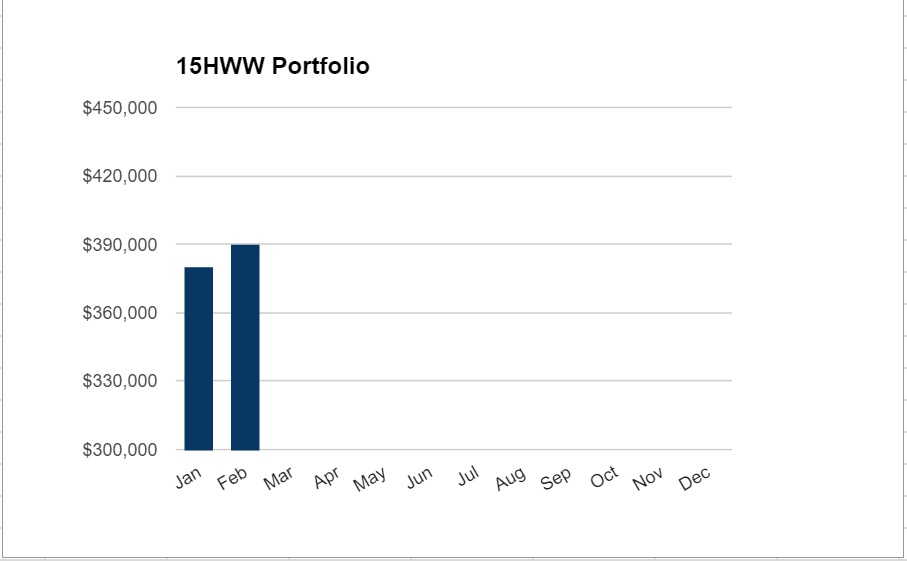

Markets are climbing slowly and as I am typing out this update, the STI has actually breached 3,100. The total value of the portfolio right now is $390,000 and it is actually up by $10,000 from the previous month. $7,000 was from capital gains and another $3,000 represents capital injection into the warchest.

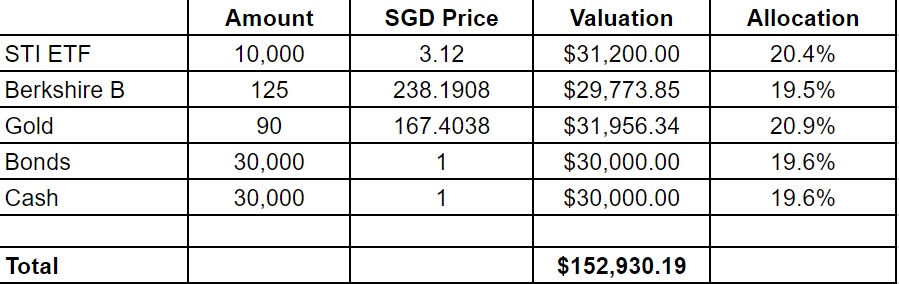

1. 15HWW Permanent Portfolio

Interestingly, STI ETF, Berk B and Gold prices are all up slightly this month, contributing to more than a $2k gain in this portfolio.

USD-SGD Rate: 1.42

UOB 50 Gram PAMP Gold Price: $2,815 x 6 = $16,890

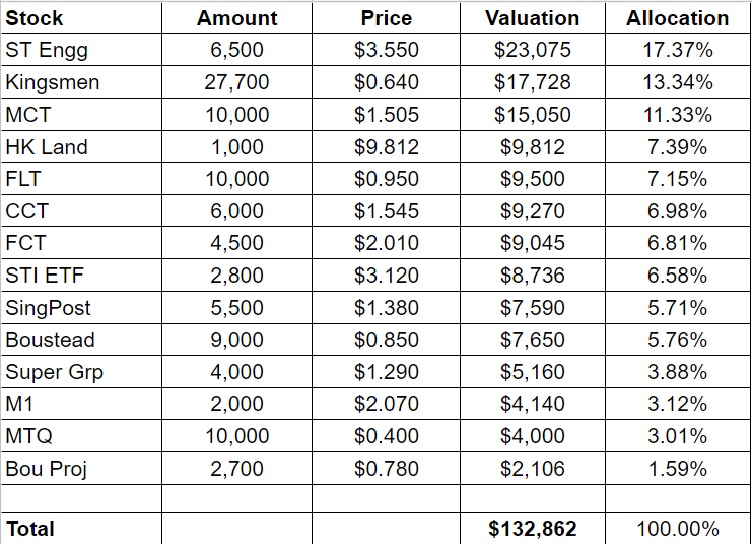

2. Personal Picks

About 3 weeks ago, I bought 10,000 shares of FLT @$0.925. Even after accounting for this buy, this portfolio is still up by $3,500 over the past month.

A rising tide lifts all boats, including this.

XIRR: 6.6% (Nov 2010 to Feb 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI). For obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few indicators as shown below.

The portfolio was flat over the past month and I missed out on some local stocks that Doctor Wealth picked as the prices soared significantly. Hopefully, I will get a chance to add on to this segment soon.

Portfolio Value: $37,991

Number of local stocks: 2

Number of foreign stocks: 3

XIRR: 5.6% (Sep 2016 to Feb 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets. We managed to add $3,000, savings largely from our active income.

Value: $66,000

I am interested in some details of your humongous warchest. What events would trigger an investment? Are you looking for the STI or certain stocks to fall below a certain benchmark? Or big macroeconomic events such as the next recession?

Hi singvestor,

It is actually not that big as a proportion of the portfolio. Probably 15-20%?

I am not the kind who can shift from 0-100% or vice versa. More like between 40-70%.

Honestly, I don’t know what will happen in the next few months or years but if opportunities arise, I hope I can take a little bit of an advantage with the funds.