Ah, it’s been 3 months since my last blog post. Honestly, it doesn’t feel that long ago.

This also means there’s plenty of pent-up thoughts to craft (or vomit) out. And since I feel there’s no better way to do it than through an interview with myself (ownself reply ownself), you are now reading my longest blog post ever.

Almost 5,000 words with plenty of memes/pics/charts.

I tried my best to be forthcoming, coherent and yet inject a bit of humour at the same time (a.k.a the 15HWW way).

To facilitate your reading (or skipping), I have grouped them into 4 separate sections:

- FIRE

- Personal Finance

- Investing

- Blogging

FIRE

a. What is my take on FIRE?

Interestingly, this was a FIRE blog before FIRE even gained momentum in the US. Alright, maybe FI(S)RE is more appropriate since I have never been fully convinced of the notion of retiring early. Semi-retirement, probably. If my savings and investments doubled, I might be tempted to reduce my current working hours by one-third.

Financial Independence (FI) is quite straightforward. It’s just really all about the Math. The often-touted 4% withdrawal rule, despite its detractors, is a good starting point for most. Using the above metric, I am still quite a distance away from FI, which is why I am both puzzled yet honoured when I am cited as an example in FIRE articles such as this.

Retiring Early (RE), on the other hand, is more divisive. It’s more or less an escape from an unpleasant reality. I can totally relate, as 6-7 years ago, there was nothing I desired more than to escape my cubicle. So you could imagine how FI as a means to RE was such an attractive proposition then.

I am still a strong supporter of FIRE, even right now. But honestly, FIRE does not have such a strong hold on me anymore.

That’s because I have Financial Security (more on this later) and I have basically managed to rejig my lifestyle and perspectives in recent years.

I won’t go as far to say that life is a series of rainbows currently. However, it’s really a whole world of difference when you wake up smiling and anticipating what the day has to offer as compared to dreading the rest of the day.

My favourite FIRE blogger LivingaFI puts it best with this pic above:

When dread fills your world, your vision gets tainted, even something beautiful would appear really grey and FUGLY. Luckily, I didn’t require full FI to get back to regular vision.

b. Do I have a long-term FIRE target?

It’s a cool $2 million for the household.

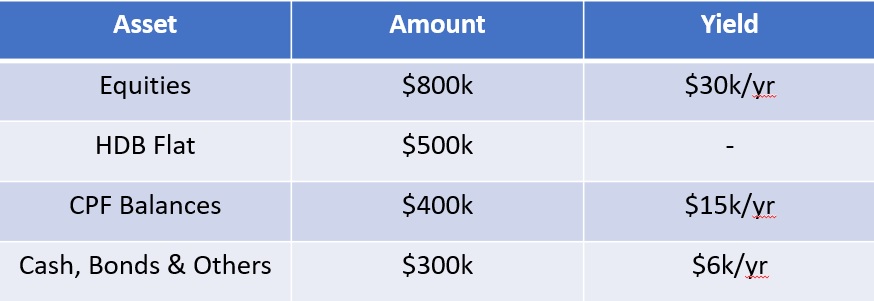

Before you baulk at the number, let me caveat that it’s for a household and I would include the following in the tally:

- Typical cash, bonds and stocks

- CPF balances (OA, SA, MA funds)

- Home equity

We are currently about halfway there and I reckon we should be able to achieve the target by our early forties.

$2 million at 40 makes a lot of sense because from a pure drawdown method (super conservative), the money can last 50 years if we take out $40k a year. Or 40 years if we take out a more generous $50k a year.

It’s not unrealistic to take into account CPF funds in your forties as the funds start to become liquid in a decade or two. I also include home equity because when push comes to shove or if it makes sense financially, we are prepared to sell and then rent for our accommodation needs.

Here’s how I might divide up the $2 million if we had it today.

To some of my peers, the $2 million target might seem like a lack of ambition on my part. So not surprisingly, I do have a more ambitious FatFIRE target at the back of my mind, which is to maintain a yearly income of $120,000.

The $120,000 would comprise both active and passive income. So let’s say passive income is $20,000 (based of 4% withdrawal rule), so we would have to earn at least $100,000 annually to meet the target. If passive income grows to $50,000, we might then be able to fully semi-retire and work a 15 hour work week since we would just need to bring in $70,000 for the year.

Since I doubt we would ever spend $10,000 in a month, this would likely ensure that our net worth/portfolio constantly receives injections instead of being drawn down.

