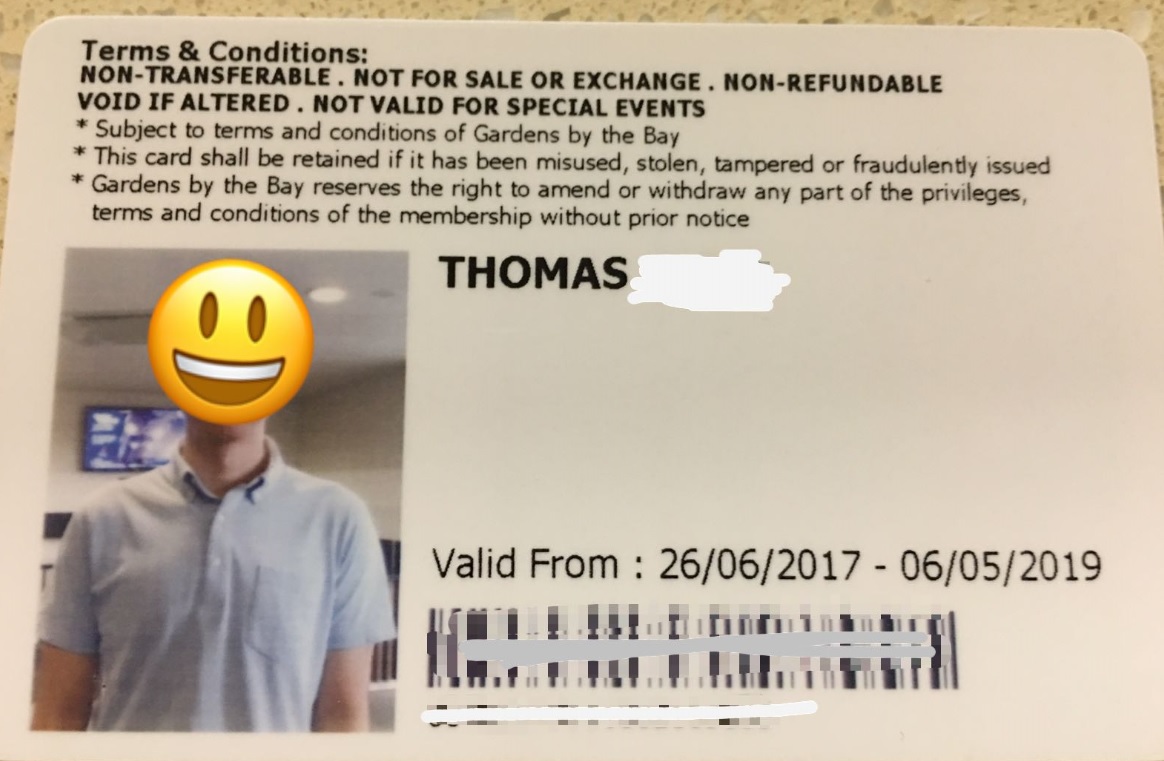

I visit Gardens by the Bay very frequently, since I am a “Friend Of The Gardens”. In fact, it’s quite common to spot me and the Mrs sitting on one of the benches inside the Flower Dome, enjoying a cup of coffee, appreciating the flowers and engaging in some people-watching.

Most Singaporeans will agree with me that Gardens by the Bay is a world-class tourist attraction. But do you know that it is also a world-class employer?

Gardens By The Bay Raises Retirement Age

This has brought relief to older workers like Mr Abdul Aziz Ismail, 61, an engineering manager at Gardens by the Bay. He was planning to retire as he was unsure if he would be eligible for re-employment at 62. Now, he has the option to work at Gardens by the Bay in his current role for a longer time since he enjoys the working environment.

I really applaud this gesture from Gardens by the Bay.

Raising Retirement Age Provides More Options

My in-laws are approaching 60. That definitely calls for a big celebration. However, I cannot deny that there is some form of unease dogging them as they near the retirement age of 62.

This is especially so for my father-in-law. He is still in the pink of his health and my sensing is that he prefers to continue working for a few more years in his current role. However, there is a chance he might have to accept retirement if his employer offers him an unsuitable or undesirable role for re-employment.

He has been with his company for more than 30 years. In line with the sentiments of NTUC Secretary General Ng Chee Meng, I think if my father-in-law’s company (or even the law) raises the retirement age, my father-in-law can continue working, earning an income, and leverage on his experience to contribute further to the company.

But of course, if he wants to retire early, no laws or his company can stop him from doing so!

Retirement Age Is Not CPF Withdrawal Age

When there are calls to raise the retirement age, most people react with negative alarm. That’s because they assumed that their CPF Withdrawal Age will also be raised in tandem with retirement age. But that’s not true.

Whether you are still working or not, when you turn 55, you can withdraw the savings left in your CPF Ordinary and Special Accounts after setting aside the Full Retirement Sum (FRS) or Basic Retirement Sum (BRS).

Moreover, CPF LIFE payouts will begin at 65 although you can choose to start your payouts at a later age. For every year you delay starting your payouts, the monthly payouts may increase by up to 7%.

Conclusion

If not for the love of the job or working, why would older workers still need a choice to work? It’s likely because they cannot afford to retire.

Only about half of CPF members were able to set aside their Full Retirement Sum in cash at age 55 in 2016. So when it comes down to the crunch, raising the retirement age will allow some of these older workers to have a longer runway to amass a larger nest egg for their retirement, should they choose to continue working.

“The human being needs a challenge, and my advice to every person in Singapore and elsewhere: Keep yourself interested, have a challenge” – Lee Kuan Yew

In Singapore, they should do away with the official retirement age. Let the needs of companies & needs of workers determine employment. Let the workers’ & companies’ rights & protections be reviewed & legislated. Update the Employment Act and Companies Act.

In other countries, retirement age is important as that determines when state pension or state-sponsored healthcare is available. Like S’pore CPF, many countries also pay higher pension the later you stop working & the more you contributed to pension taxes.

In previous decades, the CPF Minimum Sum Payout Date was managed in accordance with the changes in S’pore’s retirement age. From 55 to 60 to 62, 63, 64 and finally 65.

I would say that there is high chance of CPF Life Payout Date being raised in the future as the population continues to age & govt encourages more elderly to remain employed. This is workable as long as enough jobs are available and ageism is vigorously enforced against.

Hi Sinkie,

Yes, since the retirement age in Singapore is not linked to pension, there’s not much value to the retirement age. It’s probably just a pain point for workers who want to continue working.

For my own personal agenda, I hope that any delay in CPF LIFE payout date will be strictly voluntary if it’s supposed to be after 65. Unless the govt comes in and provide additional incentives out of their own pocket for retirees who delay payouts.

Depending on your position in your company, and the level below you, you work until 70 and below you waiting for promotion until their neck broken.

Since can work until 70, no problem for those below. Similar situation as when retirement age raised from 55 to 60 then to 65.

What people not happy is the long time interval between promotions & big salary jumps.

Civil service long time ago solved this by 2 means:

1. Greater separation between salary grade & job title. A high-performing manager can have similar pay to junior director if he/she is handling high-level projects etc.

2. Create lots of titles … assistant director, deputy director, executive director, director, principal director, director emeritus, mentor director. Plenty of promotion possibilities. But all mostly doing same job.

This is very true.

My previous organisation expanded their org chart so much, which coincidentally allowed so many senior positions to spring up. I really do wonder if the workload has increased by that much.

Hi 15HWW,

I’ll keep a keen eye out for you the next time I visit Gardens by the Bay. =)