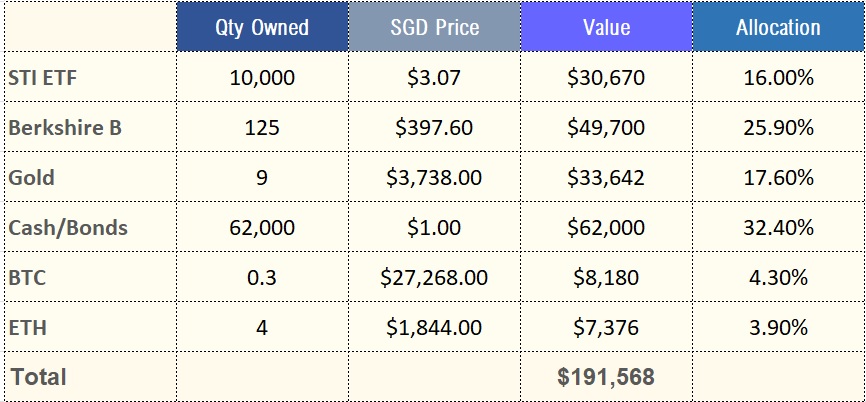

As at Oct 2022

Genesis

The 15HWW Permanent Portfolio was built during late 2016 with a capital of around $140,000 and I started tracking it from Jan 2017.

The aim of a permanent portfolio is to create a liquid portfolio with low volatility and a respectable return. A comparative benchmark is the CPF SA return of 4%.

To keep the portfolio as simple as possible, there is neither rebalancing nor injection of funds.

Purpose

Personally, I view many components of this portfolio as a form of emergency fund. For example, the cash and bonds are invested in very liquid and safe instruments and can be sold and cashed out within a matter of days.

Another reason is that by showcasing and regularly updating this humble portfolio, I hope it will inspire confidence in some readers to take some risk, invest and build wealth steadily with a low-effort portfolio.

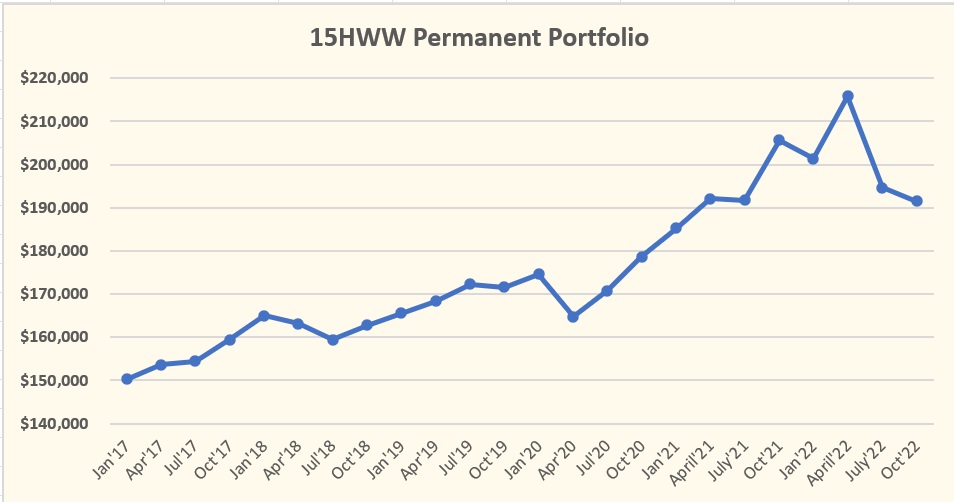

Portfolio Value From Jan 2017 To Oct 2022

October 2022 Update

Annualised Return: 4.2% p.a. (Jan 2017 to Oct 2022)

We are in a bear market and at this point, the portfolio return is barely beating CPF SA’s 4% yield. I guess the consolation is that I can access this portfolio anytime whereas if I had parked everything in CPF SA, the funds will be locked up until I am 55. Which is still almost two decades away.

In short, I have been enduring volatility (quite low) to protect liquidity.

Another silver lining is that the fall in value of the portfolio has moderated as compared to the previous quarter. Hopefully we are much nearer to the light at the end of the tunnel.

Annex: A Brief On The Various Components Of The 15HWW Permanent Portfolio

1. STI ETF (Initial Allocation: 20%)

It comprises the 30 biggest listed companies in Singapore and many of them are dividend-paying. The ETF distributes the dividends semi-annually, in February and August every year.

2. Berkshire B (Initial Allocation: 20%)

The idea is to use Warren Buffett’s holding company to loosely replicate the S&P 500 for US equities exposure. Since foreigners investing in US stocks are taxed on dividends, it is an advantage that Berkshire B does not pay any dividends.

