Core inflation has risen to 5.3%, a 14-year high, and it is unlikely to go away any time soon.

Although we do not have any control over the price of electricity, food or mortgage interest rates, we can definitely take steps to mitigate the impact of inflation in our daily lives.

A silver lining has been the increasing interest rates on our deposit accounts, and I believe everyone should take advantage to get more rewards out of our savings.

Save More With POSB Credit Cards

I do believe POSB Everyday Card is one of the best and most versatile cashback cards in the market.

With no minimum spend, one can earn up to 7% cash rebates on groceries, utilities, fuel and transport. Plus, unlock bigger savings of up to 10% cash rebates on dining, shopping, phone bills and more when a minimum of S$800 is spent in a month. It is quite easy to reach this minimum when your essential spendings are consolidated on this card.

For instance, if you live near a Sheng Siong supermarket and buy your groceries there, the POSB Everyday Card gives you 7% cash rebates (up from 5%) If you like the convenience of food delivery services, you can enjoy 10% cash rebates on foodpanda, Deliveroo and more. There is also a 5%* cash rebates for utilities (up from 3%) and a newly added category for bus/MRT rides giving you 5% cash rebates when you use your POSB Everyday Card. These are part of the POSB’s initiatives to help us fight inflation.

Personally, I bill my recurring electricity bill to POSB Everyday Card for 5%* cash rebates and my telco bills also receives 3% cash rebates. As a driver, I also use the POSB Everyday Card together with my SPC membership to enjoy up to 20.1% + 2% fuel savings when I pump petrol at SPC.

*5% for electricity covers SP Group (recurring), Geneco, Union Power, Tuas Power. 4% if your electricity provider is Keppel Electric, Sembcorp Power and Senoko Energy.

Save More With POSB Home Loan

I have been staying in my HDB flat for 10 years and have saved significantly on my mortgage payments with POSB Home Loans. I have written about them in 2013 and 2017 when we were in a low-interest rate environment.

In fact, in early 2020, I also managed to refinance again with POSB to a home loan at a 5-year fixed rate of 2% p.a. to keep my monthly home loan instalment at around $1,000.

In this current high-interest rate environment, POSB has also not forgotten borrowers who are most impacted by inflation.

Alternative and current POSB Home Loan Promotion

For a new homeowner, you can receive a $500 cash bonus when you get a new home loan with POSB with a POSB SAYE account. To encourage responsible home ownership, if you get a Mortgage Reducing Term Assurance (MRTA) to take care of your mortgage should an unfortunate event happen, you will get another $200. That is a total of $700 cash bonus.

If you are on a bank loan right now and qualify for this promotion, I would think refinancing to this POSB Home Loan is a no-brainer. Additionally, receive a S$2,000 cash reward when you refinance your home loan with POSB with a minimum loan amount of S$250,000.

Earn More With POSB Invest-Saver

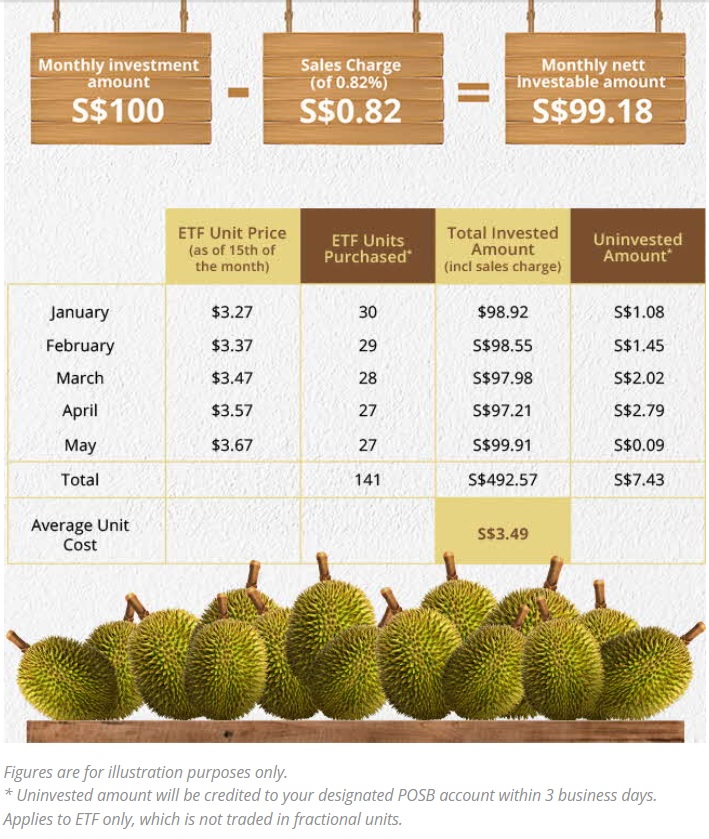

I have been investing with POSB Invest-Saver for a very long time. It is extremely affordable as we can start investing in Exchange Traded Funds (ETFs) or Unit Trusts (UTs) with as little as S$100 a month.

The sales charge is 0.82% which is just $0.82 for a $100 monthly investment. I have been investing in the Nikko AM Singapore STI ETF and the ABF Singapore Bond Index Fund under POSB Invest-Saver.

The largest company in the STI is incidentally DBS Group Holdings Ltd (SGX: D05). The ETF’s annualised performance is 7.9%p.a.** since its inception in 2009, which has helped to grow my savings.

Alternative: digiPortfolio (The digiportfolio combines human expertise with robo-technology. You can check out the newest SaveUp or Income portfolios which offers more stable growth and regular payouts from $100 initial investment.)

** Source: Nikko Asset Management Asia Limited as of 31 October 2022

Earn More With POSB CashBack Bonus

Transacting with POSB has also provided me with an opportunity to earn up to $130 cashback a month on my transactions with no minimum balance required in our savings account.

Credit Card Spend ($500): 0.3% cashback which amounts to $1.50

Home Loan Instalments ($1,000): 3% cashback which amounts to $30

Investments ($1,000): 3% cashback which amounts $30

Total Cashback is over $60 every month and annualised, it is $720, a tidy amount. If your account balance is on average <$10,000 every month, that is effectively a 7.2% p.a. return, higher than any other deposit accounts for such a modest balance.

Conclusion

By saving and earning more with POSB, it has definitely helped me and my family to cope in this high-inflation environment! More milk powder for Baby 15HWW =)

So pay a visit to the POSB website today to learn more about these great promotions from our friendly banker next door!

Thank you for reading!

This article is written in partnership with POSB Bank. I only believe in promoting products and services that I would use myself, and when I believe they are of value to my readers too. The views in this article are strictly mine.

SGD deposits are insured up to S$75,000 by SDIC.

This article is for general information only and should not be relied upon as financial advice. Any views, opinions or recommendation expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

For POSB Everyday Card, T&Cs apply. Please refer to here for full details on the card benefits.