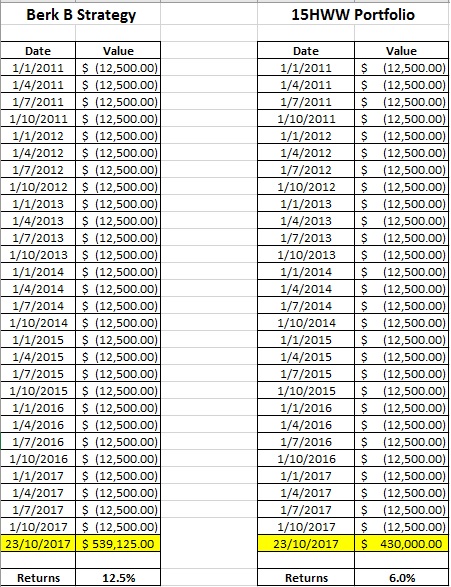

It’s been 7 years and the 15HWW portfolio currently stands at around $430,000. It comprises $350,000 of capital which also means that the remaining $80,000 comes from net profits, dividends and interest from the deployment of the capital.

With sporadic injections of $350,000 of capital over 7 years, a simple proxy would be to assume that we are injecting $50,000 every year which is also equivalent to injecting $12,500 every quarter.

From this set of assumptions, I calculated that our annualised return thus far is 6.0%.

But what would have been the returns and outcome if I did not bother much about the markets and just invested mechanically and systematically into Berkshire B?

Berkshire B’s advantage over the S&P 500 is that as foreigners, there is a dividend tax. This is circumvented since Berkshire has no dividend policy. Moreover, it’s a good substitute to investing in STI ETF since Berkshire is probably as diversified the STI ETF and in fact, provides more geographical diversification.

Lastly, if you don’t think you can outperform Buffett, why not join him? A no-brainer, huh?

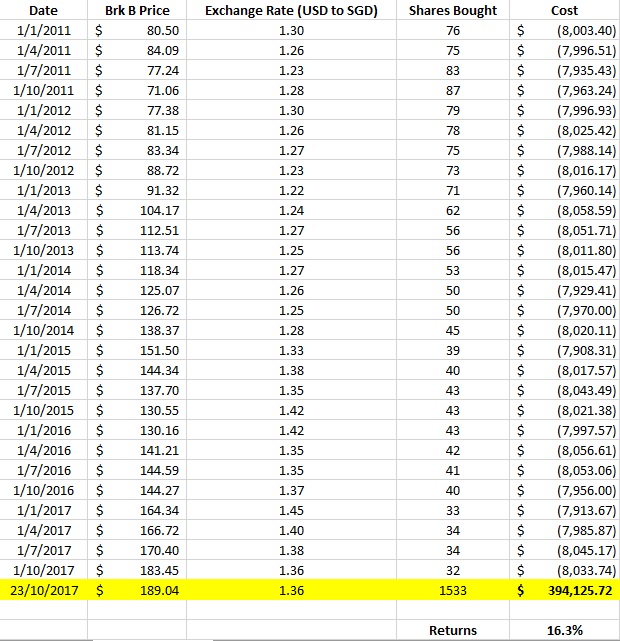

Assumptions:

1. Since the 15HWW portfolio is currently about 60% invested in equities, for a better apple-to-apple comparison, only $8,000 would be invested into Berk B every quarter.

2. $50 of transaction cost would be added to each purchase. This should also help to cover additional exchange rate and custodian fees for owning a US stock.

3. The remaining $4,500 for each quarter will be parked in cash/bonds that generate 2-3% interest. Let’s assume quite reasonably that $126,000 will grow to become $145,000 at the end of the period.

And here’s the results (screenshots from excel):

7 Observations & Reflections:

- The value of 1,533 shares of Berk B ($394,125) + the value of the cash/bonds ($145,000) gives a final total portfolio value of $539,125 for this hypothetical simulation. The annualised return is about 12.5%.

- If we only focus on Berk B’s annualised return, it is pretty astonishing at 16.3%! At the end of 7 years, the capital of $224,000 invested in Berk B has almost doubled and turned into $394,000. This is one of the biggest benefits of fully participating in a bull market. It would take a very big correction to wipe out all the gains.

- This also means that the US market is likely to be fully valued if not overvalued at this point in time. I am not ruling out the possibility of Berk B to continue its stellar performance for the next few years but seriously, the probability is definitely lower now as compared to 7 years ago.

