In case you are new to this blog, this is not a case study on the 15HWW household. Our total household income is definitely less than half of $350k. IRAS knows, of course.

As tutors working from home, we save on rental costs and pass these savings back to parents. Since fees are comparatively lower, our income is also rather modest. But hey, we are not complaining as we genuinely enjoy our work!

P.S. enrolment for Academic Year 2023 has started for our classes. If you are residing in the Northeastern region of Singapore and looking for a reliable tutor, do drop us an email (15hourworkweek@gmail.com) for an enquiry!

The decision not to climb the corporate ladder means that our income is starting to massively trail many of our peers. Especially those that have done well in the public and financial sectors after more than a decade in the workforce. In fact, some of the power couples I know exceed $350k in annual household incomes, placing them firmly in the top 10% of households.

Mrs 15HWW always believes that if we manage to double our income, all our financial stresses will melt away just like FTX deposits. Therefore, she got quite a bit of a shock after reading this blog post from Finance Smiths that detailed their struggles in this current climate.

Since I am privy to some of the “complaints” of well-heeled friends and families, I tend to be more empathetic towards Mr Smith’s predicament. And I thought, well, perhaps a hypothetical case study would shed more light.

Case Study Of A High-Earning And Young Household

Scenario:

- Household of 4 members

- A couple in their late thirties or early forties with a toddler and an infant

- For simplicity sake, let’s assume each adult earns $175k a year

Next, let’s add up their annual expenses in the following categories.

1. Supplementary Retirement Scheme ($30k)

Since the couple’s marginal income tax rates are likely to exceed 15%, it is prudent for them to max out their SRS contributions for tax relief.

With maximum contributions for each individual set at $15k, this $30k that is being set aside can be considered illiquid and categorised as long-term savings. Any withdrawals before the retirement age will be slapped with a 5% penalty.

