Yes, not going to fall into the trap of labelling “buy a modest home” as poor financial advice. That’s digging a bottomless pit for myself to jump in.

Because sometimes higher housing equity or even more wealth might mean little for some people. Especially if one is actually ok with living a very simple lifestyle that most would label as poverty level. And well, a higher mortgage can lead to alot of stress too. That is indeed hard to quantify.

But from the angle of wealth-building, buying a modest home has been suboptimal in Singapore over the last decade. I know, because I am the worse off for it, especially if I “compare” myself with a dear senior of mine.

Storytime (because this is what is going to differentiate writers from ChatGPT or Notion AI from now on)

15 years ago, I was a Year 2 student in NUS Economics and I took a pretty difficult module called International Economics. IIRC, I was taught by a Korean or Jap lecturer and it was littered with difficult Mathematics. Tutorial participation had a 10% weightage and the tutor would call you out randomly to do a question. If you did not get it correct, sadly, you get no participation marks.

Therefore, most students would spend many hours preparing for the tutorial and since the questions were really difficult, it was still a dice roll during the class. However, I always managed to get my questions correct. This intrigued a Year 3 student and after the 4th tutorial that semester, he approached me to check if I was a Math genius.

Obviously, I was not and I transparently told him that I attended the first tutorial of the week an hour before. I would wear a cap and sit inconspicuously in one corner of the room and spend it learning and copying the answers. After the lesson ended, as a precautionary measure, I would change out of my T-shirt before attending my class to ensure the tutor would not remember me.

I explained that this was a more efficient use of my time since I was already a pseudo full-time tutor then. I honestly thought he would be turned off by this “cheating” and I offered to share my answers with him if he did not report me.

He was pretty kind then and reassuringly told me that I had not really done anything wrong. Instead, he was intrigued by my behavior and wanted to find out more about me. We struck up a friendship and I proceeded to share with him many of my thoughts and beliefs. He brushed many of them off as ludicrous (like FIRE) but one thing he was really fascinated with was that at the tender age of 22, I was already thinking about settling down with my girlfriend and began balloting for a BTO.

A year later, when he found out that I had already successfully balloted for one, he also started his home hunting process. His steady girlfriend was a year younger than him but had started working. So they could qualify for a small loan just like us. However, they were unsuccessful in a few of their ballots.

The next year, after he also entered the workforce, amidst the supply crunch, the government started launching ECs again and he asked me about my views on it. I told him that it was a no-brainer and that my in-laws are applying for one as a second timer. Plus I shared my belief that Singapore will be the outright Number 1 city in the world within a decade’s time.

That seemed to reassure him and he bought a 3 bedroom unit for around $700,000 in the North East area to kickstart his property flipping journey. He is probably the most successful property story I know of, especially since his household does not earn a very high income. Both his wife and him graduated with average grades have been school teachers ever since they graduated. They do not side hustle as tutors too.

2013

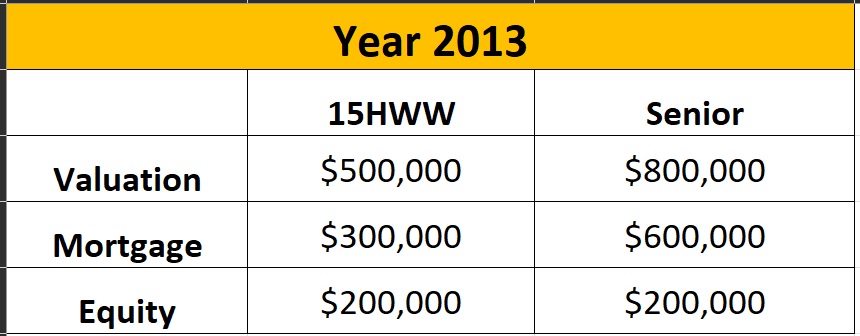

With the background story out of the way, let us review our property journey together in 2013, when both of us have already moved in to our first homes.

Similar downpayment of around $100,000 and both of us had about $250k of equity almost immediately just by buying our first homes direct from the government.

Obviously they had a much bigger monthly mortgage but interest rates were low and since they were both civil servants, servicing a $2,500 monthly mortgage was acceptable. Of course, ours were even more manageable at $1,000 a month.

