As mentioned in many of the pages and posts on this blog, we started a Regular Savings Plan (RSP) with Philip Sharebuilder back in Nov 2010. To minimize the monthly fees of $6 to 1% of the investment, we also committed $600 to this product every month. Since the plan offered us the option of choosing two counters without additional charges incurred, we allocated $500 to the STI ETF and $100 to one of the local banks, DBS.

Monthly statements were provided as an update and I was normally the one paying closer attention to them. Understandably, even though Mrs 15 HWW is the owner of this account. After all, it’s hard to find someone more passionate about our finances than me. But once in a while, I will make it known to her that she made $xxx or xx% gains in her portfolio. She will be pleased to have married such a savvy husband but I would sometimes be exasperated if she follows up with this “Should we sell some?” question. 🙄

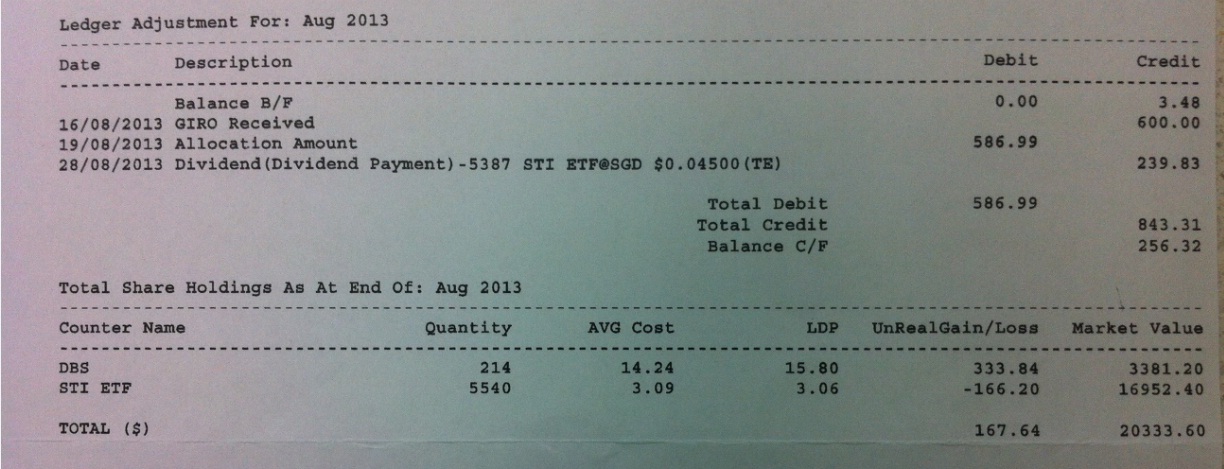

The monthly statement for end Aug came in a few weeks ago. Taking a quick glance through it, I have to admit I was a little surprised to find out that the STI ETF component was in the red (image below: -166.20).

Although I wasn’t really that concerned, I also casually made the remark that “we would have been better off saving the money in a bank account for the past 3 years instead“. Alarmed that her funds were not doing well, the Mrs heaved a sigh of relief that luckily, we didn’t need the money now and had no real need to liqudate the investments at a loss. This got me thinking. What if we had really needed it now?

====================

These are some of the methods I would consider (based on risk tolerance) if I am transported back in time, still setting aside $600/month, but intending to accumulate a sum I needed three years down the road:

1. Don’t Invest Those Money

If I needed this $20k for the wedding or renovation (important events), I would probably not invest the $600 saved in the market. I will park them in higher interest saving accounts like CIMB’s StarSaver instead and have the peace of mind every night that my capital is well-protected for the next 3 years.

2. Reduce Your Stake Along The Journey!

One might also argue that 3 years isn’t that short a time and there’s really plenty of money to be made during this period. In fact, the local papers just listed 5 blue chip stocks that provided double digit returns during the last 5 years!

