On hindsight, Mrs 15HWW’s foray into tech stocks in early 2021 marked the market top. Some of her purchases like Alibaba, Square, ARKG and Roblox have soured badly. She is down by at least 50% for most of these positions and now, she is keen to relinquish control of this satellite portfolio.

Instead of allowing her to quit entirely, I think it is more useful to double down and learn from this lesson. Afterall, if something untoward happens to me, Mrs 15HWW has to be ready to assume the role of CFO for the household.

I guess the silver lining is that she went in with “play money” and her capital was about a thousand bucks for each position. And she found out her risk or volatility tolerance the hard way.

So perhaps defensive ETFs would be the way to go for her. Granted, the best time to have bought them was probably in 2020 when they were “unloved”. But of course, better late than never.

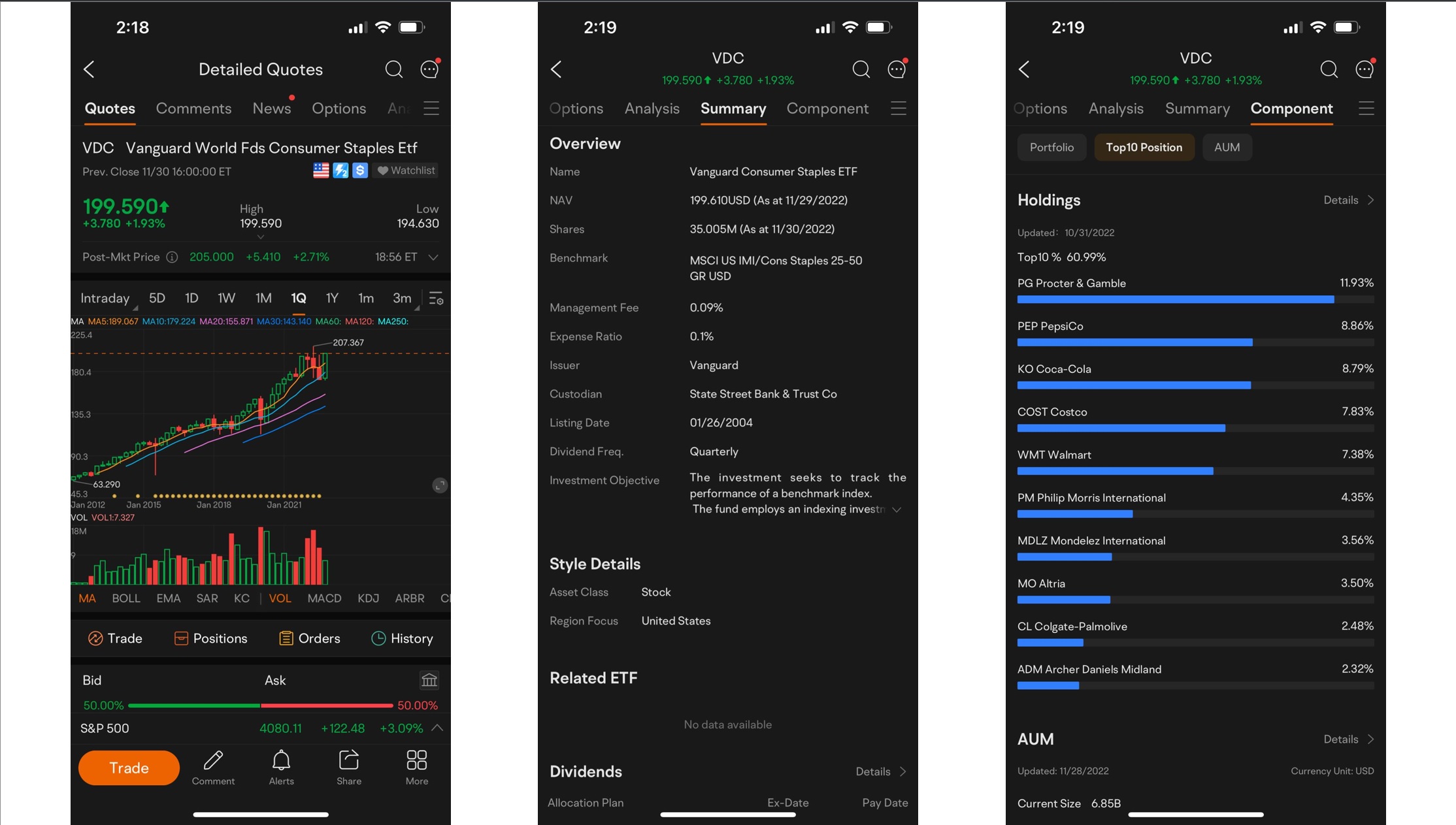

Vanguard World Fds Consumer Staples ETF (VDC)

An ETF that tracks stocks of U.S. companies within the consumer staples sector is about as defensive as it goes. Even in a recession, we would still have to eat, wash our laundry and shop at supermarkets.

If you look at the chart above, the price is showing an uptrend. Even in this current bear market, the price has already recently rebounded and is not far from an all-time high.

Annualised for the past decade, the return is a very respectable 12%^ per annum. The management fees and expense ratios are also low, adding up to less than 0.2%.

The portfolio is fairly concentrated though, with the top 10 companies comprising 61% of the ETF. Major holdings include big names like Proctor & Gamble (Gillette, Oral-B, Olay), soft drink giants PepsiCo and Coca Cola and supermarket chains like Costco and Walmart.

