I am not talking about you.

The fact that you are reading this post (or better, following me), you are likely to be financially savvy. Probably already done all three things I am going to mention later.

But well, you can still benefit from this post since it’s Chinese New Year. Some folks who know about my identity as a financial blogger have been asking me for tips and even advice for the past few days.

So if you also have friends and relatives looking for quick wins in their financial life, I have got you covered.

When we wish others 恭喜发财, we need to back it up with some action!

Switch To A Cheaper Electricity Retailer

Apparently, even after the Open Electricity Market (OEM) has been around for two years, more than half of Singaporean households have not switched to a cheaper electricity retailer.

This really shows the power and stickiness of the status quo.

I know that there are still some people who are skeptical and quite afraid that the quality of their electricity will be compromised if they switch.

After using Sembcorp Power for two years, I am quite satisfied and even proceeded to renew for another two years with them (with some vouchers thrown in). Half the population has switched and I am sure you have not felt any tangible difference.

So it’s time to spread the message and convince the other half of the population to switch and save between 20-30% of their electricity bills every month.

Help your friends and relatives save a few hundred dollars every year.

I know there are like 15 alternatives out there and it can get confusing. But seriously, switching to which particular electricity retailer doesn’t matter as much.

90% of the benefits/savings will come from the act of switching.

Refinance Your Mortgage

Obviously, this does not apply to people who have no or very low mortgages. Honestly, more power to them.

Otherwise, for people who own private properties with large loans, refinancing is likely a biennial or even annual event to capture better mortgage rates. A 0.5% difference in rates can mean a difference of a few hundred dollars in monthly mortgage payments.

So one will be hard pressed to find a home owner with >$1 million in mortgage who can but has not refinanced recently. Especially after the collapse in interest rates after Covid-19.

Therefore, the target audience for such “advice” tends to centre around folks with moderately-sized HDB mortgages, between $300k and $500k and who are on the HDB Concessionary Loan.

There’s nothing concessionary about the HDB loan these days, with its 2.6% housing loan interest rate.

Especially since one could possibly refinance to a 5 year fixed rate at 1.5%. That’s a guaranteed 1.1% savings over 5 years.

If one could pay off the outstanding mortgage in 10 years, there is a very high probability of benefiting from the refinance. Mortgage rates from the banks need to rise to an average of 3.7% for the 6th to 10th year to negate any savings as compared to staying on the HDB Loan.

Of course, if you feel that there is a realistic chance you might not be able to repay your monthly mortgages, not refinancing could be more prudent since the government is likely to be more forgiving than the banks.

Start Investing Your SRS

By the time you read this, it’s likely less than 10 hours away from the deadline for Endowus’ February promotion.

Basically, if you sign up for an Endowus Account today and fund it by the end of the month, including using my referral code, both you and I will get $28 off access fees.

This is a $16 decision (a pretty decent ang bao) since typically, it’s just $20 off access fees.

As mentioned about a week ago in this post, using your SRS funds to open an Endowus account is quite a no-brainer decision in this month of February.

It is also one of the best ways for someone to start their investment journey with a $1,000 capital and enjoy low investing costs.

And of course, feel free to use your own referral code to get your family and friends started on their investment journey!

I digress but after about 8 years writing on this blog, this is the first time I am doing some form of affiliate marketing. Besides the referral rewards, it’s also about being curious and trying something new on this blog.

And I am quite surprised at the results.

I thought I would probably get 10 or at most 20 sign-ups. But so far, I already have received about 30 referrals. That’s potentially close to $1,000 of access fees. It’s an amount not to be sniffed at, at least for me!

The caveat is that only one account out of the 30 has been fully funded so far.

I know it takes 15-30 minutes to complete the onboarding process and choosing the funds could be an “obstacle” for some. So here’s a few of my own screenshots in case you need some “push” to get started.

