With decent income and very manageable expenses recently, we were able to inject close to $5k to the portfolio. But unfortunately, the portfolio did not rise by that much.

Even after a couple of very good days in the market, the portfolio still took a small hit due to the poor performance of a couple of stocks. The appreciating SGD is also a drag on the foreign holdings.

I am still ambivalent towards the direction of the market since I have enough invested and also have abit of cash to take advantage of any weaknesses in the market.

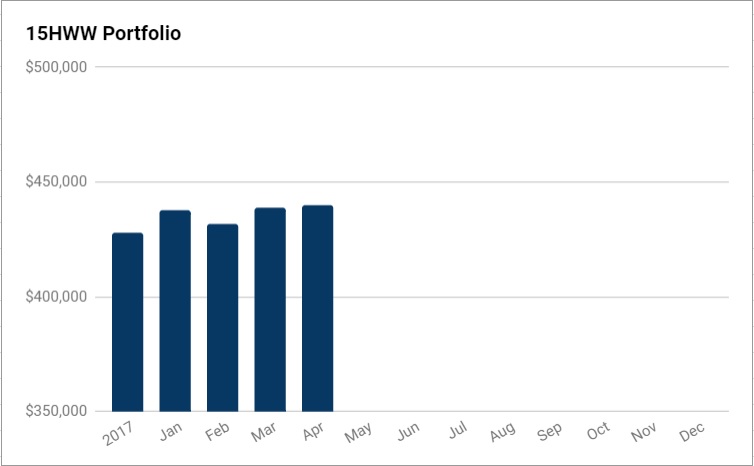

Overall Portfolio (Value: $440,000)

Monthly Change: +$1,000 (+0.2%)

Yearly Change: +$39,000 (+9.7%)

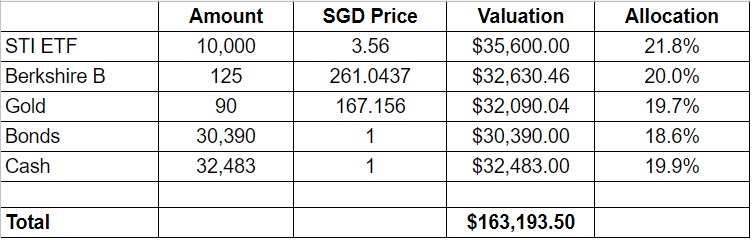

1. 15HWW Permanent Portfolio

The gain in the STI ETF managed to offset the fall in Berk B, so the sub-portfolio turned in flat.

USD-SGD Rate: 1.31

UOB 50 Gram PAMP Gold Price: $2,841 x 6 = $17,046

Annualised Return: 6.7% p.a. (Jan 2017 to Apr 2018)

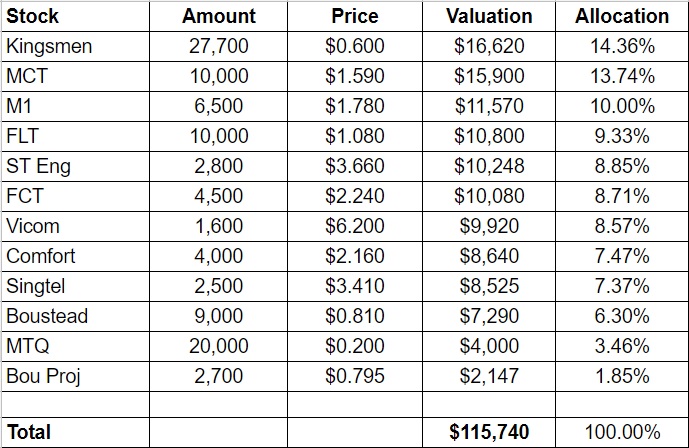

2. Personal Picks

I subscribed to 10,000 shares of MTQ at $0.20 in their rights issue. No surprises that I got the full allocation since the price has continued to tank.

The drop in valuation for Kingsmen and MTQ meant the portfolio actually lost $1k in value from the past month.

Annualised Return: 6.5% p.a. (Nov 2010 to Apr 2018)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few comments and indicators below.

No transactions this month.

The latest buy on Bursa just three months ago has lost one-third of its value, which helps to explain why the portfolio has turned south and negative.

I am still quite unperturbed and could be adding some HK counters (that are still suffering from the effects of the so called trade war) in the next few days.

Sub-portfolio Value: $78,082

Number of local stocks: 6

Number of international stocks: 5

Annualised Return: -1.9% p.a. (Sep 2016 to Apr 2018)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $83,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

I wonder if cash from your emergency fund, permanant portfolio and warchest overlap or are kept seperately in 3 different accounts?

Hi Ms L,

They do not overlap and are all separate, so I do hold quite a bit of cash as a proportion of my portfolio.

I think u shld increase cash holding to 40% at least due to the uncertain market.

Plus cut loss in some of the counters.

Noticed u have many of those crappy ones. No small or mid cap growth counters

Now i beginningg to doubt DWI.

Hi Contrarian,

I am still keeping faith. If a small cap jump by 100%, the DWI portfolio will be back up to a decent 8% return p.a.