Many years ago, I had assumed that the journey to wealth is a meandering linear path. Slowly and steadily, wealth stacks up. Dollar by dollar.

What I failed to take into account then is the declining utility of every next dollar.

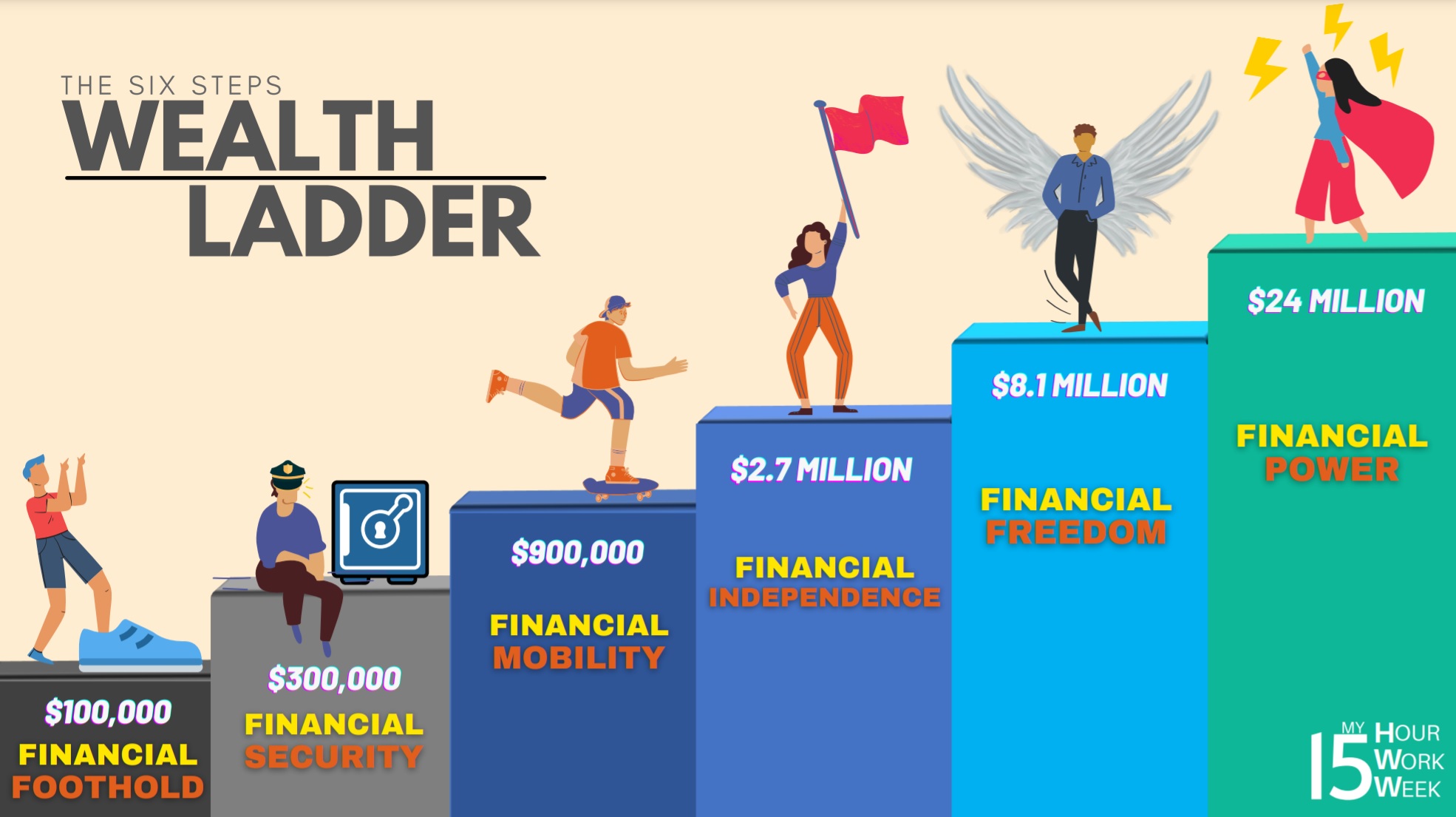

So instead of a linear path, I have updated my views and now believe that a wealth ladder is more appropriate. Simply because:

“It takes a giant step in wealth to fundamentally alter how we live our lives” – Nick Maggiulli (www.ofdollarsanddata.com)

The question is, how BIG is that giant step? How much more do you need to accumulate to experience a fundamental improvement in your life?