The economists got it wrong because money does not have to be spent to provide utility. There’s satisfaction just by seeing the numbers jump higher. I am sure many other financial bloggers will agree with me.

c. What would I do if I had to FIRE now?

As mentioned earlier, we are only about halfway to our FIRE target. It’s not nearly enough if we were never going to earn another single cent in our lives.

But a robust form of Financial Security? I would say yes. The very basics like food and utilities can all be covered for many decades and there’s a lot more leverage to say no to $$$ as compared to 5 or 6 years ago.

And if we were willing to take some drastic decision to relocate, our current savings might just be borderline enough.

Basically, in this worst case scenario, we would liquidate as much of our assets as possible and relocate to a cheaper city like Chiang Mai.

I am sorry, Chiang Mai. I don’t know you well at all and you do look really beautiful in this picture. Apologies that you have to be lumped together with “worst case scenario”. No hard feelings, I hope.

It’s all theoretical because for instance, we have never even been to Chiang Mai. My point of reference is based on what Jason Fieber (Mr Free at 33) had shared about his dividend expat life in Chiang Mai.

Going to a place like Chiang Mai or another city temporarily for about half a year sounds like a great opportunity. But permanently? That’s likely undesirable since we would have to forgo close relationships forged with family and friends in Singapore.

Nonetheless, it’s quite reassuring to have this as a worst-case scenario.

d. Thoughts on how sequence of returns might end up ruining my FIRE hopes?

If this is a worry in your life, then congratulations. You are in a better place than 90% of the population.

It probably means that you have amassed at least 20x your annual expenses. Otherwise, why should you be concerned over whether 5%, 4% or 3% withdrawal rates is the safe rate for you?

I know I am not anywhere near 20x, so I am just knuckling down, busy earning, saving and investing my money.

Alright, enough trolling. Honestly, I really appreciate the write-ups Kyith has written about sequence of returns on Investment Moats.

But it’s probably too technical for the layman or irrelevant for most starting out. This is also one of the rare instances when Kyith is writing more for himself rather than for his many mainstream readers.

Okok, shall stop the trolling for real.

I am just a baby troll…

If you are really losing sleep over this issue, my unprofessional advice is to allay the worries by either:

- Being more conservative in your asset allocation. A bit more cash, a bit more bonds, less stocks.

- Find more palatable work and just work a couple of years longer to save more. Or continue to find part-time gigs after quitting a full-time job.

I really have no better suggestions because no one can foresee the future and give you an accurate year-by-year estimate of your investment returns over the next few decades.

Personal Finance

a. On increasing savings and reducing expenses

For people facing financial problems, let me apply the Pareto rule by gifting you the following 5 words that should prove an effective solution at least 80% of the time.

“SPEND LESS THAN YOU EARN!”

That’s the best financial advice for the masses out there. Simple, but not easy.

As for greedier folks who want to get to FI earlier and save >50% of their income, things get a little trickier.

Before I talk about how I do it, I shall first share an Interesting personal snippet:

I have soft, supple ears. Apparently, they are less rigid than the average person’s. According to some Chinese folklore, that means I am easily influenced or swayed. Instead of letting it be a weakness, I try to use it to my advantage when I need to reduce my expenses.

For me, the easiest way is to read to be influenced. If it’s purely about cutting down, Early Retirement Extreme or Stoicism books come to mind. If fiction is more of your cup of tea, I would recommend reading the Jack Reacher series. He was a minimalist before the term was even in vogue.

Tom Cruise really isn’t an accurate depiction of Jack Reacher.

But he is my kind of superhero… and I might retaliate like him if you try to touch my ears!

Next suggestion is to surround yourself with frugal people. You really are the average of the five people you interact with the most. Drop me an email, buy me lunch, and who knows, that could be the start of a budding friendship that helps you to save money.

Another suggestion is to track your expenses. I am not a fan of budgeting but I diligently tracked our expenses for 5 years and in the recent six months when I stopped, I reckoned our expenses eventually inflated by about 20%. The very act of tracking will subconsciously reduce your expenses.

The last hack that I have goes back to books. Reading dystopias like 1984 or Man In The High Castle has proven to be highly disturbing, especially the former. But the upside is that it’s really much easier to practise gratitude and consume less when you realise what a wonderful world it is that we live in.

b. Which saving accounts and bonds I use to park cash?

