This is a pretty good month for the portfolio. The USD and HKD finally appreciated against the SGD and some of the DWI picks also rebounded. Organically, the portfolio was up by close to 1%.

It was also a very active month as I sold quite a few counters to take some money off the table and lock in some gains. This trend will likely continue in the upcoming months if the market continues its upward climb.

I am also trying out “lower commission” platforms like the Vickers Cash Upfront option (for buying local stocks) and the FSM One platform (for buying Hong Kong shares). So far, so good and I can consider buying stuff in smaller denominations going forward.

Our investments will also be shifting more towards indexation. This will free up more time and focus and I can then channel these resources to work and writing.

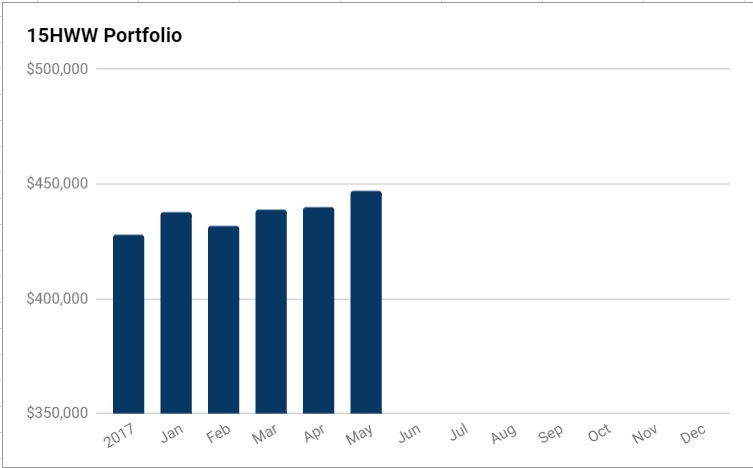

Overall Portfolio (Value: $447,000)

Monthly Change: +$7,000 (+1.6%)

Yearly Change: +$41,000 (+10.1%)

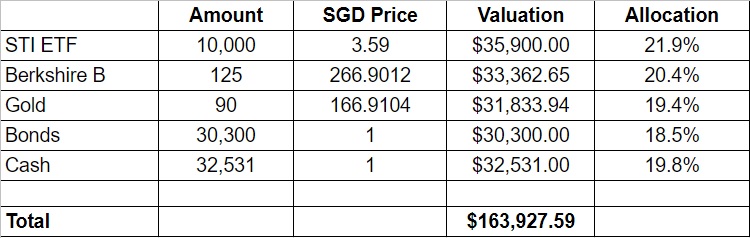

1. 15HWW Permanent Portfolio

With the appreciation in USD, the portfolio is up by close to $1,000 as compared to the previous month.

USD-SGD Rate: 1.34

UOB 50 Gram PAMP Gold Price: $2,802 x 6 = $16,812

Annualised Return: 6.7% p.a. (Jan 2017 to May 2018)

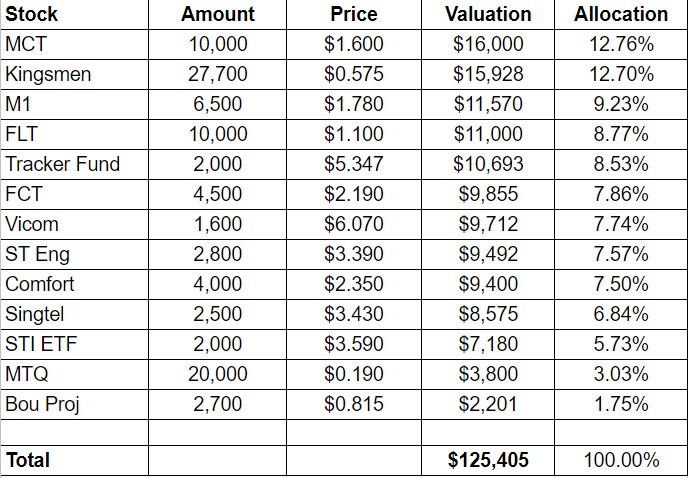

2. Personal Picks

I sold off Boustead but added some STI ETF and the Hang Seng Tracker Fund for the very long haul.

The prices of most of the counters are flat if not lower since most of them has gone XD in the past couple of months.

Annualised Return: 6.4% p.a. (Nov 2010 to May 2018)

3. DWI Picks

This is the last month that I will be updating this sub-portfolio.

After a 1.5 year experiment, I will not be mirroring the buys and sells anymore. The outsourcing has been partial at best and I realise that if I want to practise this strategy, I should either internalise the materials or outsource completely. Otherwise, I will always be lacking conviction and confused whether I should buy more or cut.

I have sold off most of the foreign stocks as I lock in some gains. The other counters will likely be parked under a “Other” category in the above sub-section during future updates as I mull over what to do with them.

The portfolio gained about $3-$4K in value in the past month and I am able to close this chapter on a high note as the returns turn positive again.

Sub-portfolio Value: $40.556

Number of local stocks: 5

Number of international stocks: 1

Annualised Return: 1.5% p.a. (Sep 2016 to May 2018)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $117,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.