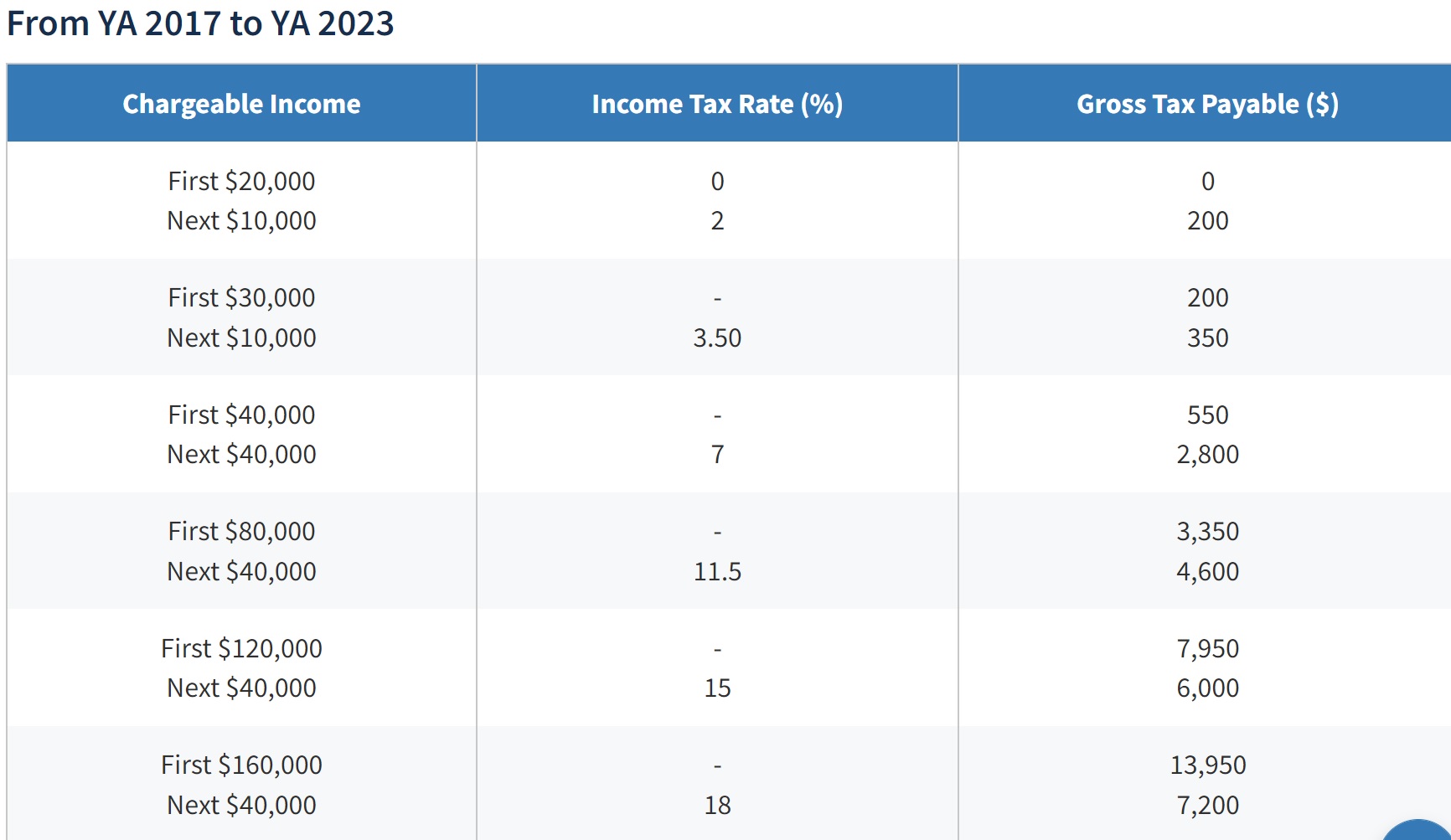

2. Taxes ($20k)

With some tax reliefs in place, I am estimating that both the husband and wife each contributes around $10k of taxes, which is a very reasonable effective tax rate of ~5% of income. Singapore is well-known for being tax friendly.