I have recently closed the Citibank Maxigain account after their recent changes. It’s quite unrealistic to increase our balances to $70k to maintain the interest we were getting. We have enjoyed the full counters for only 9 out of about 20 months, so the effective interest rate over the period was probably around 1.7%.

Was it worth the effort? Barely.

With the introduction of Singapore Saving Bonds (SSBs) that yields 2% even when you just hold for a year, and with an increased cap of up to $200,000, it’s generally not worth the effort to go through hoops and hurdles deliberately for high interest accounts anymore.

Keep it simple like Schooling and just park your cash in SSBs

c. My thoughts on insurance and CPF?

I have written what I thought to be a primer on insurance quite a few years ago and it still remains relevant today. (Links here, here and here)

I see insurance as protecting what I cannot afford to self-insure. That’s why I only have MediShield and the accompanying private Integrated Plan and some Term plans. It definitely takes up <5% of my expenses.

I am also prepared to shed them if premiums increase rapidly/unreasonably and self-insurance proves to be the lesser evil.

As for investments or growing my wealth, ILPs and endowment returns are not attractive simply because they are not going to exceed 4% or even 3.5% p.a.

So there is a case that one is probably better off doing Voluntary Contribution to CPF accounts. Since liquidity is probably not a major concern if one is considering ILPs or endowments.

Since we are on this topic, liquidity is the biggest bugbear I have with CPF. Many bloggers have been posting about their 2018 CPF interest lately. The interest can amount to $10k, 20k or even $40k but the problem is the money cannot really be touched or used if you have not satisfied the stringent age requirements.

This is why I have not harboured thoughts of topping up, at least not yet. That said, CPF interest has been really reassuring in 2018, a year when equities performed badly. The CPF interest we received definitely helped to prop up our net worth in a bad December.

It seems like a previous lifetime but it really wasn’t that long ago when I spent my 9 to 6 analysing CPF LIFE plans and their returns. A simple conclusion that I learnt? The society is better off with the Balanced Plan as the default but for an individual, it’s the Basic Plan. Go figure.

d. Any updates with regards to buying a car?

It costs at least $1,500 a month in Singapore to maintain a car. Does it generate more value from a cost-benefit analysis? Perhaps for some people or households but certainly not us.

We are working from home more and more often, rarely take public transport and definitely don’t suffer from the peak hour train crush.

Furthermore, we have stumbled on Audi on Demand. It allows us to rent a posh car for about $100 for four hours. Both the delivery and retrieval are done right at our doorstep so it just adds to our convenience.

Our ride on some days…

We have already used the service a few times and will likely book it once every month when we need to travel to inaccessible places on weekdays. Especially to run errands which require multiple stops. Public transport is a cheaper alternative but it can be time consuming and energy-draining with multiple transfers/waits.

And $100 for a monthly treat/indulgence does sound a lot more attractive and palatable than a $1,500 monthly sunk cost.

At the same time, on weekends, we shall continue to be “subsidised” by my in-laws, who drive a rather spacious Nissan Teana that can squeeze 4 adults in the back.

Investing

a. How are my investing returns so far?

Our equity returns for the past 8 years is about 6% p.a. It seems that I have greatly under-performed the index when you click on this link that shows that the STI has returned 9% p.a for the past ten years.

Even Hermione is shocked that 15HWW seems to be underperforming the STI ETF by so much!

But well, statistics can always be manipulated. The ten-year returns of the index right now is great because 2009 was a special year, the aftermath of the Great Financial Crisis (GFC). The index was below 2,000 in Jan 2009. The rebound was also quick because just a year later in Jan 2010, the index was up more than 50%.

So barring an exceptional year in 2019, in Jan 2010, the ten-year annualised return of the index is going to suck quite badly. Perhaps even below the CPF SA rate of 4%.

In comparison, I am doing not too badly. Perhaps on par with a total stock market ETF.

b. What is my investment strategy for equities?

To do well in almost any area in life, minimally, you need to know yourself well. One must be objective enough about his own strengths and weaknesses.

So at this point in the investment game, I am already playing not to lose. What do I mean?

Not exactly akin to parking the bus… but you get the idea

I am not expecting >15% annualised returns from my equity portfolio. Not even >10% either. It’s actually something more humble like 7-8% p.a. for my equities.

I know I will lose the game if I go for oversized returns and pit myself aggressively against most other stock pickers. The odds do not favor me. I am unlikely to be the top 10% of stock pickers that gobbles up >150% of the alpha. Yes, 150% is not a typo. Go figure.