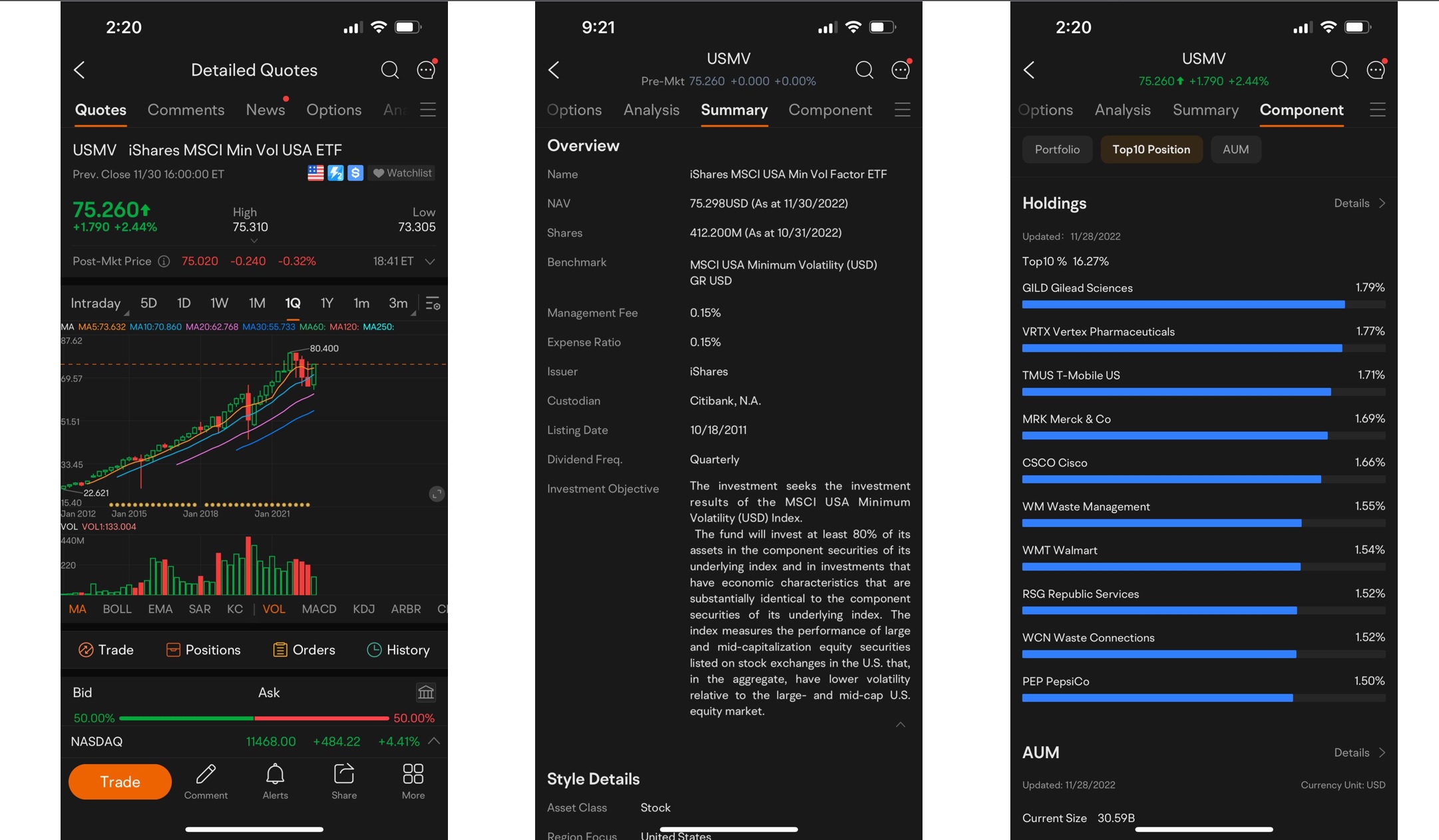

iShares MSCI Min Vol USA ETF (USMV)

This is another U.S. ETF and as the name suggests, tracks the performance of stocks that have lower volatility relative to the large and mid-cap U.S. equity market.

Pretty similar to the VDC chart, the price for USMV is also showing an uptrend. Even in this current bear market, the price is also less than 10% away from its all-time high.

Annualised for the past decade, the return is a very respectable 13%^ per annum, 1% higher than VDC. The management fees and expense ratios are also low, adding up to 0.3%.

Unlike VDC, USMV is much more diversified, with the top 10 companies comprising only 16% of the ETF. Even the biggest holding Gilead Sciences only comprise about 1.8% of the portfolio.

