Almost a year ago, I presented a case for buying a little bullion and proceeded to purchase 25 pieces of silver coins from BullionStar. Since the coins only added to around $600, I really wouldn’t regard it as a BIG investment.

However, two Fridays back, things changed. At least slightly.

I actually made a trip to the Gold Department at UOB Main Branch and parted with ~$2600 to purchase a 50 Gram PAMP gold bar.

And here’s the steps I did before grabbing a free train ride to Raffles Place.

1. Why Am I Buying Gold?

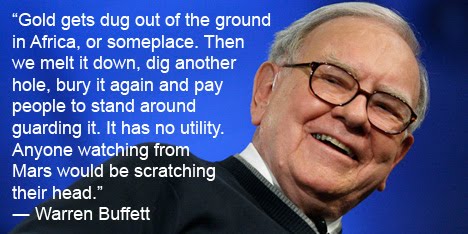

I am largely with Warren on this. Unlike stocks and businesses, gold doesn’t really provide any real utility to consumers in general. Any investment returns are likely to be speculative in nature.

If you were somebody holding alot of gold throughout the 80s and 90s, it would have been a painful experience watching the stock market go on a bull run. Gosh, I probably wouldn’t wish that on my worst enemy.

Now, so why am I buying gold then?

Basically, I see bullion as an alternative currency to hard currencies which include our SGD. Look, I definitely believe in the strength of our currency and the resilience of the country.

However, it doesn’t hurt to diversify. After all, no one can guarantee that our good life will carry on indefinitely for the next 50 years. Perhaps you would also be less sanguine after reading more about the plight of the Rohingyas and the humanitarian crisis in Syria.

So yes, I am looking to build up a small portfolio of alternative currency. And gold is one of these currencies.

2. Which Size Should I Buy?

Since I view bullion as more of an alternate currency rather than an investment, it has to satisfy the characteristics of money in economics.

Therefore, silver isn’t as appropriate since $10,000 worth of silver is really quite heavy. As it also has to be divisible easily, anything more than 100g is likely not very useful.

However, one should not go too small either. As the quantum decreases, the spread between buy an sell prices increase. The spread can go up to a ridiculous 50% for a 1 gram gold bar.

I settled for a 50 gram PAMP bar as the spread was a reasonable 3% – 4% and $10,000 could get me about 4 of them.

3. Who Should I Buy From?

Here’s a comparison of the prices from UOB and BullionStar in October 2015:

50 Gram PAMP gold bar

| Selling Price | Buy Back Price | |

| UOB | $2,725 | $2,622 |

| BullionStar | $2,721.56 | $2607.21 |

100 Gram ARGOR gold bar

| Selling Price | Buy Back Price | |

| UOB | $5,372 | $5,248 |

| BullionStar | $5,375.21 | $5,213 |

Besides being more reputable, UOB charges a lower spread for both the 50 Gram & 100 Gram gold bars. Although one would have to pay a slightly higher price for the 50 Gram gold bar from UOB, the higher buyback price more than makes up for it.

If I build up enough of these currencies, and gold prices somehow soar through the roof, I would definitely be inclined* to sell part of my holdings.

Therefore, it was a no-brainer for me to go with UOB on that Friday! 😉

* I was told at the counter that the UOB seal cannot be broken. Otherwise, UOB will not buy back the gold. And if the receipt is not furnished, $100 will be deducted from the buyback price.

Addendum on March 2018: Physical gold and paper gold are now an integral part of our portfolio. And with an increased asset base, instead of looking at 50 gram gold bars, I am more keen on 100 gram gold bars due to a lower spread.

Thank you for reading!

Ah, gold investments! They are such a fond memory to me because profits from my gold investments several years ago helped me pay for more than 20% of my university fees.

The UOB plastic seal is interestingly new to me though. In the past, they never had that plastic seal so I could have brought a bullion gold coin that I bought from someone else to UOB and they would still buy it back. The requirements on receipts were not strictly enforced at that time as well.

My prefered bullion gold of choice would be the Australia Kangaroo Nugget coins as they have a different coin design each year and that increases the rarity of the coin.

