There’s a spike in volatility during the past week. Most markets registered significant single-day declines, whether it’s the US indices, HK/China indices or the local one.

2018 is proving to be a “not so good” year for Asian markets as most of them are down by double-digit percentages for the year. Let’s see if there’s a turnaround for the remaining two months.

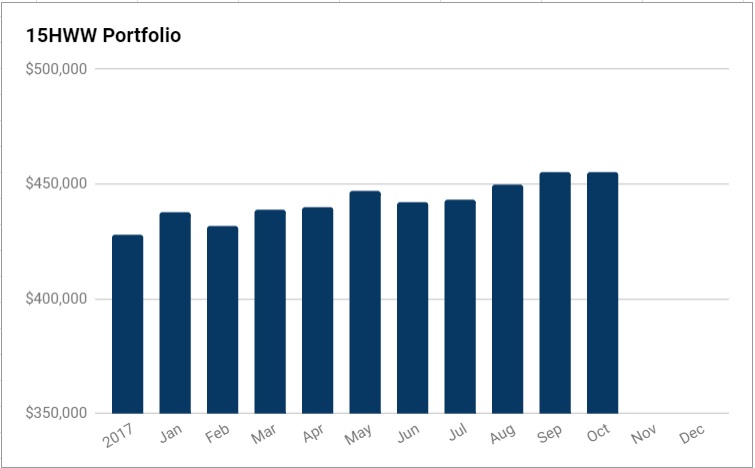

On our portfolio front, at least for this month, it’s doing much better than the broader market. With a little bit of capital injection, the portfolio managed to remain stagnant at $455,000. That’s really a surprise, since the market has weakened quite a bit for the month.

Overall Portfolio (Value: $455,000)

Monthly Change: +$0 (+0%)

Yearly Change: +$27,000 (+6.3%)

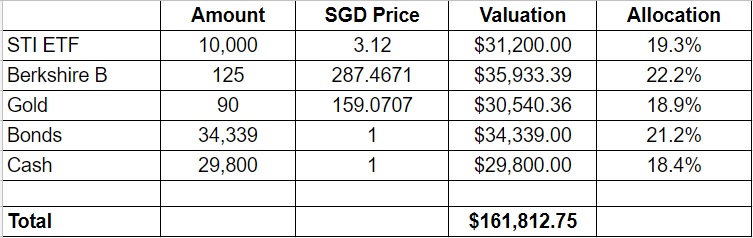

1. 15HWW Permanent Portfolio

Both Berkshire B and STI ETF declined a fair bit compared to the past month, around 3% for Berk B and 2% for STI ETF respectively.

The good news is that the decline is partially offset by the slight recovery in gold prices. This permanent portfolio is really living up to its name with generally low volatility month-on-month.

USD-SGD Rate: 1.37

UOB 50 Gram PAMP Gold Price: $2,704 x 6 = $16,224

Annualised Return: 4.3% p.a. (Jan 2017 to Oct 2018)

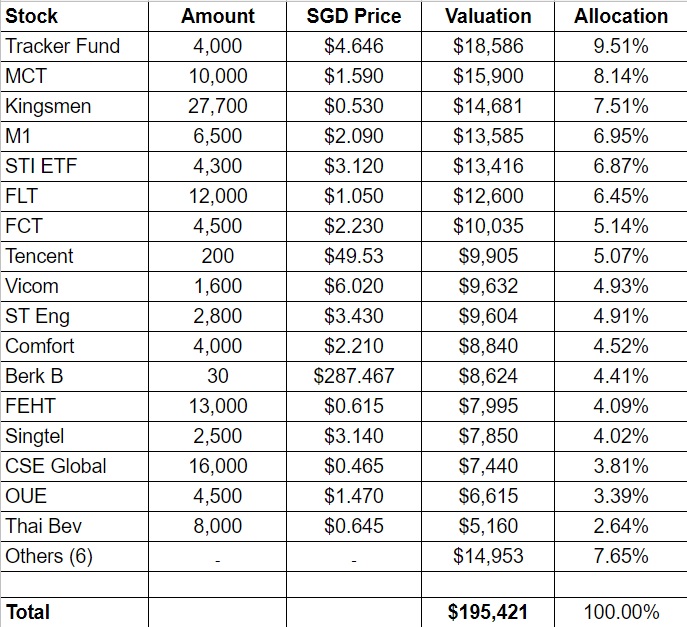

2. Personal Picks

There’s definitely temptation to add more stock exposure during the past couple of weeks and indeed, I made a small purchase and averaged down, buying 100 shares of Tencent @HKD 274.

Right now, the Hong Kong market does seem more attractive but with the ongoing trade war, it’s also much more risky as compared to the local market.

The general offer to buy out M1 has really helped to cushion the price drops of most other counters in this sub-portfolio.  Annualised Return: 5.5% p.a. (Nov 2010 to Oct 2018)

Annualised Return: 5.5% p.a. (Nov 2010 to Oct 2018)

3. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

I just realised that the warchest amount has been hovering around the $100k mark for the past half a year. This also means that I have been deploying savings quite frequently into the stock market during this period, albeit not in a big way.

Warchest Value: $98,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

There was a recent article on SRS, went back to read your post again from a few years and wanted to ask. Is SRS a complete forget about this? Does it warrant a look as one grows older some years down the road and consider maxing out the srs contribution?

specifically 50% of future withdrawal is taxed. hence the tax savings enjoyed today would translate to that.

using figures from one blogger, “if an SRS member withdraws $40,000 per annum, only $20,000 (50% of $40,000) will be considered as taxable income. If an individual has no other source of taxable income at that age, then he will not have to pay any income tax, since his first $20,000 is tax-free.”

would this work out? for the part you wrote about the risk of the monies being taxed at the point of withdrawal.

Again, same question i have asked 5 years back should we just forget about the whole thing? and just focus on CPF to maximise tax deductions.

The reason im writing is during five years ago, i’ve decided i would not pay attention to srs at the point.

Im re-looking at the numbers now. please let me know what you think.

“When you reach the statutory retirement age (62 at the time of writing), any amount withdrawn from your SRS account enjoys a 50% tax concession. Furthermore, you can withdraw the amounts in your SRS over 10 years. At the end of 10 years, any amount remaining will be considered as a lump sum withdrawal and only 50% is subjected to income tax.

This means that if you have $400,000 in your SRS account, you can withdraw $40,000 per annum and only $20,000 is subject to tax. As the first $20,000 of your income attracts a tax rate of 0%, you can effectively withdraw $400,000 tax free with any amounts above that enjoying a 50% tax concession.”

And the one from IRAS

https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Special-tax-schemes/Supplementary-Retirement-Scheme–SRS-/Tax-on-SRS-withdrawal/

“If you choose not to withdraw the balance and leave the balance with the SRS operator, returns from such investments will be subject to the same tax treatment as any other investments in the future.”

Currently, an SRS member can withdraw up to $40,000 per year# from his SRS account tax-free on or after reaching age 62, if he has no other taxable income and relief. Over the 10-year withdrawal period, he can withdraw up to $400,000 ($40,000 p.a. X 10 years) tax-free.

Makes sense

Hi. Can you share your experience on which portofolio do you think will be better in terms of return and risk? Portfolio 2 seems to have more diversification