After several years attempting to prospect companies, I finally recognised that this is not something I intrinsically enjoy.

Getting to know how a company really functions is interesting enough but I would rather use my time to read other stuff like geopolitics or even fiction rather than detect potential corporate issues lurking in those dreary annual or quarterly reports.

Potential Of Macroeconomic Trends

On the other hand, I am more interested in how I can profit from macroeconomic trends.

Imagine if I had known 5 years ago that the US was going to recover/grow really well and had invested in Berkshire Hathaway earlier.

Or expected the prevalence and dominance of the few tech companies in the Tech Boom 2.0 and allocated a little bit of capital on them.

Even right now, on the back of exceptionally good returns in the equity markets in 2017, I am curious to find out how I should position my portfolio going into 2018.

And yes, with the strengthening Sing dollar, I have been exchanging foreign currencies like USD, CAD and AUD in the past few months. It’s not exactly currency investment/trading but a few thousand here and there to sort of prepay for future holidays at a cheaper rate.

Profiting From Macroeconomic Trends

So whether it’s for investments or to find out where it’s more worth it to travel to, I am interested to hear the views of Xeo Lye and Elvin Liang who makes use of top down macroeconomic models as an integral part of their portfolio composition:

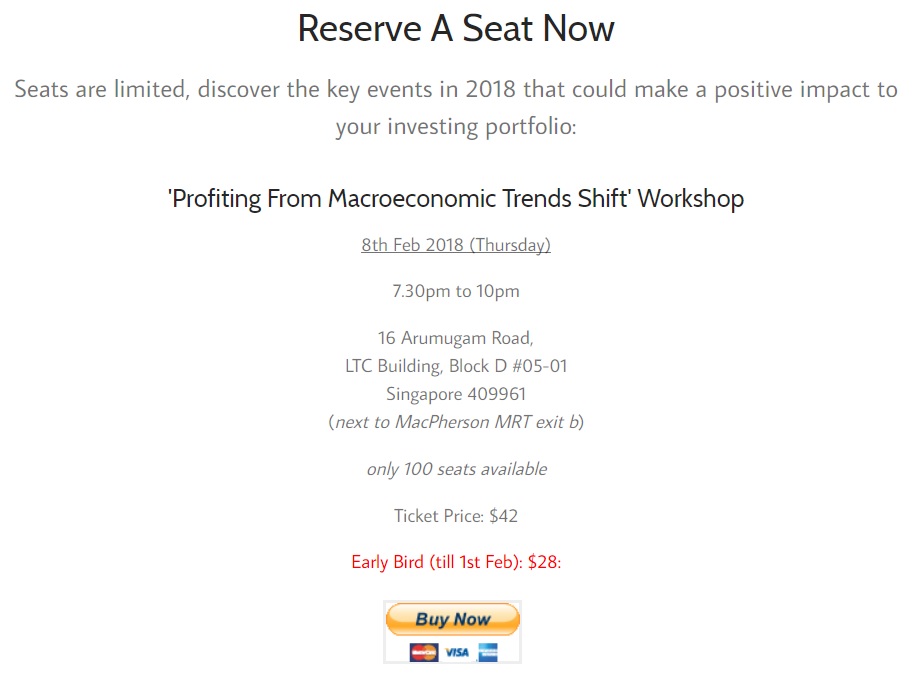

The event is not priced at a couple of hundred bucks and at just $28 (cheaper than musicals). There is so much value and so little downside.

The early bird price will be over in a few days’ time. So do hurry up and click HERE if you are interested.

I will likely be attending this event and if you’re free next Thursday evening, I hope to see you at LTC Building too!