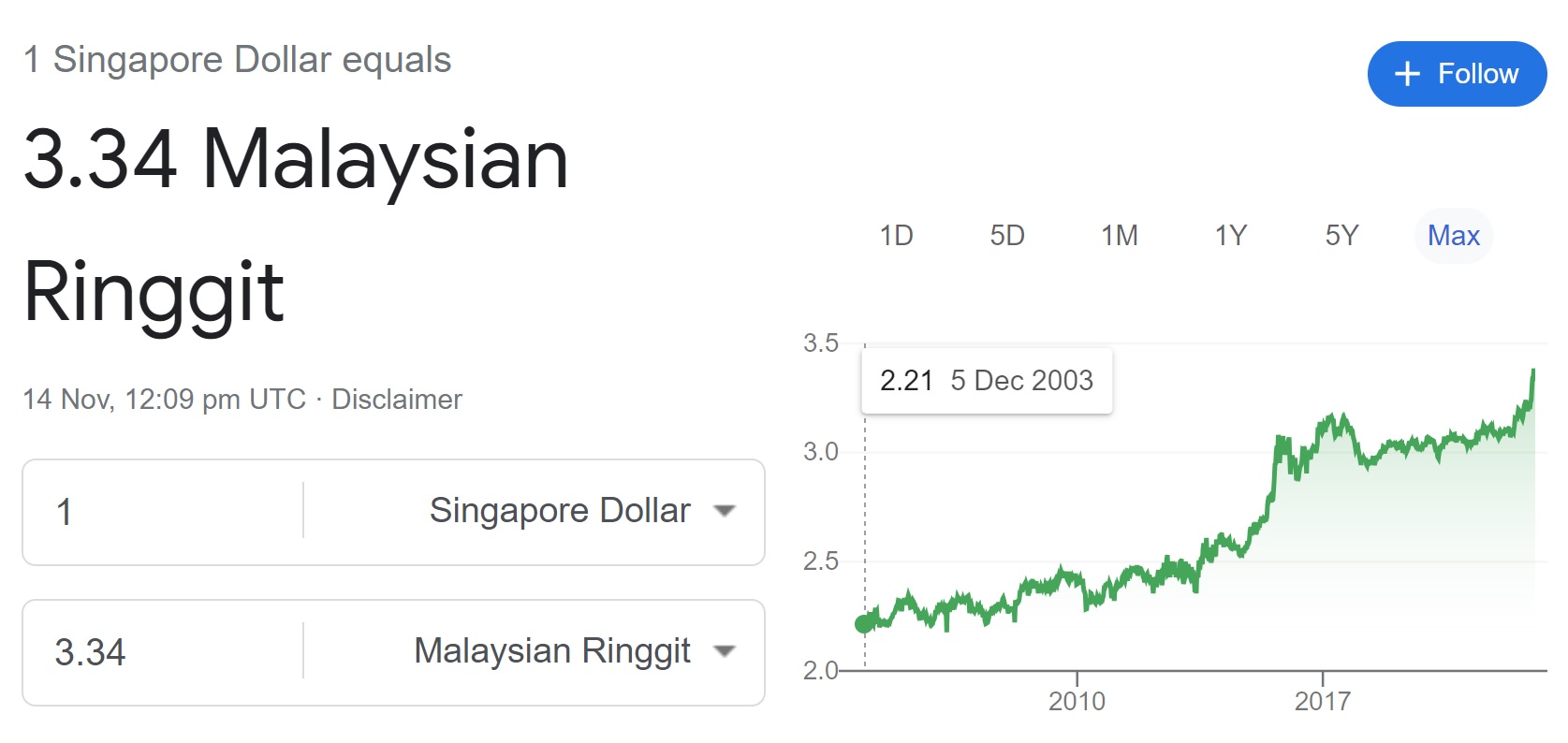

Singapore is often touted as an economic miracle and the strength of the SGD is testament to this. In case you did not know, Singapore issued its first notes and coins in 1967, at par with the Malaysian Ringgit.

