I realised I haven’t been blogging for a couple of weeks.

That’s because I have been kept pretty busy, spending precious time around My Car Forum, researching on car ownership costs, car models, reviews and of course, visiting car showrooms on weekday mornings and blablabla…

All these were triggered by the sharp fall in COE prices in early July, which caused me to revisit my car conundrum which I wrote about 2 years ago.

And since I know there are quite a few people around me (including financial bloggers) pondering over the purchase of a car, I shall share what I have found out over a couple of blog posts, starting with the cost of buying cars.

This is nothing new since there’s lots of car cost guides out there and I feel these are the best ones available (here, here, here and here). However, I still found them slightly lacking for my needs.

So here’s my take.

And in case you are wondering, nope, I definitely have not made any booking for a new car yet. =p

1. Cost Of Depreciating A Brand New Car

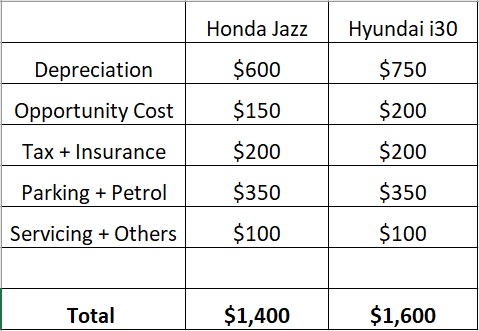

Honda Jazz 1.3L vs Hyundai i30 Wagon 1.4T

Honda Jazz 1.3L – $600 per month

Hyundai i30 Wagon 1.4T – $750 per month

How I arrived at this ballpark

I am assuming buying a brand new car and using it for the full 10 years of the COE entitlement.

Off Peak Car (OPC) also doesn’t make any sense for us since our working hours are almost exactly opposite from the typical employee.

The Honda Jazz 1.3L costs around $75,000, one of the lowest priced cars in the market right now since it qualifies for a $10,000 VES rebate. However, the flip side is that at the end of the 10 years, the PARF rebate would be minimal, about $3,000.

So taking $72,000 and depreciating it over 120 months, we arrive at $600 per month.

The Mrs test drove the Hyundai i30 Wagon 1.4T and immediately preferred it over the other models that she had tried. I shall not bore you with the details but the summary is that it’s a better drive, offers more space and flexibility along with better safety features.

The Hyundai i30 Wagon costs around $98,000 and at the end of the 10 years, the PARF rebate would be around $10,000.

So taking $88,000 and depreciating it over 120 months, we arrive at $750 per month.

Can the expenses be further reduced?

Erm, it’s possible with cars like the Mitsubishi Attrage but we doubt we would be comfortable driving that car for 10 years. Anyway, the difference is less than $100 month compared to the Honda Jazz, which is really a small premium.

2. Opportunity Costs Of Owning The Car

Honda Jazz 1.3L – $150 per month

Hyundai i30 Wagon 1.4T – $200 per month

How I arrived at this ballpark

If I were to buy a new car, it’s almost certain that I will either be getting it from Kah Motors (Honda) or Komoco Motors (Hyundai). This is because they don’t penalise buyers who are not getting a loan for their car.

If some SEs from these distributors are reading my blog and would like to earn my commission, feel free to send me an irresistible quote and tempt me to take the plunge.

The effective interest rate for car loans hover at around 4% so it’s a no-brainer for me to avoid these loans.

With the upcoming UOB One Account changes on 1 August (rant for another day), I have already parked $75,000 there. This amount will provide me with ~$150 of interest every month given prevailing interest rates of about 2.4%.

And if I were to buy a brand new car, I will liquidate the whole account which also means forgoing this amount of interest. Most car buying guides don’t account for the opportunity cost of the downpayment, which I believe understates the cost of owning a car.

The more expensive Hyundai option would also likely compel me to close my Citibank Maxigain Account ($25k inside) to avoid any car loan. That’s an extra $50 of interest forgone every month, so the opportunity cost will total to $200 a month for the more desirable car.

Can the expenses be further reduced?

Other than purchasing a cheaper car, nope. In fact, the opportunity cost figure is likely higher for most people if we take into account higher financing costs.

