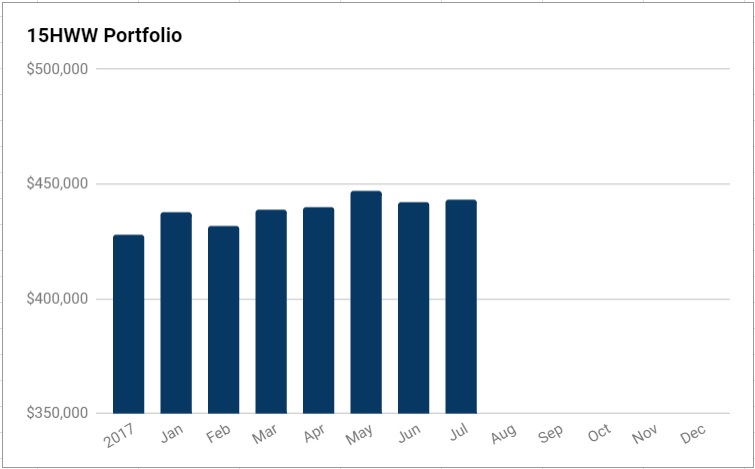

The overall stock market is finally showing some signs of stabilising after a few consecutive months of poor performance. The portfolio remained flat despite a few thousand dollars of capital injection.

Injections could become even more muted going forward as we seriously consider the possibility of buying a car.

The big news this past month was the property cooling measures, with additional ABSD and lower LTV limits. With little exposure to both developers as well as banks, the portfolio emerged relatively unscathed.

But just to show how poor a market timer I was, I bought some Capitaland shares a week before the announcement. =p

Overall Portfolio (Value: $443,000)

Monthly Change: +$1,000 (+0.2%)

Yearly Change: +$29,000 (+7.0%)

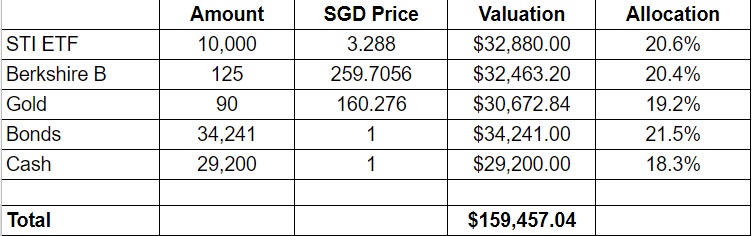

1. 15HWW Permanent Portfolio

The sub-portfolio declined by another $1,000 with the STI ETF continuing its decline coupled with the drop in gold prices.

The performance of the sub-portfolio has also moderated to an annualised 4.0%, which is definitely worse than GIC’s return.

USD-SGD Rate: 1.36

UOB 50 Gram PAMP Gold Price: $2,708 x 6 = $16,248

Annualised Return: 4.0% p.a. (Jan 2017 to Jul 2018)

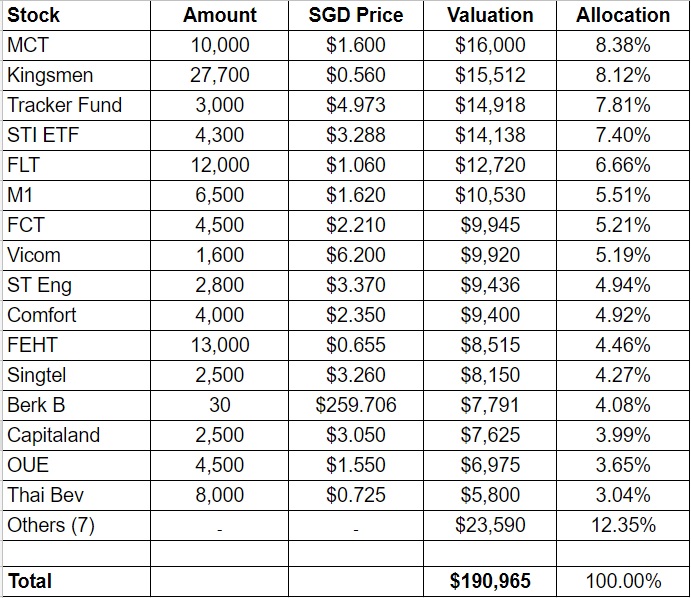

2. Personal Picks

As mentioned earlier in the preamble, I bought some Capitaland shares at $3.17 a week before the sudden announcement from the government. I felt most developers were trading at reasonable valuations after recent price wobbles from the HSR issue with Malaysia.

They appear even more attractive now and I am definitely taking a closer look at some of them.

Annualised Return: 5.8% p.a. (Nov 2010 to Jul 2018)

3. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $93,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

Thank you so much for sharing your story. I love hearing about other people pursuing FI, there’s always something to learn from their experience.

I started my journey towards financial independence 3 years ago, hoping to be able to retire within 5 years. To my own surprise, I’m actually on track to pull it off.

I wish you all the best and look forward to more updates!