I am not exactly nimble in the markets either so I only employ a long-only strategy. My holdings are a mix of ETF-like instruments and stocks and will continue to be so.

The Hang Seng Tracker Fund and Berkshire B will continue to be significant components as they are simple instruments to gain immediate and reliable overseas exposure to China and US respectively. As for local equities, I might actually reduce STI ETF over time and pick up the constituents instead.

Although I wouldn’t recommend a Vanguard fund (largely due to tax costs), I think it’s a reasonably good choice for most people too.

I actually have a piece of heuristic that has worked quite well so far for beginners and amateurs like me.

Don’t go for REITs, dividend counters or bonds with the highest yields (Top 10 Percentile)

The market is generally quite efficient in pricing these yields and if it’s unreasonably high, there’s probably a hidden trap somewhere. Don’t be a yield pig, avoid them if possible, especially if you cannot assess risks well.

I have rather humble goals for my overall portfolio (stocks, cash, bonds and gold). It’s simply bettering the CPF SA rate of 4% yet retaining ample liquidity and autonomy of the money.

c. How important do I think asset allocation is?

Unless you are willing to go vvvvv deep in investing (which most aren’t), asset allocation is probably more critical than stock picking. For instance, stock picking won’t save your ass as much as proper asset allocation. Asset allocation is typically a low-hanging fruit waiting to be plucked for retail investors.

I am not exactly a quant person (especially for picking stocks), but I do believe in relying on some quantitative rules for asset allocation. It takes the emotion out of the game and the rules can assist in protecting downside and also excel marginally at timing purchases and sales.

For instance, if you only have 40% exposure to equities, a 50% market crash would mean that you are only down 20%, which is tolerable. And if you have a fixed percentage allocation for different assets, rebalancing at the end of each year means you can achieve some semblance of “buy low and sell high”.

d. My thoughts on geopolitics and how it might impact the markets?

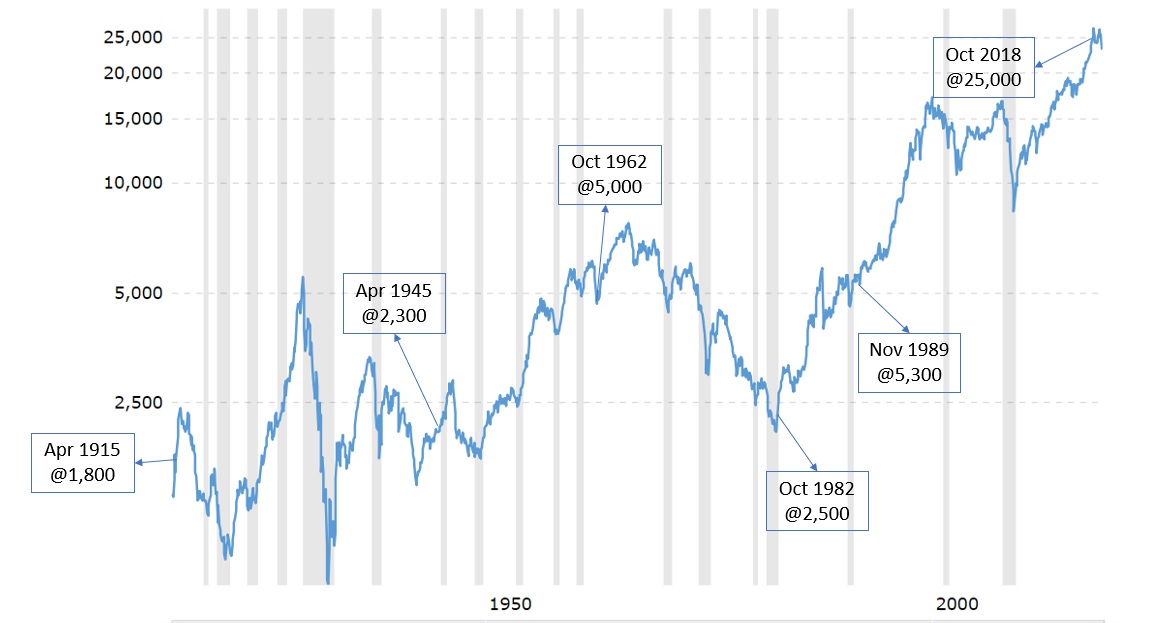

I like to do hindsight analyses and since we are at geopolitics, why not do one about the US for the past 100 years?