Personally, I still own a few bullion gold and silver coins but I’ve largely discounted them from my portfolio as they were literally ‘free’ after I divested my gold investments at a profit. I wouldn’t invest in physical gold at the moment because I think there’s little money to be made now.

All the best for your gold investments!

Hi Mickey J,

Wow, 20% of university fees. You must have made really quite a lot!

Hmm, Kangaroo Nugget coins. Will go read up about them. Learnt something new from you today.

Just curious, why do you feel there’s little money to be made now whereas you felt differently a few years back?

A few years ago, there were many factors that helped pushed gold prices up. Federal interest rates, US currency, China, etc. Now, everything is in reverse.

Hi Mickey J,

Thanks for your insight!

Oooo, good choice with the 50g denomination!

The new 2016 Pandas from China are getting off troy ounces and moving to grams. 50g is one of the denominations that they have, so I think it’s a good denomination to have.

Hi GMGH,

I didn’t know about the Pandas. I didn’t really do that much of research and I was actually quite stunned when I had two designs to choose from for the 50g PAMP gold bars.

Hi 15HWW,

Now the next question comes after buying.

A safe place to keep them at home… Hahahaa

How do you compare gold coin to gold bar aside from gold bar is more expensive?

Hi Rolf,

Gold coins are lighter than the 50 gram PAMP bars, so the spread is slightly higher at close to 5%?

Maybe when my assets soar, I can move on the the 100 gram bars. LOL!

Why not go for Canadian Gold Maple Leaf or the likes?

Hi Norman,

As it’s a smaller denomination, the spread is higher.

Gold is crises metal. Crises will come again , turst me. That is when gold will soar. We are Chinese, we trust gold . WB will one day be humble. That day I think is near.

Hi peter,

Honestly, I buy it as a hedge against crises. But I seriously don’t hope for it to happen.

How do I part with the gold I bought in HK. The thing is, I got 3kg of it, jewellery stores dun provide me a good price…

Hmmmm. Very interesting from you.

I agree that gold is a kind of universally accepted currency, even better than USD or what. But generally physical gold/silver is kind of iffy for me. I work with gold in jewellery and you wouldn’t believe how cheap it (plus workmanship) can be. Of course I guess bullion is more accepted as compared to jewellery that can be much more subjective.

Still, it’s less liquid than cash, I suppose. I’m not sure how physical gold reacts in times of crisis. I know gold price will probably go up, but will pawnshops/UOB/etc be able to raise their spreads due to a higher supply (ie more people looking to sell) vs lower demand (less people looking to buy)? Since the physical market is not always representative of the commodities market.

Anyway, this is very interesting and do keep us updated!

Hi Singaporemm,

Think for jewellery, there is a big premium paid for the worksmanship and when one sells or pawn it, much of that value is lost.

Your take on demand and supply of gold in a time of crisis is interesting. For me, I am just thinking that if one day paper currencies are no longer accepted, the demand for physical bullion for transaction would increase much faster than the supply? But I guess that’s a big assumption I am making.

I hope I never have to update you since this is a small hedge against “big shit”.

Whether gold rise in value, it is of limited use if you can’t derive an income from them, sell them at their current price or spend them easily. It is not as liquid as you think. In addition, in really dire times where the monetary system fails and paper money becomes worthless, bartering would likely be the common outcome where ppl exchanges stuff or services for basic necessities like foodAfter all, even if these real assets have risen in value, it is of limited use if you can’t derive an income from them, sell them at their current price or spend them. Think about it, will ppl want your gold more or food more when economic situation is very dire. Lastly, people tend to overlook the opportunity cost that comes in holding hard physical gold be it in whatever forms. Some alternativd perspective for your consideration.

Hi Heng Chian,

My humble view is that even in dire circumstances, the human desire to store some form of wealth would still be present.

History has also shown that in difficult times, people are willing to use gold as a medium of exchange.

Nonetheless, I am not holding and not intending to hold alot of it. Just a small percentage more as a hedge and insurance.

Hey! Thank for sharing your insights in this article! I am keen to buy gold, but was just wondering, after you buy them, where did you store them? At home? Or with UOB’s vault?

