I started reading up and exploring the Singapore Finance Universe about 10-15 years ago.

It was tough back then. There was both a dearth of good content and also good products available to the Singaporean retail investor, especially for young adults who are beginning their investing journey.

Fast forward to today and I think the scene has improved dramatically, and I believe it boils down to two relatively new entrants to the Universe.

1. Seedly

Source: Seedly

Quality, Unbiased Content

Seedly, especially as a personal finance community, has grown to be really huge over the last few years. So, I am always pleasantly surprised that they have not gone down the traditional monetisation routes.

Whether it’s running advertisements on their sites (huge opportunity costs given their large monthly viewership) or sponsored posts, they have chosen not to dilute the user experience or cloud their objectivity.

They are sticking very closely to the mission and purpose in providing quality, unbiased financial content to the man on the street.

Long may it continue.

Cool and Helpful Community

I was recently invited by Seedly to set up an account, log in and become an active user in the community. You can actually check out my profile here.

For the past few weeks, I have participated in a review, wrote an opinion (wowed at the reach it got) and answered some questions like the one below.

Abit shameless of me here…… but glad to have provided some value

The ability to ask any personal finance or investing questions (anonymously) together with a high probability of receiving good answers is literally “WOW!”

Granted, many of the replies are from financial advisors but I have to say many of them do provide quality responses. And well, if you get lucky, there’s always financial bloggers like me lurking around.

And of course, I also found out the positive impact robo-advisors are making.

2. Robo-advisors (especially Endowus)

Source: Endowus

I have not used any robo-advisors (at least, not yet) but there’s no doubt if they were around a decade ago, I would have signed up.

Why?

- Low fees for smaller portfolios

- Ability to invest CPF and SRS funds

Low Fees For Smaller Portfolios

When I was an undergrad, it took months for me to save $3,000. If I used that sum of money and bought local stocks with a typical or traditional broker, the transaction cost would be close to 1%.

And I get no diversification.

A typical alternative then would be to DCA into the STI ETF, which unfortunately has provided disappointing returns for the past decade and lacks exposure to global growth companies.

A possible solution would be to purchase funds, but one would have to contend with sales charges, trailer fees and what not, which greatly eats into the returns.

I know because I have had a bad experience.

