This is the second of a series of a quarterly updates on where I would park SGD200,000 on this blog. Yes, I know am a month late and with the alternative of spending time with my toddler, it just takes increasingly lots more willpower to log in to the blog.

So here is a quick update on where I would allocate the cash.

SGD100,000 in UOB One Account (~5% p.a)

No change.

There is a SGD100,000 cap for the UOB One Account, otherwise I would be tempted to just dump the entire SGD200,000 inside. The first SGD75,000 is also guaranteed by the government although counterparty risk for UOB deposits should not keep anyone awake at night.

Only two requirements, credit >$1599 salary and spend $500 on a UOB credit card, which are really easy to fulfil. There are also ways to get around it (google online?) if you find the above criteria hard.

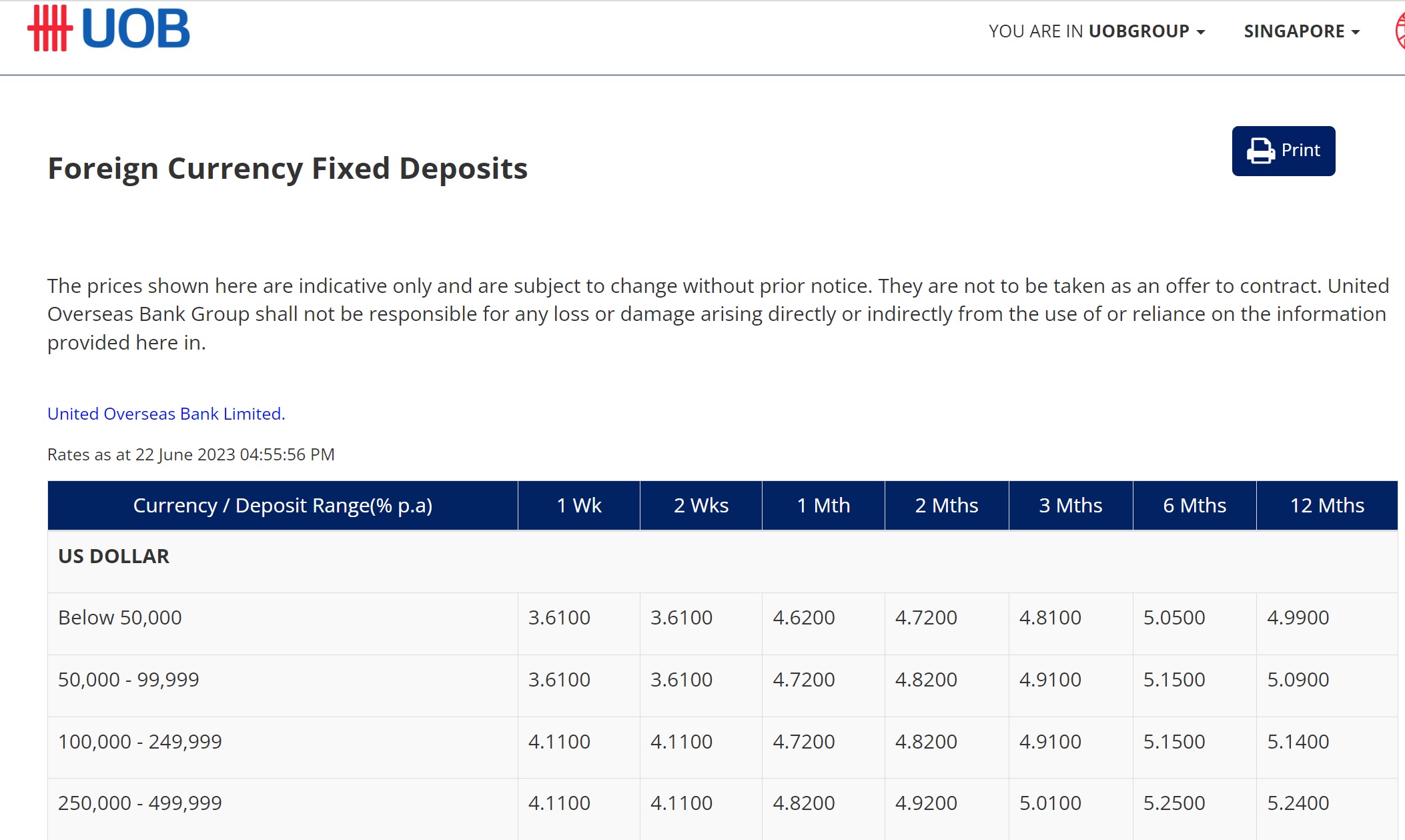

USD 50,000 in UOB 6-Month Fixed Deposit (~5.15% p.a)

No change and 3 more months before the Fixed Deposit matures.

Honestly, if I were really rich, I would almost surely dump US$1m into 20-Year Treasury Bills at >5% yield. USD 4.5k a month would settle most of the basic expenses of a household for the next 2 decades. Ain’t that sweet?

As mentioned above, holding extra counterparty risk with UOB does not raise alarms for me.

SGD33,000 in SSB (~3.3% p.a)

With the closure of MoneyOwl, I have cashed out of the 4% Fullerton SGD Cash Fund and to keep things simple and avoid counterparty risk or hassle, decided to park it with the latest issue of the Singapore Saving Bonds.

3.3% rates for 10 years is decent and there is downside protection in case rates go up again, since one can always redeem older issues at par.

Conclusion

In case it is not obvious, I would never claim that this is the “best” way for anyone. Firstly, some people will claim that one should not have so much spare cash on the side, while others will think 200k is peanuts (Fixed Deposits and T-bills have no cap). And then for instance, some might think it is a hassle to have three separate accounts while others might think I am not diversifying enough.

Nonetheless, what I have suggested above is very similar to what I am doing in real life too, in case you are wondering.

If there is any compelling alternative or long-term promotions that are worth making an effort to further optimise my cash, do drop a comment! Will really appreciate it.

Thank you for reading.

hi there!

I would love to hear more about your toddler! I have one too and it is just one of those amazing times.

it would be great to read your financial blog with family perspective, maybe encourage others that having kids is not scary at all, but just… awesome. it’s also a kind of risk taking and kids are real assets!

cheers

Lara