2018

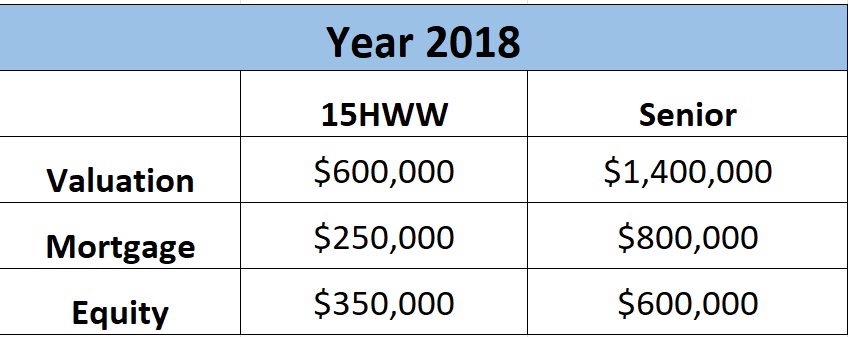

In 2018, both our units have reached the 5 Year MOP mark and by 2016, with F1 and MBS, my thesis of Singapore being the Number 1 city in the world was playing out. Hoping for me not to miss out on the property bonanza, my senior actually urged me to consider upgrading to a new EC, especially since there were still a few projects then where there was no levy payable.

But with me quitting my job (which he was aghast and vehemently against), there was no way my household was able to qualify for a loan for an upgrade. On hindsight, this was probably the biggest opportunity cost to my decision to quit so early on.

My senior proceeded to sell his 3-bedroom EC in early 2018 for a 50% markup at slightly above $1m and then used the proceeds to buy another 3-bedroom condominium. This was a more desirable apartment since it was one station closer to town and nearer to the train station. He purchased it at $1.4 million. Since the condo was <5 years old, furnishings were still new and there was minimal renovation involved.

There were some considerations about the “sell one buy two” strategy but Mr Senior and Mrs Senior brushed it off almost immediately. I also gave my input that leveraging on one property was probably enough for their risk profile. It is true that by then, they were earning >$10,000 a month in combined income but they also had a young child and their parents were also not exactly loaded. Their risk appetite beyond properties was also considered conservative.

In fact, in the end, most of the profits from their first property went into a bigger downpayment for their next apartment. Therefore, their mortgage loan was only $800k, about 60% of the property valuation.

Their mortgage payment every month was now ~$3,500, an increase of $1,000 from 5 years ago. But well, their income definitely increased by a greater amount so it was still manageable.

And as seen above, their housing equity started to pull ahead of us even though both our first properties appreciated by 50%. As their first property was worth more in absolute quantum, the absolute amount gained was also bigger.

2023

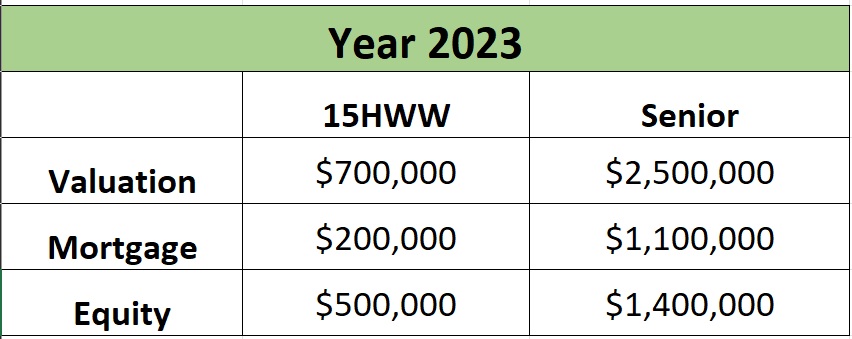

In 2021, when my senior’s second property passed the 3 year mark, he began looking for a bigger property and chanced upon a freehold 4-bedroom condo selling at around the $2 million mark. It was still around the North East area but slightly further away from the train station.

Working from home during the onset of the pandemic meant three bedrooms was barely enough for their household of three. Moreover, Mr Senior and Mrs Senior was expecting a second child very soon. So he needed more space. And he believed that Singapore will manage the pandemic almost better than any country and would emerge even stronger in its relative position, so he was very bullish in a bearish property market.