3. Gold (Initial Allocation: 20%)

I used to hold some paper gold but have since converted them to physical gold. The portfolio consists of 9 pieces of 50g PAMP Gold Bar bought from UOB Bank. They are fairly liquid since they can be sold back to UOB Bank at a small spread. You can also check the prices here.

4. Cash/Bonds (Initial Allocation: 30%)

The majority is invested in Astrea Bonds and Singapore Saving Bonds (SSBs) which are very liquid in nature. Astrea Bonds are traded on the market while SSBs can be redeemed at par value, usually in a week or two’s time.

5. Bitcoin (Initial Allocation: 5%)

Added in 2021 to diversify away from cash and gold as a store of value. As many centralised crypto exchanges have abused users’ trust in them, my bitcoin is now stored in a cold wallet.

6.. Ether (Initial Allocation: 5%)

Added in 2022 since I am not a Bitcoin Maxi. As many centralised crypto exchanges have abused users’ trust in them, all my ether is staked on-chain.

Looking good and you only have 2 REITS on your portfolio! 🙂

Wow you have such a strong portfolio! I am turning 31 with more than 200K cash sitting around earning peanuts fixed D interest and I don’t have a single stock to my name 🙁 I was waiting to buy Keppel Corp but kept hanging on for that final decline to below 7.99… then I missed the boat and the rest is history Greed’s always getting the better of me!!

Hi HY,

If you have 200K of cash sitting around at this point in time, you can easily replicate my portfolio!

Perhaps one way to overcome this “greed” of yours is to start small? About 5 years ago, I just took the plunge and bought some stocks to kickstart the journey. I suffered some losses in the first year but as they were good businesses, the prices rebounded subsequently. The losses initially were quite small and quite inconsequential.

And since you do have quite a bit of cash, the losses on a small portfolio should have little impact on your overall financial health. The benefits are far-reaching though. Very importantly, you will start to discover your own psyche in investing. According to most experts, that determines your investment outcome more than any other factor.

Hi 15 HWW, it is very heartening to see someone so young, yet have such a structured and discipline personal finance system.

HY, I do agree with 15 HWW on the need to start small, if there’s damage, it would be small and contained, at the same time, the value from the experience would be priceless and irreplaceable.

Another way you could do this is to know how much the company is worth, in that way, when the price goes below your valuation, you could could consider buying in bite-sized amount, with tiered entry prices. Many of the leading bloggers/writers are already doing that. Fifthperson mentioned about it. Author of ASSI, AK, calls such actions “Nibbling at a stock”.

15 HWW, u reckon?

would take small bite-sized portion of your cash holding and tiered you

Any Brokers to recommend?

doing good mate! 😀

Hi pib,

Thanks! Hope you are doing well down under!

Hello, i’m interested in when did you start investing and how did you do it financially?

I’m still in my first year of work and am building up a 6 month buffer as well as paying insurance while saving roughly 30% of my income, which should take me about another year to fill up.

Did you start investing while building up your buffer or after?

Buffer: http://www.moneyunder30.com/emergency-fund

Hi JC,

I started investing 5 years ago and I guess I already had a 6 months buffer before I started investing.

But back then, my expenses were really low so it didn’t take me very long to build up a buffer.

Hi, I’m a final year uni student and am looking to build a portfolio as strong as yours! May I know how you allocate your expenses between personal savings and investments? Plus, since you’re already married, the wedding must have been a rather huge expense! How do you do all that while still managing to accummulate $250,000? Would love for some financial tips 🙂

Hi AZ,

Actually, back in those days, I didn’t really have a rule between personal savings and investments!

Most of it was actually channelled into investments as I always feel the cash will come in quickly again through the job. 🙂

We tried to cap the wedding costs through a few measures and the angbao more than covered the extra expenses. You can read more about it here: https://www.my15hourworkweek.com/2013/08/19/money-bomb-1-the-wedding/

As I have explained, there really isn’t much secret sauce to it. It’s just frugality and some hard work when we were young.

You’re young too and I think with your current mindset, you wouldn’t be too far off by the time you turn 30!

Hey 15HWW,

can’t wait for the new layout to be ready. Wanted to pick your brains and find out what tips you would give a noob when it comes to investing and portfolio building. I’m a late starter but at least, I’m starting 🙂

KP

Hi KP,

There are tons of tips everywhere, not just on this blog but on the local blogosphere!

Earn a bit more, save a bit more, and find out slowly which investment style suits your temperament.

hi may i ask which broker you are using and recommend?

Hi kelvin,

I am using iOCBC purely for convenience sake. Most brokers’ fees are similar although there are some that are slightly cheaper than the rest.

Hi, I really impress with your portfolio, wish I can replicate yours soon since I am bit late to start investing. Question, we all know that CEO of Berkshire Hathaway is old, do you still consider his stock on your core portfolio if one day he pass away?

