Even though I have been managing my portfolio actively for the last decade, I have always been interested in trying out more passive forms of investing.

Cue the My 15HWW Permanent Portfolio, which is performing decently and within expectations for the past 4 years.

However, there’s still a manual rebalancing component to it and I admit that I have procrastinated when it was triggered (>30% change in portfolio proportion). Well, it’s a real hassle to go down to UOB Main Branch to sell my physical gold bars, not to mention the transaction costs involved if I want to buy them back.

The Case For Robo-Advisors

Therefore, it’s natural to want to turn to robo-advisors to manage a portion of my savings for an even more hands-free approach.

I also believe robo-advisors are now the most fuss-free and convenient way for young adults/beginners to start investing their money.

Like me, you can start with $1,000 to get your feet wet and test out the product and service before committing even more savings to it.

If you choose a more aggressive 80:20 allocation (80% equities, 20% fixed income), you can look forward to >7% p.a. returns in the long run, based on historical returns.

So yes, the purpose of this post is to convince/encourage fence-sitters (like yours truly a week ago) to set up an account and try out a robo-advisor like Endowus.

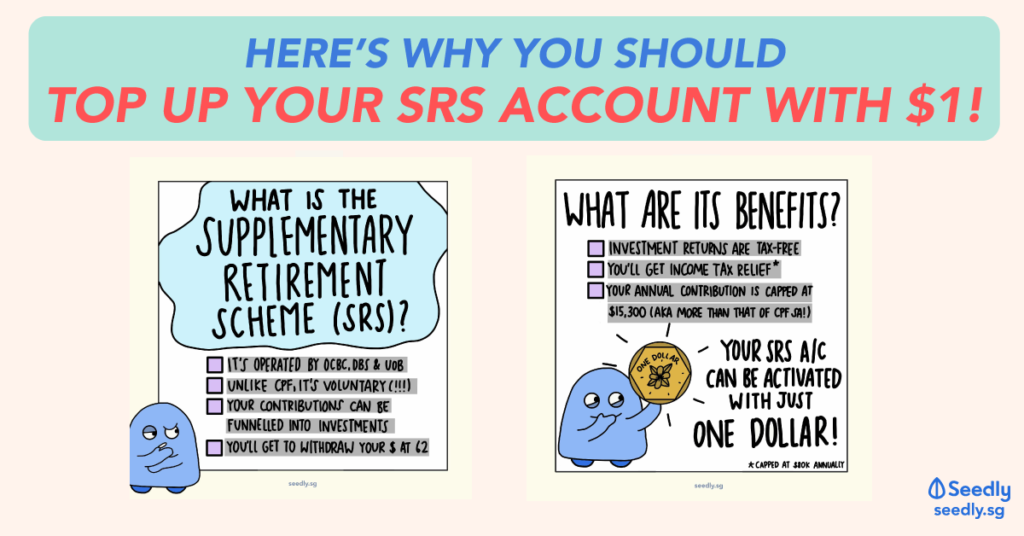

So Why SRS?

I have chosen Endowus* as I have heard good reviews from friends.

In case you did not know, Endowus is a digital wealth platform that grants Singaporeans like me exclusive access to best-in-class funds at low cost. I can invest my Cash, CPF & SRS funds with them.

So why did I choose to start with the Supplementary Retirement Scheme (SRS)?

Source: Seedly

Source: Seedly

My marginal income tax rate for this $1,000 investment is likely to be at least 7% and I can claim tax relief for SRS top-ups. Basically, I get to save at least $70.

More importantly, the money is liquid unlike CPF top-ups. If I am down and out in the near future and has no income, I can withdraw my SRS funds at 5% penalty. A $50 penalty for a $1,000 withdrawal, so I will still ahead by at least $20.

Endowus is also providing preferential access fees for CPF and SRS funds, at 0.40% vs 0.6% for cash if we compare using the same $1,000 lump sum investment.

Basically, the access fee is what Endowus charges me to access their platform. It’s how they earn their honest living.

To give you an illustration, since I am starting with an investment of $1,000 using my SRS funds (0.4% access fee), I will pay a yearly fee of $4 to Endowus, instead of $6 (if I use cash).

I know it’s just $2, but it can be significant yearly savings if you multiply it by 50 or even 100 eventually.

So overall, I feel it really makes lots of sense for me to start investing with Endowus using SRS funds.

And Why Endowus Now?

Usually, Endowus requires a $10,000 minimum investment to open an account with them. A week ago, I baulked at this.

Source: Endowus

Source: Endowus

The Promotion

However, for the month of February 2021, they have lowered their requirements to just $888! Huat ah!

Furthermore, from now till 14 February 2021 (9 days away), when I refer a friend to invest with Endowus, both me and my friend will receive a $28 access fee credit each upon investing.

As mentioned before, if you start with a balance of $1,000, using a 0.4% access fee for SRS funds, that’s $4 a year of fee paid to Endowus.

So a $28 credit means they are investing my money for free for 7 years!

That’s why I think it’s a no-brainer to sign up with them during this period.

If you would like to support me in this win-win situation, you can use my referral code to sign up for an Endowus account. Remember, you have until Valentine’s Day to sign up!

*In case you are interested, I use Endowus Fund Smart and picked the Dimensional Global Core Equity Fund (0.30% Total Expense Ratio) and the Dimensional Global Short Fixed Income (0.27% Total Expense Ratio) using a 80:20 allocation.

Thank you for reading.

Disclaimer: This article contains affiliate links which goes towards ensuring the sustainability of this blog.

2 Replies to “Funded SRS With $1,000 To Open Endowus Account”