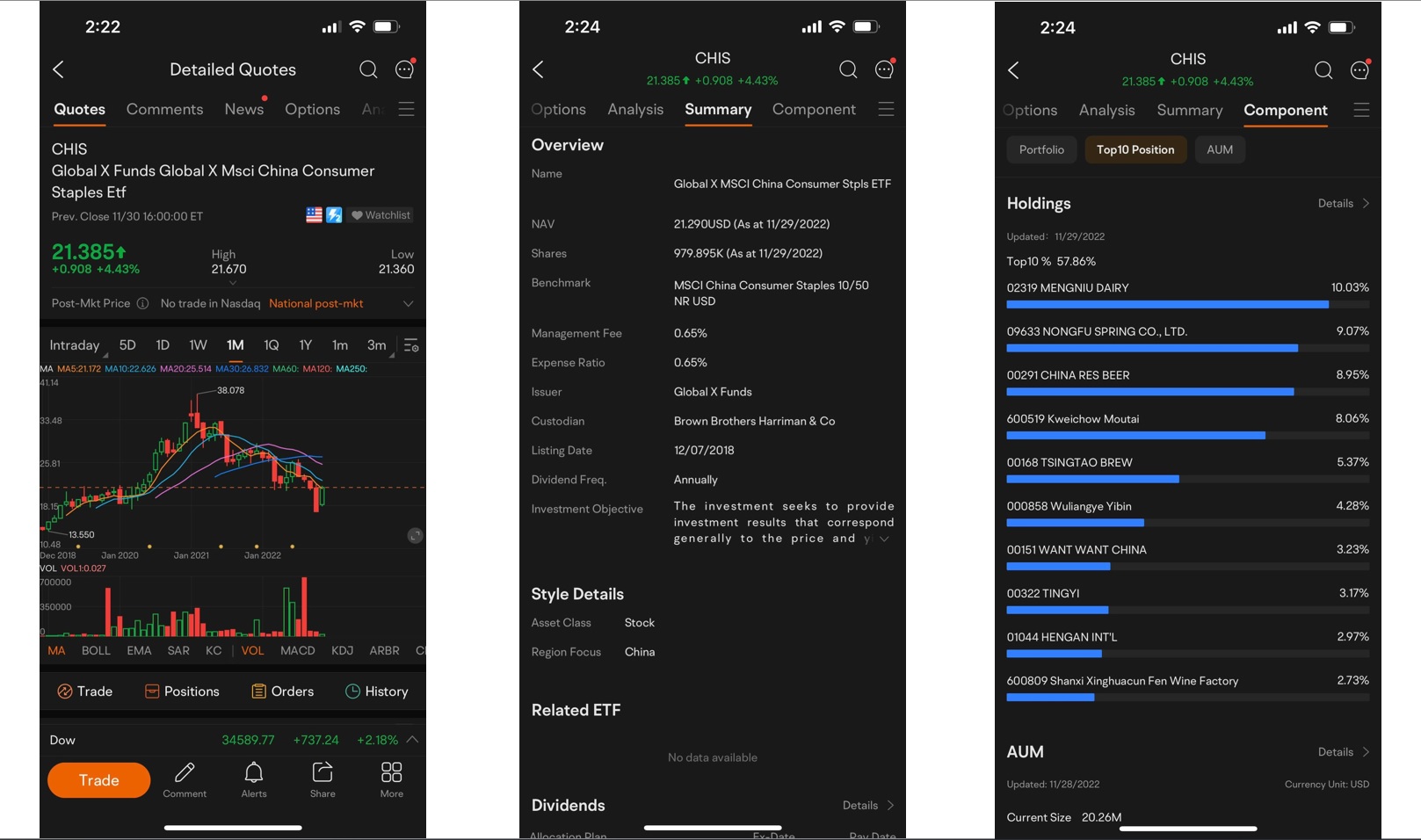

Global X MSCI China Consumer Staples ETF (CHIS)

The third ETF that I am proposing to the Mrs is not a U.S. ETF. It is CHIS which tracks the MSCI China Consumer Staples 10/50 Index. And as we all know, China stocks are not for the faint of hearts, especially in 2022.

The price chart does not look great as it appears that the bubble popped in early 2021 for CHIS. To put things into perspective, from Dec 2018 to Dec 2020, in the short span of two years, the price went up 3x.

Unexpectedly, annualised for the past four years, the return is still a very respectable 12%^ per annum. However, the management fees and expense ratios are significantly higher, adding up to 1.3%.

There is an element of concentration similar to VDC, with the top 10 companies comprising about 58% of the ETF. Familiar names include food and beverage giants like Mengniu, Nongfu, Moutai and Want Want.

Conclusion

An ETF by itself is already considered very diversified, especially if we compare against buying one stock.

That said, I would be keen to buy all three ETFs mentioned since there is very little overlap in terms of the portfolio, especially the top 10 companies for each ETF. If I have to choose one, USMV would probably be the pick of the bunch due to its lower concentration risk.

Thank you for reading.

All the screenshots above are accessed using moomoo SG app on 1st December 2022.

Trade on the go at lower fees with moomoo compared to other brokerages. Invest in U.S. Stocks, Options, and ETFs at S$0* commission forever for eligible SG residents trading in US markets.

At the same time, if you sign up for a new moomoo SG universal account here and deposit S$2,700/ US$2,000 / HK$16,000 into your universal cash account, you can still get a FREE share* of a US company.

^ Data is accurate as of 1st December 2022 and is derived from the past performance and should not be viewed as an indicator of future results.

*T&Cs apply.

This article is written in collaboration with moomoo Singapore. All views expressed in the article are of my independent opinion. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

How about just a single world index ETF like VWRA instead? 😉

Hi Kevin,

Of course that would work but I think VWRA is slightly less defensive and more volatile?

Can this sudden interest in defensives mark the market bottom?? 😛

Bit like the magazine cover signal heheh.

Hi Sinkie,

The Mrs will be v upset if she is both the top and bottom signal. Lol