Hi Ricky,

10 years ago, people were already concerned about Buffett’s age but things are still good right now. But of course, he’s probably nearer and nearer to his death.

I do have faith that the leadership succession plans are already in place so I am not too worried. If there is a knee-jerk reaction and the price tumbles, I would see it as a good opportunity to add more of it.

Hi 15HWW,

Thank you for sharing your personal investment portfolio. May I know how do you manage to have $400k by the age of 30? The amount is pretty impressive. Is stock investing your only way of achieving that?

Thank you,

Fellow PFG

Hi Fellow PFG,

Just curious, what does PFG stand for?

Firstly, it’s a two-person portfolio, not one. Basically it’s more about savings rather than investment returns at this stage. But going forward, investment returns will play an equally important if not more important role.

Hi I’m new to your blog and very amassed by the amount you have in your portfolio. Could you further elaborate and share on roughly how much to save and invest per month and how long has it been as I’m also doing that for my wife and myself thanks!

Hi Bob,

Welcome to the blog and thanks for your comments.

It would be difficult to advise as how much to save and invest is a function of how much you earn. We were able to save and invest more in the past when we had higher incomes. Now, the savings and investing are much more modest as self-employed individuals.

Will you have kids in future? If yes, how will that affect your 15HWW?

Hi Bakkie,

We hope to have kids in the future and although it will definitely increase our expenses, we feel that it should be manageable when the time comes.

Hi 15HWW,

I am looking to invest around 200k cash which is sitting in the bank earning close to nothing.

But I am not sure if i should be investing into stocks or property.

I see that you are getting around 5% – 7% annual returns on overall portfolio consisting mostly stocks and commodity.

I dont have time to look at the stocks and do not really have the mindset to watch the rise and fall (afarid it might go down further and sell it)

So I would like to check if you feel this this property investment with 7% guaranteed rental annual returns for 10 years by a reputable developer which can give me a good annual return and a peace of mind is a good buy.

I haven factor in the capital appreciation which I think has room to grown as its the first project to be launch (first mover advantage)

this is a the link to the property

https://newlaunch.forsale/property/the-bridge-cambodia/

Do you think guaranteed 7% per annual is a good buy?

Thanks !

Hi Kim,

It’s not fair to give a proper comment since I do not know much about property investment in general.

But I will be skeptical of any instruments that guarantees a return that is above 5%.

For STI ETF do you buy SPDR or Nikko AM?

Hi Norman,

I prefer the SPDR version as the expenses of the ETF is marginally lower.

Sorry but cnt help but wonder is buying 6500 worth of M1 shares worthy?

But great portfolio… are you collecting those for dividends?

Hi Dave,

I am definitely sitting on a paper loss for M1 now. And yes, you are right that most of these stocks are mainly for income.

I’m sure you’re aware of the Joseph Cycle:

https://dollarsandsense.sg/the-joseph-cycle-will-the-stock-market-crash-after-2022/

Would it be wise to wait until 2022 to invest a chunk into the markets or begin now with smaller, more regular amounts? I’m specifically looking at an STI ETF.

Hi Thomas,

Nice portfolio there. Noticed most of them are yield companies with stable income/large cap.

it may be weird to ask. Do you feel the growth in one’s net worth with such yield portfolio is considered slow or it is of moderate speed?

Asking because I felt Singtel is rather a slowpoke as it had a mediocre returns over the last 2 years.

hello! could i please enquire – did you buy the tracker fund as a lump sum investment, or periodically (e.g. monthly)? if it was done on an automated monthly basis, could you please share which platform you are using? thanks much in advance!

Hi xinling,

It’s not an automated purchases although I do intend to do it on a periodical basis manually. Going forward, it is likely I will schedule two lump sum purchases (around $5-$6k each) in a year.

thanks much for sharing thomas! 🙂

With regards to my comment earlier, I am just curious as to why you would invest in Berkshire B and the STI ETF as compared to say, Vanguard S&P 500 ETF?

Historical data shows that the US economy has provided far superior returns as compared to the Singaporean Economy and Berkshire B does not provide dividend income as compared to the aforementioned ETF.

Also, the STI ETF (I’m assuming the AM Nikko STI ETF) is a synthetic ETF which in my opinion is far riskier than a physical ETF since the returns in a synthetic ETF can be generated through highly risky interest rate swaps and CFDs.

Hi

May I know if Uob is obliged to buy back from items purchased from them?

Thanks

Hi Fasia,

Although I have not tried it before, I believe UOB is obliged to buy the physical gold it sold back at the spread.

I also think there is a good chance you can sell it back at a higher price to other retailers if you have the documentation that you bought the item from UOB.

Hope the above helps!