This is one of the few chapters in the book that resonated really strongly with me.

Counterproductivity is a natural phenomenon that counteracts measures/behaviour that attempt to raise our productivity.

Cars increase our transportation speed but we are staying further and further away from our workplace. Computers, emails and smartphones make us more productive at work but we are spending more and more time on them.

The most classic case of counterproductivity in personal finance is painstakingly setting aside cash into a saving account that yields 2% while servicing debts at >10% interest at the same time.

This concept of counterproductivity is familiar to Singaporeans. Well, a little crude, but heard of LPPL? (Do click on the link for a hilarious yet Singaporean example).

Here’s 2 recent examples for further illustration.

Example 1: Starting Fixed Deposits & Endowment Plans When You Have Not Maxed Out Your Singapore Saving Bonds (SSB) Allocation

Details of the new Great Eastern 5 Year single premium endowment plan keeps popping up on various chats. Even the Mrs asked me whether the product was suitable for her parents.

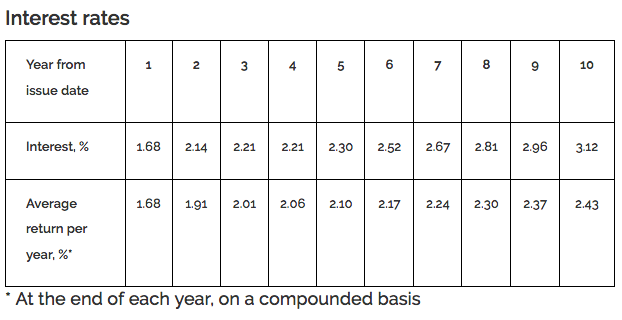

Basically, it is an endowment that guarantees a yearly return of 2.7%. Sounds great right, especially since the rates are better than the latest SSB issue below.

But what if I tell you that the endowment is not capital guaranteed if you had to break the endowment within a year or two? The SSB, on the other hand, is capital guaranteed.

So, on a risk-reward basis, I strongly believe the SSB is far superior. And there’s no point in diversification, because I cannot think of a scenario where the SG government defaults yet the banks or GE can still pay out.

Let’s not even mention fixed deposits since I doubt any non-promotional FDs can convincingly beat the 12 month rate of 1.68% offered by SSB.

Of course, if you have already maxed out the $100,000 for SSB, feel free to consider this plan. After all, if any emergencies were to happen in the next 5 years, you can always redeem the SSBs ahead of the endowment plan.

Example 2: Applying The Minimum $500 of SSB And Anticipating To Switch When SSB Rates Rise

The SSB is a hot topic recently, so we are staying on this subject.

I have recently observed and read about some people who set aside $500 for each SSB launch. Personally, I really hope they do not redeem the previous tranche when there is an increase in the SSB rates in subsequent launches.

Simply because it is counterproductive.

With the $4 transaction cost (redeem and apply), I believe it would negate most of the gains.

For example, if SSB rates were to rise by 0.1%, a $500 allocation would yield an extra $0.50 each year to add up to $5 over the whole decade.

That just about covers……… the transaction cost.

Thanks for reading.

Oh no!! I’m one of the culprit for the $500 in each SSB tranche!!

Transaction Fees are relatively important when it comes to small amounts like this. Taking the transaction fees into consideration, for those who wishes to cash out their $500 SSB in a year, is actually receiving only 0.88% interest for that ‘$500 tranche’

Hence, I believe as always, it’s important to not go according to the trend, but to rather find what is useful for you.

Personally, to me. SSB is a place for which I park some of my opportunity funds while awaiting for a big financial event to take place, which no one would know when that is going to happen.

However, if my warchest is sufficient, I’m pretty well off taking that 2.43% annualized interest for each year, which is probably somewhere close to CPF OA’s interest that is ‘redeemable’ in 10 years time 🙂

Nonetheless, it’s important to prevent cases of ‘counterproductivity’ to ensure that one does not ‘lose out’ 🙂

When I read the post, I was like “ehhhh?!?!?! That sounds like someone I know. 15HWW so naughty go “poke” that “someone” is it?”

Looks like that someone came to the confession booth. =P

Probably.. it’s also due to the meagre amount of cash I hold!! Oh no!!