There’s a little bit of euphoria in the market in the past few days as the STI Index breached the 3,300 mark temporarily yesterday.

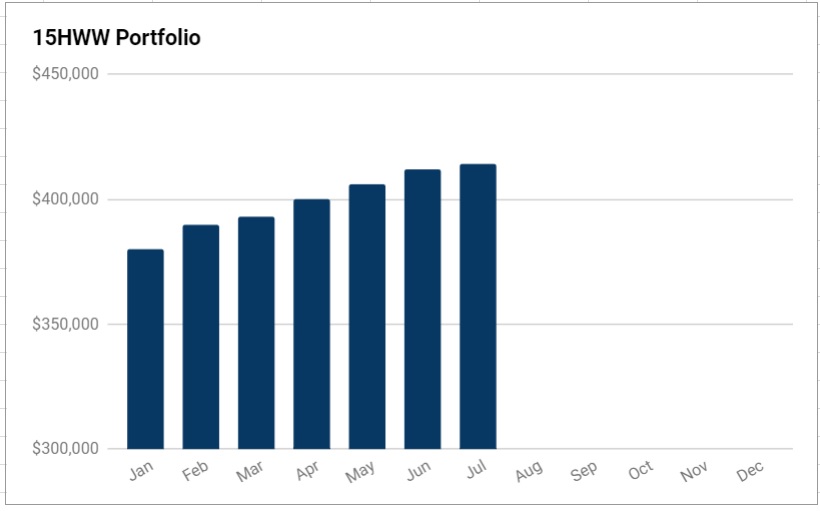

However, organically, the 15HWW portfolio actually shrank a little, due to the strong Sing Dollar which appreciated against the USD and HKD. Not to mention the anaemic performance of gold. Despite the local market doing well, the overall portfolio only rose by two thousand bucks to $414,000.

Another no-transaction month and I am looking to make a couple of sales if the market pushes up a bit more.

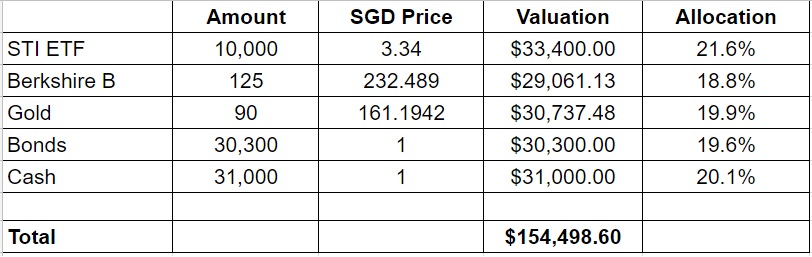

1. 15HWW Permanent Portfolio

The SGD appreciated against the USD. US$1 would have been able to exchange for SGD 1.39 a month ago but now it’s only SGD 1.37. Coupled with the price decline of gold, the portfolio lost about $1,000 in value even though the STI continued its ascent.

Since half a year has passed, I added in the interest earned on the cash component.

USD-SGD Rate: 1.37

UOB 50 Gram PAMP Gold Price: $2,705 x 6 = $16,230

Annualised Returns: 5.6% (Jan 2017 to Jul 2017)

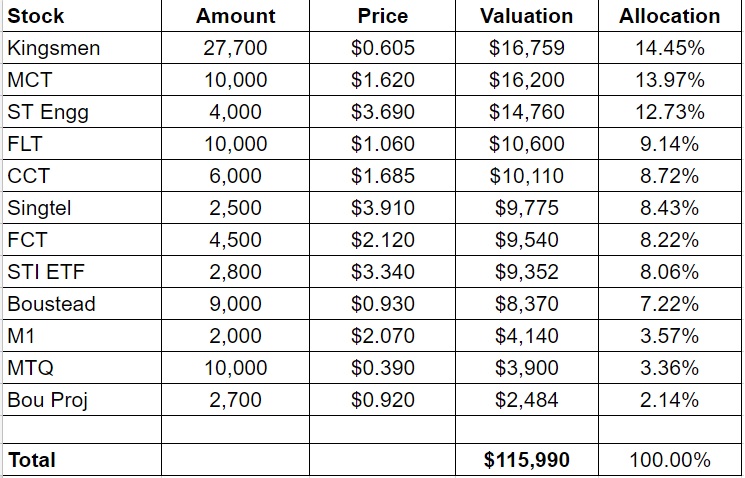

2. Personal Picks

This segment was more or less flat this month.

Annualised Returns: 7.2% (Nov 2010 to Jul 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few indicators as shown below.

The portfolio actually went down a bit by slightly more than $1,000 and it was also not helped by the SGD strengthening against the HKD. Therefore the annualised return actually went down by quite a bit. *Shrugs*

Portfolio Value: $79,491

Number of local stocks: 6

Number of international stocks: 4

Annualised Return: 6.6% (Sep 2016 to Jul 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets.

We added $3,000 from our income to the warchest this month.

Warchest Value: $64,000

Hi,

I have been reading up on investments blogs and website, intending to start doing some investments.

Any recommended articles or reading for a novice investor?

Nice portfolio you have there by the way.

Hi damien,

For a young person, I would recommend reading the writing of this 23 year old: http://www.fourpillarfreedom.com/

It’s a US blog but I think you can learn alot.

If you’re intending to start small and slow into investing, the STI ETF is a good way to start. You can do a monthly saving plan with one of the banks. Just google and you will see the various options and you can see which suits your current situation the best.

There’s some robo-advisory services with licenses from MAS, I believe they’re more competitive than most typical share/ETF investment plans offered by the local banks in terms of cost and extending exposure to mature, non-Singapore markets.

What’s your take?

Hi Ted,

I haven’t gone down to the nitty gritty but my take is likely similar to this:

https://www.cheerfulegg.com/2017/08/01/singapore-robo-advisors-yay-or-nay/