TL;DR:

If I were still on the HDB Concessionary Loan for the mortgage of my flat, I would switch over to the POSB Home Loan in a heartbeat.

Why? $23,000 of savings and perks over a decade. Read on to find out how.

WHY I AM LOOKING AT HOME LOANS AGAIN

1) Prefer Lower Mortgage Rates

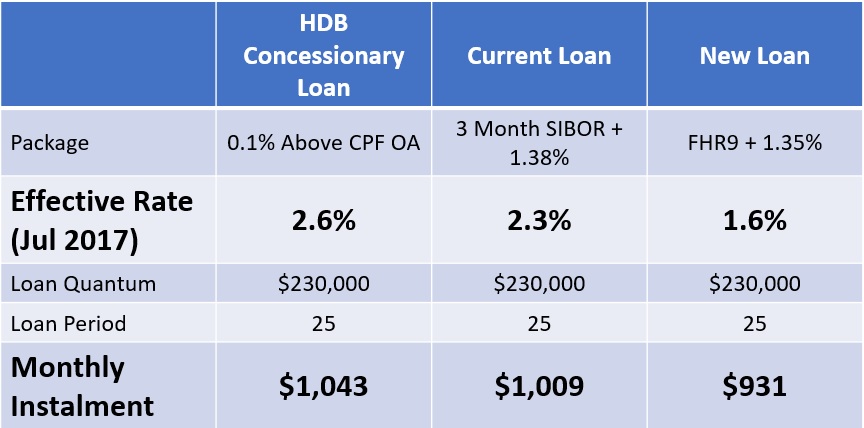

As mentioned in this earlier post, by refinancing from the HDB Concessionary Loan (HDB CL) to a bank loan 4 years ago, I was able to take a small advantage of the low SIBOR rates with some form of certainty, knowing that my mortgage interest would definitely not be above 2.5% for the next decade.

And right now, I am interested in paying even lower mortgage rates.

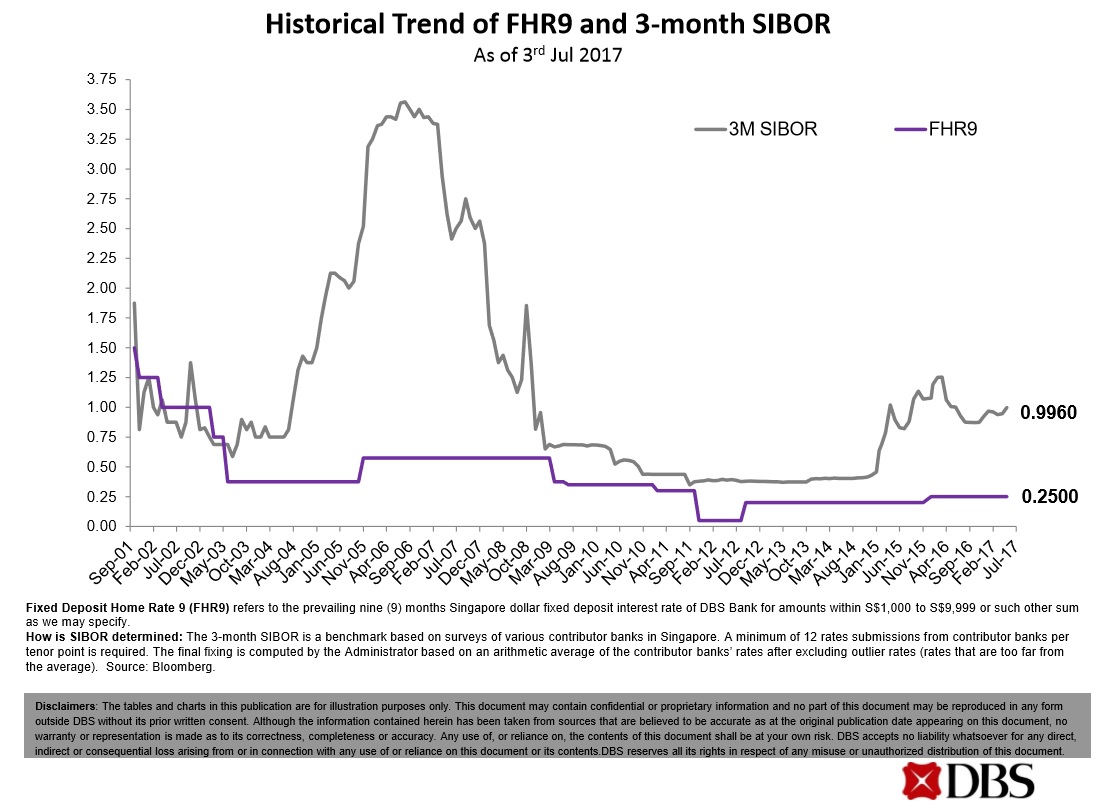

In this low interest rate environment, some banks have started to move away from the more volatile SIBOR rates and peg their home loans to more stable bank deposit rates like the Fixed Deposit Home Rate 9 (FHR9).