3. Road Tax + Car Insurance ($200 per month)

How I arrived at this ballpark

The road tax for both cars will be $600-$700 a year and I expect the insurance cost to be slightly lower than $2,000 since we are past 30 and have gotten our licenses for more than 5 years.

$2,400 a year would then translate to $200 a month.

Can the expenses be further reduced?

The road tax is dependent on the engine of the car and both cars have relatively small and economical engines. And well, insurance costs is not something an owner has direct control over. Hopefully, for us, it can reduce with No Claim Discounts (NCDs) in the future.

4. Parking + Petrol ($350 per month)

How I arrived at this ballpark

I thought by now, we would be done with the fixed costs. But no, because, well, we need to park the car somewhere overnight and HDB Multi-Storey Carparks (MSCPs) cost around $110 a month. And then let’s add in another $100 or so for miscellaneous parking charges.

Judging from the experiences (here, here and here) of other financial bloggers, I think I should do fine with a budget of $150 for petrol needs.

Can the expenses be further reduced?

I truly believe the two bloggers above are really quite badass in terms of keeping their car running expenses low, and optimisation is almost maximised.

The only other way is just to drive less and go to fewer places. But then, if that’s the case, one would have to question what’s the point of owning a vehicle in Singapore then??!!

5. Servicing + Others ($100 per month)

How I arrived at this ballpark

New car purchases often come with free servicing for the first few years. So that would help to bring down the cost. If not, new cars also require minimal servicing in the first few years.

So I believe I am being quite generous with the budget here. $100 a month might even allow me to purchase some frivolous car accessories.

Can the expenses be further reduced?

Besides the servicing cost, the point is also to include some buffer in the budgeting.

Total Cost & Conclusion

Yup, so it will set us back $1,400 each month for 10 years for an economical car purchase. And an additional $200 for a more desirable car.

At between $170,000 to $200,000, it’s truly an astronomical cost to own a car in Singapore for a decade.

Can we truly afford it? At this point, we are a little bit on the fence. So it’s really a 50/50 decision with regards to the purchase of a new car.

Hello. I am curious, why the sudden desire to buy a car. Normally you and your wife are very frugal.

Unlike in the past, private car hire (Grab) is available on demand anytime anywhere. The wait is mere minutes. Isn’t taking Grab everywhere clearly cheaper than owning a car.

Hi Aud,

Thanks for your comment and thinking so “highly” of us. =p

You are right that it’s likely that with proper planning of routes, it’s almost definite that taking cabs or PHVs would be cheaper in the long run.

However, knowing the penny-pinchers that we are, we will also reduce venturing out because of higher transport costs. Perversely, having a high fixed cost of the car might “force” us to be more adventurous and visit new but ulu places. I will probably elaborate more on a separate article.

Haha, I thought there is a baby on the way 🙂

I am still puzzled that a couple frugal enough to count the quantity of bubble tea purchases per month, would even consider buying a car. Even if venturing to ulu places, just taking GRAB to and fro is cheaper. Admittedly if there are things to carry around, having a car is more convenient as the stuff can be plonked in the car.

Cheers

Hi 15HWW,

Thanks for the backlinks. 🙂

*So you’re the reason for my spike in traffic*

I won’t be one who advises not to buy a car. Cos after pretty much settling down our lives. I think being frugal for the sake of being frugal is quite pointless.

And personally, I feel you have come to a somewhat similar conclusion, to loosen up on the spending, cos overall you’re happier with your current job/career progress and path in life.

ie, do your work for longer cos you’re contented with it, and start enjoying some of the stuff you haven’t previously.

I still do recommend a 2nd hand car though or those which are nearing the end of their life.

Maybe a car left with 1 year life, just for the experience first, so that you can get a feel of the ownership of a car.

But I understand the concerns you have mentioned previously, so there’s no getting around that part.

I second what ERSG said. Get a 2nd hand car first, if it works out, you can then decide whether to extend the COE or buy a new one.

Having said that, given how frugal you are, you would have thought/read about this and drop the idea. So I am guessing you guys are most likely going to buy a new one! Hahahaha.