This is serious but fun stuff for me. No jokes and I have picked 6 key dates in the past 100 years for the Dow Jones Index.

April 1915(@1,800) to April 1945(@2,300)

If you were an American investor living through this period, you could call this the “Lost 3 Decades”.

World War I and World War II meant the stock market suffered great declines but not even the great wars were comparable to the damage of the Great Depression in the 1930s. The euphoria of the 1920s evaporated in the 1930s and there has been no harder landing for the US stock market since.

April 1945(@2,300) to October 1962(@5,000)

The rivalry of the two world powers, the US and the Soviet Union basically started after World War II and dominated the rest of the 20th Century.

But so what? After two full-frontal world wars, the start of the Cold War was chicken feet for the population. The American public rejoiced in the post-war boom, with mass exports to help in the rebuilding of Japan and Germany. The American economy flourished and the stock market duly followed, shaking off its lethargy.

October 1962(@5,000) to October 1982(@2,500)

October 1962 is considered the height of the Cold War due to the Cuban Missile Crisis. The Americans had a genuine fear that they were losing the Cold War and World War III appeared inevitable at many moments.

Increased investment in capital goods like the military, space exploration and satellite technology and infrastructure such as the interstate highways meant consumption goods took a backseat. Sentiment was poor and the stock market dived.

Interestingly, an American who made a one time investment in the index in 1945 would have made negligible gains after 37 years in 1982.

October 1982(@2,500) to October 1989(@5,300)

By the early eighties, the US was the only superpower left. But the American public probably did not know it then. Irrational fear of the commies remained widespread. Well, it’s always darkest before dawn.

To keep up with the US in the arms race in the sixties and seventies probably wrecked the Soviet Union economy. During this period, America was probably at its strongest and most powerful relative to the rest of the world.

As the demise of the Soviet Union sunk in, the Dow Jones doubled within a short span of 7 years.

October 1989(@5,300) to October 2018(@25,000)

October 1989 marks the end of Cold War with the fall of the Berlin Wall.

In the following three decades, the US was the undisputed world leader and there was little threat of any major world dispute. Nobody could challenge them. Peace and prosperity ushered in, capitalism and globalism seized the day and unparalleled productivity growth and wealth ensued.

The stock market has more than quadrupled in the past 30 years.

Thanks for bearing with my ramblings till now. You may ask, what’s the point of all this?

Basically, the stock market has been influenced by defining geopolitical rivalries, whether it’s the world wars (less impact to the US but an unmitigated disaster for Europe) or Cold War (maturing of US as a superpower)

I think the current US-China rivalry would define the 22nd century. At least the first half of the century. Nobody else is close to them, whether it’s economic, tech, social-cultural or political influence.

I doubt the competition to be numero uno would be a non-event when we look back at history. This will have major implications on the stock market and our investments.

Minimally, it would be Cold War 2.0 as China challenges US’s position. I doubt China would willingly concede to be 2nd although they might be willing to compromise to just bide their time.

From my understanding, geopolitics tend to be more zero-sum than win-win. As China catches up, it’s inevitable for the US leaders to be increasingly hawkish. The US will have to suppress China’s rise to preserve numero uno and the multiple advantages that position yields.

Key question: Would the US or China implode like the Soviet Union within a few decades of rivalry?

Blogging

a. What are my thoughts with regards to blog monetisation?

An interesting question floated on Seedly recently about whether financial bloggers would still write if they were not getting paid.

My answer is a resounding yes because the majority of local financial bloggers that I follow actually do not receive meaningful monetary compensation for the time spent on their writing.

For those that are raking in the $$$, I also think it’s largely well-deserved. They were willing to put themselves out there and be subject to scrutiny instead of remaining anonymous. I am sure effort played a bigger role than luck in their success.

As for me? Based on advertorials and blog-associated revenue, I calculate it to be about ~$5/hour for the time I spent writing on this blog in the past 5 years. So it’s really not been that lucrative.

A financial blogger/author/speaker that I truly respect and admire once told me that my biggest superpower is my efficiency. However, by not placing ads on this blog and rejecting most advertorial requests, I have left quite a bit of money on the table. Which is actually highly inefficient and quite unbecoming of me.

