I still hold HK stocks and crypto and they are becoming more and more irrelevant in my portfolio, since their respective allocation has fallen below 10%. This is despite averaging down ever so slightly a couple of times in the past few months.

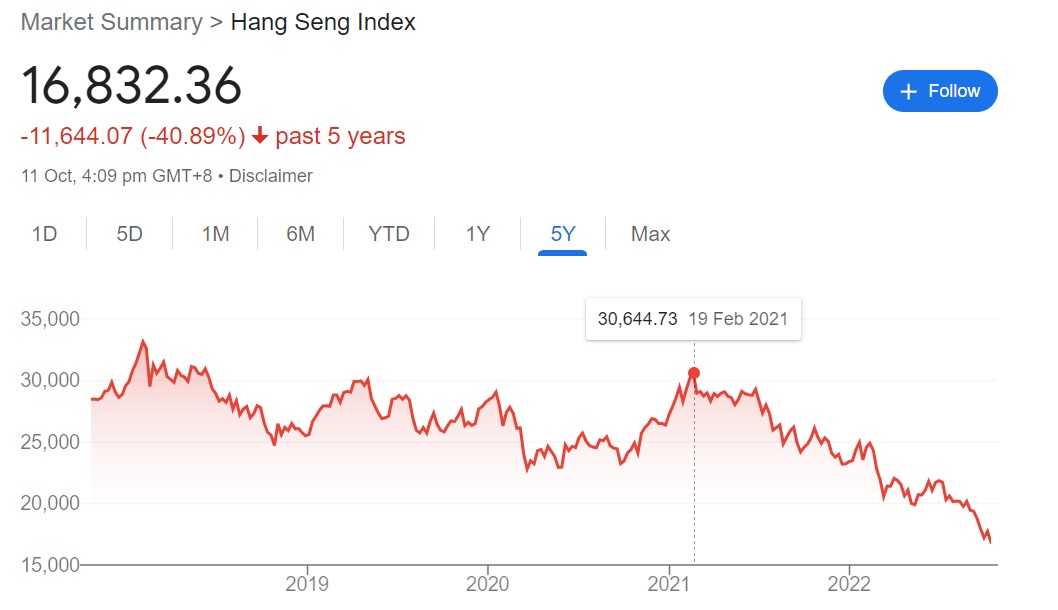

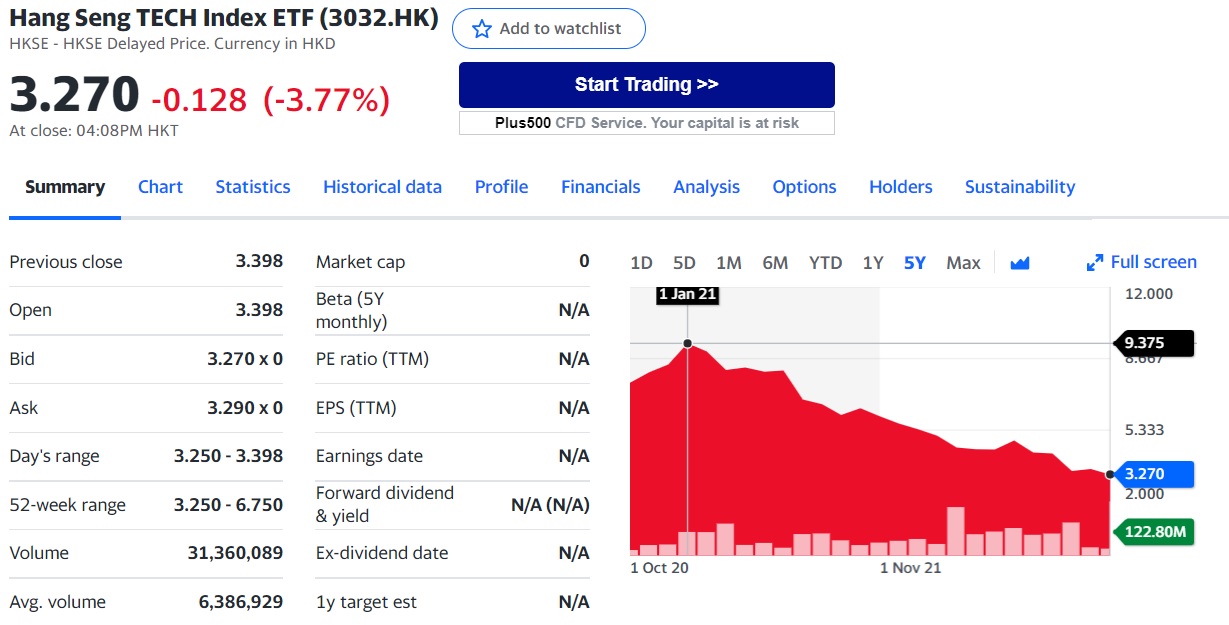

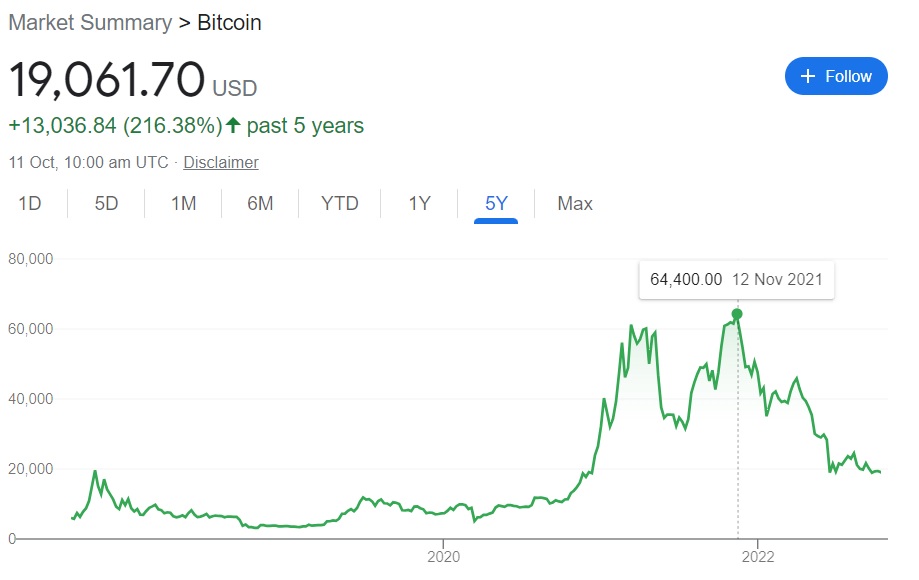

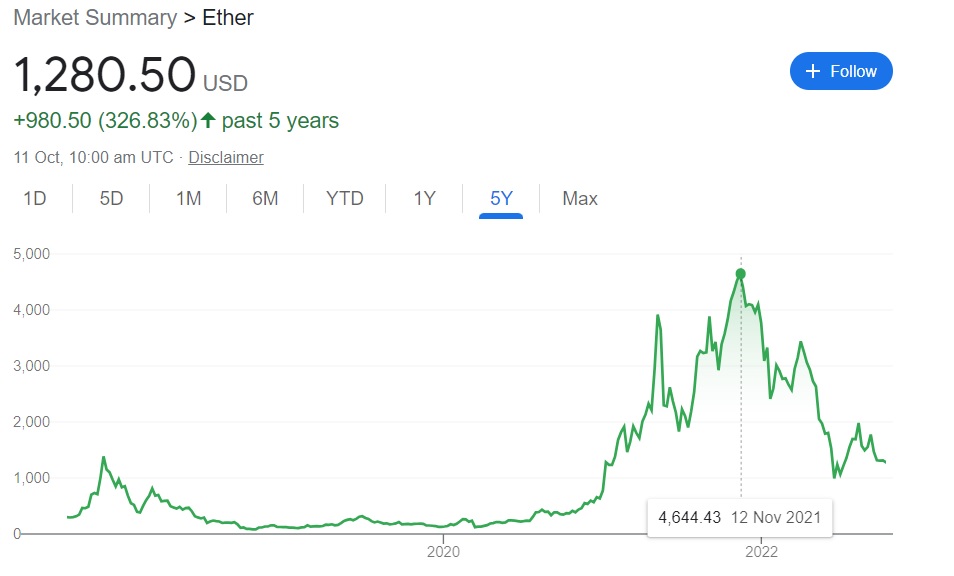

Let’s take a look at some of these very ugly charts below:

A plain vanilla index of a “developed” country/city being down 45% in 1.5 years is something to behold

The Tech Index is a horror show, a drop of 65% from peak to current levels

Bitcoin is down 70% over a year’s period after a spectacular run

Ether has fared slightly worse than Bitcoin, down 72.5% thus far

As seen above, market timing does work. If one was not drunk from the hubris and taken significant profits a year or two ago, he or she would be sitting pretty pretty at this moment in time.

I did cut a little, but I am no expert market timer and it was more of to rebalance the portfolio to my “ideal” allocation, so on hindsight, the selling of risk assets was way too inadequate.

However, not averaging down aggressively over the past year has been my saving grace. Everything I had illustrated above looked cheap to me at a price that was 20% higher.

My Strategy For The HK Market

HK is a proxy for the China market, especially for foreign investors like me. Interestingly, I am way more bearish on HK than China. If HK remains rogue in CCP’s eyes, Shanghai could and should replace HK as the preeminent financial centre.

But we are talking about the very long term here.

Short-term wise, notable risks include the HK dollar depeg, which appears inevitable if FED rate hikes persist. And of course, further crackdowns on tech companies and the real estate drag both in in the mainland and HK.