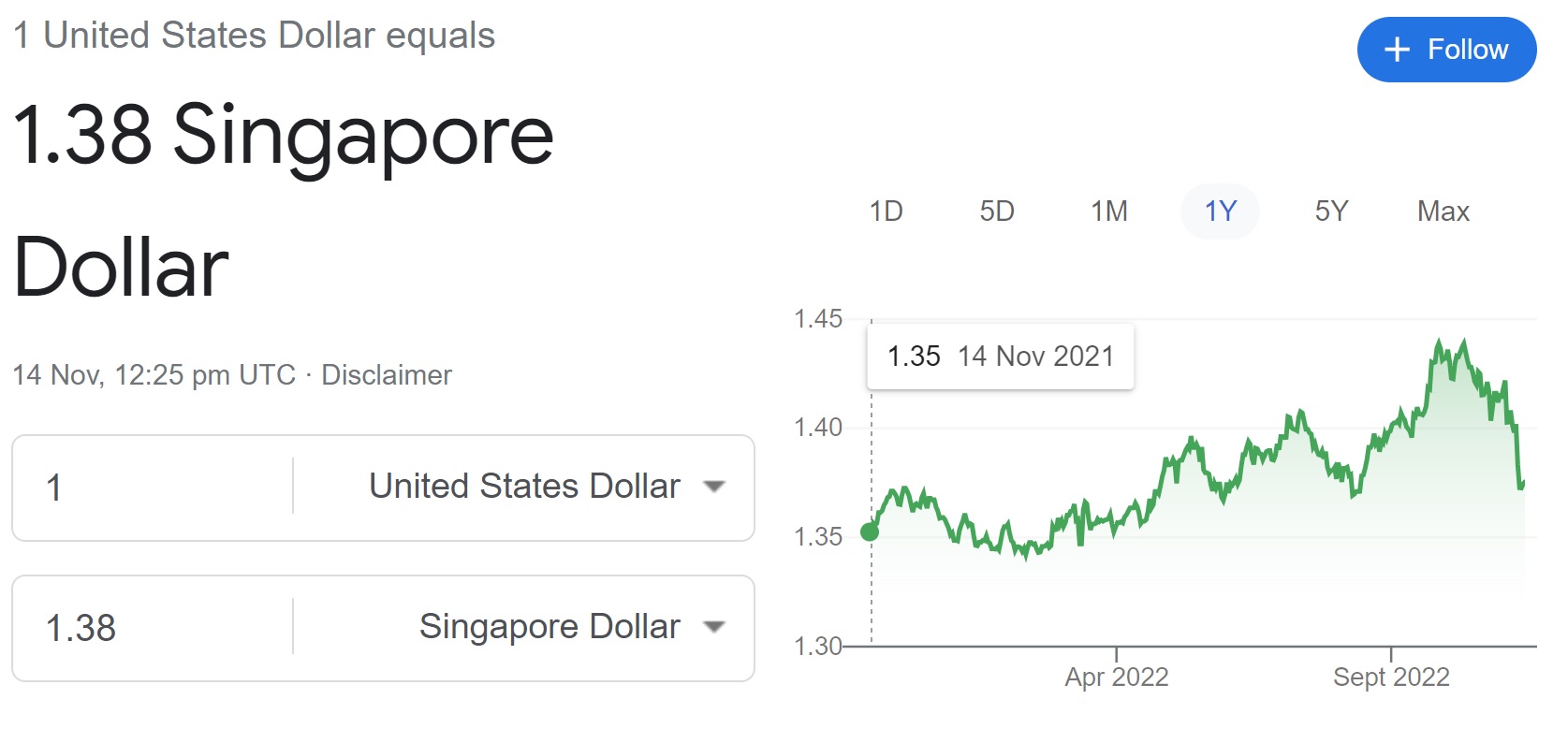

And then this happened:

Accessed using Google Finance on 14 Nov 2022

If you were a Malaysian holding onto SGD all the way for the past 55 years, you would have made a 2% annualised return just from currency appreciation alone. Not bad, isn’t it?

In 2022, with the US Fed Reserve increasing interest rates, many countries’ currencies have depreciated considerably, with SGD being a notable exception. With most countries opening up after the pandemic, many Singaporeans have taken advantage of the strong SGD to travel to destinations like Malaysia, Australia and Japan.

However, despite the strength of SGD, there are still at least 5 currencies that outperformed it. Here is the list:

