This post is about two weeks late but in the world of stocks, bonds and cash, I doubt the difference is noticeable. Maybe a 0.1% difference in the overall XIRR?

What’s more stark is that I have not sold stocks to raise more capital for crypto in the past year. (Bad call so far though.)

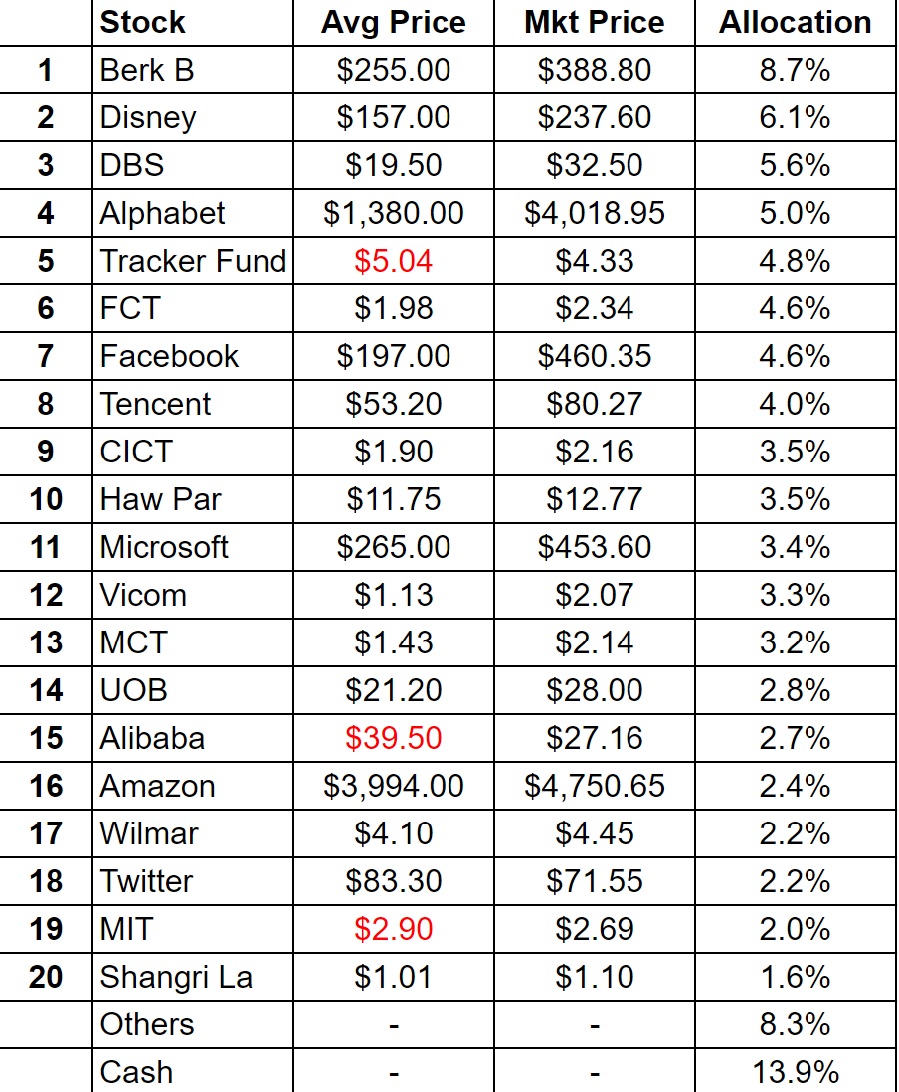

Here’s the 15HWW Investment Portfolio:

Annualised Return: 8.9% p.a. (Nov 2010 to Oct 2021)

This portfolio probably lagged the US indices and maybe even the SG indices. US markets keep breaking new highs but my portfolio is just not feeling it. I guess even having a rather small exposure to HK stocks have dragged the portfolio returns.

The biggest change is probably the cash portion. I took plenty of cash and bonds and pumped it into the cryptosphere in July and August so one could observe the huge drop.

Actually, it might as well be zero as I doubt I will allocate more cash to the traditional financial markets anymore.

