Most of the people I know identify themselves as the “sandwiched middle-class”. Not surprisingly since in Singapore, it probably covers anyone between the 20th and 80th percentile.

Anyway, I think the term “middle-class” is so broadly defined nowadays that I feel it is necessary to subdivide it further so that instead of just 3 categories, we get 5 quintiles on the social ladder instead:

- Lower (0 to 20th percentile)

- Lower Middle (20th to 40th percentile)

- Middle (40th to 60th percentile)

- Upper Middle (60th to 80th percentile)

- Upper (80th to 100th percentile)

The majority of this blog’s readers is likely to span across the three middle quintiles. If you are at the bottom and reading this, there’s probably more pressing concerns like earning a higher income. And if you are at the top, I doubt you get much value out of my writing.

The three middle quintiles are more relevant to this blog. For example, Lean-FIRE is probably at the lower middle class and Fat-Fire at the upper middle.

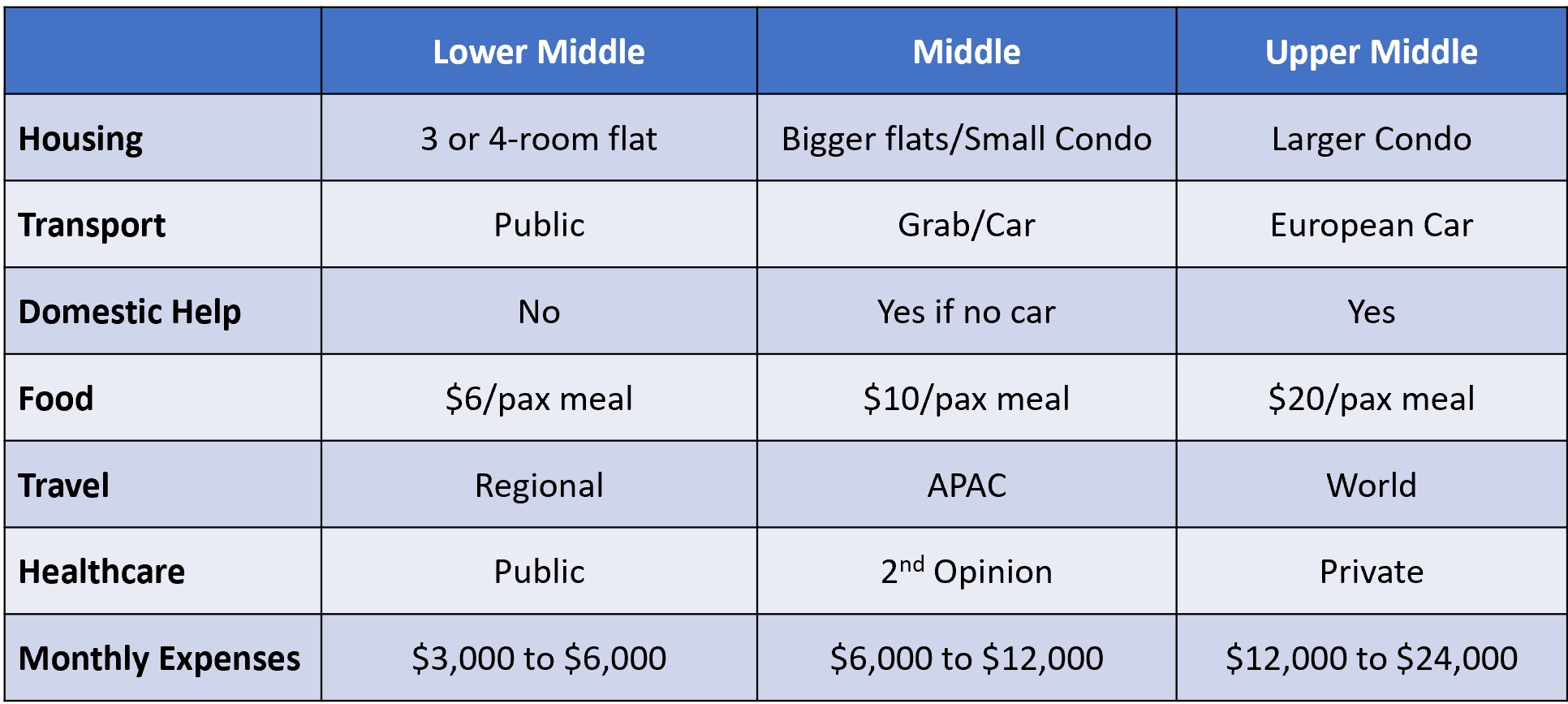

Let’s take a look at my attempt to segment and dissect the middle class lifestyles.