Therefore, if I had a bigger risk appetite, I would still invest. However, to avoid the situation of liquidating all the holdings when the market is distressed (just when I need the money), I could possibly have taken some profits when the market was doing well. For example, I could have sold a proportion in May this year when the STI was hovering near 3,500!

3. Accept the Risk!

Have you watched “Deal Or No Deal”?

Imagine if you’re down to the last two briefcases and they contain either $1 or $1,000,000. The banker then offers you $300k for you. Would you take his offer or would you prefer to open your chosen briefcase?

For some, it’s really all or nothing. They would rather invest in the market until the day they have to liquidate, hoping that it has appreciated to $30k (accepting the risk that it might drop to $15k) than accepting a certain value of $20k. They convince themselves by saying that the market on the average returns at least 10% a year and they can’t be that unlucky over a period as long as 3 years, right?

====================

If you’re in my shoes, besides making a choice based on your risk appetite, it also depends on how “long-term” you view your investments.

As seen from my real-life example, even accounting for the benefits of dollar-cost averaging, I am still facing a paper loss for my investments in the STI ETF. But that’s fine, since I am a firm believer in the merits behind this particular method of investing and tend to view 3 years as a short time in the investment sphere. In my opinion, it’s really hard to justify the money you need <5 years later as a long-term investment.

In fact, since the main objective of our investments is to generate enough dividends to cover our expenses, you could also argue that our investment horizon is as long as FOREVER. That’s not to say that I wouldn’t be selling any of my shares anytime soon. Seriously, I could even sell the whole STI ETF stake tomorrow, if market conditions (appreciate by 30% overnight) or my asset allocation strategies (windfall of $1 million in stock options) change.

What a longer investment horizon (not needing the money anytime soon) does is to boost your chances of being never forced to sell your investments at distressed prices like those we saw last month. That’s certainly not wishful thinking if you also conserve some cash by your side, too.

P.S. I understand that this post is a little late and might be slightly less relevant now since markets have rebounded in Sep. But hey, who’s to say STI won’t go down to <3,000 in a few months or so again?

The idea of investing in an ETF is so that you don’t have to worry if it is in the black or red on a month by month basis. Assessing it on a yearly or even multi-year basis would be the more relevant method, as it is supposed to mirror the long-term returns of the index (adjusted for, of course survivorship bias).

Hi Musicwhiz,

Yes, assessing it on a yearly basis would be fairer. And to be honest, even though we monitor monthly, we rarely worry about its performance.

As I always advocate one to invest early, this post is meant to tamper expectations that one would definitely make a profit. There’s always a risk. Even after almost 3 years of passive investing, the investment hasn’t been outperforming fixed deposit returns.

I think the objective of the investment is most impt. if main objective of investments is to generate enough dividends to cover expenses, then even if it results in unrealised capital losses, ur main objective remains satisfied.

The problem now lies in two areas:

(1) ETFs are meant to mimick underlying asset class returns – not to beat it. In last 20 years, the secular bull market supported popularity of ETFs and indexes. Now seems like a sideways market, so would ETFs work as well as in the past? No rising tide that lifts all ships. ETFs comprised of good ships and leaking ships, you can’t avoid the latter.

(2) The Missus seems to have a different view of what the ETF should entail in terms of risk & return. If there is such a mismatch in expectations, should reconsider if she should have part ownership over the investment. I had a similar problem before and “bought” over the stock from my wife which she bought based on my recommendation. (of course we all know my money is her money hahaha)

Nice blog btw!!

Hi HL Tiong,

Thanks for dropping by.

(1) I agree there’s a chance ETFs might not work as well as in the past. There’s always a danger when everyone’s jumping in, especially in the past 10 years with so many experts advocating it. Moreover, resource constraints and more capital (diminishing returns from investments) could also depress market returns in the years to come.

(2) The Mrs still has a trader mindset but she’s improving and slowly thinking more “long-term”. I don’t really see this as a problem but more of more education on my part? LOL.