Assuming conservatively a home loan package where the mortgage rate is FHR9 +1.35%, the effective rate would currently be at 1.6%. If I were on this package, my estimated monthly instalment would decrease from $1,009 to about $931, giving me additional savings of $80 a month, which will work out to $1,000 a year!

I am willing to give up the security of an interest cap for even more mortgage savings.

2) Arbitrage CPF OA Funds

If I had $200,000 in your CPF Ordinary Account (OA) and an outstanding $200,000 home loan, what should I do?

Option A: Pay off the entire loan immediately

Option B: Continue with monthly instalments

If I were on the HDB CL, using all the CPF OA funds to pay off the loan is an obvious choice, since I could save 0.1% of additional mortgage interest. Furthermore, becoming debt-free is a notable financial milestone.

However, if I were on a bank home loan with an effective rate of 1.6%, Option B might be a savvier decision.

For a 20 year loan tenure at 1.6%, the monthly instalment would be $974.

As the CPF funds are generating higher interest, even if $974 is deducted monthly over 20 years, at the end of the 20 year period, I would be left with an amount close to $25,000. (Refer to spreadsheet for the calculations)

There is nothing to lose and everything to gain especially when there is no penalty on a full-repayment. Just pay off the loan when/if the floating mortgage rate on the home loan rises significantly.

Instead of using our CPF OA funds to pay down our housing loan, we prefer to keep it for an arbitrage right now.

3) Reduced Risk With Significant Cash & CPF OA Buffer

I hear the naysayers now.

What if the FHR9 soars after the first few years? Like becoming 3%! You will be paying much higher monthly instalments and you will live to regret abandoning the HDB CL!

Just take a look at this comparison of 3-month SIBOR rates and DBS’s FHR9 rates below.

Source: DBS

From the chart above, the last time FHR9 + 1.35% was higher than the HDB CL rate of 2.6% was 16 years ago. So the chances of FHR9 suddenly soaring is really pretty low.

Furthermore, the Mrs and I have close to $50,000 in our CPF OA funds and we are also sitting on more than $50,000 of cash at this point in time. We are also planning to build up an additional $50,000 in government bonds over the next two to three years.

The risk of being caught with our pants down by rising interest rates is quite minimal. With our CPF and cash buffer, we could pay off most of our housing loan if need be.

WHY THE POSB LOAN IS A GREAT REFINANCING OPTION

1) Various Options To Suit Your Needs

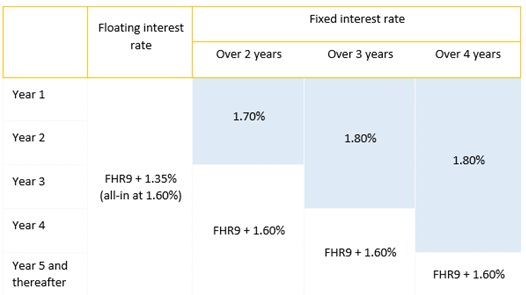

Although I am personally keener on the floating interest rate package so as to enjoy a lower interest rate now, I can understand that there are some who prefers the certainty of a fixed interest rate. But it is important to choose the right fixed rate period.

For example, if you are thinking of selling your flat 3 years later, you could select the 2 or 3 year fixed rate package* to enjoy guaranteed mortgage savings for those 2 or 3 years.

2) Save Up To 1% On Your Home Loan

Yes, saving up to 1% for your HDB home loan is not a hypothetical situation, as seen from the interest rate option above.