3. Mortgage ($72k)

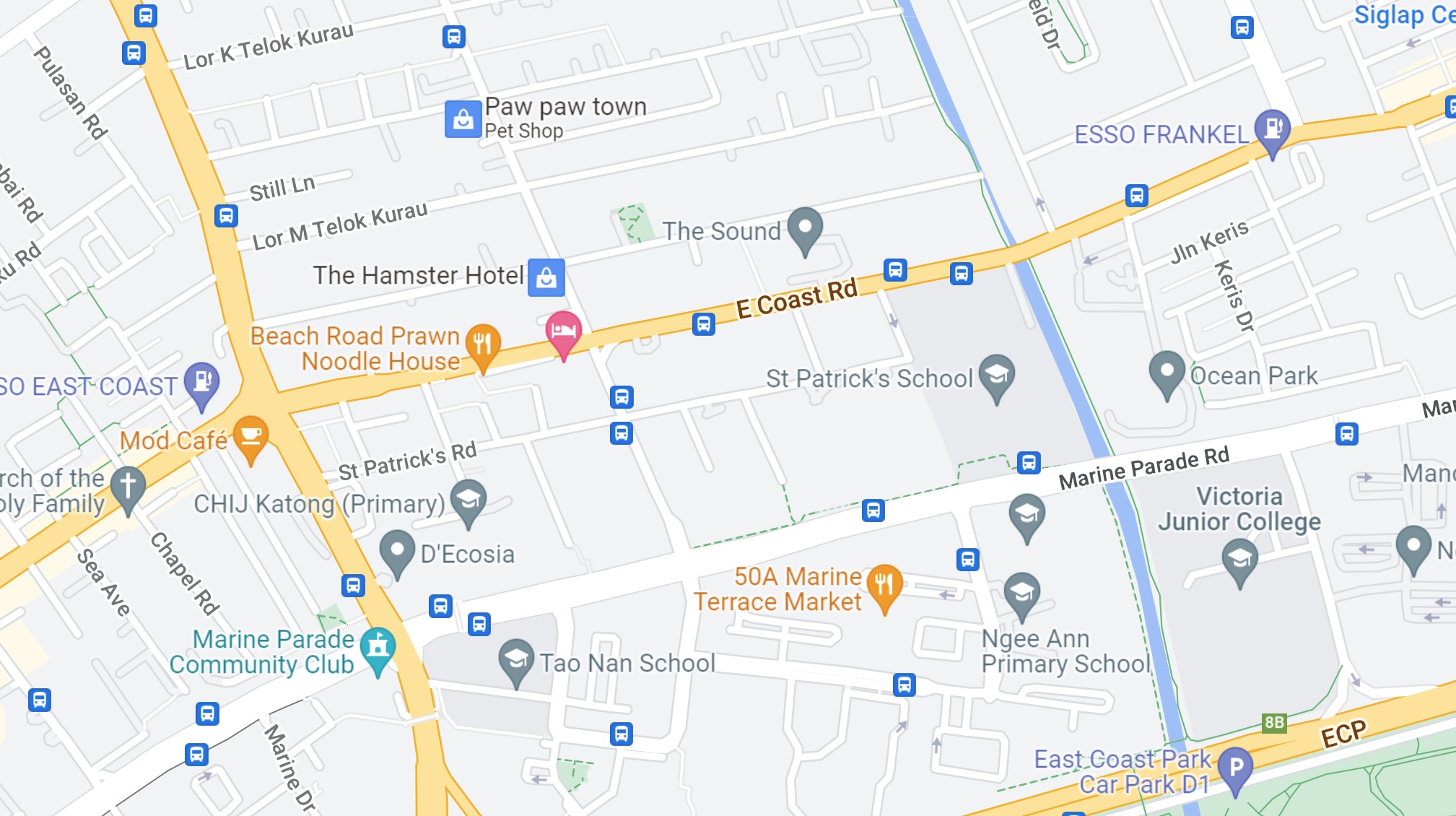

With 2 kids in tow, a home near good primary schools will become a priority for the couple. Besides Bukit Timah (where prices of homes are even higher), Telok Kurau is another popular area for many parents.

From the map above, you can see that there are quite a few good Primary school choices like CHIJ Katong, St Patrick’s and of course, Tao Nan. And then, there is Victoria JC in the vicinity.

There are also many food and cafe options in the Siglap area, not to mention the proximity to East Coast Park for weekend activities, making Telok Kurau an ideal location for young parents.

With a growing family, this couple might likely have upgraded from their starter home (BTO or small condo) to a 4-bedroom unit in Telok Kurau. Maybe something like this unit but at a more manageable price of $2 million in 2020.

Four bedrooms also do not seem excessive since the couple plans to stay in the place for at least a decade. One bedroom for the couple, two rooms for the children and an additional room for work/recreation purpose.

As a financially prudent couple, they also did not overleverage, making a 40% downpayment and locking in a $1.2 million mortgage at rates of 1.5%. Based on this Moneysense mortgage calculator, over a 25 year loan period, the annual mortgage payments would have added up to $58k. Very manageable since CPF OA contributions would take care of almost half the payment.

However, the lock-in is expiring soon, and if rates were to increase to 3.5%, the monthly mortgage payments would increase by 25% to $6k a month and $72k a year, adding to their financial burden.

4. Car ($30k)

This couple currently owns a modest sedan but they are looking for a bigger car, a 6-7 seater for their growing family. It is not as frivolous as you think because with 2 car seats, their sedan cannot even accommodate their helper, not to mention parents or in-laws.

