I think it has been a good first quarter in 2021 for most local investors. Singapore equities finally showed some signs of life.

Despite venturing out to the US and HK market, I still have the biggest exposure to the Singapore market. So needless to say, I have also benefited from the rising Singapore tide.

Here’s the 15HWW Investment Portfolio:

Annualised Return: 9.8% p.a. (Nov 2010 to Apr 2021)

It does appear that funds are starting to rotate out of sexy and story stocks and into the laggards. Some of my holdings like DBS and Haw Par climbed >10% since the previous update three months ago. They joined Berkshire B and Facebook as stellar performers.

This helped to offset some of the pain in my HK holdings. Chinese tech giants, starting with Alibaba, are realising the need to kneel, as the CCP waves its whips around. Basically, you are screwed if you ever put profits before the well-being of the state.

This did not bode well for the share prices of Alibaba, Tencent and Ping An for the quarter. Share prices of all three declined by ~10%.

The portfolio value increased slightly and the annualised returns is inching closer to that magical 10% mark. Except for making multiple small purchases using the Moomoo platform, it has been an inactive quarter, just as expected.

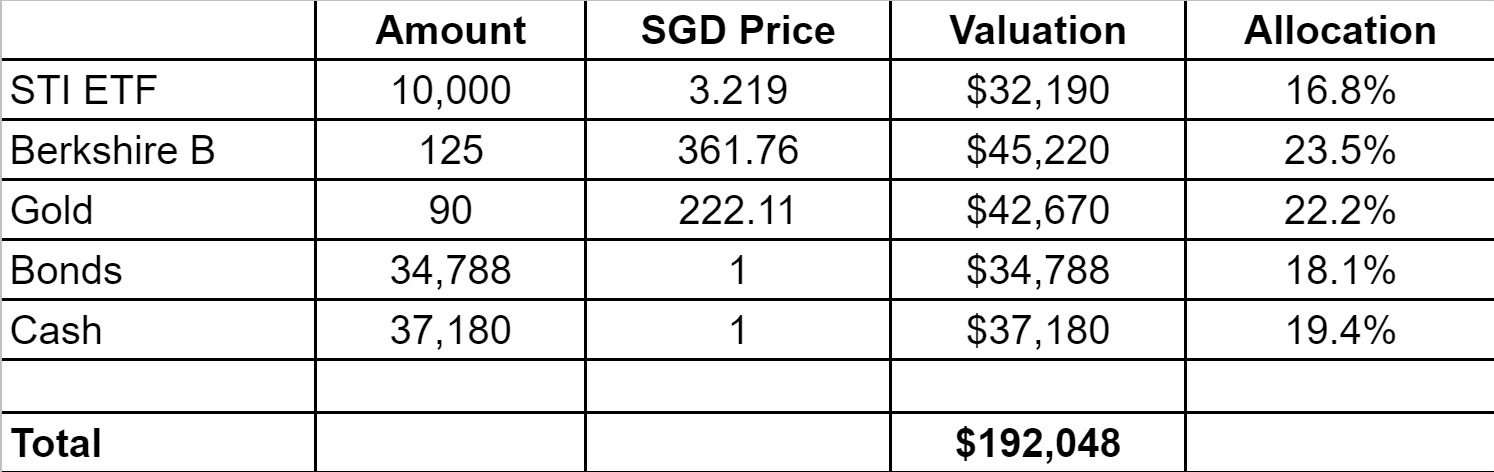

Here’s the 15HWW Permanent Portfolio:

Annualised Return: 5.9% p.a. (Jan 2017 to Apr 2021)

Significant gains for both Berkshire B and STI ETF helped to more than offset Gold’s small decline. With an exceptional quarter, Berk B’s valuation is now above that of Gold.

Uncle Warren is winning against the goldbugs, at least for now.

As a result, the annualised return of this sub-portfolio has been massively boosted to 5.9%. This is a great return for what I consider to be defensive and low-volatility part of my overall portfolio.

A sign of the times, perhaps.

Till the next update. Thanks for reading!

Related Articles:

One Reply to “Investment Portfolio Update: April 2021”