Inequality. It’s not just happening within society, it’s also clearly evident in the markets.

While the US market surges on, almost every other market has been reeling in the past couple of months. US indices have doubled from a decade ago but Chinese, Hong Kong and even Singapore based indices have struggled to eke out any noticeable gains.

The big question is whether there would be some form of reversal to the mean or the gap would continue to widen for the next decade.

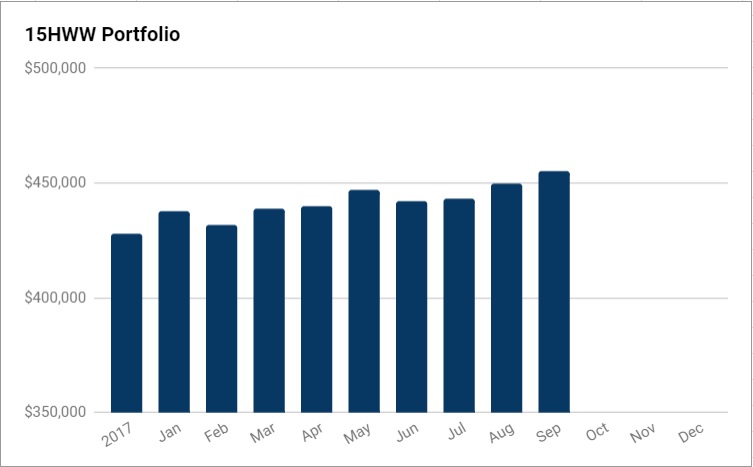

Alright, enough with the macro. I am quite pleased that organically, our portfolio remained flat for the month despite the weak market.

The portfolio value currently stands at $455,000 and the increase in value is largely due to a bumper dividend month in August and of course, capital injection from savings. Exposure to the US market through Berkshire B has helped to prop up our portfolio in recent months.

Overall Portfolio (Value: $455,000)

Monthly Change: +$5,000 (+1.1%)

Yearly Change: +$34,000 (+8.1%)

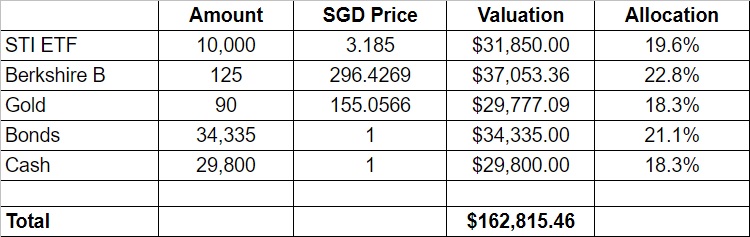

1. 15HWW Permanent Portfolio

Berkshire continues to be on a tear relative to the other assets in this sub-portfolio. The cash component also increased by $600 from the dividends from STI ETF.

These helped to increase the value of the PP by close to $2k despite the drop in price of the STI ETF and the annualised return is a pretty respectable 4.9%.

USD-SGD Rate: 1.37

UOB 50 Gram PAMP Gold Price: $2,637 x 6 = $15,822

Annualised Return: 4.9% p.a. (Jan 2017 to Sep 2018)

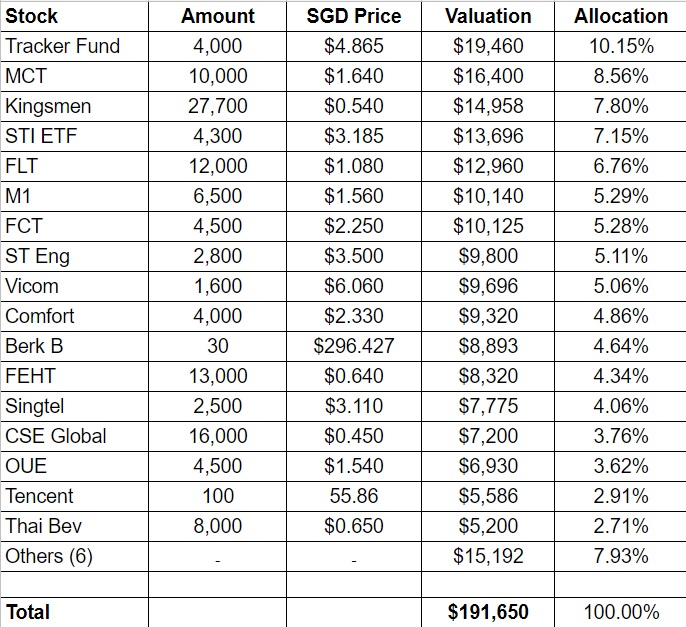

2. Personal Picks

This has been an active month. With heightened geopolitical tensions, I am increasingly jittery with regards to Singapore businesses that have significant exposure to the China market.

That helps to explain the sale of Capitaland just a few months after my purchase. With the weakening HK market, I also bought more Tracker Fund and initiated my first tech stock with a very small purchase of Tencent.  Annualised Return: 5.6% p.a. (Nov 2010 to Sep 2018)

Annualised Return: 5.6% p.a. (Nov 2010 to Sep 2018)

3. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $101,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

One Reply to “Portfolio Update: September 2018”