For a better understanding of the background behind the two portfolios below, please refer to this post that was written in May 2023, when I kickstarted this $1 million retirement portfolio.

With the preamble out of the way, let’s take a look at the two portfolios’ performance for the past quarter.

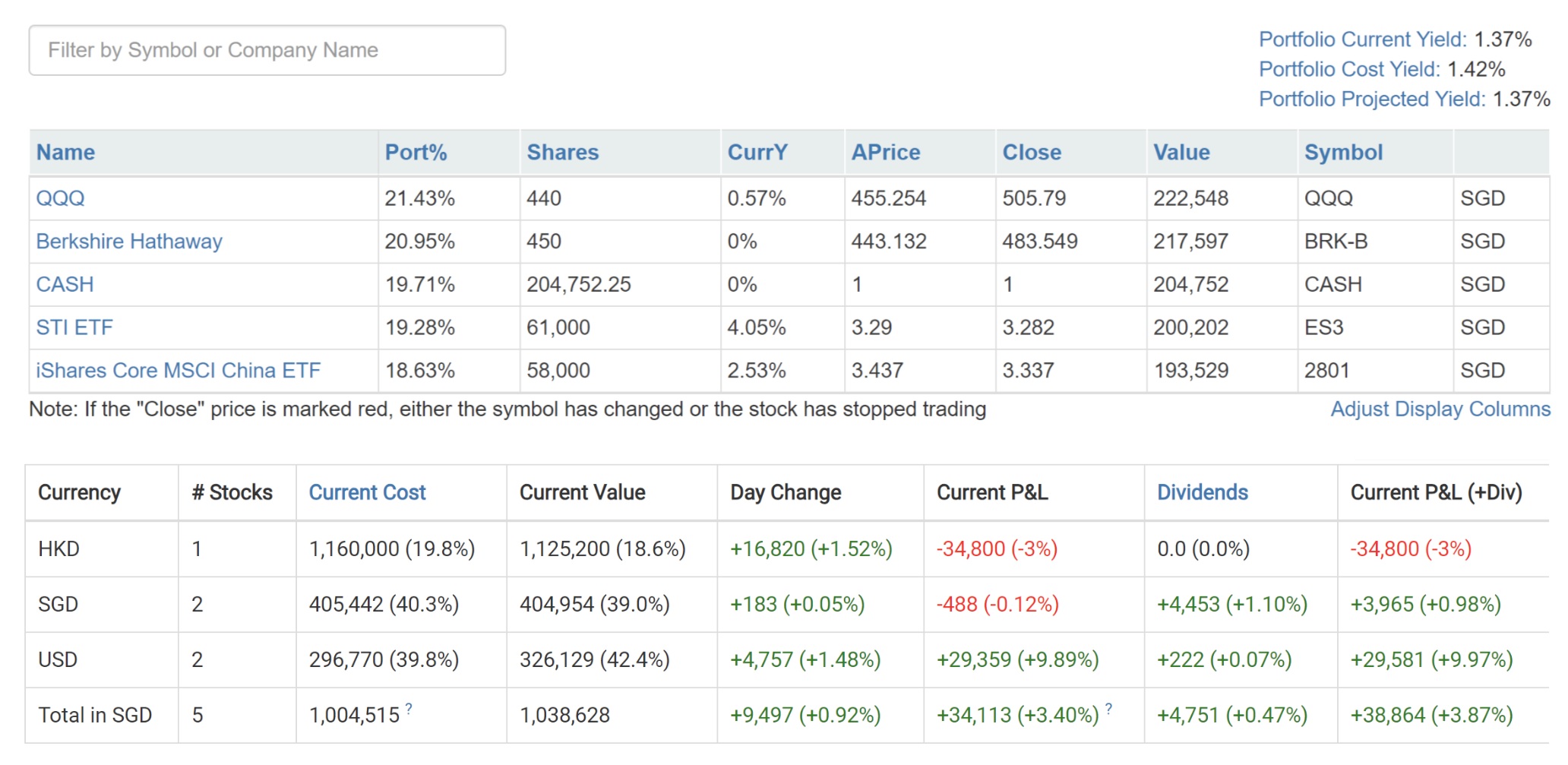

$1 Million ETF Portfolio

This is the default portfolio and it has done well, up ~4% in the past three months. The Singapore portion is flat, China/HK is down and US equities have really helped to propel the portfolio forward, up a significant 10% over the past quarter.

Unsurprisingly, with a heavier weightage in US equities, the ETF version has outperformed the Dividend version.