Is it more like a leap whereby we have to multiply our networth by 10 times for each upgrade in lifestyle? This appears extreme at face value, but that’s what Nick suggested in his article.

My experience and intuition suggests that a more reasonable approach will be to adopt a scale in between the linear and logarithmic scales. A multiple of three appears to work well to develop and explain The Six Steps Of The Wealth Ladder.

(Infographics courtesy of Mrs 15HWW)

Below are further elaborations on each step of the Wealth Ladder.

Step 1: Financial Foothold ($100k)

As mentioned previously, the first $100k matters and it’s good to get it out of the way as early as possible. This is where you lay the basic foundations of wealth and build important habits like saving a significant proportion of your income.

Possible Paths:

Income and saving rate are the key levers here.

- 10 Years – Save $10k a year

- 5 Years – Save $20k a year

- 2 Years – Save $50k a year

Saving the first $100k is an important milestone and gets you a strong foothold at the start of the wealth ladder.

Step 2: Financial Security ($300k)

Using a simple 4% drawdown rule, that’s $12k a year and $1,000 a month. Having this level of wealth will probably allow you to cover the bulk of a HDB mortgage, your food expenses and utility bills. The basic needs in life can be taken care of with $300k.

$1,000 a month is incidentally also a close peg to current CPF LIFE payouts.

Possible Paths:

Besides income and saving rate, investment return starts playing a role here.

- 20 Years – Invest $10k a year at 5% p.a. return

- 10 Years – Invest $20k a year at 8% p.a. return

- 5 Years – Invest $50k a year at 12% p.a. return

Building up your first $300k is a critical milestone and provides a secure safety net to reach higher up the wealth ladder.

Step 3: Financial Mobility ($900k)

Using the same 4% drawdown rule, that’s $36k a year and $3,000 a month. This might be Lean FIRE territory for some, especially if there is a partner who has also accumulated a similar amount.

$3,000 a month does not project an image of comfort for most Singaporeans. I also know of very few people who voluntarily drawdown on such an amount, especially if they are below 45.

Regardless, $900k would definitely grant someone plenty of options and flexibility in life. Whether it is downshifting your career, an extended sabbatical or travelling overseas for a few years.

Possible Paths:

Income and investment returns start to matter more here.

- 25 Years – Invest $20k a year at 5% p.a. return

- 15 Years – Invest $30k a year at 8% p.a. return

- 10 Years – Invest $50k a year at 12% p.a. return

Accumulating your first $900k is a momentous milestone. Most Singaporeans’ wealth journey will not extend beyond this step.

Step 4: Financial Independence ($2.7 million)

Using a more conservative 3.5% drawdown rule, that’s $94.5k a year and $7,875 a month. This is ample for an individual and might even be enough to cover an entire household’s monthly expenses.

Many might argue that $2.7 million seems excessive for Financial Independence.

However, after reading this long and gut-wrenching post and experiencing the inelastic demand of private healthcare myself recently, I would definitely not label $2.7 million as FAT FIRE.

Furthermore, based on my observations, many prominent local financial bloggers accumulated this ballpark figure before they retired in their 40s. They are also obviously not spendthrifts.

Possible Paths:

It is about being a master optimiser in income, saving rate and investment returns here.

- 30 Years – Invest $30k a year at 8% p.a. return

- 20 Years – Invest $50k a year at 12% p.a. return

- 15 Years – Invest $70k a year at 15% p.a. return

Racking up $2.7 million in your lifetime is a remarkable achievement. That is Financial Independence and one might not need to earn a single cent after that.

