Sometimes, you just have to hold your hands up and admit that you got it wrong. My COE prediction 1.5 years ago was pretty on the mark, but cars are a much smaller ticket item as compared to a property. So that’s scant consolation.

HDB Prices in 2017

My current flat reached its Minimum Occupation Status (MOP) about 5 years ago in late 2017. I had half-serious thoughts about upgrading to a bigger flat within the Punggol area. The Mrs and I were already tutors and we were transitioning to conducting lessons at home, so more space would have been ideal. Since we are already staying in a 5-room flat, the only alternatives are the bigger loft units, of which there were <100 in the estate.

These loft units already made the news as far back as 2015, when one of them sold for $760k. I probably could have stretched my finances in 2017/2018 and tried to buy one for $800-$850k. However, at that point, I thought the prices were pretty unreasonable, since I was fixated on the price the BTO buyer paid for. They stood ready to make a 2x.

HDB Prices in 2022

Fast forward to 2022 and a similar loft unit has just sold for $1.2 million. I guess the lack of supply of such units and a buoyant private property market contributed to such a headline number. This was probably the last straw for the authorities/regulators, who came up with the latest round of cooling measures just last week.

Right now, based on this most recent property price and the current interest rates, I would be priced out of such a HDB unit.

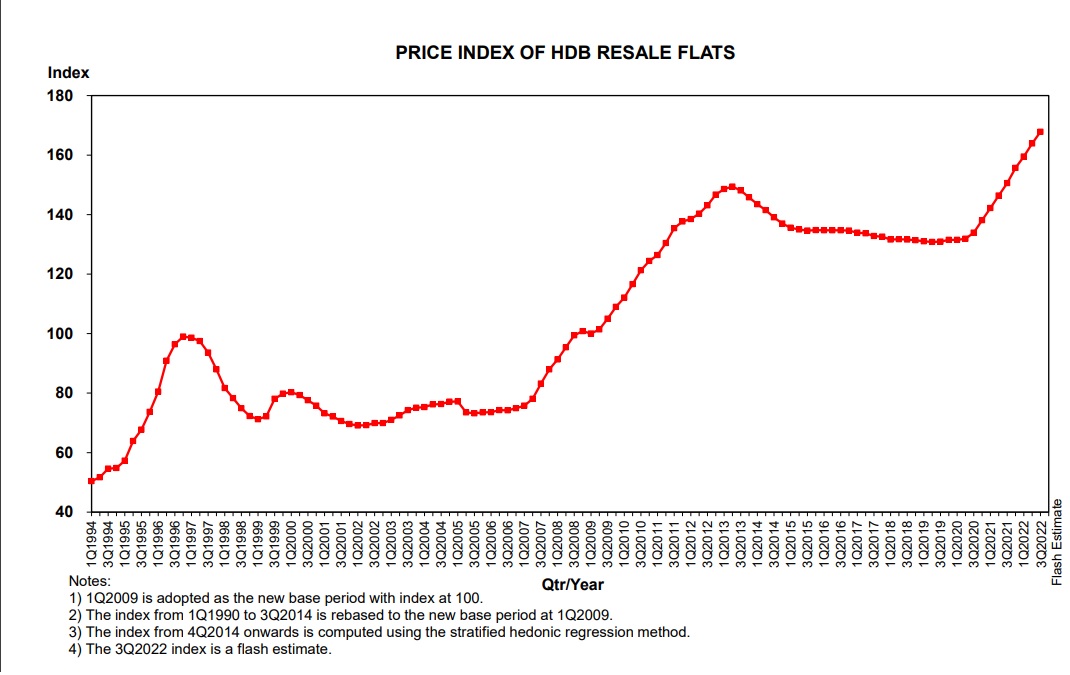

You might argue that I am using an extreme example since prices of such loft units rose >50% over a 5-6 years period. However, the HDB resale price index below will also reflect the 30% increase in prices of HDB flats across the board.

Up Only Since 2019!

Will Prices Continue To Go Up?

With a big recession looming across the world, I am pretty confident that property prices would actually dip in almost all the major cities in the world. Once jobs get hit, coupled with increasing interest rates, people will not be able to service mortgages. Whether it’s London, San Francisco, Vancouver or Melbourne. 10% dip minimum, probably 20%. Unless, of course, the FED pivot happens. You cannot bet against it since judging by the experience of the past 2-3 years, sentiments in the market can change in an instant.

Singapore is a little bit different. With the world in chaos and conflicts threatening to erupt on the European continent and North East Asia, the relative position of Singapore has never been stronger. I have spoken to some friends recently and they have remarked that the capital inflows to Singapore is like a neverending waterfall. Seems like the elites from all over the world wants to park money/assets here.

It’s generally a good thing for most Singaporeans, and more so if you believe in trickle-down economics. And obviously, impacts on the HDB market are likely to be muted since the government has a mandate to continue to make HDB affordable, especially for Zoomers who are coming of age soon.

Personally, I am on the lookout to shift to a 5-room HDB flat in a more desirable location within the estate. So I am indeed hoping for HDB prices to moderate in the near future to make up for the lost opportunity 5 years ago.

Thanks for reading!