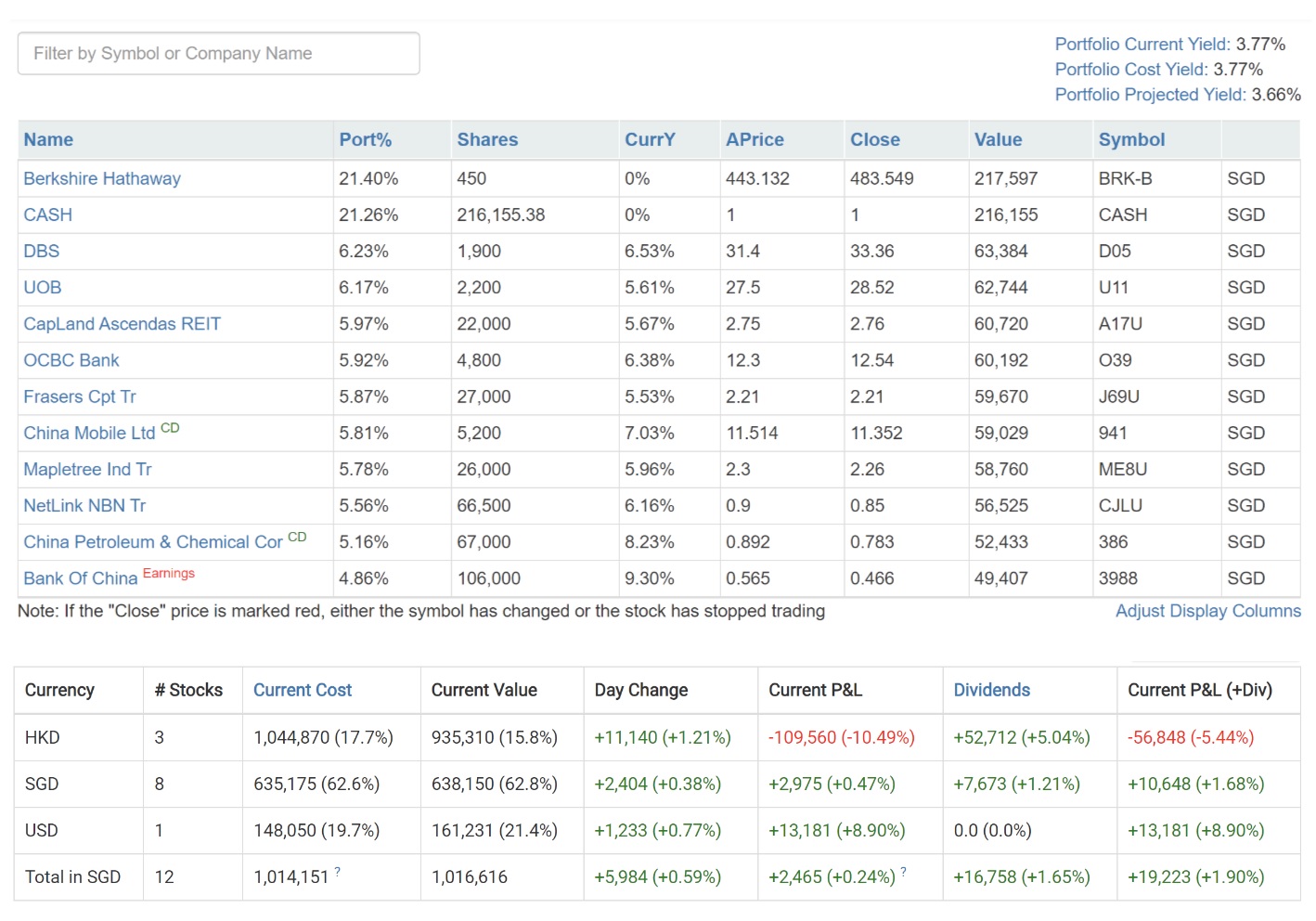

$1 Million Dividend Portfolio

Even after eking out a cumulative 16k dividend from June to Aug, the Dividend portfolio is still ~20k behind the ETF version. Well, if it is any consolation, it is at least still green.

At this moment in time, I hardly know anyone who is actively and spontaneously adding Chinese/HK stocks after quite a few false dawns. They seem to have lost any investable narrative and most international investors are avoiding them like a plague. I am pretty shocked that the BOC position can be in the red by almost 20% within just 3 short months.

If there is a turnaround (i.e. 2x, 3x or even 4x within a short span of a few years), I would definitely not begrudge those that are heavy in them. Probably hats off!

Conclusion

If you find the above useful, do use it as a reference but do not blindly copy everything! After all, it’s all theoretical even though I do hold a majority of the counters that are mentioned above.

And definitely welcome any feedback, especially if you think I made major errors or blindspots in the portfolios.

I aim to update these portfolios once a quarter. The next update will be in November 2023. Till then. We shall see if these portfolios can thrive for the next 3 to 4 decades.

Sir, brk-b is included in both portfolios. Is that a mistake? Thanks for sharing

Why is BRK in the dividend portfolio?

Hi 15HWW

What tool did you use to track your holdings?