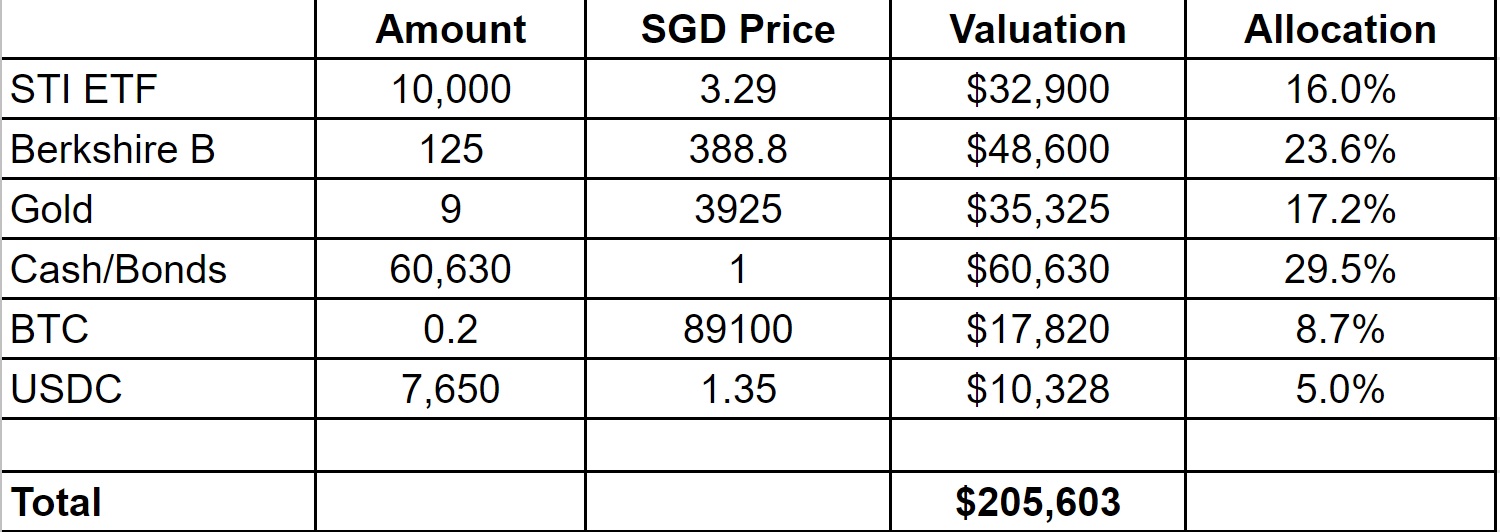

Here’s the 15HWW Permanent Portfolio:

Annualised Return: 6.7% p.a. (Jan 2017 to Oct 2021)

The decision to allocate 0.2 BTC to this sub-portfolio paid off handsomely over the past quarter. July was the bottom and BTC price has basically more than doubled from USD 30k to USD 65k. Ironically, BTC is one of the worst-performing coins in my crypto bag.

Even with such a small allocation, BTC managed to drag the annualised return from 5.5% to a more respectable 6.7%.

We are reaching the end of the year and I will not be surprised to see articles urging people to top-up CPF. This will allow one to reduce taxes and also earn a risk-free 4% return.

But seriously, is that the best use of your money and savings? Lose access to it for 2 or 3 decades for a return that is not able to beat inflation in this post-pandemic world?

The 15HWW Permanent Portfolio has beaten 4% consistently for the past 4 years with no liquidity constraints. Volatility is also super low. Just an example.

And just a few days ago, I helped to onboard a childhood friend to crypto. Of course, I cannot guarantee that he will make money but I truly believe the odds are in his favour to beat a return of 4% per annum.

Heck, he probably made 4% over the weekend.

SG financial bloggers are generally a smart lot and my guess is half already have exposure to crypto. The percentage is probably much higher if you filter out the older ones.

Do you want to join them or fade them?

So if you, my dear reader, needs some handholding and help with onboarding, feel free to email me. There is a 99% chance I will reply you if you send an email to me before 15 November 2021.

You do not need to spend a few hundred bucks on a course to learn about the very basics.

Till the next quarterly update. Thanks for reading!

Related Articles:

July 2021 Portfolio Update: Bad Vibes

Hi, I would like some help with on boarding. Could you contact me?

Hello, keen to explore the crypto holdings too!

Hi! I would like to learn more on crypto. Thanks for rendering support : )

Surprised you don’t have any global equities exposure in your permanent portfolio.

Hi, would appreciate some hand holding. Thanks!

Hi,

Is your % allocation based on average or market price? Thanks

It is based on market price.