A table/diagram speaks a thousand words.

Some caveats:

- Obviously, for most households, it is unlikely for all types of expenses to fit nicely under one specific column. But one column is likely to resonate stronger with you.

- The range for the monthly expenses is pretty big since it is dependent on the size of the household and the number of dependents (elderly parents, children etc.)

- A person could earn $100,000 a month and live a lower-middle lifestyle. I am just looking at expenses and material lifestyle.

- This just covers the material standard of living. Someone in the lower quintile might be leading “happier”, “less-stressed” or “more fulfilling” lives. As I always tell my Econs students, do not forget about the non-material standard of living!

Lower (0 to 20th percentile)

Cannot afford.

Struggle to afford.

Or worry about affording the lower-middle class lifestyle.

Growing up, there were probably times when my family probably fell under here and I believe the ruling party’s primary mandate for the first 30 years of their leadership was lifting households from this financially dire situation.

Lower Middle (20th to 40th percentile)

This household typically stays in a smaller public flat that is <$500k in value. Location probably not near to town.

The family relies largely on public transport (buses, trains) with the occasional taxis/grabs. No domestic helper and on average, the cost of each meal per person is less than $6. The default is a home-cooked meal or dabaos from hawker/food-centre.

Trips to JB or nearby South-east Asia is the norm for vacations.

The budget for healthcare tends to be tight and the family will likely turn to polyclinics and public hospitals when the need arises.

For such a lifestyle, monthly expenses will likely range between $3,000 to $6,000, depending on number of dependents.

Middle (40th to 60th percentile)

This household typically stays in either a large public flat that is >$500k in value or a small EC/condo. Depends on whether the family values space or facilities/prestige more.

The family is likely to have to choose either a typical Korean/Japanese car or a domestic helper. Highly unlikely to be able to afford both long-term. On average, the cost of each meal per person is about $10. Probably a few restaurant visits in a week.

Annual trips to APAC destinations like Taiwan, Korea or Australia would be on the cards, if not for the pandemic.

With hospitalisation insurance, if a serious medical issue arises, the household can seek a second opinion and if the diagnosis or treatment is not too dissimilar, might return back to the public option to save on costs.

For such a lifestyle, monthly expenses will likely range between $6,000 to $12,000, depending on the family size.

Upper Middle (60th to 80th percentile)

This household typically stays in a nice private apartment in CCR or OCR. Maybe has aspirations for a landed property or what they say, “a reasonably-sized house”.

The family is likely to enjoy a nice German car and employ a domestic helper to take care of time-consuming household chores. On average, the cost of each meal per person is probably about $20. Nice home-cooked meals could be the norm mixed with splurges at atas restaurants.

Multiple trips to pricier destinations like Japan, Europe or North America are typically scheduled within a year.

Would almost always turn to private medical care to seek better treatment or at the very least, save on the waiting time.

For such a lifestyle, monthly expenses will likely range between $12,000 to $24,000, depending on the family size.

Upper (80th to 100th percentile)

Beyond upper middle.

We are talking about landed houses, luxury cars, ski trips, degustation menus etc.

Almost definitely beyond this blog’s scope and focus.

Where The 15HWW Household Stands

Currently, our expenditure pattern puts us right smack in the middle class.

However, for the bulk of the past decade, we were probably more frugal and closer to living a lower middle class lifestyle. A key priority would be to ensure that we never fall before the second quintile.

If we were to semi-retire today, lower middle would also be the lifestyle we have to pursue to ensure the money lasts.

That’s probably why both of us are still working and hustling hard, as we prefer some of the comforts of the middle class and also value certain aspects of the upper middle class lifestyle. Try guessing which ones they are!

In the end, like most things in life, it’s about the choices and trade-offs we make. Learn to optimise for the lifestyle you need/desire.

Thanks for reading!

Related Articles:

5 Revelations After 2 Years Of Car Ownership

Birthday Post: 35 Things I Am Grateful For