I know, I know.

I am a decade past my mid-twenties so this is akin to a Boomer proselytizing to the Zoomer generation. But well, I still receive emails occasionally from peeps who are starting out in their financial journey.

So this is me trying to put myself in their shoes and empathise with their situation. Or maybe you could consider this a letter to myself 10 or even 5 years ago.

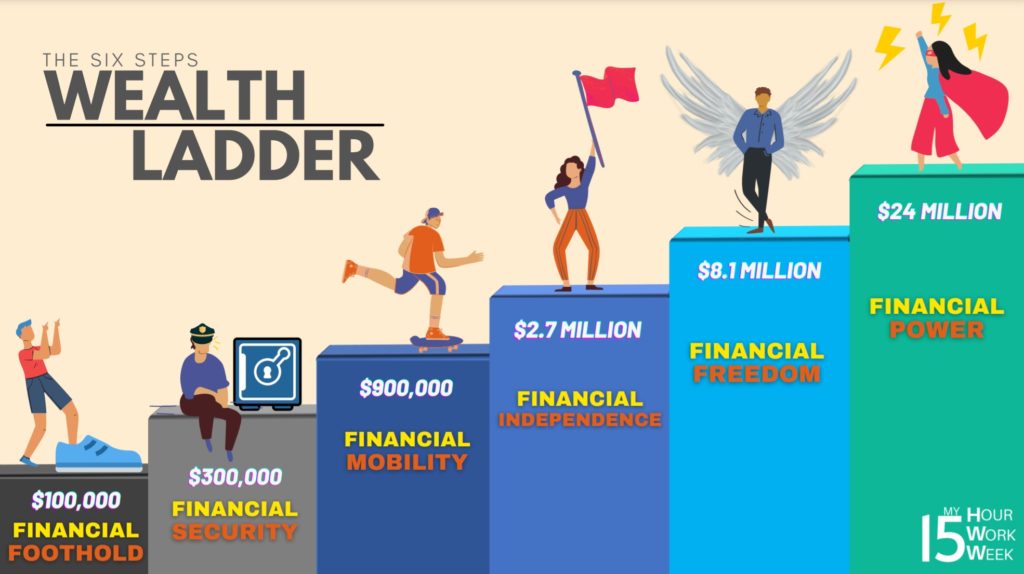

Just a note, everything written here is not financial advice and just my humble opinion. And my view is that $100k is an important milestone but at the same time, probably only gives one a basic financial foothold in the wealth ladder.

Therefore, at this stage, my overarching philosophy is to think bigger. Keep your investments simple and focus on increasing your income.

Singapore Stocks – 20%

I know that the current narrative is that Singapore stocks could be a poor bet for long term investors.

But well, it could pay to be a contrarian at this stage. The narrative could easily flip over the next few years. Firstly, you cannot deny the home ground advantage. No currency conversion friction and of course, no capital gains tax.

If you are a Singaporean, it is also less complicated starting out your investment journey on the SGX. And with only $20k, I don’t think one needs to look beyond the STI ETF.

Singapore is a financial services hub and even if you are just bullish on ” Singapore Banks and Reits” (like me), the STI ETF is already probably ~60% dominated by these two sectors.

US Stocks – 20%

The flavour of the decade in the tradfi stocks universe, the S&P 500 more than doubled and QQQ (Nasdaq) more than tripled in the past 10 years.

All-Time Highs (ATHs) are breached pretty consistently and experts preaching “reversion to the mean” have been consistently burned.

I personally believe there are three contenders for a $20k allocation here. If you are aggressive, you can go for QQQ (tech allocation). Something more moderate will be SPY (S&P 500) and if you are more conservative like me, Berk B could work (tax benefits with no dividends and lower volatility).

HK/China Stocks – 20%

Battered badly by all the fear, uncertainty and doubts (FUD) after the Chinese government imposed what was considered “draconian” regulatory actions by West. So the HK/China market is obviously a value play compared to the US market.

In fact, I wrote about why I added the iShares Hang Seng Tech ETF a week ago. So that’s an obvious choice if you believe Tech is going to continue to eat up the world.

Otherwise something more bread and butter would be the HK Tracker Fund (HKG 2800) that would include the banks and consumer staples.

Crypto – 20%

Crypto is my ultra learning project for 2021 and it’s been a great learning journey thus far. I feel like by attaching 20% or $20k here, I am being very conservative. Mainly to pander to the mainstream audience.

In case you think you are very late to crypto, let me reassure you that you might not be. Opportunities still abound and just over the last week, I managed to pick up a 10x in a very small bag. Yes, no typo here. 10x within 7 days.

Work and start-up potential is also huge. I have seen a close friend begin a project just three months ago and his effort is starting to be recognised by the big players in the universe.

So if you just want to dip your toes in this space, just start stacking Bitcoin, Ether or even stablecoins. You can always level up thereafter.

Cash – 20%

You are in your twenties and having cash is not meant to be a conservative measure. It’s just a call option to pursue potential opportunities.

Whether it’s seed money for a potential business opportunity, quit a job and take a sabbatical, or capital to go full-time in a nascent industry like crypto.

You are starting out and the world is your oyster, especially if your background and situation provides you with a solid base to take more risks in your life.

Remember, even if you lose it all ($100k) at this stage of your life, you will likely earn it all back within a few years or even less.

Let me reiterate again. Focus your efforts on exploring opportunities and attempt to scale a few potential income sources. Unless you are confident you have a tremendous edge even with a small capital, the optimal play is to keep your investments simple with proper diversification.

Thanks for reading.

Related Articles:

Comparing CPF, Stocks and Crypto Returns

This seems like a low maintenance and diversified portfolio! Personally, i do 20% SG banks, reits, then 30% cash (both as hedge) and then 50% crypto!

I gave this some serious thought a couple of years back when I hit the big 3-0.

I was blessed with a great job – had 100k in investable assets after 2 years of work, but did a shit job investing (8 yr IRR OF 1.9%) for ~8 years as I was 90% SG and 10% cash.

If I can go back in time – I would diversify more aggressively – 15% SG, 50% US and 40% China

With age, i’ve come to recognize how small a market Singapore really is and how over expose I was to the SG market (CPF, Housing, etc.)

Oh well, hindsight 20/20

Best,

JW