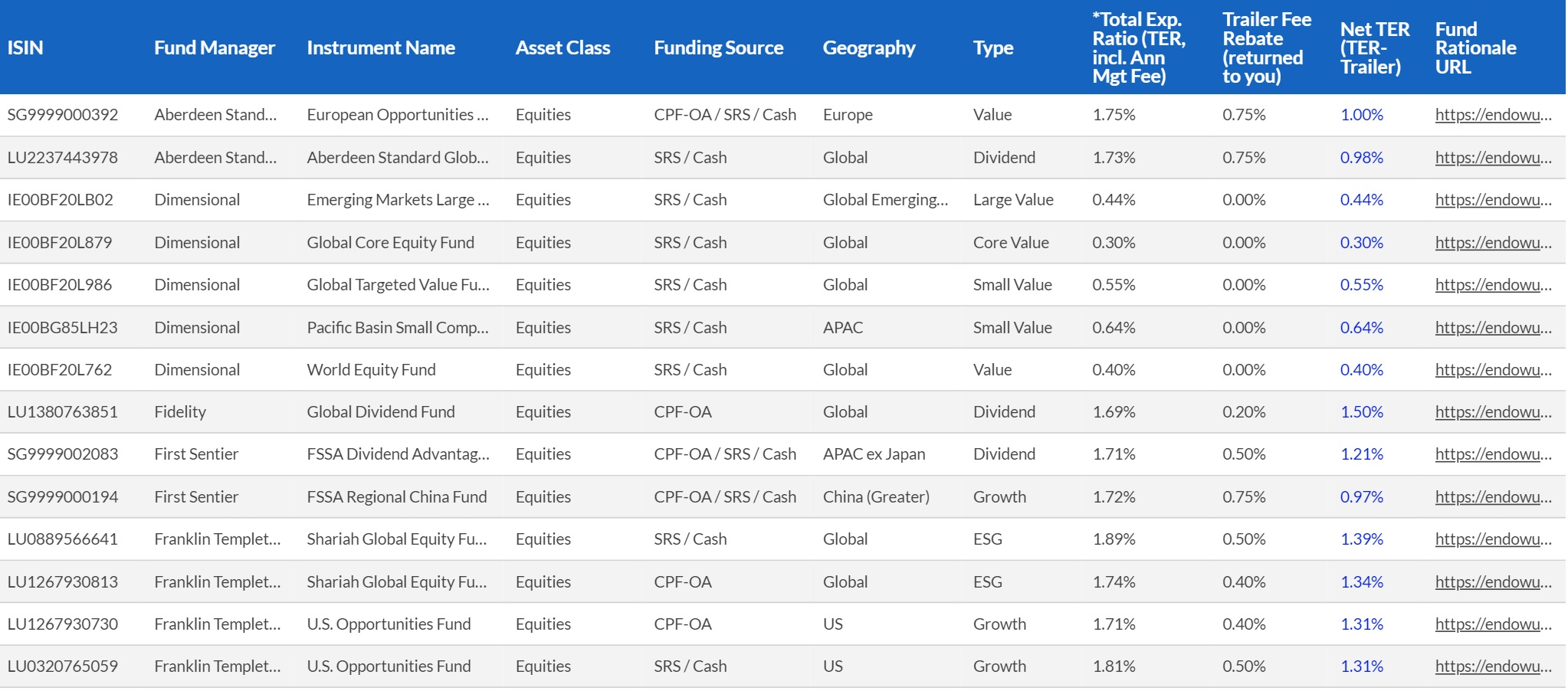

Enter robo-advisors, with no sales charges, no trailer fees and no rebalancing charges.

If robo-advisors were around back then, I would quite happily pay 0.5% to the platform and another 0.5% to low-cost ETFs/unit trusts, like those shown below.

The Net TER for some of the funds are really reasonable

Robo-advisors are great for people who are starting out on their investment journey, since brokerage charges are higher as a proportion.

As for me right now, let’s just say that on a $500,000 portfolio, I would balk at paying a typical 0.5% platform fee, which is equivalent to $2,500.

I definitely do not incur even half of that in a year, not even in 2020 when I made more transactions than usual.

Ability to Invest CPF and SRS Funds

There’s at least 5 or 6 current incumbents who are providing some form of robo-advisory services in Singapore. I would love to be proven wrong but I think there would be some consolidation in the future.

Smartly exited recently and it might not be the last given Singapore’s small market. But I do believe Endowus will be one of the strongest ones left standing.

Yours truly spent two years working at CPF Board and my job involved proposals to increase the returns of CPF members. Not surprisingly, nothing came out of it, which did leave me quite bitter. Well, I digress.

But boy am I glad that they have turned to/allowed Endowus to help invest Singaporeans’ retirement savings.

My stance is 2.5% is a low return for long-term savings.

If you do not need your OA money for mortgage and there is >10 years before you can withdraw the money, one should really consider investing a portion of it.

Enter Endowus, which is also the only approved robo-advisor for CPF and SRS funds so far.

If you are worried about the credibility of the different robo-advisors out there and plagued by the paradox of choice, I think it’s quite prudent/efficient to go with CPF Board’s choice. There is absolutely no way they have not done their due diligence. And you can bet the CPF monies are heavily regulated/monitored.

It’s also sweet that the platform or access fee is lower for CPF and SRS funds at 0.4% compared to cash (unless you are investing >$1,000,000).

“Mr 15HWW, you talk a nice game. So why haven’t you opened an account with them? Where’s the skin in the game?”

Well, for starters, I have really low CPF balances since I have been a self-employed for the past 6 years. My OA balances still attract Extra Interest, so my hurdle is 3.5% instead of the typical 2.5%.

More reason for procrastination there.

But most likely, I will open an account by the end of 2021 to invest my SRS funds. It’s still $1 at the moment but it’s starting to make sense to top further. Maybe I will write another post when that happens.

Thanks for reading.

How coincidentally that I created my Endowus account last night to invest my CPF funds! 🙂

Hi Glan,

Wow, Endowus is really winning then. This might also be the kick I need to open an account with them.

Let’s see if your CPF funds return >2.5% in the long run. The odds are definitely with you!