I am experiencing some form of lifestyle inflation with the recent opening of Waterway Point. Instead of settling for a simple and cheap cai peng at the food centre nearby, I have been frequenting the restaurants at the mall.

For example, with some time to burn before my next lesson today, I am seriously tempted to visit Bali Thai and enjoy their weekday promotional meal.

The total bill would probably add up to $15 but I would convince myself that it’s worth it since it’s both a late lunch and an early dinner. The food is much nicer than the food centre or the food court and moreover, I would get to enjoy my book in a nice environment too.

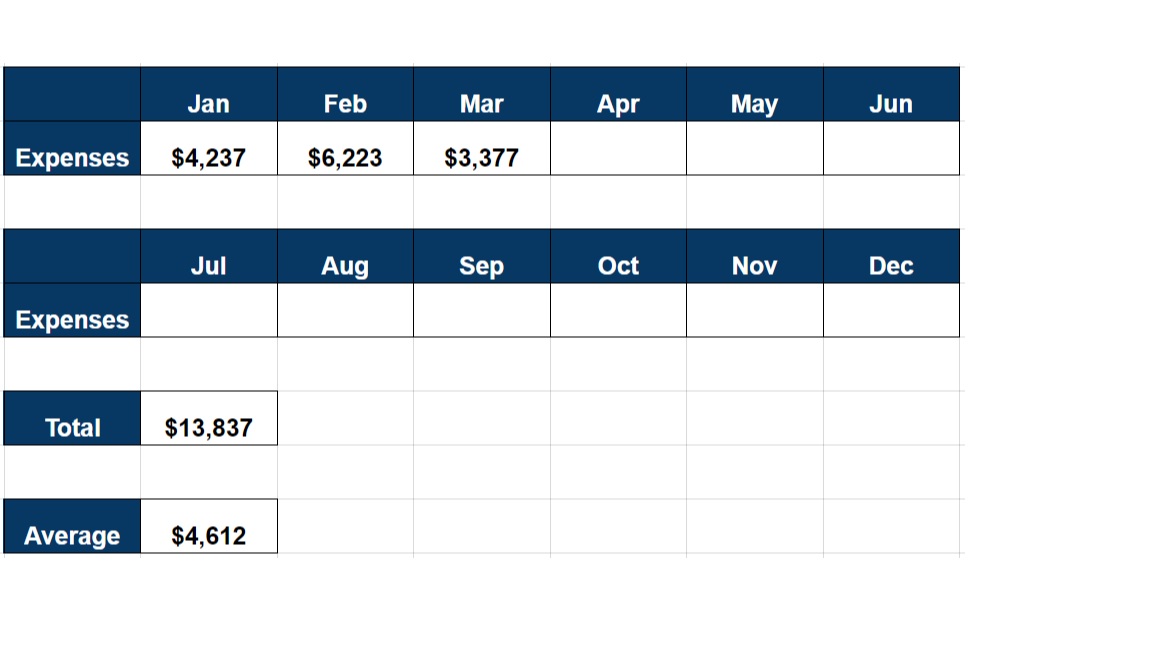

Thus, it’s not surprising that food expenses has gone up recently, and perhaps it could stay that way? Afterall, our expenses in March still came in below $3,400!

Eating Out: $875.90

Hawker ($268.90) – I think on average, we are spending between $250-$300 on hawker every month. The data is pretty consistent and unless we really start cooking more, it isn’t going to come down.

Fast Food ($43.50) – 1 KFC meal together with the in-laws bumped up this category. One Subway meal, probably the first Subway sandwich I had this year. Instead of having fast food, when I crave for convenience and air-con, I am going to restaurants. Is it healthier? Looking at the picture above, I am really skeptical.

Restaurants ($563.50) – With meals at places at Lao Huo Tang restaurant, Dian Xiao Er and of course, DTF increasingly often, expenses here is increasing. At the same time, there is a desire to give ourselves occasional treats at more upmarket places, I would have to admit that eating out is “our poison”.

Groceries: $86.20

Supermarket ($86.20) – Tidbits and icecream for my students during the lessons I have at home. And of course, the fruits which I have for breakfast.

Beverages & Snacks: $49.10

Beverages ($10) – This is a good habit that we have adopted. We rarely, if ever, order drinks when we eat out. Since we both don’t really appreciate alcohol and feel that soft drinks/syrup is insanely priced, we eliminate them.

Snacks ($39.10) – I enjoy some chocolates occasionally and I am hooked on Royce’s Nama chocolates these days. A box lasts us for around a month.

Utilities: $168.61

Electricity, Gas & Water ($80.91) – I think the bill is quite stable at between $80-$90 for the past half a year. Electricity usage was at 250kWh for this month. 13KWh of gas and 6.8 Cu M of water make up the rest of the utility bill.

Cellphones ($87.70) – $45 for the Mrs and $42.70 for me. I exceeded my data plan, which is quite ridiculous. I need to prevent myself from getting addicted to a phone.

Transport: $50

1 EZ Reload transaction for the Mrs.

Departmental: $157

Clothing ($157) – The Mrs paid for the family’s expenses at Uniqlo.

Miscellaneous: $168

Gifts ($48) – We bought a cake to celebrate our nephew’s birthday and I got a book for one of my tutees for her birthday too.

Travel Insurance ($120) – Travelling is more expensive than people perceive to be. Most people forgot to include these expenses in their travels and travel insurance for 4 set us back by $120.

Total: $1,554.81

Overall Total: $3,376.81 (included fixed expenses of $1,822)

Been there, done that, was once tempted too much by all the lunch deals. You will never want to go back and pay full price afterwards.

Oh, go try use eatigo app, 50% off at a lot of non peak hours.

😀

Hi Ellaa,

Your “escapades” to Tiong Bahru was really interesting, and amazing considering you spent like less than $15?!

Ok, I will definitely download the app. I am really an app and tech noob. Haven’t tried out services like FoodPanda before too.