It’s been 7 years and the 15HWW portfolio currently stands at around $430,000. It comprises $350,000 of capital which also means that the remaining $80,000 comes from net profits, dividends and interest from the deployment of the capital.

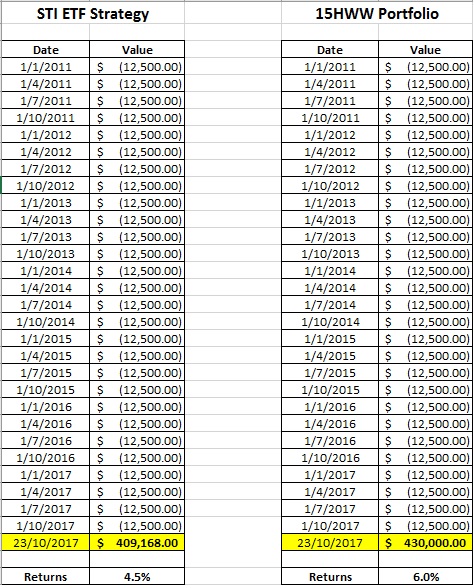

With sporadic injections of $350,000 of capital over 7 years, a simple proxy would be to assume that we are injecting $50,000 every year which is also equivalent to injecting $12,500 every quarter.

From this set of assumptions, I calculated that our annualised return thus far is 6.0%.

But what would have been the returns and outcome if I did not bother much about the markets and just invested mechanically and systematically into the STI ETF?

Assumptions:

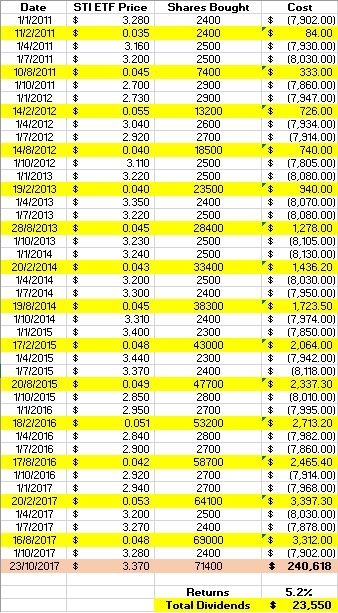

1. Since the 15HWW portfolio is currently about 60% invested in equities, for a better apple-to-apple comparison, only $8,000 would be invested into the STI ETF every quarter.

2. $30 of transaction cost would be added to each purchase.

3. The remaining $4,500 for each quarter will be parked in cash/bonds that generate 2-3% interest. Let’s assume quite reasonably that $126,000 will grow to become $145,000 at the end of the period.

And here’s the results (screenshots from excel):

7 Observations & Reflections:

7 Observations & Reflections:

- The value of 71,400 shares of STI ETF ($240,618) + the total amount of dividends received ($23,550) + the value of the cash/bonds($145,000) gives a final total portfolio value of $409,168 for this hypothetical simulation. The annualised return is about 4.5%.

- If we only focus on STI ETF’s annualised return, it is slightly higher at 5.2%. But honestly, this is still pretty pathetic if we are indeed near the end of a bull market. A 20% drop would wipe out all the accumulated returns. The Singapore market is really one of the worst geographical markets to be investing in for the past 7 years.

- This also means that the Singapore market is unlikely to be overvalued at this point in time. If there is no big correction in the world markets, especially in the US, there is a good chance the local index could catch up in the next couple of years.

- Even though 64% ($8000/$12,500) was invested in the market, it’s quite interesting that the equity portion at the end of 7 years comprise only 59% of the portfolio. The main reason is that dividends contributed the majority of STI ETF’s return during this period. The STI ETF is only marginally higher as compared to 7 years ago.

- If we compare 4.5% to 15HWW’s portfolio performance of 6%, it’s really not that much of a difference. It drives home the point that it is hard to outperform the benchmark and definitely even harder to outperform it by a huge margin.

- Even though index investing lost in this contest, did the 15HWW portfolio really win? Well, I only have an additional $20,000 to show after 7 years of effort, sweat and anguish. There is an argument that I should have focused on other aspects of my life rather than split hairs picking winners in the local market.

- Once again, there is only about $20,000 of difference at the end of the day. This gives credence to the idea that at the early stage of wealth building, the returns do not really matter. It’s the savings that’s doing 80-90% of the hard lifting.

Thanks for the analysis. I’d think that for the 1.5% difference, I’d rather spend my time earning more money instead of analyzing stocks. I don’t think I have the expertise to pick the right stocks.

But that said, the point that the Singapore market is the worst market to invest in does make sense. I’m wondering if I’m better off putting more money in global markets (ETF) instead. At the risk of other factors like currency, etc. of course.

What do you think?

Hi Mickey,

I think it all depends on whether 1. Things will revert to the mean or 2. The difference in returns will continue to compound.

Most likely, the answer is somewhere in between. Hindsight tends to make things clear but the difficulty is always what to do going forward.

All the best!

For a more mechanical & systematic approach … the dividends from ETFs should be re-invested back into them, together with annual re-balancing.

An idiot-proof approach will be a 2 ETF approach e.g. 60% in SPDR STI ETF and 40% in ABF S’pore Bond ETF.

Depending on investible amounts and/or to minimize transaction expenses, just accumulate savings & any dividends, and invest on quarterly basis.

To reduce home-bias, can change 60% STI ETF into 30% STI ETF and 30% Global ETF.

Unfortunately SGX doesn’t carry any good global ETF …. need to get from US or UK.

Hi Sinkie,

That’s a good and simple approach. However, with many step-up saving accounts these days, there is a chance cash might not underperform the ABF Bond Fund by much.

I think for many investors in Singapore, they can’t get overcome the hurdle of the higher transaction costs or the dividend tax involved.

Guys, don’t mean to sound arrogant but if u wish to learn how to outperform the market by a greater margin, are open-minded and don’t mind putting in the time & effort to learn, go grab Matthew Galgani’s book, “how to make money in stocks (getting started)”. The book title may sound cheesy but there’s plenty of simple wisdom in it. Go read it. If u like to have further discussions, feel free to email me at isaac_hua@hotmail.com (not issac), I’ll be more than happy to help. All the best.

Hi Isaac,

Thanks for dropping by and I might check out the book in the future. Thanks for the recommendation.

one of the most interesting blogs i recently read online.

suggestion: Tuning of a few parameters to really examine the difference:

– what about mthly ETF investment, instead of qtrly assumption now?

– how about reinvest dividends into ETF?

my guess is that will improve dummy STI ETF method’s return. Looking fwd to such outcomes.

Hi Bruce,

Thanks for your kind comments.

Regarding the simulation, I don’t think a monthly investment will change the results much and in fact, the higher % cost of each transaction will eat into the returns.

As for reinvesting the dividends, that should definitely help to improve returns, but at the expense of having a lower allocation in cash/bonds. So there’s some form of trade-off there.

I feel that most people stick with common blue chips like cdg, singtel, etc and reits with dividend 5 to 8%.

It will be hard to beat the etf.

Hi Desmondsph,

You are right on that count. It’s hard to beat the STI ETF if one’s portfolio largely consists of STI constituents.

Hi 15 HWW,

Nice blog. Do you think it is a good time to purchase STI ETF now or should I focus on purchasing blue chip stocks like Singtel?

Thanks! Looking forward to learn more from you.

Hi Alexander,

That’s a difficult question to answer and it really depends on your objective. For single stocks, you really need to understand why Stock A and not Stock B?