Step 5: Financial Freedom ($8.1 million)

To put things into perspective, even big lottery winnings might not get you here. This is also where we approach “Elite” stage, where most of the aspirational desires of typical Singaporeans can be fulfilled.

A swanky apartment in central Singapore, a high-end continental car, holidays flying business class, tuition fees to the best overseas colleges for your children. All of these would be well within reach.

Possible Paths:

You are NGMI if you are just relying on being an optimiser. You would need to be elite at either earning income or obtaining stellar investment returns.

- 35 Years – Invest $35k a year at 10% p.a. return

- 25 Years – Invest $60k a year at 12% p.a. return

- 15 Years – Invest $80k a year at 24% p.a. return

This is what I define as FAT FIRE and reaching Financial Freedom means material trade-offs are few and far between.

Step 6: Financial Power (>$24 million)

This is unicorn territory. Prices do not matter anymore, unless we are talking about status symbols like yachts, sports cars or “reasonably-sized houses”.

At this point, one could also start yielding substantial influence and power.

It starts with the family and will surely extend to your friends. Your views will be worth more than “2 cents” and your words might even impact society once you start transcending the UHNW barriers.

Possible Paths:

This is beyond my pay grade. Realistically, only a few ways to get here. Successful entrepreneurship, C-suite income or legendary investment returns.

What I am illustrating below is not realistic at all. Maybe to show how difficult it is for the man on the street to achieve it.

- 35 Years – Invest $50k a year at 12% p.a. return

- 25 Years – Invest $80k a year at 18% p.a. return

- 15 Years – Invest $100k a year at 35% p.a. return

With Financial Power, thoughts of legacy-building might start to dominate. Or maybe if you are young enough, exploring options to reverse aging.

Conclusion

My stance is every 3x increase in your net worth will allow you to take a step up in this wealth ladder. A step up will likely result in the ability to improve standards of living for you, or even the people around you.

And I would advise you to aim at least one rung higher than what you think is realistically possible.

Good luck to all who are climbing this ladder!

Thank you for reading.

This is a great illustration! I’ve always projected somewhere between $5-10m for a comfortable retirement.

Hi Vincent,

Thanks for the comment!

Your goals before you reach 30 are pretty inspiring! All the best for “Three Guys Brew”!

Bro,

Why financial freedom need 8m? Very tough to achieve.

Best regards,

Jason

Hi Jason,

Nice blog you have there and it’s my first time reading it.

Anyway, Financial Freedom is likely a stretch goal for most people. At this stage, it’s about nice houses, cars and schools. For some $5m to $6m would be enough.

But I would say $2m to $3m would not be enough. That is likely just Financial Independence and have to be quite careful with fulfilling “wants”.

Hope the above clarifies.

Thanks for this article! I like how this article helps to put things into perspective.

By the way, welcome back to the blogging space. Been reading your blog for a few years and I’m glad that you are blogging regularly again 🙂

Hi Jason,

Thanks for the kind comments. Enjoying your data-driven articles too!

independence and freedom are synonymous for most people. Perhaps, choose something else to aptly distinguish these 2 huge tiers (i.e. normal fire vs fat fire sound honestly more clear).

Hi DC,

Thanks for your suggestion and you definitely have a point. I was also considering the nuances between the words and eventually settled for what you read. Starting each stage with “Financial” was something I decided to stick with.

Hopefully the description for each stages helped to provide more distinction between them!

Hey ptrick

Great write-up. Just wanted to clarify one thing on the wealth ladder post you recently posted.

1) From Financial Independence onwards. Is this wealth ladder so u refer to cash/liquid/investment saving? Or do you include house/property/CPF SRS etc in this as well?

The reason I ask this is this there are many ppl owning property(s) that is close to 1 m and have CPF saving which is 200 – 600 k ( mostly SRS SA and MA). That takes them to ~$1 m+ already. However, they live on that property and are 10 – 20 years away from touching CPF/SRS. . This kind of distorts the whole picture. my assumption is In terms of cash and investment saving they will be in the 400k to 600k range.

so I would love to hear your views

PS: I came to this post as Patrick Teo posted this in his telegram channel recently