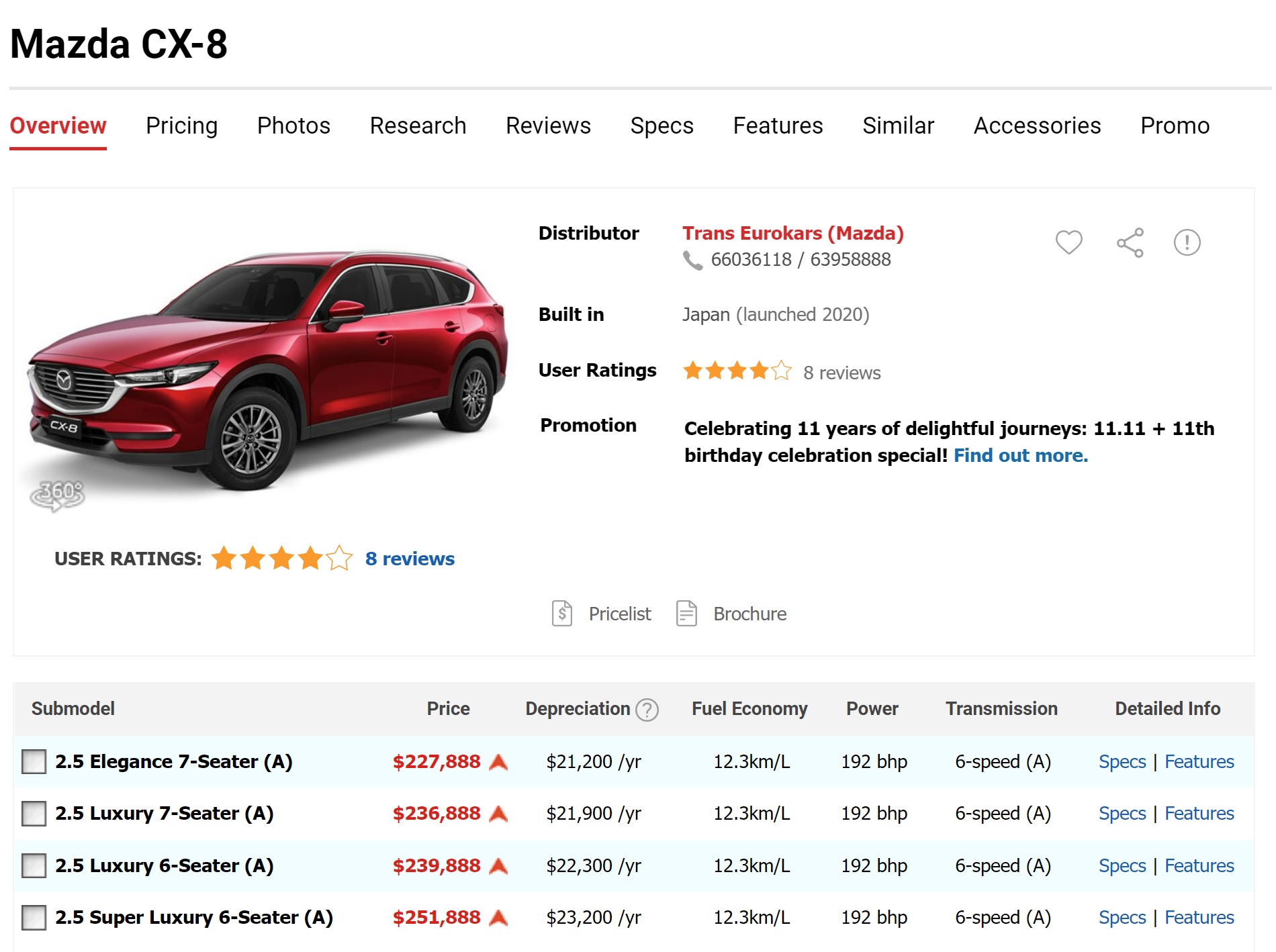

However, with COE prices climbing, this is not a good time to be changing their vehicle.

For example, a brand new Mazda CX-8 would cost around $240,000 in the current market. Well, we are not even looking at continental models here!

Screenshot from SG Carmart

If they make a 50% downpayment (financed through the sale of their current wheels), they would have to take a $120k loan. Based on DBS’s car instalment calculator, for a loan period of 7 years at 3% rates, monthly payments would be about $1.7k. In a year, that would add up to $20k.

