot celebrate this occasion with their loved ones due to the pandemic.

Things can only look up from here!

Family > Freedom > Money

Till the next quarterly update. Thanks for reading!

Related Articles:

Portfolio Update: October 2021

July 2021 Portfolio Update: Bad Vibes

I’m interested to hear your thoughts about the revelations re cypto. A discussion that I’ve been having with my friends in this space is the technology can exist without the coins i.e. blockchain / DeFi can exist without bitcoin, ether, ripple, etc.

The coins are instruments to speculate (at least to me); crypto is a zero sum game, for someone to make money, there must be someone that loses money. This is very different from companies which have a stream of cashflow / business model underpinning its valuation (e.g. dividends).

Best,

JW