For some people, tabulating expenses can be a nightmare scenario. Be it the hassle of recording, the shock at finding out how much your healthcare insurance have increased or the guilt at finding out how much you had spent on lottery.

But not so for the 15HWW household. We have been publishing monthly expenses updates on this blog since August 2013. That’s 54 times consecutively. They are the main reasons why I have been able to consistently write every month.

They are a hassle to look back on, though.

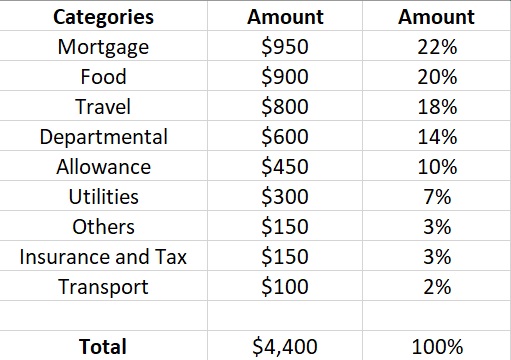

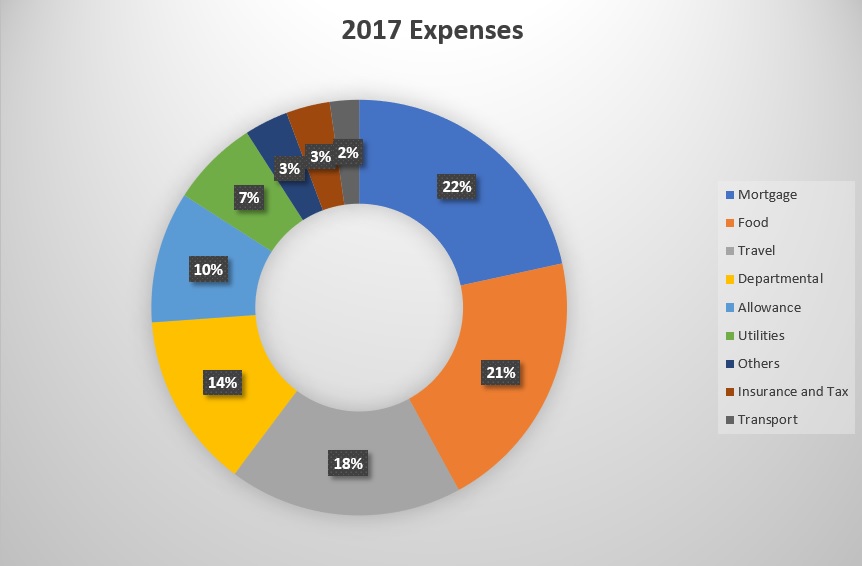

So a couple of weeks ago, I exported all of my expenses records in 2017 (on the app) to Excel. I then managed to simplify the expenses to the following table and chart for my future reference.

We spent about $53,000 last year which translates to $4,400 a month on average. Here’s some snippets on where the money went to.

Mortgage ($950)

The roof over our head, the “office” where we derive a significant proportion of our income and the place we call home.

Unless we prepay, there is still another 25 years to go before we can finish paying off our home loan.

As the home equity is close to $300,000, we could easily downgrade to a 3 room flat and probably reduce our mortgage to $300. But seriously, that’s more of a contingency plan rather than something on the cards.

Food ($900)

Besides the meals out and snacks, this also includes groceries shopping in the wet markets and supermarkets.

I personally think that we are quite frivolous with regards to spending on food. For example, we would incur $400 of spending at restaurants in a typical month.

Going forward, the odds are that we would be cooking and eating at home more often. The $100 each spent at supermarkets and wet markets should also stretch us further.

Travel ($800)

This will likely be the wildcard every year. Our expenses would be ridiculously low if we strip this out.

Trips to Melbourne and Taipei contributed almost $8,000 and we have also pre-paid for a Phuket package holiday coming up in May.

We are still debating whether we should go somewhere more exotic (South Africa, Brazil etc) at the end of this year or explore another city in neighbouring South East Asia.

Departmental ($600)

We spent about $120 a month on books, electronics and clothes respectively. In my opinion, that’s really quite manageable.

The biggest contributor was actually gifts. Be it in the form of ang baos or presents to our students, friends or relatives.

For 2018, I have decided to tag work-related expenses separately. We would then have a better representation of our core spending.

Allowance ($450)

The full amount is given to Mrs 15HWW’s parents. We have no intention to cut it even if we are retired. This is probably the last category we would choose to cut even if push comes to shove.

In fact, I am quite apologetic that we have not raised the amount in the past couple of years. Our saving grace is that they are earning a higher income than both of us.

Utilities ($300)

The $300 is split quite equally into three categories:

- Cell Phones

- Utility Bills

- S & CC + Broadband

Cell phone usage is becoming more and more of a bane. If not for work, I would seriously consider using a pre-paid sim card.

Others ($150)

For 2017, they included items such as shopping at Watsons. Otherwise, they would include personal care like haircuts and facials for the Mrs and the occasional visits and donations to temples.

Insurance & Tax ($150)

Many of our friends feel that we are under-insured since we are just spending slightly more than $100 a month on insurance coverage. Honestly, I prefer to self-insure if possible and we only purchase health insurance a few hundred thousand dollars of term insurance each.

Our income and property taxes are so low that I don’t bother about using GIRO monthly installments.

Transport ($100)

This is another ridiculous low category.

Yes, we each spend less than $50 on transport a month. And this already takes into account the occasional Grab rides.

The main perk of our work is that we don’t really have to travel. We either stay at home or walk about 10 minutes to our students’ homes. We don’t worry about train breakdowns, inconsistent bus timings or packed buses and trains. No traffic jam griping and exorbitant COEs too!

“If you can’t measure it, you can’t improve it. ” – Peter Drucker

Thanks for reading!

Average $600/month on departmental stuff and $800/month on travel are very high.

Travelling within APAC should be cheap especially SEA. I think you are splurging somewhere.

Hi Frugal,

If we exclude gifts, the departmental section is probably just $300 a month.

Yes, travel is very high. And if we do a trip to North America or Europe, just one trip would bust $800 a month.

Income tax girogood for clocking savings account bonus leh.. unless u alr have enuf

Wow impressive! That’s like only $2,200 each per month!

Hi KK,

Thanks! Some people think it’s low while others think its high. I guess we just can’t please everyone!

Hi, what app do you use to track your expenses?

I’m not too sure what they use but I would like to recommend my personal expense tracking app! :p

I use Money Lover, a mobile app. It’s free for up to 3 wallets I think and you can only use a limited number of categories to classify your transactions. I paid for the premium (one-time only) and there’s no more restrictions with the number of wallets and categories. Allows you to export to csv as well. Not perfect but easy enough to use and I’ve been at it for 2 plus years, going to 3. Hope this helps! 🙂

Hi Eunice,

Thanks for your recommendation!

Hi Ben,

I use this app called HomeBudget on the iPhone. I think there are many similar trackers out there.

Nice! Your monthly expenses update was what inspired me to start tracking my expenses! Do keep it up 🙂

Hi KPO,

Thanks! I also pop over to your blog to take a peep at your expenses too!