Hi KPO,

Thanks for your suggestion. But like what I mentioned earlier, there’s the much higher odds of ending up with a lemon. And running + depreciation cost likely to be higher than a new car.

Downside for a new car is that once you drive it out of the showroom, the value of the car drop by >10%.

Have to choose the “poison” carefully.

Hi ERSG,

Must be small spikes la, I also not that “influential”. =p

Yes, I have somewhat loosened up. I stop calculating expenses because at this stage, it’s really quite marginal unless there is a big “life change”.

I am definitely considering a 9 year old car. But since I am a car noob, have a nagging feeling I will end up with a lemon.

I feel it’s not necessary to be TOO concerned about a lemon. The probability really isn’t that high.

Furthermore, the risk is pretty minimal, cos your purchase value should be quite close to your scrap value. So the max loss is pretty much the difference between your purchase price and just de-registering it.

It’s one of those things.

Drive out of a car showroom and you 100% lose 10% of the value.

Drive out of a 2nd hand car dealer and you 5% have a chance of lemon (maybe even lower chance.) Furthermore the max loss is also purchase price-deregistering price.

Hahaha, you might even consider car troubles to be part of the experience in owning a car. So that you learn what not to do next time 😉

do you want a car because its cheaper or do you need a car?

Hi JalanJalan23,

It’s quite rare for someone to really “need” a car. There are always alternatives to get around it. I guess for me, it’s really more of a “want”. And how long I want to deprive or delay this “want”. Who knows, this “want” might also disappear over time.

My view is to get new instead of second hand car as COE quotas is still high. Wait another year or 2, COE quotas will be reduced, so likely the price of COE may spike up. Lock the price of COE for 10 years at a low rate now.

Why not Elantra? For basic model, some can get at a price of 70k when COE dropped to 25k.

I see that you didn’t include any fines/ERP in your calculations. Perhaps ERP not so much for your lifestyle, but I suggest budgeting for unexpected fines. Your Servicing+Others category isn’t enough for that. Indiscriminate parking alone would take up more than half the budget, and beating the red light is a whopping $200 fine (plus 12 demerit points).

Though most of us strive not to beat the red light or speed when there’s a traffic camera, sometimes you never know if you misjudge your speed or the braking distance at a traffic light. Unless of course, if you strictly drive at the speed limit only, and slow down and prepare to brake at every traffic light junction haha.

Hi 15HWW,

Have you considered getting a 2nd hand manual car? You might be able to bargain for a lower price since they are harder to sell than cars with auto transmission.

Hi WGM,

Thanks for your suggestion. The Mrs can’t drive a manual, so the option is out.

Anyway, nice blog there. I am also thinking about buying a new laptop, so it’s interesting to hear your views on using the money to buy an ETF vs a laptop.

Hi Mr15HWW,

thanks for linking to my blog.

I’m glad you found it useful.

I have also shared some other tips both car and non-car related on my blog:

https://my-radical-thoughts.blogspot.com/p/my-expenses.html

I also shared my rationale for buying a car:

http://my-radical-thoughts.blogspot.com/2017/12/saving-money-on-car-ownership.html

I am quite frugal excluding the purchase of a car.

Having a car is great. It gives you freedom and a sense of control if you like driving.

It also allows you to explore ulu places.

This is the proof that I have explored many places with my car during the past 2 years of ownership:

http://my-radical-thoughts.blogspot.com/2017/10/where-else-to-go-in-singapore.html

feel free to ask me more questions on money-saving tips. I consider myself an expert in saving money and exploiting systems heh, still while enjoying life.

Last time I also thought that I could taxi everywhere which is still cheaper than owning a car. But over time when I built up my savings and grew discontented with public transport, I decided to buy one.

If you ask me whether I regretted buying, I ‘d say partially, due to the COE dropped quite a fair bit, causing more depreciation to my car. Other than that, I’m very satisfied and I’d say my quality of life has improved. The best time to buy a car is probably during a recession, like stocks, lol.

Once you own a car, you wouldnt feel like going back to taxi/public transport, even despite the high price.

Would you mind exchanging blog links? I have taken the liberty to add a link to your site on my blog already.