About a month ago, on 19 September, I had a really strange desire. I actually wanted to get my hands on one thousand sets of 128GB iPhone 6 Plus (Gold)! And no, it’s not because I have another 999 girlfriends. 😉

This desire was triggered largely because I had managed to sell a 16GB iPhone 6 Plus (Silver) on the day the phones were launched. (A good way to reduce the cost of owning a phone. )

I was one of the lucky few that managed to complete my re-contract on the M1 website in early September. 😀 And after collecting the phone in the morning of the launch, I promptly sold it within a few hours for a hefty profit close to a thousand bucks! As the prices escalated in the late afternoon, it was easy to make $1,000 off an iPhone 6 Plus even if one had paid the full retail price charged by Apple. Imagine if I had 1,000 sets?! I would immediately become a millionaire! (I know I am daydreaming.)

However, some of my friends weren’t that impressed when they heard me excitedly re-telling this tale:

“It’s so hard to get an iPhone 6 Plus on the launch day! Why did you sell it? You should have just become one of the first users of this magical device and enjoy it for yourself!”

This mindset probably also helps to explain why there are thousands of people in China willing to pay almost $3,000 for the 128GB iPhone 6 Plus (Gold). And I can only pinpoint such irrational behaviour to one thing:

A lack of patience.

There are just too many who simply can’t wait for a month or so before the phones were launched in their home countries.

And I think everyone (including yours truly) can benefit when we exercise more patience in our life. Besides lightening the strains of the wallet by reducing our expenditure, patience can also help us when we save and invest too. Yes, we can get rich with a bit more patience!

Here’s how:

====================

Patience in Expenditure

Before meeting dear wife at Suntec City for dinner last Friday evening, I went to the Arcade @Raffles Place to exchange some currency. Then I took a slow stroll along Singapore River (I like to walk.) and since I was early, decided to pop by Esplanade. And not surprisingly, I ended up at the library. 😆

Since I haven’t been there for quite some time, what surprised me was the extensive collection of DVD and Blue Ray films that were stocked at the Esplanade Library. Unfortunately, I could only borrow one more item and thus just got this title below:

Mrs 15HWW actually wanted to catch Despicable Me 2 on the big screens earlier in the year but unfortunately she decided to give that a miss since she hadn’t watched the original. So I try to make it up with this and I am glad I did it since both of us enjoyed this show. (Although I had to live with her “It’s so fluffy I am going to die” verse for a couple of days. 😉 )

So instead of paying to watch movies in theaters or buying DVDs/Blue Rays from shops like Poh Kim or even renting them, one could simply just wait for them to be available in our local libraries for free! I went back to the same library yesterday to repeat the process and got these classics:

Even recent titles like Rise Of The Planet Of The Apes and The Amazing Spiderman were also available as of yesterday.

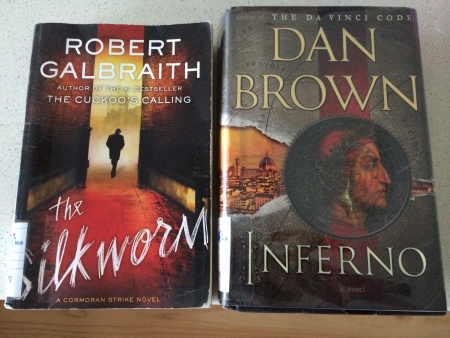

And how can I talk about our libraries without mentioning about books. Lucky me managed to borrow these two bestsellers for free recently:

Besides being free, not buying them means I don’t have to worry about finding storage space for these books too!

Exercising patience in our spending is not just limited to stuff like watching movies and reading books. For most items, they are always more expensive (less discounts) when they are newly launched. One can likely get them cheaper by at least 10-20% after waiting a few months.

This is patience in the form of delayed gratification.

Patience in Saving

Since both the Mrs and I are under 30, I find it hard not to refer to this article (I think it’s somewhat become a classic.) when I want to talk about savings.

For most young adults in their early twenties, it does appear virtually impossible to accumulate $100,000 before one turns 30. However, if one breaks it down to saving let’s say $20,000 in a year or $1,500 every month, it definitely does appear less daunting. And so what if you can’t hit that amount by 30. Exercise a little bit more patience and I am sure you can hit that 6-digit sum within another few years.