Considering other car-related expenses like fuel, parking and insurance costs, car expenses would easily total $30k.

5. Parents Allowance ($30k)

Going out on a limb here.

My guess is if you hold a fancy title in your office (VP or Director etc) and your parents have a good idea that your household’s income is ~$350k, $1.2k is probably a reasonable minimum. No?

Especially if the parents are retired and do need the financial contribution.

Based on two sets of parents, the annualised figure adds up to $30k.

6. Childcare/Enrichment ($30k)

Before this year, I had never heard of MapleBear.

However, after Baby 15HWW was born, the Mrs casually remarked that if money and time was not an issue, she would like to send our baby to MapleBear, especially the centre at Turf City. Apparently, as I was told, many notable influencers send their children there.

Prince Charming to be, eh?

I did some googling and consider the fees to be exorbitant. Even after subsidies, it is more than $1k a month for a kid.

I guess the FOMO is real. If you work very hard at your career and enjoys relative success, it is only fair to spend the money and reward your child with a nice learning environment, or what many consider to be a headstart.

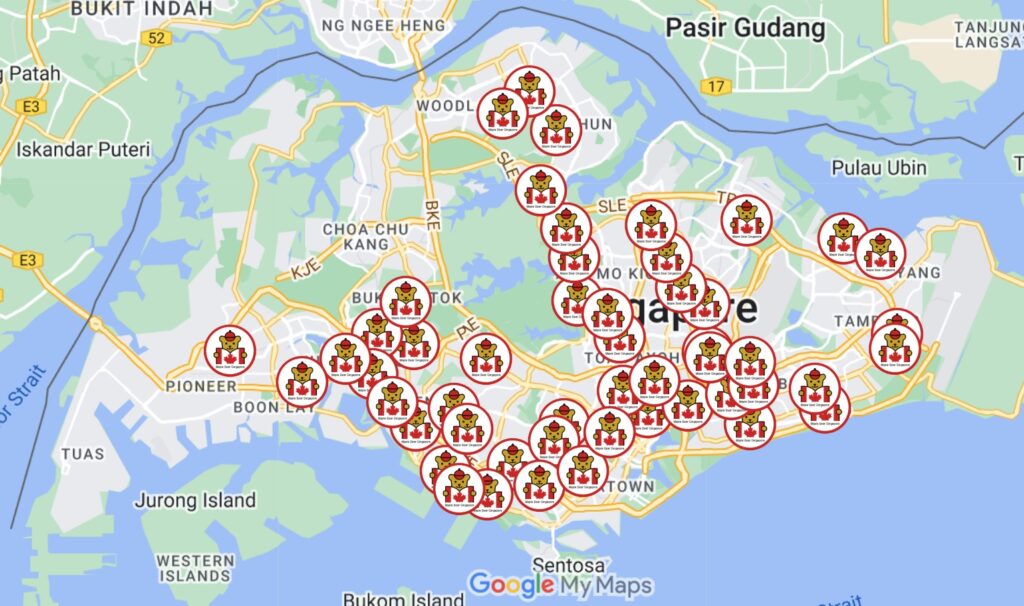

For something I consider to be rather upmarket and niche, I am very very surprised that there are more than 30 MapleBear centres in Singapore.

So maybe I am already being conservative by estimating $30k of childcare/enrichment expenses for an infant and a toddler of this high-earning couple.

7. Holidays ($20k)

2 to 3 trips a year after the pandemic does not sound that excessive, right?

A long-haul trip for a family of four to somewhere like Japan or Europe plus some bigger item purchases (bags, watches) could exceed $15k.

Then there is a leftover budget of $5k for one or two short villa stays in the Southeast Asian region.

8. Helper, Utilities & Insurance ($35k)

I presume with both of them working hard climbing the corporate ladder, employing a helper is extremely economical from the cost-benefit point of view. You can outsource almost all the housework and cleaning up after the children. Including indirect costs, having a helper should set a household back by $10k a year.