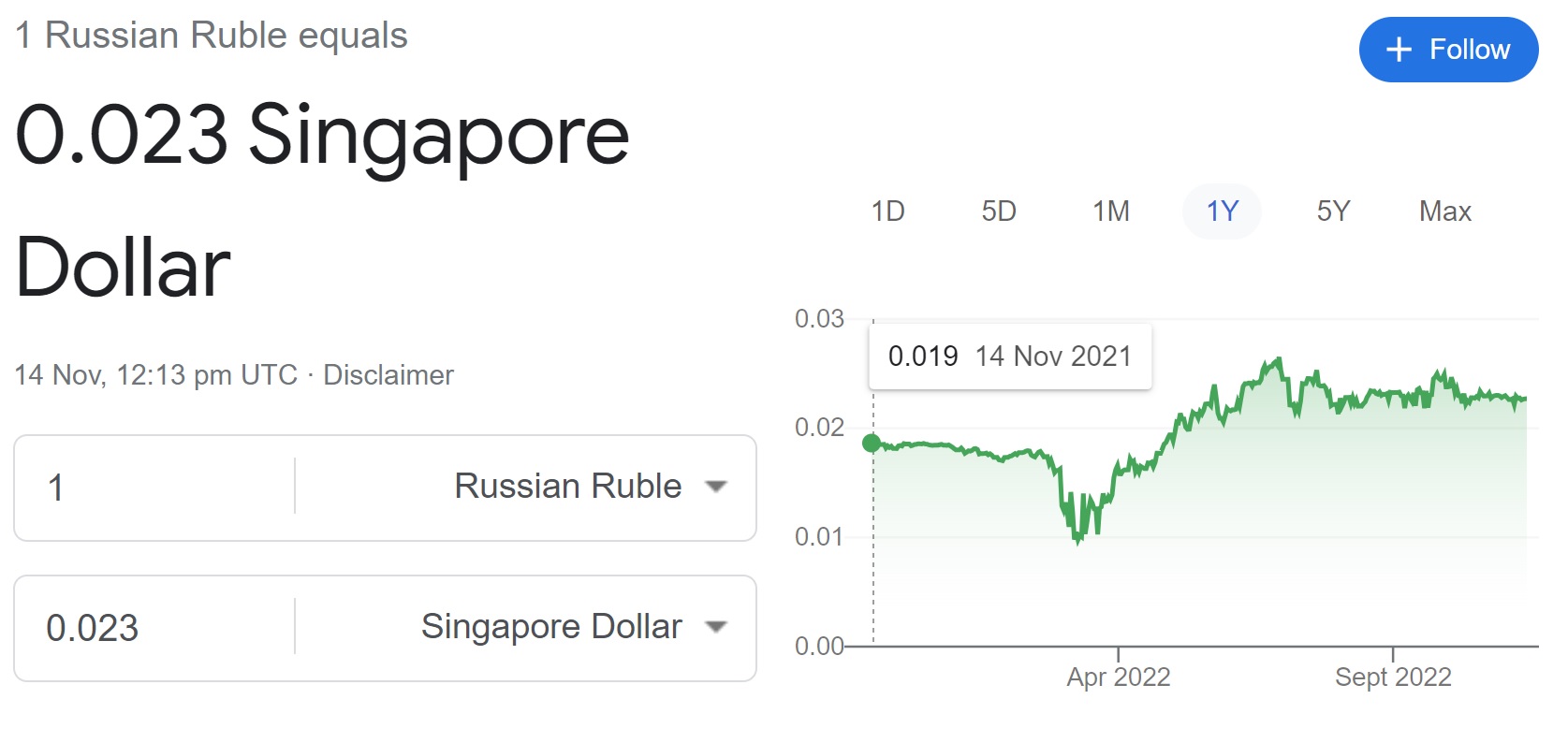

1. Russian Ruble

Accessed using Google Finance on 14 Nov 2022

The Russian ruble has appreciated by 21% against the SGD in the past 12 months. In fact, if you managed to buy the ruble during its lows in April 2022, you will be pocketing a pretty unbelievable 100% gain.

2. Brazilian Real

Accessed using Google Finance on 14 Nov 2022

The Brazilian real has appreciated by 4% against the SGD in the past 12 months. There is a lot of interest in Latin American markets. In fact, in Aug 2022, Temasek Holding entered into a partnership with Brazil’s Votorantim Group to launch a US$700million fund to invest in Brazilian companies.