He did discuss with me about his finances but since he was about to be promoted, I reckoned that a $1.1 million mortgage was still fairly reasonable since their mortgage payment would only increase by another $1,000. His increment for that year would more than cover it. Moreover, he could sell his unit at close to $1.6 million so it was just a $300,000 upgrade, we reasoned. His offer of $1.9m was accepted since the seller was also urgently looking to sell to move to a bigger unit.

So Mr and Mrs Senior benefited quite a bit from the last 2 years’ property boom. Their current property is now valued at close to $2.5m in today’s frothy market.

They are now easily $900,000 ahead of us in the housing equity game. Even if we are conservative and add up moving, renovation and transaction fees, that would shave at most $200k off. Probably less than $100k in reality.

Considering that they did not inject considerably more funds than us (higher mortgage payments though) into their property journey, I believe their outcome is very impressive. Conservative leverage at its best in the Singapore property market.

The Downgrading Issue

Despite the huge paper gains, downgrading to realise the profits is almost always a last resort in our society and it is evident in this case too. Despite his conservative investment stance, Mr Senior also became a tad greedy and joined me to dabble in crypto during 2021, hoping to make a 10 or 20x to clear off his mortgage. However, since he does not want to self-custody at all, all he has to show is a mid 5-digit loss in FTX.

But things are coming to a head soon. Teaching in government schools is a tough profession to be in for an idealist and it is easy to be burnt out after a decade in the service. It is especially evident for Mrs Senior, who is thinking of switching to a part-time role to spend more time with her two children at home.

At the same time, they have to refinance their mortgage soon and at the current elevated interest rates, their mortgage could increase by another $1,000 a month, making it a greater burden on the household.

If they downgraded to a $800,000 flat, they would immediately become mortgage free and add another $500,000 to their investment portfolio. Maybe Mrs Senior could even FIRE. Obviously, this was suggested by me and immediately dismissed by them.

In reality, from our conversations, I believe the most they would accept is downgrading to their first EC. It helps that they still maintain friendships with some neighbours there. A 4-bedroom unit would cost $1.5m while a 3-bedroom unit would be $1.2m. They are happy to work for another decade or two and are just considering cashing out during these frothy times to reduce their mortgage significantly.

Conclusion

I cannot deny that I am a tad envious but honestly, as long-time friends that commit to meeting up at least once every quarter, I am truly delighted for them. I always want my friends to win in life.

The option is now on the table for them to cash in on their property gains and own an EC mortgage-free. That should also allow Mrs Senior to take on a reduced role in her workplace.

So as illustrated above, it has paid off handsomely for Mr and Mrs Senior to have been a bit more risk-taking in their property journey. Their gains definitely dwarfed what I have achieved investing in the stock market.

My decision to stick to a modest flat has not really paid off in terms of wealth-building, but what about now? For folks a decade or more younger than us, I can only say that I have even bigger reservations about upgrading compared to 5 years ago .

But well, I have been wrong the past decade and could continue to be wrong.

Thanks for reading.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts.

Do follow me on social media for updates too!

Thanks for the support!

Personally, I am irritated by ads and pop-ups so I do not use any of them on this blog too.

I think the big variable is they have a fairly huge income >10k.

while u reduce yur working hrs.

u get more time for yourself?

I mean it’s not directly apple to apple comparison. remove employment income u will still coast thru. how Abt them?

their equity is definitely higher as they are paying more into mortgage payment while u utilizing yur cash on other opportunities.

even if breakdown into net worth, it’s still not a reliable comparison since their household income is probably bigger than yours and assuming all expense is the same. u work like 8-9 yrs? so they have extra 3-4 yrs of employed income?

basically they trade time for money. u traded less time for money.

modest flat. we qualified for 3 room bto in 2009 which have 3k income benchmark. we moved in mid 2012.

we finish paying in mid 2015.

upgrade to a 4 room in end 2018. 2 mths later wife resign her part time. few mths later part time again as alamak no childcare subsidy haha. end 2020 she retire again. Dec 2022, 4 room hdb loan finished paying off. so my equity in the property is only 400+k.

unless they moved out, their expense is another additional 1k or smtg due to higher interest rate which is not visible when comparing just in terms of equity.

anyway in terms of true wealth, it’s time and liquid cash/assets tats impt instead of high value property which also demand a lot of fees, expenses to maintain.