Utilities like electricity, water, telco, broadband and other costs like property taxes, smartphones and laptops should easily add another $10k ever year. And with significant human capital to protect, spending $15k or $7.5k for each working adult annually on insurance premiums appears to be prudent.

9. Groceries & Dining ($25k)

Even at $800 per month, grocery costs will add up to $10k a year. It is not an incredulous amount for a household of 4 if you include costs like fresh threadfins from the wet market, diapers and milk powder for the children.

This meal for four pax is going to cost $100, no?

Both husband and wife also sets aside a $600 monthly budget each to dine out together or with their colleagues. It’s just $20 per meal/pax if they dine out 30 times in a month. Over the course of the year, dining costs would total about $15k.

10. Savings & Investments ($58k)

This is basically what is left over.

The absolute amount is still substantial but as a percentage of their income, it is just slightly over 15%.

In fact, if the wife decides to take a lighter role in the office or work part-time and they maintain the same lifestyle, this component is likely to be fully wiped out.

Conclusion

I am not going so far as to say that $350k annual income for a household is the new middle class. However, I do believe that if inflation is increasing rapidly for necessities like food and electricity, the effect is even more pronounced for “status” goods.

Yes, there is a part of me that regrets not buying the Mrs a chanel bag already.

And another case in point: 5 years ago, as a thought experiment, I wrote about how I would spend $15,000 a month. If I were to write a similar article today, the number is going to be closer to $25,000 instead.

So maybe with raging inflation, most segments of the population are “struggling” in their own ways.

The exception is those with ample wealth. For example, if this hypothetical couple inherited $3 million dollars each or even better, sell a business for $6 million, they would be able to replicate the same lifestyle illustrated above without having to earn an income.

All they need to do is to have been able to invest the $6 million in a 4.19% T-bill.

Income inequality is starting to matter less and less as compared to wealth inequality, as we live in a more and more capitalistic world.

But is capitalism on its last legs? Honestly, I have no idea and a big part of me hopes not.

Thanks for reading.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts.

Do follow me on social media for updates too!

Thanks for the support!

Personally, I am irritated by ads and pop-ups so I do not use any of them on this blog too.

Interesting hypothetical. One has to also speculate how much money the couple saved/invested before they got married, bought their condo and had children.

If they are earning $350k in late thirties, I expect them to be earning $240k (i.e. at least $10k/mth each) when they just turn 30. If they stayed with their respective parents to save costs until they got married (early 30s?), and invested their savings, they should already have an investment portfolio which can generate passive income to help them with early childcare costs. After all, if they are in a job with that income level, they will probably be saving all that money because their job will be so busy they got no time to spend it. High paying jobs usually have plenty of opportunities for overseas business travel, making standalone holidays less essential.

Once children get into primary school, the costs go right down.

Finally, spending $7.5k per year on insurance – sounds like an insurance agent’s dream client. Do people spend that much on insurance? (I am vested in Aviva and Prudential so I don’t actually mind because they pay for my dividends) No wonder they are getting into financial difficulty. For reference, my personal insurance outlay is probably around $2k a year (one small life policy+hospitalisation+Term)

Hi,

Firstly, thanks for the detailed comment!

I guess if you read Finance Smith’s blog post, you realise that having an aggressive investment portfolio has been more of a bane for this year. Quite painful to suffer a $300k drawdown on a $1m portfolio.

As for the insurance component, I am assuming they bought either an ILP or an endowment plan. I guess a $1m term insurance is not that cheap also? Maybe I went quite off with that figure.

Btw, quite interesting that I have nv come across your blog until now. I guess your decision to allocate more towards property rather than investments has paid off. No doubt property has outperformed STI for another decade again.

Hi,

I blog more for my own reference so the blog is not found in the usual link aggregators, though I sometimes post comments in other local blogs, especially when the content interests me. I found your hypothetical situation interesting to think about.

