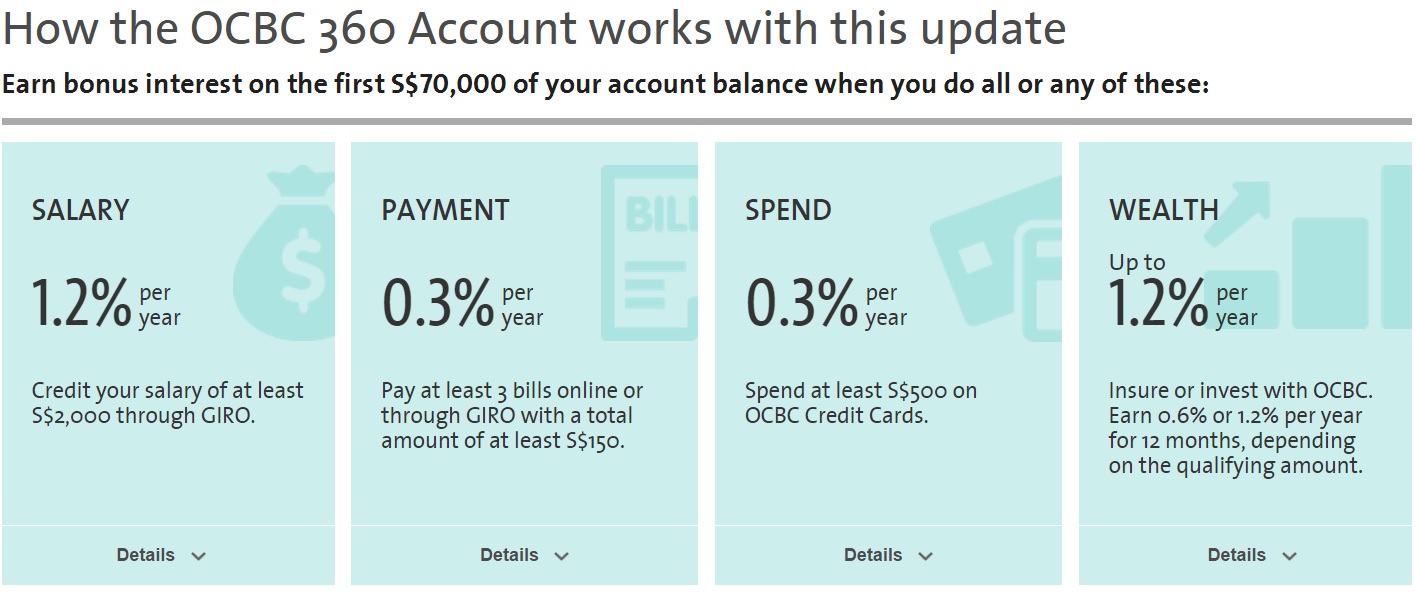

I received an SMS from OCBC about the new updates to the OCBC 360 account and after a couple of clicks, I was greeted with this:

Basically, OCBC 360 has regressed from an amazing product three years ago to a good product two years ago and is now just an ok product at best. This is reflected by the many (somewhat vitriolic) blog posts about this change during the past 24 hours.

Although I am definitely disappointed by the reduction in the interest rates for the payment and spend part, here’s why I am taking quite a different position from most other financial bloggers and remaining on OCBC 360.

Convenience/Lock-In

If you are an OCBC shareholder, you should laud what the management is doing. Paying less interest on existing deposits.

Obviously, some people will switch their funds around in search of the highest interest rates. But I believe most will stay put since it is quite a hassle for most to email the HR to change their salary crediting, adjust their GIRO payments that is attached to an OCBC credit card and subscribe for new credit cards from other banks.

Well, that is what we would have to do if we wanted to switch from the package of OCBC 360 & the OCBC 365 card to UOB One or the BOC SmartSaver bundles. Not to mention, we are using iOCBC as our brokerage.

If I were to make a switch, it would be to the BOC SmartSaver Program since it is likely to yield a realistic interest of 2.35%. But at this moment, there is an inertia to make the change since I honestly believe BOC will likely adjust their rates within a year after getting their hands on the deposits.