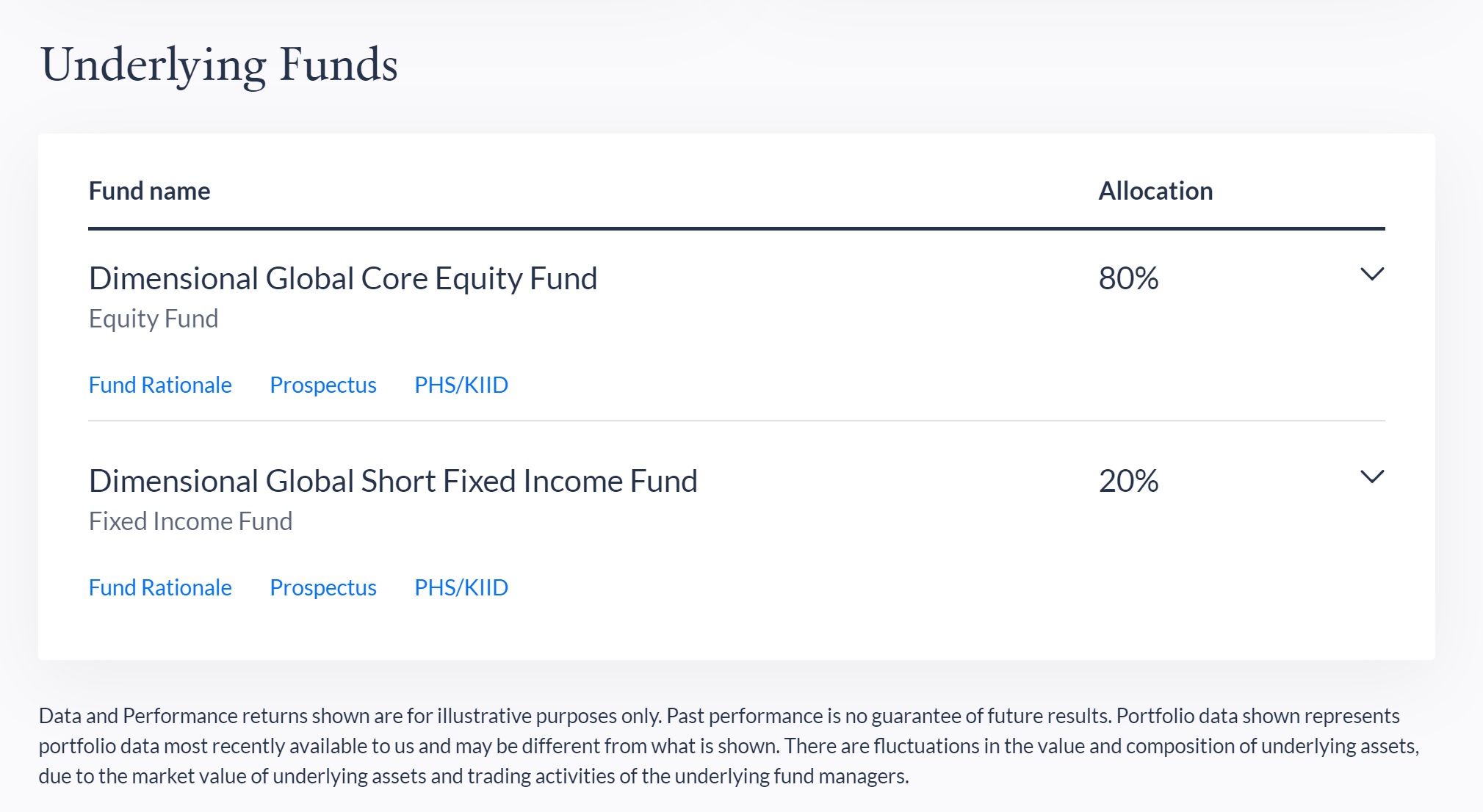

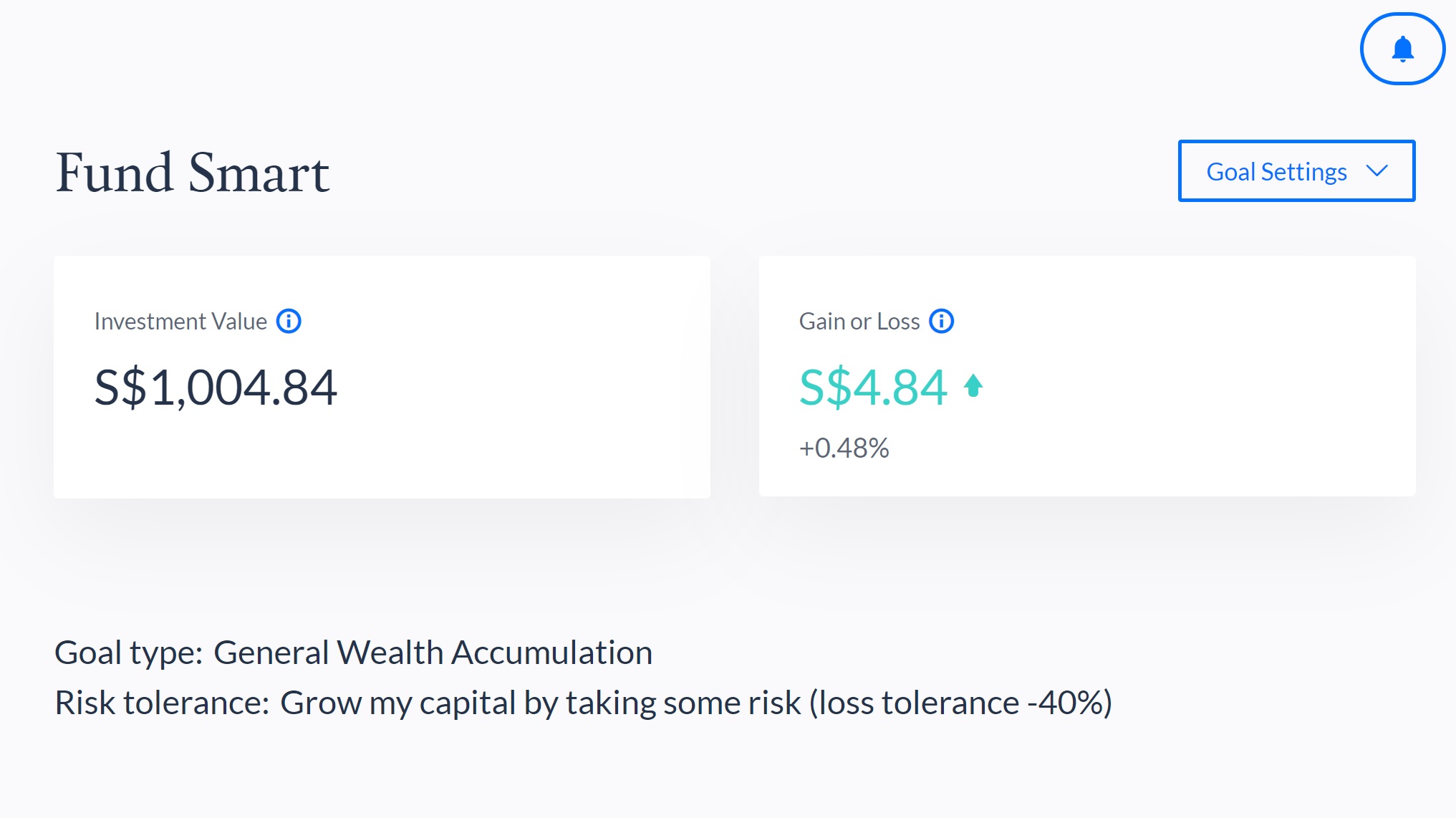

If you need some reference, this is my allocation using Endowus Fund Smart

There’s some gains after just a few days. Good start to the year. LOL.

Do note that it could take a week to complete the whole process of investing the funds.

More importantly, it could make for an interesting case study on psychology and especially investing inertia. We shall see.

Thank you for reading.

Disclaimer: This article contains affiliate links which goes towards ensuring the sustainability of this blog.

I used your referral and topup to a $1000 using SRS.

But i selected General Wealth Accumulation instead of Fund Smart.

Was wondering if the fees incurred by the fund will be higher?

Hi Jon,

Thanks for using the referral. Really appreciate it.

I don’t think the expenses will necessarily be higher. It really depends on your asset allocation and I personally think any difference is likely to be marginal. I only choose two funds to make things simpler.

If I am not wrong, there should be the option of making a change too if that’s what you decide to do.

Nice Post!