Regarding Finance Smith’s situation, I noticed that he is planning to get a new (and big – according to his blog) car soon. Car prices are really no joke now. I am in the same boat as my COE is going to expire as well. If he decides to go car-less it will probably relieve a lot of his financial stress but once you are used to a car it is really hard to ‘downgrade’. Though technically, if you have an investment portfolio generating $3k of passive income a month, this will effectively pay for the car (thats one way to view passive income I guess).

In terms of investing style, I am more of a value investor in terms of what I use for stock screens and I also like collecting passive income. Like other bloggers I started off buying lots of REITs but for 2022 I resolved to buy more ETF and do less stock picking. I don’t do property investment as I think it is a hassle – there is property to look after, plus there is the ABSD issue and rental income is taxable at whatever tax bracket you happen to be in.

Hi Limster,

COE expiring is a real issue as even a renewal will be v costly at this stage. Just curious as to why you did not consider changing yr ride about 3 years ago?

From your blog, I got the sense that you started to invest less in stocks while contributing more to your mortgage, so that’s where the “invest in property” idea came in.

In my opinion, buying a “bigger home” is a form of allocating more into property too.

Ah, now I see what you mean about home being a form of investment. Got it. Regarding my car, my plan was to change nearer the 10 year mark. 3 years ago. I was thinking of an EV and nearer the COE expiry, I hoped there would be more models to choose from (other than Tesla). I do have one I am interested in getting: I’ll try not to think too hard about the price otherwise I might not buy – I’ll just console myself that my passive income can pay for it and no exhaust fumes is good for the physical environment.

Anyway, thanks for the discussion, don’t want to distract from your blog by talking too much about myself. 🙂

No problem. Will likely pop over to your blog to drop some comments/questions when you publish your updates too!

Maplebear is pretty expensive at $1000 a month. Our kids only had PapaBear (I started working from home before WFH became a norm) and MamaBear (housewife) for nursery and kindergarten classes. And no tuition or enrichment classes for primary education. Did they lose out? Not at all! They are both now in the coveted Bishan-Braddel School. Parents are the best teachers for their kids … and you two are tutors? Just make sure you read a lot to them … 也別忘了用華語和孩子們溝通.

Hi Matty,

Guess PapaBear and MamaBear are way more important in a child’s early years then!

Bishan-Braddell school, seems like a neighbourhood school? Lol. Coincidentally, today is PSLE results day, u will be making many parents jelly, especially those that poured in lots of financial resources.

Thanks for the tip on reading! We are definitely doing our best on that front even though he has not even turned one!

Hello 15HWW,

The issue has always been keeping up with the Joneses. I have friends (myself included) prior to having kids would have dismissed paying >$1,000 for pre-school, now on avg. the people i know are paying slightly above $2,000 per month.

That also flows down to other decisions such as housing.

I make decent coin (am part of the 10% HH income), but buying a decent sized house in a good location (not super prime) e.g. Novena / Newton is tough. Housing prices have really shot up. Not complaining, just stating an observation – I guess in these locations you are bidding with the foreigners who have no problem dropping the 30% ABSD.

Best,

JW

Hi JW,

Thanks for sharing your insights and it does back up my observation that ‘marginal’ improvements in lifestyle is increasingly costly.

Guess this is a price we have to pay for becoming the Number 1 City in the world.

Hi, I’ll like to share that from the female perspective, the wife shouldn’t contribute to SRS because high income mothers have working mother child relief which for 2 kids may already come up to $80k relief cap. She is likely to invest into liquid financial assets using the cash instead of locking her liquidity in for no additional benefits.

Hi Y,

Thanks for sharing this perspective! Did not think of that!

2nd year using Klaus Cassius and with over $460K in returns, here’s how it’s managed:

-Singapore savings bonds (3.1%pa yield)

-Fixed deposit (4.15% pa)

-Corporate Bonds (4.1% pa)

-ETFs (Stock market)

-GXS bank ( 3.48% pa up to $5K)

-Standard chartered ( 2% pa)

They help me and take time to learn about the various instruments, understand my risk appetite and goals. So far so good it’s top notch.