At age 28, both Mrs 15HWW and I have saved at least $100,000 (investment returns and interest excluded) each from our income thus far. When we look back, it really did seem impossible to chalk up such an amount within a few short years. Even now, the target of saving a combined $500,000 before we turn 35 appears very challenging. Nonetheless, I am sure that with time, discipline and some patience, we can reach this amount in pure savings by then.

This is patience in the form of not giving up.

Patience in Investments

Most people want to become rich and that’s generally not a bad thing. Furthermore, there’s nothing dangerous about wanting to get rich. But what’s dangerous is when a person wants to get rich… FAST.

Sometimes, 5% or even 10% returns isn’t enough an enticement to many. They want their money to double in 3 years, 2 years or even a year! And that’s when people fall prey to risky investments or even outright scams.

If one is able to generate a 12% return, he could double his money every 6 years. With patience and consistent savings, this person will almost definitely become a rich man after a few decades.

With markets correcting during the past few weeks and months, I have to admit that it is indeed tempting to put in significant cash to buy up some distressed assets. However, what is cheap can always become cheaper. Thus, in a falling market, I have devised a system for me to allocate a certain amount of cash when STI breaches a certain mark.

This helps me to exercise patience with my “warchest” and ensure that I will almost always have the opportunity to “average down”. Such an action should help to reduce the “percentage loss” of the portfolio which could make it more palatable psychologically to continue staying vested in a bear market.

This is patience in the form of not being too greedy.

====================

I alone managed to accumulate 300k inclusive of investment returns when I turned 30, savings rate of 70% per mth. I also have the same goal of 500k by 35 which I think is achievable.

Now with a baby n a household to maintain, i could only save 20% at best after deducting all expenses. Not sure if you n mrs is considering starting a family, if yes it is a definitely a ‘game changer’. Looking at the intangible aspect, it all worth it to us.

I agreed that patience is the key, I need to push back another 5 yrs perhaps to reach my goal but if no 2 comes along then the game plan changes again.

I am looking forward to see how yr financial planning changes once you have yr first one. All the best!

Hi Peter,

Wow, $300K alone by 30 is a really incredible achievement. I am pretty sure even in the personal finance blogosphere, few had achieved that.

Yup, we do intend to start a family and we shall see if expenses spike up. Think a notable expense would be a car since many households purchased one after having kids.

Wow, your post totally resonates with me. I live by the same values as you! Totally cool and awesome to find someone who is on the same wavelength. I agree that patience is one’s best friend. I am also often looking for passive income, leveraging on the all so awesome library (knowledge is one’s best friend) and thrtiness, while not being stingy, is the way to go! Keep preservering even when the going gets tough. Keep your powder dry and be patient — for amazing investments.

Cheers, sgpropertyinc

http://Www.sgpropertyinc.blogspot.com

Sorry, typed too fast on my phone.

Correcting my own typo errors.

*thriftiness

*pesevering

Hi Sgpropertyinc,

Thanks for your kind works and glad to see a kindred spirit.

I generally prefer to stay vested even in volatile conditions and I prepare around 6-7 bullets. Everytime the index drops by 5%, I will fire off one round. =p

Good read..will impart all these knowledge to my young ones..

Btw, wonder if unit trusts is a good saving tool as compared to dividends stocks?

Hi Oldies,

Thanks for your kind comments.

Think for unit trusts, it can be as good a saving tool as dividend stocks. One thing to beware of is the annual costs of investing in a unit trust. Some of them can be exorbitantly high yet doesn’t outperform the market consistently.

I think that’s a good strategy. To nibble in this current uncertainty.

🙂

Do u have a stop loss strategy?

Hi Sgpropertyinc,

I don’t really have a “technical” stop loss strategy. I probably would exit a position if I feel there is a good probability that the business is unprofitable in the long term. My idea of a hedge is by ensuring a position carries a weightage of no more than 10% of my portfolio.

Hi there,

Do you mind elaborating on your system of allocating a certain amount of cash when STI breaches a certain mark?

Hear to learn from you.

Cheers

Hi Jon,

First of all, I doubt I am in a position to teach, so please don’t say you are “learning” from me. I don’t mind sharing, though.

Well, the market has fallen a fair bit since June. Since I am holding about 35% in cash now, I could put in 5% if the STI breaches 3150, another 5% if it goes below 3,000 and so on. This is something that I would feel suit my personal psyche.

You could adopt something similar if you feel it’s suitable for you. =)