Small Decrease In Total Interest Earned

People often forget about the increase in the quantum that earns the revised bonus interest of 1.8%.

Previously: 0.0225 x $60,000 = $1,350

From 1 April 2017: 0.0185 x $70,000 = $1,295

Since we generally do keep more than $70,000 in the OCBC 360 account, it’s a $55 decrease over a year, just a 4% drop.

Possible Alternatives We Are Looking At

There could come a moment in the near future when our situation might not qualify for these high interest “jump-through-the-hoops” accounts so we are definitely looking at alternatives to park our cash and emergency funds.

CitiBank Maxigain appears to be one such account and after 12 months (aka 12 counters), the interest rate could be close to 2%. The criteria of an increasing balance to qualify for the bonus interests isn’t too difficult to navigate past since one just has to transfer $10 to the account every month.

Perhaps I will pay Citibank a visit in the next week. Getting past the RMs at the branch at Waterway Point in itself would be a formidable feat.

Otherwise, I would be waiting for the SSBs to go above 2.5% again to park more cash there.

Addendum:

1. Four months on, we are ditching the OCBC 360 and moving onto another bank account. Please refer to this latest post for the reasons why.

Haha, I’m staying with the OCBC 360 bank account as well. The interest differential is small if you can come up with the additional S$10,000 to increase the balance from S$60,000 to S$70,000. Besides, as you have mentioned, I’m an OCBC shareholder as well so this action doesn’t hurt as much since it helps to lower the bank expenses. The UOB One bank account seems to be better but I’m not sure about the other high interest bank accounts.

I called in to clarify the interest hoops. To enjoy the Earn bonus of 1% on the first $70,000, you are required to have $200,000 in the account. Otherwise you are earning only 1.8% on the (1) Salary Crediting, (2) Giro & (3) Credit card minimum spending.

Hi Han,

I think we will not bother with that extra 1%. If one has an extra $130,000 in cash, there are much better avenues out there. Putting it in OCBC 360 to get an extra 1% on the first $70,000 seems like a really lousy deal.

Hi Finance Smiths,

Yup, very little difference in terms of total interest.

BOC seems to be the best from a simple comparison. If your salary is above $6,000, it’s a no-brainer to take BOC.

I don’t like UOB because of the UOB card (the 3 month cashback criteria).

Lol.

I just opened the acc. I am damn slow … but thanks for showing me the difference in interest

Doesn’t seem a lot difference to

Me

Hi Sillyinvestor,

If you already have >$70,000 in the account, really not much difference. I think the hassle of contacting the HQ to credit your salary to a new account again might be quite a hassle.

You can take a look at Maybank SaveUp. It looks quite attractive.

Citibank MaxiGain doesn’t need top up every month. I put deposit there and didn’t top up but still got increasing bonus

Hi GS,

Thanks for your recommendation. However, I find Citibank MaxiGain much more compelling than MaxiGain. Not easy for us to qualify for three products.

if the only criteria i’m meeting is crediting monthly salary > 2k into the account, is opening an OCBC 360 account still the best choice out there?

Hi max,

It’s still pretty decent since you are getting 1.2%?

Hi 15hww!

I don’t think the $55 decrease in interest earned over a year is fairly computed. I will include opportunity cost incurred on that additional $10k as well. For example, that 10k can be easily put into CIMB FastSaver, which will yield an additional $100 a year (1% p.a. interest).

The total loss in interest is in fact, $155 a year for the scenario above.

Just my 2 cents.

Hi fighting4ff,

You are quite right! But maybe the Mrs and I are quite a special case. We generally do keep a buffer of about $10,000 on the account.

That said, the opportunity cost will be even greater using the Citibank Maxigains accoount.

Are you familiar with Citibank Maxigains?

I understand that every month you will gain one counter, which gives you an additional 0.1% interest, up to a maximum of 12 counters.

But what happens after you hit the limit? will you get to keep the 12 counters as long as no withdrawal is made? Or will it be resetted?

Fighting4ff

Hi Fighting4FF,

I am not 100% sure yet as I have not opened the account.

My belief is that as long as no withdrawals are made, the 12 counters will be maintained.

I will probably write a blog post and update when I sign up for the account.