However, barring any major conflict, it would be quite unthinkable to witness another 50% (or even 25%) drop in the HK markets so the odds do favour a heavier weightage. A sudden rebound could be on the cards. Since I am playing a bit more conservative, I am increasingly biased towards investing in a China Consumer Staples ETF and should allocate soon.

My Strategy For Crypto

I have realised in the past year that I do not have any edge engaging in crypto alts. Only some prudent allocation and profit-taking strategy spared my ass from a complete spanking. Ouch!

That said, as a market dominated by Bitcoin and Ether, I do believe crypto has much better odds of reclaiming all-time highs as compared to the HK market.

The “store-of-value” narrative is probably the only narrative a passive investor like me can adopt in the crypto market and both assets have passed this test. Even in this latest crypto correction/bear market, it is notable that Ether is down just slightly more than Bitcoin.

I have been very slowly DCA-ing my stablecoins (denominated in USD) into both Bitcoin and Ether and if the market tanks further, the shift to a martingale DCA strategy should intensify.

Conclusion

Further downsides should be muted especially since the consensus is now that the FED is not going to pivot anytime soon. If you are feeling afraid now, I personally think the time to reduce allocation has already sailed. If you wanted to rebalance from a 80/20 to 60/40 portfolio, you should have done it a year ago. Right now, one should minimally try to maintain the same asset allocation, which means you will be buying more of these two markets.

If both of these markets really go to zero and never come back, it’s likely that there will be more important things to worry about than just your retirement portfolio.

And also, never ever commit more money (or leverage) than you can afford to lose.

“Always seek to avoid irreversible or permanent damage that you can never recover from” – Mr 15HWW

Prices for both markets have plunged to an extent where it’s possible to allocate such that you could possibly enjoy significant upside if things rebound and yet, if market sentiments remain weak, you can stay stoic.

Thanks for reading!