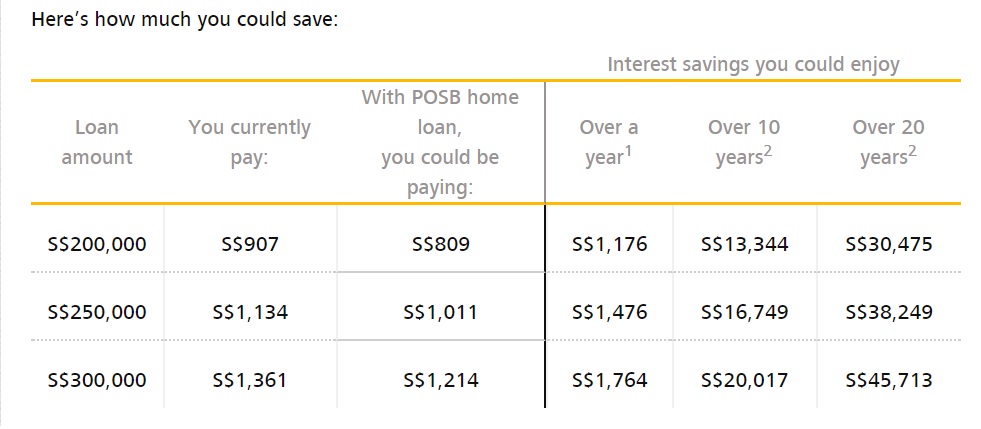

When you switch to the POSB Home Loan, take a good look at how much you could save.

Notes:

1 Interest savings are estimated based on 1.60% p.a. interest rate for a 25-year loan, compared to HDB concessionary loan rate of 2.60% p.a.

2 Interest savings is compounded at 2.5% p.a. (CPF Ordinary Account rate) in your CPF Ordinary Account)

You can click here to calculate your savings when you switch to a POSB Home Loan.

3) No Refinancing Fees & A Free Dyson Vacuum Worth $999!!!!!!!!

You can switch your loan free-of-charge as POSB will absorb your legal and valuation fees amounting to $2,000.

Well, the Mrs has been wanting to get a Dyson Cord-free vacuum. It’s cool and fabulous but the price tag is crazy at $1000!!! The good news is that with this offer, you can now get it for free with POSB!

All you need to do is to share your refinancing experience on this deal with your friends on Facebook or Instagram. Get 8 likes and a free vacuum will be on its way to you.

BONUS FEATURE: POSB CASHBACK BONUS

If you are thinking why I have not considered refinancing with another bank, here’s the answer: POSB Cashback Bonus.

For the past few months, both the Mrs and I have EACH received >$30 of cashback through this scheme. That’s a total cashback of more than $60.

Our Three Qualifying Components:

- Our Home Loan with POSB which we are attempting to reprice.

- POSB EveryDay Card. We use the Everyday Card for our EZ link transactions and I also charge my utility and conservancy fees to it.

- The POSB Invest Saver is a pretty good saving and investment program, especially for beginning investors. Both of us started a $100 contribution to the Nikko STI ETF.

The 3% cashback on our mortgage has been so….. rewarding.

You can click here to find out more about our experience with the POSB Cashback Bonus.

Summary

If you have an outstanding home loan close to $230,000 like me, the interest savings would add up to $15,000 over a decade. Including the free vacuum cleaner and the potential cashback from the POSB Cashback Bonus, we are looking at a mind-blowing $23,000 of savings and perks in total!

So really, consider the POSB Home Loan Promotion!

*For the fixed rate packages, there is a lock-in period which will be the same duration your rates are fixed for i.e. 2-year fixed means 2-year lock-in. A 1.5% fee of outstanding loan amount will be incurred if you sell off your flat and/or prepay your loan within the fixed-rate period. So, it is important to choose the right fixed rate period.

This article is written in partnership with DBS Bank. I only believe in promoting products and services that I would use myself, and when I believe they are of value to my readers too. The views in this article are strictly mine.

We’ve been on zero-interest-rate policy since SARS …. a full 7 years before the western world. And looks likely to continue for the foreseeable future.

So yah …. taking a FD-based loan rate is a no brainer today.

However, while FD rates can remain below inflation-rate even when other interest rates / CPI normalize (2004-2006) or even shoot up (2007-2008), there is no guarantee for the board reference rate to stay low e.g. 1.35%. It can easily end up FHR9 + 2.5% (or 3%). In fact this is what will most likely happen if rates go back up, else the bank loses money.

If you’ve got a lowish debt servicing ratio or have the means to redeem your loan, then that’s fine. It’s only those who are tempted by low rates now to push the boundaries into buying properties that they can just afford.

Hi Sinkie,

I concur with most of your thoughts but I doubt the bank can just change the reference rates since it’s already stated in the contract.

