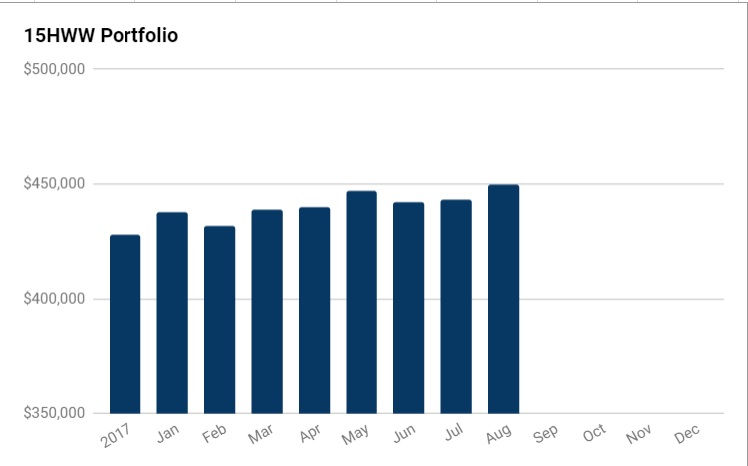

I thought I could finally mention this phrase “a rising tide lifts all boats” but the Turkish Lira crisis in the past week put paid to that.

Nonetheless, it’s still a good month. The entire portfolio remained quite resilient for the past month and with a few thousand dollars of injection, the value of the portfolio finally breached $450,000 after a few months of hard tries.

Like the entire stock market, the portfolio has not done too well for 2018 thus far and it’s mainly capital injections and accrued interest that helped to grow the portfolio. Hopefully, I can just sit back for the rest of the year and let the market do its job.

Overall Portfolio (Value: $450,000)

Monthly Change: +$7,000 (+1.6%)

Yearly Change: +$35,000 (+8.4%)

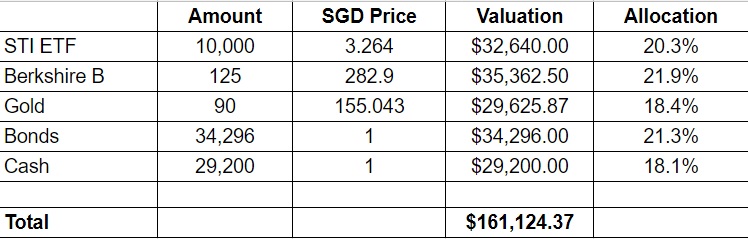

1. 15HWW Permanent Portfolio

The sub-portfolio increased by $2,000 and there were two key drivers. The rise of Berkshire B and the appreciation of the USD against the SGD. This helped to more than offset the continued weakness of gold.

The performance of the sub-portfolio has ranged between 4% to 5%, which is within my expectation.

I am confident that permanent portfolio concept should perform better than insurance/endowment returns in the long run, offer the same stability of returns yet also offer more liquidity to the investor.

USD-SGD Rate: 1.38

UOB 50 Gram PAMP Gold Price: $2,612 x 6 = $15,672

Annualised Return: 4.5% p.a. (Jan 2017 to Aug 2018)

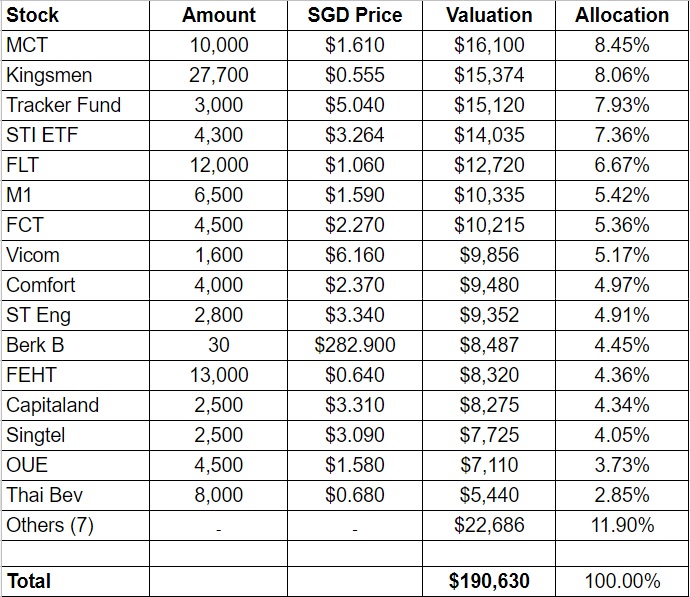

2. Personal Picks

Most of the stocks remained resilient even after quite a few turned XD in the current month. Rather than scour for new stocks, I am likely to add on to some existing positions in the coming months.

Annualised Return: 5.7% p.a. (Nov 2010 to Aug 2018)

3. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $98,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

Hi a recent reader. Do you ever intend to buy stocks like Amazon, Google, Facebook? Why or why not? Would love to hear your view on this.

Hi Dion,

The intention is there but it’s quite hard for me to pull the trigger at current elevated prices.

Congrats on breaching the $450,000 NW mark. It won’t be long until you reach half a million!

Half millionaire soon

Hi Uncle CW8888,

Yeah, hopefully half millionaire in half a year’s time!

What investment platform do you use?

Hi L,

I use DBS Vickers Cash Upfront to buy (lower fees) and iOCBC to sell (platform preference).