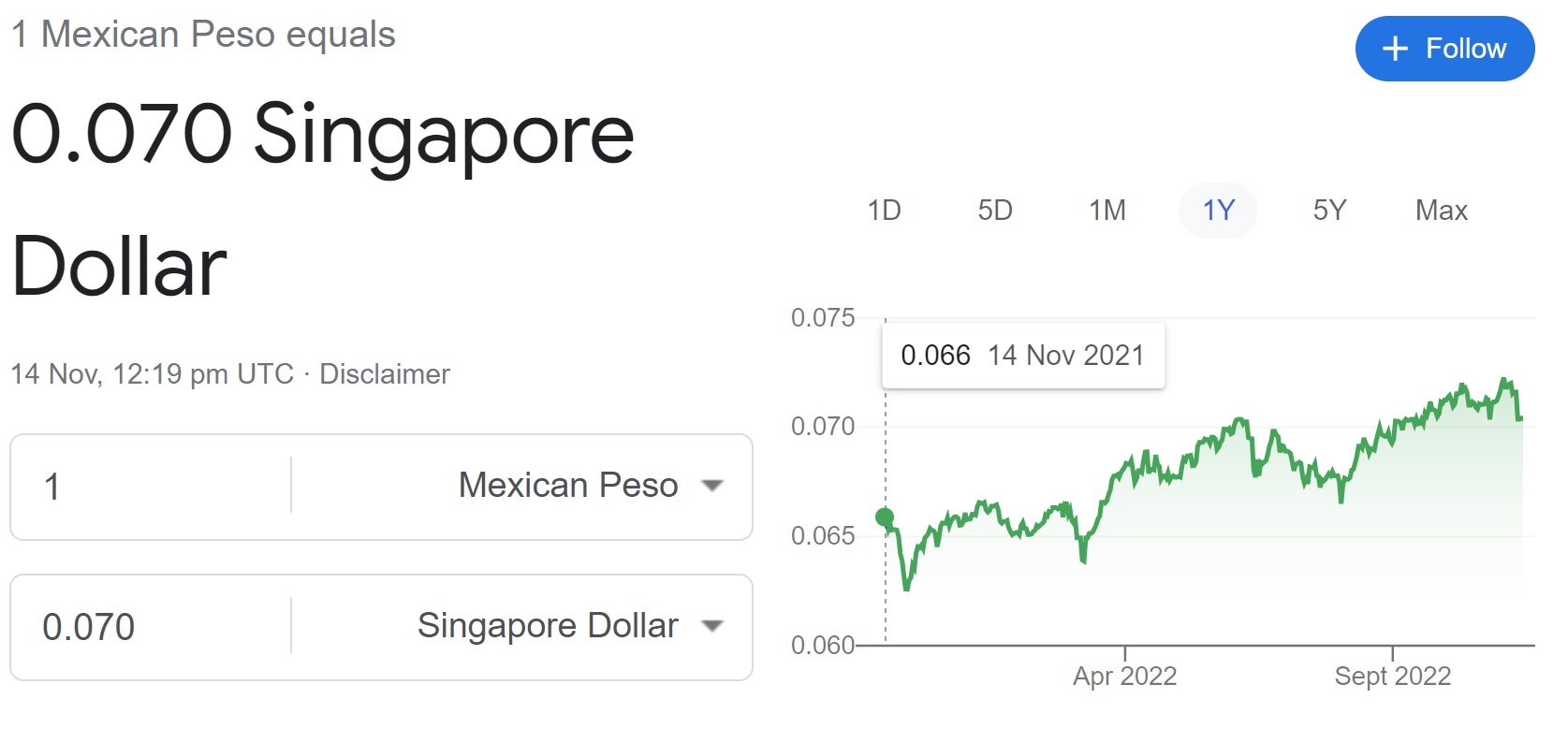

3. Mexican Peso

Accessed using Google Finance on 14 Nov 2022

The Mexican peso has appreciated by 6% against the SGD in the past 12 months. Could it be because more firms are considering setting up a base in Mexico to better access North American customers?

