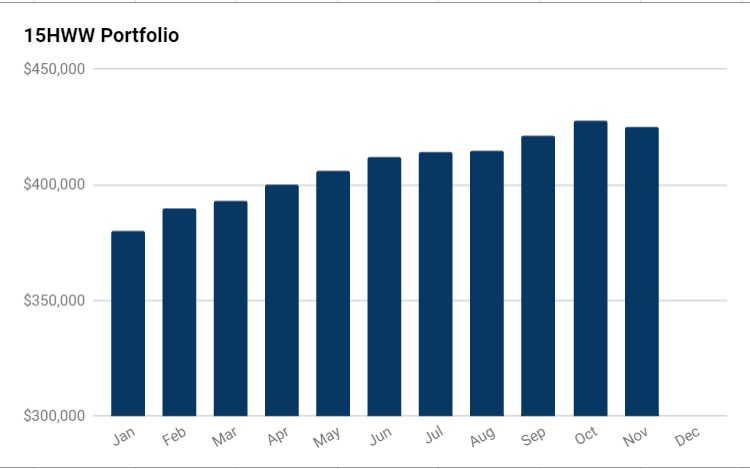

With much lower income coupled with higher expenses, there is no cash injection to the portfolio in November. And it showed.

So yes, there was no make-up on. And the portfolio isn’t like my Mrs who continues to thrive without powder, eyeliner and the likes. Left to the vagaries of the market, the portfolio has turned quite ugly this month. The equity portion easily dropped by >1%.

In the end, for the first time this year, month-on-month, the portfolio actually decreased in value. It dropped by $3,000 to reach $425,000.

I guess the good news is that cash is piling up after a big sell and I might have an additional bullet or two if a correction comes round the corner.

Overall Portfolio (Value: $425,000)

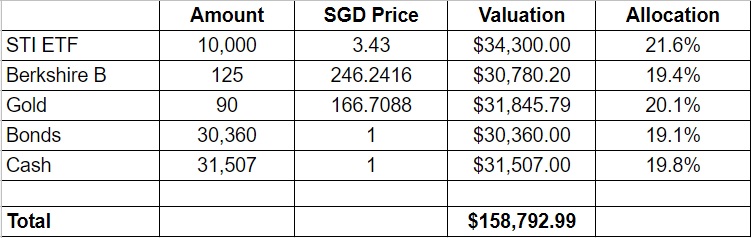

1. 15HWW Permanent Portfolio

Interestingly, the STI ETF actually did pretty well compared to last month’s update. But it was more than offset by the decline in Berk B as the share price dropped close to 3%.

The cash position was also slightly boosted by the coupons from a tranche of SSBs. Guess more time is needed for this sub-portfolio to breach $160,000.

USD-SGD Rate: 1.36

UOB 50 Gram PAMP Gold Price: $2,807 x 6 = $16,842

Annualised Return: 6.6% (Jan 2017 to Nov 2017)

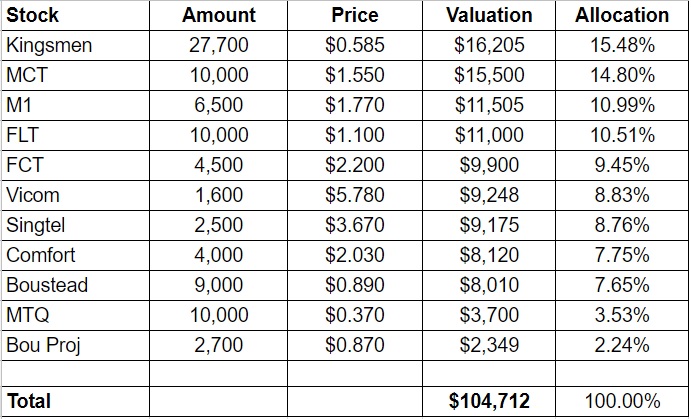

2. Personal Picks

Nothing interesting for this sub-portfolio and it pretty much maintained its value and returns as compared to last month.  Annualised Return: 6.7% (Nov 2010 to Nov 2017)

Annualised Return: 6.7% (Nov 2010 to Nov 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few comments and indicators below.

This sub-portfolio is probably the main culprit for the drop in portfolio. Compared to last month, there was almost a 3% drop in its value.

There’s a new buy which is balanced out by a sale. Since Dr Wealth has already written about it quite extensively on their blog, I will reveal that it is Ellipsiz. Half a year ago, I bought 15,000 shares @$0.555 and sold off all of them @$0.83 a few days ago, mirroring their move.

Nonetheless, the returns till now is pretty disappointing and lags the STI by a big margin this year.

Portfolio Value: $75,020

Number of local stocks: 6

Number of international stocks: 4

Annualised Return: 5.2% (Sep 2016 to Nov 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets.

Even after accounting for a purchase, the sale proceeds added another $4,000 to the warchest.

Warchest Value: $87,000

Good portfolio nevertheless. The average Singaporean in the early thirties probably doesn’t have this portfolio size even if he/she is still working full time – agree?

Would be interesting to see some stats on that.

There may be buying opportunities with minor dips/corrections occurring recently so it’s good you have an extra bullet or two.

Hi JF,

Thanks for your kind words.

Honestly, I am not sure of those stats but I reckon that you are likely right. But well, there isn’t much point comparing with others. We all have our own unique financial goals.

The blue chips are soaring and the opportunities seem to be in the mid and small caps for now.

Please have the equanimity to view the $3000 drop in context. Percentage wise it’s less than 1%. So don’t sweat the month to month volatility.

My portfolio is about the same ballpark size as yours. On a given day it can rise $2000 & I can get euphoric and tell myself that it’s as good as striking 4D. The next day it can drop $2000 & I can cry that I “lost” a vacation to Europe. This is not a way to live because the emotional roller coaster is unhealthy.

Dispassionately I look at the annual returns and just strive to outdo the STI & beat inflation.

Hi snowcap,

Actually I am really not affected at all. It’s just that a decline has happened for the first time this year and it’s good to keep these monthly updates a little bit more interesting.

You are right that it’s definitely not healthy to base your emotions and expenditure based on the mood of Mr Market. One will likely develop schizophrenia from those extreme mood swings.

Internally, I would probably only be alarmed if the portfolio drops by like 5% within a month. That would probably signify a crash.

And lastly, thanks for your encouraging words on my writing and the blog!

Great advice, I’m reminded of a quote I’ve read before whilst reading your comment Snowcap, it goes like this “In many ways, the stock market is like the weather in that if you don’t like the current conditions all you have to do is wait a while.” 😀

Of course it’s is not just dismissing the ups and downs as market noise. It is important to get the process right.

For equities, ensuring that businesses are still in good shape, profitable, addressing industry challenges, staying ahead of competitors, generating cash flow.

Keep up the blog. I’m a fan.

For bonds, assessing default risk.

For the portfolio, looking at asset allocation, adequate diversification, and rebalancing.

Hello!

I’m just wondering if the cash component of your permanant portfolio is separated from your emergency funds? Also cash from your war chest. Do you store them all together in an account?

Hi LH,

The cash from the warchest is definitely separated from the permanent portfolio.

But you are right that I include half of the gold and cash as part of my emergency funds.

I don’t store all the cash together in one account. They are parked separately either to get higher returns (UOB One) or for convenience (accounts linked to brokerage).