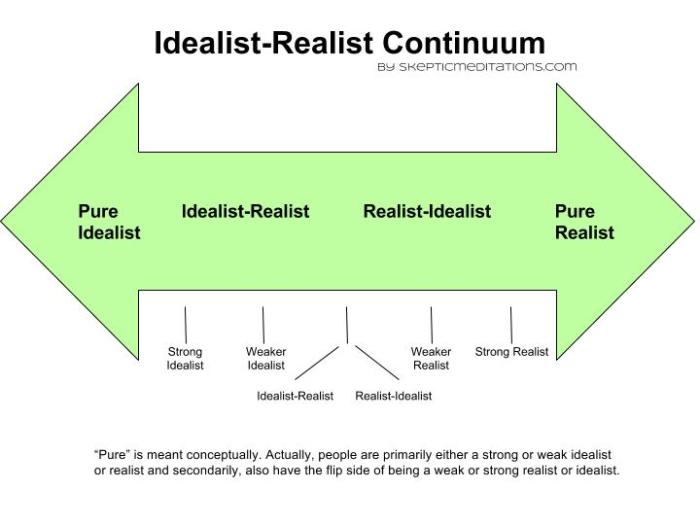

I have a theory to explain this behaviour, which is based on the idealist-realist spectrum.

In terms of sharing financial knowledge and my experiences, I am an idealist. I see this blog as something I do mainly for altruistic purposes.

So I am generally not very comfortable deriving income from this area. Sure, I have bitten the bait quite a few times when the gig is >$200/hour and a genuinely good product/service is being touted. But they have been really rare as it’s not easy to fulfil both conditions at the same time.

And I doubt I would ever want to derive income directly from my readers. Let’s say I charge $1k for some workshop/event. Somehow, I would see it as $$$ that the reader could have saved/invested rather than $$$ spent on vacations/bags/feasts. The former induces guilt while the latter implies I am providing a lot more value than alternatives

I am not trying to take the moral high ground here and I appreciate that there is some cognitive dissonance going on. Because I am a pretty strong realist in the field where I derive my main income. For instance, I always see the fees I charge parents as $$$ that provides exceptional value to their family in the long-term.

Perhaps since this is not my bread and butter, so maybe that’s why I can afford to be an idealist and continue to romanticise financial blogging.

b. How I have benefited from blogging?

Well, as seen from the above, we might all need an area in life to be idealistic about. But really, most things are motivated by personal interest. Including the birth of this blog.

When I started this blog 5-6 years ago, it was an outlet to express my frustration and to receive some form of encouragement or validation. Hey, I was pretty angsty then. I was cringing when I read this again recently.

On hindsight, through writing, I learnt more about personal finance and investments, since writing clarified my thoughts and decisions. I am my biggest own fan and I doubt anybody has read my writing as many times or as carefully as me.

This blog has also given me ample opportunities to meet people and form friendships with a subset of them. A common personal criticism that I receive from friends is my reclusiveness, aloofness and general unwillingness to “open up”. Not surprisingly, since I am a typical INTJ.

However, the natural camaraderie that I share with some financial bloggers has been truly invaluable. I can only conclude that writing a blog is really one of the best ways to reach out to like-minded people.

c. Why I am taking a break from blogging?

I am not sure whether “despite” or “because of” is a more appropriate word to use here.

But basically, I am being ultra-rational here and the many benefits listed above are all suffering significantly from the law of diminishing returns.

For instance, with a higher satisfaction in life, there’s less to rant, write and preach. Personally, in terms of personal finance and investments, there’s also less and less to learn and clarify. Being well-prepared, it’s basically become a waiting game, whether it’s a bull or a bear market.

Moreover, if I were to apply the trending KonMari method, more than half of the articles written in the past year did not “spark joy”. (Yes, I managed to be on trend!)

On a more serious note, writing on this blog felt more and more contrived. It’s became like a burden, having to write to live up to the identity of Mr 15HWW and remain relevant as a financial blogger.

Of course, this post is different. But heck, it really took a lot of time to conceive and plan and edit.

I have also come to realise that the adage “All things considered, it’s better to be anonymous than famous” holds a lot of wisdom for me. I am ok with being transparent yet anonymous. However, if anonymity is increasingly being compromised, I would rather become invisible.

More like Harry with his invisible cloak rather than The Hollow Man though, ahem.

If I were to ever get my hands on an invisibility cloak, I promise to be more like Harry!

Well, because I am not evil!

So, in light of all this, I will be enforcing minimally, a six month writing break from this blog.

d. What I am going to do with the free time?