Hi Rokawa,

Thanks for your advice and sharing your story. I guess slowly upgrading like you and remaining largely debt-free is a prudent lifestyle and the biggest upside is a low-stress and flexible lifestyle. No golden handcuffs etc.

15HWW,

I like these Real People Real Stories posts!

It’s refreshing transparent and honest.

Most prefer to flex how they “outperformed” others. You know, if you believe me, follow me kind of posts.

It’s only fair.

Those who take on more risks, should outperform during bull markets.

Then again, they are the same ones who get chopped down harder during bear markets.

The biggest winners in life are those who bought properties early. The earlier and the bigger ones you buy, the higher chance of winning in life. Nothing to do with grades or school or which job or company you work for. Just the kind of property you buy and when.

Case in point, I heard of people who bought landed in 2008 and 2021, can easily earn $1m profit in 1-3 years. Someone flipped a landed for $1m profit bought late 2020/early 2021.

It’s insane!

Hi hljj,

2 generations ago, teachers can buy landed properties.

1 generation ago, teachers can buy condos.

Now, young teachers can barely afford resale flats.

Some people are more comfortable taking on debt to buy property. I have friends who bought and rebuilt semi-Ds into their ‘dream home’ , 3-3.5 storeys, some even with lifts. It was a labour of love for them and their houses are really beautiful.

When I visit their homes sometimes I am tempted to daydream about “upgrading” but I know that such results take a lot of time and effort and will also put me in debt for a long time. I very much prefer my current position of having positive cashflow from dividends and staying in my current decent sized condo. If I was in a shoebox apartment I would probably feel more of a need to upgrade 🙂

Hi BAC,

I think you shared a very valid point. There has to be “contentment” at some stage, especially when one reaches his/her financial goals. Otherwise, the goalposts will always shift.

my alternative take is that housing equity in one’s primary residence has a large discount rate when it comes to effective net worth, as it is does have more features of a consumption item/liability at times. I would crudely define effective net worth as net worth that affects the quality of one’s financial life, which either consists of realisable capital gains or cashflow.

Primary residences are generally a large cash-flow drain.

Effective profit is rarely realised, as people tend to roll it into the next primary residence (typically of higher cost) and it starts all over again, potentially with an even larger cash-drain. Theoretically, downgrading is the way to realise this, but practically it almost never happens unless one is forced to by circumstances, or a conscious one-time downgrade to unlock cash for retirement.

Of course, there are always pros and cons to either decision. How much one values the quality of life increase of a more expensive place is an important factor. If one seeks to attain some form of financial independence (which imo is directly correlated with effective net worth) however, one has to make the choice between leaning toward either the QoL of an expensive primary residence, or financial independence. I do not subscribe to the notion that these two are complementary approaches.

Just my 2 cents worth! Great writing as always, enjoyed it much.

Cheers!

Hi bird,

Yes, I have not really seen downgrading happening around me except for retirees. Most Asians typically will keep on upgrading and hope to leave behind their homes to their children as legacy.

It is almost binary like nice house/early FI. Only the truly rich gets to have the cake and eat it too.

Thanks for the comprehensive sharing in your comment!

Thanks for the eye opening post. Leverage is a double edged sword – you can earn more by taking more debt, but also lose more. Honestly I think property is a difficult investment tool, and along the way, you’re paying for lawyers, agents, contractors etc. Every month, I look at how much the bank is earning from my mortgage and I cry 😂

Hi DT,

Hope your interest rate was low, at least in the past few years!

Your point on lawyers, agents and taxes is v true! The best real estate agents earn v v high income in Singapore, probably comparable to political office holders. The property pie has increased significantly over the past decades and owners have had to share it with many middleman or people servicing the industry.

This is a very interesting post. I just want to say that in our society, where stocks/bonds are viewed as high risk, the FOMO of looking enviously at other people’s property gains is strong

I am not referring to you, to be clear. I wonder what the next decade holds for them.