I made our first foray into the stock market on 1st November 2010.

It’s been 7 years and the 15HWW portfolio currently stands at around $430,000. It comprises $350,000 of capital which also means that the remaining $80,000 comes from net profits, dividends and interest from the deployment of the capital.

I have kept a detailed record of my investment transactions over this period but not the cash injections into the portfolio. Accounting for cash is messy but excluding cash tends to overstate the portfolio return if the equities are performing better than the other instruments.

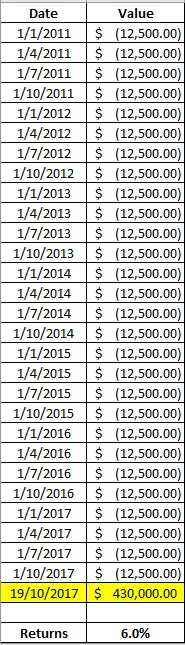

But interestingly, since it’s been $350,000 of capital over 7 years, I think it’s a good proxy to assume that we are injecting $50,000 every year which is also equivalent to injecting $12,500 every quarter.

And here’s the results (a screenshot from excel):

7 Reflections & Pointers:

- Pretty surprisingly, the annualised return is exactly 6.0%, which is the target I had set for myself half a year back. 6.0% is proving to be a reasonable target to aim for the entire portfolio.

- I had overestimated my abilities when I was a fresh newbie. Honestly, 7 years ago, I would have scoffed at this set of results and expected a return above 10%. Pretty unrealistic.

- The market is a good place to find out more about yourself and your biases. In the first few years, I really had this tendency to sell my winners and keep the losers. I am also especially vulnerable to the anchoring bias, finding it hard to average up on a winner. Luckily, I haven’t really paid expensive fees in this process of learning more about myself.

- It’s inevitable to make losses on some investments. From Sembcorp to Wilmar to MTQ and to M1, I have made losses of a few thousand dollars on each of them. I just had to make sure the winners such as Spindex, Vicom, MCT and Berk B more than make up the difference.

- Over this 7 year period, the equities proportion has varied from 45% to 75% and this range is the extent of market timing that I will likely perform. This will ensure that I don’t make the biggest mistake, which is staying out of the market for too long a period.

- 7 years is not very long. In fact, more seasoned investors will point out that I have not experienced a market crash. Nonetheless, the corrections in 2012 and 2016 should be able to help me when a big bear comes.

- Investing is an iterative process. Very notably, I made some rash decisions to dump sizeable positions in bank and property stocks during Brexit a year ago. I am learning and since I should still have quite a few decades to look forward to, I expect the performance of the 15HWW portfolio to improve over time.

Wow 6% is pretty awesome.

Hi Mickey,

Thanks! I think the test will come when a bigger correction happens. I will be very pleased if I can be nearer to 10% after one/two complete market cycles.

Hi 15HWW,

6% annualized return is pretty good!! Hopefully, I’d be able to say this 6 years later!

$12,500 of injection quarterly is very impressive!

Hi sleepydevil,

Actually, it’s really the savings that matter more than the returns in the first 7 years. For the next 7 years, the returns might hold a larger weight, especially since we are likely to slow down on savings.

You are starting at such a young age and I am quite sure you will be doing very well by the time you reach your early thirties!

Your Blog is one of the early ones I start reading and still read.

Keep up the good works. I personally enjoy them and they share some insight how to manage our financial and investment.

More good year !!

Hi Ethan,

Thanks for your encouraging comment!

It’s comments like this that motivates and inspires me to continue writing. =)

Woah. Congrats on the 6% return! However, I think your return should be higher because you included a huge part of the warchest/cash as your portfolio too.

Hi KPO,

Thanks. By leaving a part as cash/warchest, the hope is that it will help to “boost” returns by buying low during a correction.

It also helps to mitigate big losses and we can then sleep more soundly at night even during a market crash.

Congratulations and enjoy the moment!

Selling my winners and keeping the losers is something that I learned along the way too.

Hi Bernard,

Thanks! I guess it’s really human nature to keep stocks in cold storage, hoping it will turn one day.

The market is a good place to find out more about yourself and your biases. In the first few years, I really had this tendency to sell my winners and keep the losers. I am also especially vulnerable to the anchoring bias, finding it hard to average up on a winner. Luckily, I haven’t really paid expensive fees in this process of learning more about myself.

Very true, very true… 🙂 I tend to sell early and hang on to bleeding counters and I have a difficult time accepting that to win more, i need to up my average cost on a profitable stock!! 🙂

Hi Marvin,

Interesting that you have a similar experience too! Time will help us to see this bias clearer and it’s then up to us how we can implement some plan/initiative to correct for these biases.

Rule of 72

This means that by 2029, your portfolio will be $860,000

and by 2042, your portfolio will be $1.72mil!

And that’s excluding any capital injections.

So… how old will you be in 2042?

Hi TTI,

In 2042, quite old already. 55 or 56?

Means I have to continue adding capital or aim to improve my returns to like 8% to compound slightly faster.

Congrats on your achievement!

It is my 7th year in the market too. I went into stock market since July 2010.

My accumulated capital is 184k and now has grown to 410k. I am not sure how to calculate the return rate since i have been adding my capital not in periodic order.

Hi LTI,

Wow, you more than doubled your capital! I think your annualised return is definitely more than 15% and maybe even more than 20%.

The addition to my capital is also definitely not systematic. The method I used is just a good proxy for my situation.

Hi have you thought about investing in index? Since it generates higher returns and requires less effort.

Hi John,

A part of my strategy is to invest in a index as part of a permanent portfolio.

The less effort part is correct. But the STI ETF did not really generate higher returns in the past few years, as mentioned in my latest post here.

https://www.my15hourworkweek.com/2017/10/24/what-if-i-had-invested-in-the-sti-etf-for-the-past-7-years/

I think in general, SG market is not really worth investing.

Most of the blue chips have not risen much in value. Many of them are no longer innovative and facing global challenges and stiff competition.

Only the banks rose in value by a lot.

Luckily I bought DBS and OCBC, they are the biggest gainers in my portfolio — over 40% since last year. They helped to average out the disappointing returns generated by other blue chips.

Also to clarify I wasn’t pointing at STI. I’m referring to S&P.

Like you I was too focused on the local market.

Now I’m turning my attention to the US market.

Just waiting for the next correction to deploy my war chest.