Hi Jason,

I store them at home. Since I don’t own a lot, I guess it should be relatively safe.

Hi

Just to add. I have been buying gold jewellery to wear and am told by pawn shops that they will buy back jewellery or bars at the same gold price. My principle is this – at least I enjo the jewellery rather than just keeping the gold bars in a safe. Also you would have to pay for the safe. And keeping gold at home is not that safe.

love gold!

Hi Juliana,

If I am not wrong, gold jewellery is always sold at a premium due to the workmanship costs.

Since keeping gold jewellery at home is deemed safe, keeping gold bars at home should not be more dangerous?

do you think it’s good to buy gold coins from pawnshop?

Hi KC,

I really have no idea! I am not sure if they sell at a cheaper price than UOB. UOB is attractive to me as they have a buyback price and the spread is reasonable to me.

Never, never buy from pawnshops. Their spread is the worst of all. There are so many bullion stores you can purchase from. Buying price is not the only factor you must consider, you must also consider where/how to sell, ease of selling and most importantly the best selling price.

Hi all

I’m planning to buy soon. is there any good deal that you know guys?

any suggestions?

I’m thinking that gold will help me to fight the value of my few dollars in the bank.

Do u need to book an appointmentbwith uob or you just walk in?

Hi Bunny,

Nope! Just a straight walk in would do!

I’m thinking selling my car and put the cash into gold. Is it a good time to buy now ?

As of 26/02/16

Hi Ady,

I seriously have no idea. To me, it’s more of a small hedge rather than an investment.

Your car is a liability unless you use it to make money like Uber. Most of us buy gold as a long term investment comparing to putting the spare cash in FD or saving.

The gold prices in increasing.

I think you may be on to something about buying physical gold.

See the Keiser report episode 884 the interview with Sandeep Jaitley about owning physical gold.

Can your 50g PAMP bar be sold as easily as gold coins? Especially to somebody else than UOB?

Hi Norman,

Yes, I would think they can be sold as easily as other gold coins. Since a “small premium” is paid to UOB, if I sell back to UOB, I can get back the “premium” in terms of a higher selling price.

Last year someone told me to start investing in gold because of the foreseeable weakening global economy that would be coming. I went to UOB to make some enquiries and was surprised that the RM didn’t sound encouraging. So I decided not to go ahead. Until today I am still wondering if I had made the right decision but I consoled myself that there is really no hurry to part with my money.

Hi Janice,

The RM is not encouraging because he stands to gain nothing from your transaction?

You should have just gone to the main branch and go downstairs to buy it.

Although prices have gone up, it’s still quite a bit below the peak. You can consider averaging up/down by spreading out your purchases if you would want some investment exposure to gold.

I’m ready to turn my cash savings into IPM. For that at least I know there’s a chance that gold will appreciate but definitely cash will not appreciate in its value. In fact, with inflation, the value will decrease.

Planning to buy 1kg silver coins, 1 and 10 oz gold bar.

Any take on it?

Before you decide to invest in gold or silver, you need to ask yourself a very sensitive and reasonable question: how much spare cash do I have? Why I say that? Putting $100 in the bank today, is still $100 when you withdraw tomorrow. If you buy $100 of gold or silver today, the value of the gold or silver might not be $100 tomorrow because of the spread.

An alternative is to buy 916 gold jewellery from pawnshops, without GST and without workmanship. Can wear and can look great. But only buy 916 gold minimum. Don’t buy gold below 916. Even now, more and more goldsmith shops are not charging workmanship. If they do, just tell them you don’t want to buy. Don’t buy silver, a lot of pawnshops and goldsmiths are not accepting silver at melt value. In around 2008 when gold soared, I sold a 916 gold bracelet ard 20+gm and still made $150+ profit even after deduction of 27%. I only regretted not to buy gold when during the mid 2000s.

Hi Steven,

Interesting take there.

I have not bought anything from a pawn shop before but it’s definitely something worth considering. But the Mrs doesn’t like “2nd hand” jewellery. Hah!