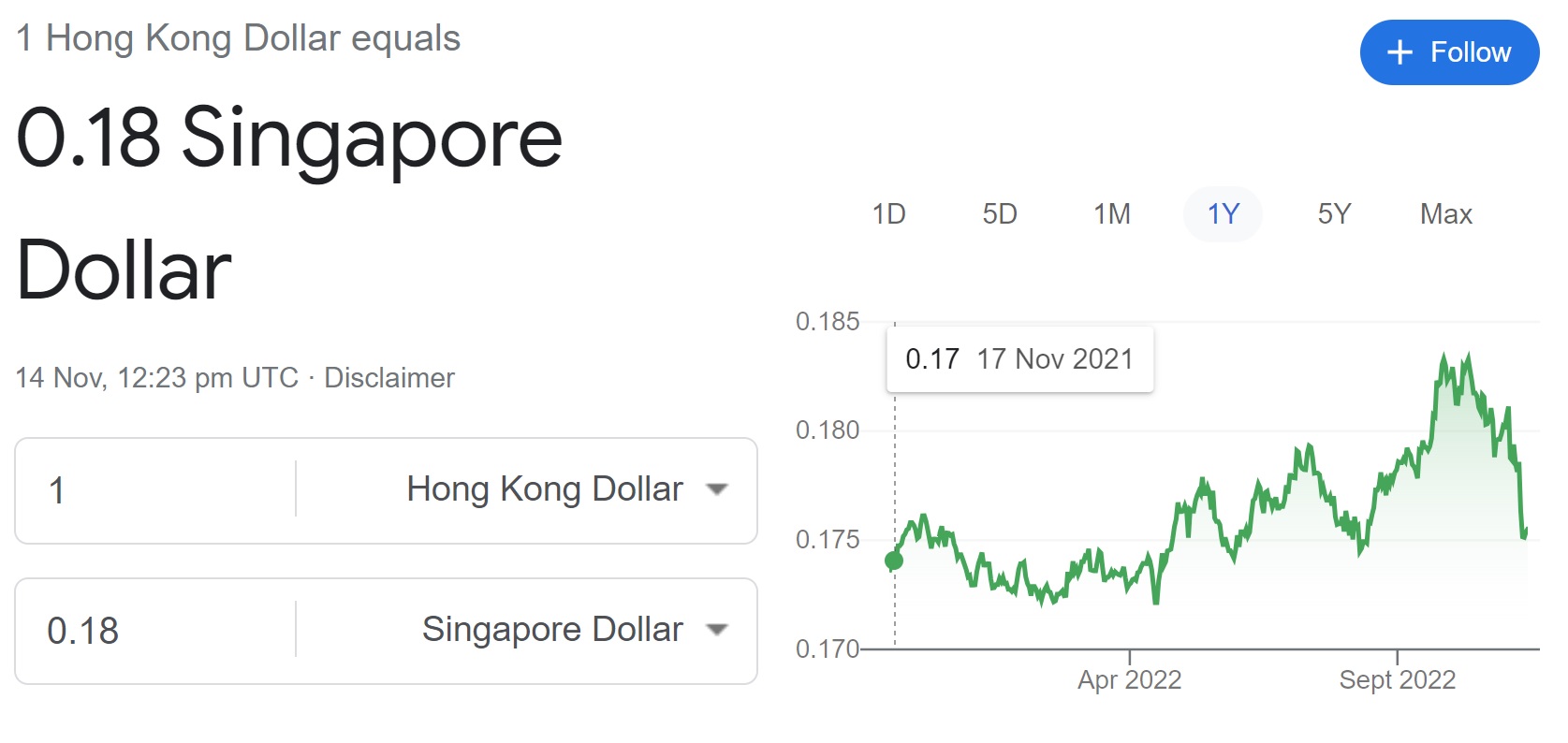

4. Hong Kong Dollar

Accessed using Google Finance on 14 Nov 2022

The Hong Kong dollar has appreciated by 0.5% against the SGD in the past 12 months. An Asian financial centre similar to Singapore, the currency is almost essentially flat, because the HKD is pegged to… the US dollar!

5. US Dollar

Accessed using Google Finance on 14 Nov 2022

The US dollar has appreciated by 2% against the SGD in the past 12 months. The US Dollar is the world’s reserve currency, with close to 60 per cent of global foreign exchange reserves held in US dollars as of 2021.

Which Currency Would I Invest In?

Holding the local currency SGD has been a good default for Singaporeans like me. If I were to set aside significant savings for another currency, the only candidate that comes to mind is the US dollar.

Besides exchanging for physical US dollars at the currency exchange (would not recommend this for anything beyond 4 digits), many local banks in Singapore are offering attractive interest rates for US currency fixed deposits.

However, if you prefer to retain the flexibility to withdraw your savings whenever you need them, you can consider the CSOP USD Money Market Fund that provides returns comparable to US Dollar deposit rates.

Accessed using moomoo app on 14 Nov 2022

If you are interested in such a fund, do note that you can gain access to CSOP USD Money Market Fund through moomoo Cash Plus.

With moomoo Cash plus, you can redeem your funds for instant use to buy stocks on the moomoo platform. Moomoo Cash Plus also do not charge any additional subscription and redemption fees for the funds.

At the same time, for new users who deposit at least S$100 into your moomoo SG universal account before 17/11/2022, you will unlock guaranteed 5%* p.a. return rewards on your moomoo Cash Plus subscription for 4 months. Applicable to the first 3000 new moomoo users and as of 14 Nov 2022, there are only 700+ slots left!

Click the link here to sign up!

*T&Cs apply.

Thank you for reading.

This article is written in collaboration with moomoo Singapore. All views expressed in the article are of my independent opinion. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.