Well, everything that you can think of that’s part of everyone’s new year resolutions.

Whether it’s reading, cooking, exercising, or sleeping more. Let’s see how things go in half a year’s time.

But mainly, I will be focusing on bringing more of my A game to my teaching. Sidetracking a bit, but one of the things that I am truly surprised by this blog is its failure to generate even one “sales lead” for me! So I need to do myself justice with one last pitch…

Hey, readers, I am really a good tutor. If you or your child stays in the Northeast area of Singapore and requires academic mentoring, drop me an email! (Even though I only have one or two slots left for this year.)

Bringing more and more of my A game to the tutoring table!

For the next couple of years, I am likely to tutor a bumper crop of A Level students (since those who wanted to enter JC did pretty well for their O’s this year). As I am helping the bulk of them with multiple subjects, I will turn back the clock by 15 years and mug like a JC student along with them.

I will also try to steer clear from gaming, despite the multiple jio-ing from students. I still believe that’s potentially a bottomless pit for me. Maybe, just maybe, if Liverpool wins the league title, things might change. I might allow myself to get a PS4 and indulge in a season of FIFA to commemorate and replicate their success.

As always, thank you for reading! Wishing everyone a great 2019 ahead!

天下无不散之筵席 – Mr 15HWW

All the best for 2019!

Have a great break and when inspiration comes and you feel like it, write something. 😁

I’ll definitely miss your articles.

Great to see you post again!

Thanks for the tip on car rentals! I have no intention to buy a car in SG, and renting could be an alternative to PHCs/taxis/public transportation in certain situations.

Curious to know your reasoning behind not buying the ETF for your equities, since it’s much simpler than picking stocks and frees up time to focus on other things.

Personally, I’m picking stocks because despite the odds, I still want to beat the market over the long term. I’m currently beating the market by 5 – 10% over the short term (6 months) since I started. However, if I do not beat the market by significant margins over the long term, I would seriously consider just buying the ETF and spend my time and effort elsewhere.

I should also add that there is also a luck component in investing, since the short term returns of the market is almost impossible to predict. My beating the market could very well be beginner’s luck instead of me actually being good at stock picking. My returns could be lower than the market after a few years.

Actually took a look at the STI (ES3) and it’s roughly the same level as 8 years ago, so it’s returns are actually only from the dividends (2-3%), which means your returns actually beat the market!

Hi WGM,

No la, cannot cherry pick and compare like that too. I have HK and US stocks, so my guess is it is not far off from a world index.

Sad to see you go, but all the best with your future. Truly amazing post. 🙂

Love your blog so much. Cheers to a great 2019!

great post. i think retiring in Chiang Mai is totally doable and could be a fun adventure! i’ve lived in thailand for the past decade and it’s really easy commuting to fro Singapore. give it a thought perhaps 🙂

Welcome back. Possible to elaborate on why Cpf balanced plan is better for society, but for individual the basic plan is preferred?

Hi,

For CPF Balanced plans, there is more risk pooling, so the people who live longer are sort of taken care of by the people who pass away earlier.

But as individuals, unless one is altruistic, one would not want to subsidise strangers. If pass away early, rather bequest to children.

What a massive update! Chiang Mai is already so full of digital nomads though – how about another city? Danang? Somewhere in the Philippines? Or how about buying a small house in a city in Sicily for a cool SGD 75,000? Or renting one cheaply? Sunny and nice weather, friendly locals and amazing food at cheap prices + cheap flat tax for retirees.

Biggest surprise of the post for me were the SSB rates – they sure have changed the last time I looked! 10 years average yield is similar, but we get to enjoy 2% right from the start now – nice.

Hi singvestor,

Thanks for the suggestions. They would come in handy when I want to take a one year sabbatical away from Singapore!

All the very best for a glorious 2019 on both your professional and personal side. Follow your instincts. And enjoy it.

Be sure to come back and write once in a while?

You are an inspiration to many, including me 🙂

That’s a very long and detailed post. Finally finished reading it.

I have been an avid fan of your articles and will certainly miss it. You definitely deserve a break from blogging. Because there’s so much more to living your life!

Hope you have a great 2019 ahead!

Cheers!

i will really, totally miss your blogposts… and btw i really enjoyed this long piece, it felt as though you’re sitting there talking to me as i read your thoughts.

my fave section is the Personal Finance part. hehe, i also like the ending part ^^

thanks for blogging all these years, and hope you’ll still do the occasional pop-up online!