- Even though 64% ($8000/$12,500) was invested in the market, the equity portion at the end of 7 years has increased to 73% of the portfolio. If I were prudent, I would call for a rebalancing to a more conservative 65/35 split and lock in some gains.

- If we compare 12.5% to 15HWW’s portfolio performance of 6%, that is a BIGGGG difference. It drives home the point that choosing or concentrating on a geographical market matters alot. Even a great stock picker in the local markets would have found it difficult to beat Berk B’s return of 16.3%.

- Purely investing in Berk B would have provided me with an additional $110,000 in my portfolio. That is a big difference and it would matter even more from here onward. Without any further capital injections, at 6% returns, $430,000 would grow to $770,000 in a decade’s time. At 12.5%, $430,000 would grow to $1.4 million after 10 years!

- Investment returns is actually something not within our control. Really. We can only focus on our investment process. The lesson learnt for me was that for my first 7 years, I was too concentrated on the Singapore market, which meant that I missed out on the huge US and global rally. I only had an epiphany late in 2015 to simplify my investments and diversify out of Singapore. Right now, I have a small exposure to both the US and HK markets and I am looking to increase them slowly in the next few years.

how would this Bershire B compared to say, IWDA?

i know latter is an etf.. but both are highly geo diversified and both are divd reinvested.

nonetheless, i have to agree that Bershire 16% is quite hard to beat!

also, now that warren buffet and charlie munger are in their 80s , do you reckon the berkshire fund will take a hit? are they able to continue their performance, or perhaps go on a downward spiral after their passing on?

Hi FC,

IWDA seems interesting. But I am not sure when the dividend is reinvested, is there less taxes involved. As the fund is domiciled in Ireland, it will still be taxed at source and I think the advantage of Berk B is that it circumvents that.

Nonetheless, IWDA does hold certain advantages like a higher estate tax limit.

Buffett and Munger are not exactly managing a company. Most of the companies they own have a strong management team on their own. It’s whether their successors can prove to be good allocators of capital like them. If they can’t, they will then declare a dividend, and that will be the day when I liquidate most of my holdings since it will negate my key reason for holding Berkshire B.

I’ve read this with regards to IWDA from Shiny Things’ thread on HWZ.

” It’s not subject to Irish estate tax, either; Ireland’s tax laws specifically say “there is no estate tax on Irish assets if neither the dead dude nor the person inheriting is Irish tax resident”. “

Hi Joyce,

Thanks for the info and clarification. Much appreciated!

Hi Thomas,

I was just wondering, what platform did you use to buy Berkshire B?

Thanks.

Hi HW,

I use a local brokerage which is iOCBC. There’s no advantage over other local brokers and I also pay a custodial fee of $2 every month.

Indeed it would be great to compare with a global etf like VWRD or IWDA

Hi, thanks for sharing your backtest results. It really does show how strongly the US stock market has run up which makes me reluctant to get into US ETFs at this stage.

Have you considered using Interactive Brokers to hold your US shares? The fx conversion rates are as good as it gets for retail investors like us and there’s also no custodian fees.

Hi Mr C,

So are you mainly invested in SG?

Regarding brokerages, I prefer to use a local brokerage as I do not trade very often.

Interactive Brokers charge a USD 10 dollar fee if the trading fees is less than $10 per month, so paying the Custodian fee is likely cheaper in the long run? More over IB platform is not easy to navigate for me.

Just curious, are you using IB? Let me know if I made a mistake anywhere as the last time I researched on brokerages was close to 2 years ago. Would be good to get a refresher from you.

Hi, yes my ETFs are mainly SG and I do use IB for some international stocks.

IB waives the monthly US$10 fee if your holding is above a certain amount, I think US$100k. So over time, that fee will disappear as a portfolio is built up. You may also want to quantify the exchange rates differential as the spread in local brokers can be quite substantial. But in the end, the decision depends on individual circumstances like frequency of trade, quantum of holdings, etc.

Hi Mr C,

Thanks for updating me on the waiver of the US$10 fee if the holdings are above a certain amount. It will make alot of sense to open an account with IB if there is a correction and I enter the a foreign stock/market in a big way.

The savings on the trades and custodian fees could be significant in the long run.

Also, the commission per trade for IB is just a few USD vs local brokers at around USD20 (int trades).