You are right that there is a difference between “taking advantage by low rates” vs “being taken advantage of low rates”

is there a min amount for posb loan? my housing loan is below 80k

Hi SK,

If I am not wrong, the minimum loan quantum for a bank loan is $100k.

Hi Thomas, I’m a regular reader of your blog. Your articles are very insightful and beneficial.

I may not agree with your thoughts in this article though. But it’s always good to have meaningful disagreements right? That’s how we learn to see from other perspective and rationalize, and make better financial decisions.

Using the past 15 years historical data in interest rates may not be a good idea. Near zero interest rates we saw since the GFC in 2008 is certainly not a norm. Go google on the long term debt cycle and watch the video by Ray Dalio. Many ppl thinks that near zero interest rates is a norm, but it’s not. It only happens once in a lifetime, the last being in the 1930’s, post Great Depression. A long term debt cycle spans about 75-100 yrs. Thats why most of us are unaware of, even policy makers, since we probably never experienced it before. Long story short, consider googling on the 3 month US treasury bill history since the 1930s, you will know what I mean. The 3 month sibor doesn’t have enough historical data.

So basically, if we are seeing the start of another long term debt cycle, it may be a start of higher interest rates to come in the next 20-30 yrs. Of course, with each recession of the economic cycle (short term debt cycle), central banks will slash rates lower to stimulate growth, but we may not see rates near zero again for a long time.

My opinion is in an increasing rate environment, both in a short term & long term debt cycle, hdb rates may be more stable and safer, esp if rates hover above 3% for long period of time. The last time CPF increase the OA interest rates was in 1950-1970s, around 5-6%. But the 3 mth treasury bill was at 7-15%. CPF may hike again, but I think it would probably be slower and lower than banks. The fed dot plot is already projecting 2-3% rates in 2018-2019. Of course no one knows for sure. But risk is lower for hdb loan in my opinion. For hdb loaners, if they are wrong, they pay maybe extra 1%, but for bank loaners, if they wrong, they may pay significantly more %.

Even if wanna switch to bank loan from HDB, maybe a better time is when rates are coming down, not up?

Hi Isaac,

Thanks for the informative reply. I really appreciate your effort and I am sure other readers will benefit from it too!

You have raised some very good points and I certainly do believe that in the decades to come, interest rates will rise up again.

However, in the short term, I do think my mortgage rate will be below 2%. Well, in fact, I am willing to go out on an arm and a leg and say that I am quite confident rates will not be above 2.6% for the next 5 years. This thinking is what prompted me to reprice my loan to a full floating package.

Instead of reverting to the mean, I believe that the longer rates stay low and the longer most major economies stay anaemic, there is a good chance we could see two decades of low rates. We are already reaching the end of the first decade of low rates and there are still little signs of interest rates picking up.

At the same time, if rates do increase quickly in a short period of time, it must signal some form of economic overheating and it’s likely that prices of assets like stocks will increase. So even in that unlikely event, I could easily sell some of the stocks to repay the loan. So the risk is somewhat hedged.

Furthermore, the arbitrage opportunity for CPF OA funds will also help to make up for potential future interest increases. So I do deem that our risk is quite small.

Of course, everybody’s situation and views are different and I am by no means suggesting that everybody should refinance their loans to take advantage of lower bank mortgage rates.

I enjoyed this “conversation” and looking forward to hearing from you again.

hi, what happens if my loan is significantly larger than my cpf balance, assuming i’m on a bank loan? will it be better to pay up the loan? thanks!

Hi xl,

I am not sure of your context so it’s hard to provide suggestions.

If you are on a bank loan now, it’s highly likely that CPF OA interest is higher than the loan rate and you can arbitrage by delaying the repayment of your loan. And if you are sitting on cash, there are quite a few relatively safe and risk-free products out there that provides >2% interest a year.

But of course, if peace of mind is what you seek, it might be better for you to pay up the loan and be debt-free.

thanks!

hmm, my objective is to find out if i should pay off the housing loan taken with a bank, or to keep the cash pile.

for illustration, let’s take housing loan to be 400k, and cpf balance to be 50k.

please correct me if im understanding it wrongly, but from your comment, it seems that it would be wiser to do the usual monthly repayments, on the basis that the cash pile should earn us better returns.

your thoughts?

Hi xl,

Yes, that was what I meant. If there is no prepayment penalty, it would make sense to do the usual monthly repayments if your savings can earn a higher rate of return than your mortgage interest. In the event mortgage rates rise and exceed your saving returns, you should then pay down your mortgage.