Hi

Do you know if PAMP gold bars bought from UOB would be accepted subsequently by all other institutions like Bullion Star?

thanks

KC

Hi KC,

I think they would likely be accepted by other institutions but the prices could be different. I guess comparing the prices, there is a premium when one buys from UOB and it’s likely only UOB will be buying back with the premium provided the seal is still in place.

Best to check with the institutions though.

Gold is NOT an investment lads….its insurance and should be treated as such.

It pays no return because it has no risk, its gold.

100% of fiat currencies over time go to their intrinsic value which is zero. The only thing then left is gold.

However way we want to label gold, it is a safe haven. Savings in gold, not fiat currencies.

What are the carrying costs at UOB? Storage and insurance

I read from the bullionstar website that if u buy their brand of gold bar and sell back, there is 0% spread.Is that possible? Can someone verify?

Hi Lester,

From what I read on their website, it appears so. But you would have to at least buy 10 pieces of 100g gold bars which costs more than $60,000 at this point in time.

You could buy one at a time at bullionstar,, no spread one, I just did

what is UOB spread %?

Do you all know UOB gold trading is not covered by SDIC?

Hi

I just want to ask if i buy gold from uob then sell to shops like poh heng nx time whats the price difference going to be like for example if i buy for $50 per grams and poh heng is charging $60 per grams will they buy it from u at $60 per grams or $50 if i sell at the same day for example ??

poh heng will sell u at $60 per gram.but take in will be much much lower.

Hi

I just want to know if i buy the gold from uob will the other shops like poh heng for example buy it back at the same price that they are selling or will it be lower ?? Like for example if i buy at $50 then poh heng is selling it at $60 will they buy uob gold bar from me at $60 or $50 ??

Hilo,

I want to buy physical in the near future. I have been hesitating between UOB and Bullionstar. My target is mulitple 100g gold. Any comment or advise?

Hi Golddigger,

I think either option should work well enough. I personally prefer buying from UOB because it’s a local bank and the spread is not too big. Although, maintaining the seal and receipt is quite an inconvenience.

Thank you for replying.

I had purchased from UOB which the transaction was pretty fast.

Now aiming for 1kg by end of Dec as it is more cost effective than multiple 100g.

I am just puzzled by the gold price heading south. My assumption is once dear Trump officially took office and sure have lots of complications and that is time for Gold to fulfill its potential. Is my thinking too 1 dimension or naive?

Hi Golddigger,

Wow. If you’re aiming for 1kg, you definitely have deep pockets.

I will be honest and admit that I have no idea what is the short term direction of gold prices. I am just purchasing it as a hedge and using it as part of a permanent portfolio. i.e. will buy more if the price drops and sell some if the price rise by quite a bit.

No I am just a normal working class who spend at least $1k per month. Just that I am single and do not have any liabilities…

I realised that you always have high EQ to ans and respond to comments; this is something I wan to learn from u : )

Hi,

$1k a month is not alot and you are probably quite frugal. Kudos!

High EQ? Nah. I am just speaking my mind most of the time and I really don’t know how gold prices will react for the next few months.

May I offer you a humble tip of mine: find out the spread of the gold and silver you intended to purchase from the company. That will be a clear indicated who should you purchase from. This information exclude the rest of the other concerns.

yes.u r naïve.

if he alone can make gold price go south,

he would have buy in a few tonn of gold himself.

I thought so too. Sometimes I am just too navie…. n yet I still wana invest in Reits also in the near future… But I just dun wan all the cash in bank doing nothing… Waiting for new year for higher interest rate promo from all banks

is it worth it to buy gold from UAE? heard oil and gold is cheaper there plus not VAT.

visiting AD soon.

Hi marc,

I seriously have no idea.

The best idea I have?

Note down some of the prices and spreads in Singapore and when you fly over, do a comparison?

where to see spread?

Hi marc,

Spread is observed by comparing the buy price and then the sell price of each gold retailer.

Hi, can I ask for any input from people of knowledge of what you think of buying goldshare instead of physical gold?

It seems lack the problem of storage / loss and easier to trade?

Thank for enlightenment !